Key Takeaway

Golar LNG (NASDAQ:GLNG) stands as a pivotal figure in the LNG industry, specializing in LNG infrastructure development through floating liquefaction assets (FLNG). Their current fleet consists of two FLNGs and two LNG carriers. FLNG Hilli, the world’s first converted floating LNG facility, produces 2.4 million tonnes per annum (mtpa) and has been operational since 2018, serving a contract with Perenco and Cameroon’s national oil company. FLNG Gimi, with a production capacity of 2.7 mtpa, is nearing completion and is set to start a 20-year contract with BP in early 2024. These assets, along with others in Golar’s portfolio, offer a strong foundation for growth.

In terms of shareholder value, Golar has made significant strides, with the introduction of a dividend payment in the first quarter of 2023 and a successful $150.0 million share buyback program. These financial moves combined with a robust liquidity position showcase the Company’s commitment to enhancing shareholder returns.

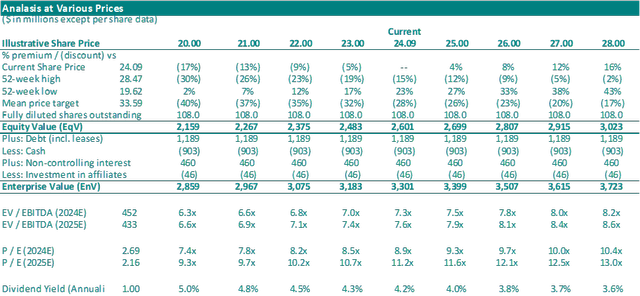

Looking forward, Golar’s path to growth hinges on navigating uncertainties surrounding its FLNG deployments and contracts. Despite the challenges, the stock’s valuation, at 7.3x EV/EBITDA (2024E) and 8.9x P/E (2024) multiples, seems to account for the current risks. Golar is well-positioned for growth with its leading role in the market and efficient FLNG technology. The company’s consistent pursuit of expansion and opportunities indicates an attractive investment option, particularly if there’s a chance of the share price dipping close to the $20.00 – $21.00 mark. If such a case materializes, it will present a very appealing opportunity for potential investors to explore.

Charting Golar’s infrastructure play in the LNG industry

Golar LNG is a leading player in the liquified natural gas industry primarily engaged in LNG infrastructure development by providing floating liquefaction assets. The Company plays a pivotal role in the global LNG supply chain by providing infrastructure solutions that unlock stranded gas resources and provide a more flexible and cost-effective way to produce and export LNG. As of today, the Company’s fleet consists of two FLNGs and two LNG carriers.

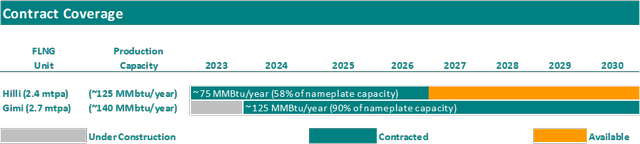

The FLNG Hilli, the world’s first converted floating LNG facility has a production capacity of 2.4 mtpa and started operations in 2018. The FLNG asset has a contract with a consortium of Perenco and Société Nationale des Hydrocarbures, Cameroon’s national oil company to source natural gas from Peranco’s Sanage and Ebome gas fields in Cameroon. This contract ends in 2026 and Golar is in discussions with parties to source another contract for the asset.

The FLNG Gimi, which has a production capacity of 2.7 mtpa, is currently completing conversion and commencing commissioning into an FLNG. As of June 30, 2023, FLNG Gimi is 97% technically completed. The asset has been contracted to BP for a 20-year period. The contract is expected to commence in the first quarter of 2024. Gimi will produce LNG from the Greater Tortue Ahmeyim gas field offshore Mauritania and Senegal. At the time of writing, based on the Marine Traffic database, the asset is still moored in the Keppel shipyard in Singapore.

Apart from the two FLNGs, the Company also owns Golar Arctic, a 2013-built 140,000 cbm Steam LNG carrier, post SNAM’s (OTCPK:SNMRF) decision not to convert the vessel as an FSRU, Golar is operating it as an LNG carrier and Fuji LNG which will act as a donor vessel for a prospective MKII 3.5 mtpa FLNG project. The Company has already committed $328.5 million in long lead items and engineering and is in discussions for potential deployment opportunities. However, no commercial contract has been secured as of today.

Company’s Earnings Release (June 30, 2023)

Unlocking shareholder value

In the first and second quarters of 2023, Golar made significant financial moves by reinstating its quarterly dividend payments at $0.25 per share each quarter. This translates to an annualized dividend of $1.00 per share, resulting in a dividend yield of 4.2% based on the current share price of $24.09.

Simultaneously, Golar initiated a substantial $150.0 million share buyback program during the first quarter of 2023. On the back of this program, the Company repurchased 1.4 million shares at an average cost of $21.06 per share. As of today, the cumulative total of shareholder returns for the Company amounts to $82.9 million, comprising $53.4 million in dividend payments and $29.5 million allocated to share repurchases.

Golar’s decision to reinstate dividends and further enhance shareholder returns through share repurchases was made possible by its robust financial position. As of June 30, 2023, Golar reported robust liquidity totaling approximately $904.0 million inclusive of $132.0 million of restricted cash. Golar’s share of contractual debt stood at $1,189 million, leaving a net contractual debt of $279.0 million after considering the available cash.

Path to future growth and investment opportunities

The company’s share price at $24.00, trading at a 7.3x EV/EBITDA (2024E) and 8.9x P/E (2024) multiples, appears to fairly reflect the current risk profile of the company. Specifically, after the conclusion of FLNG Hilli’s current contract with Parenco, there’s uncertainty about its future deployment. At the same time, the FSRU project for Golar Arctic has hit a roadblock and left the Company with operating a steam LNG carrier that falls outside its core focus. This valuation at $24.09 assumes that FLNG Gimi will start its 20-year contract with BP without any unforeseen problems.

However, there are positive factors at play. The tight energy markets are aligning with Golar’s ambitions for more FLNG projects given its market-leading track record and proven FLNG technology at below $600/mtpa which is looking very attractive compared to peers. The next stage of growth is expected to come from the prospective MKII 3.5 mtpa FLNG project and securing further contracts for FLNG Hilli.

In addition to growth prospects, the current dividend yield of 4.2% is an attractive incentive for shareholders as they await further expansion. Any weakness in the share price, should it drop between the $20.00 – $21.00 mark, could present an enticing opportunity for investors to consider buying into GLNG. The Company repurchased shares at an average of $21.06 per share, an implied 6.6x EV/EBITDA (2024E) and 7.8x P/E (2024) multiples.

Company’s Earnings Release (June 30, 2023), FactSet (October 14, 2023), Author’s Analysis

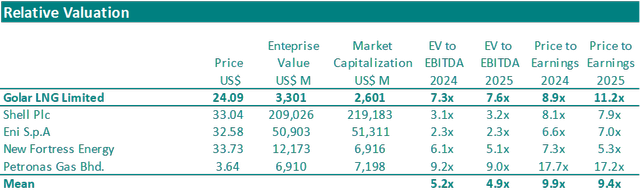

The table below offers a comparison between GLNG and several competitors who operate or have FLNG assets under construction, including Shell (SHEL), Eni (E), New Fortress (NFE), and Petronas Gas (OTCPK:PNAGF). Notably, in terms of the key metric EV/EBITDA (2024), GLNG trades at a multiple of 7.3x, while the other FLNG companies’ mean stands at 5.2x. Additionally, at a GLNG share price of $24.09, it represents an 8.9x P/E (2024) multiple, whereas the other companies are at 9.9x on average.

FactSet Data (October 14, 2023)

Conclusion

Despite certain uncertainties, such as the redeployment of FLNG Hilli and the challenges with the Golar Arctic FSRU project, Golar is actively exploring opportunities to continue its growth trajectory. The company’s strategic moves, including the reinstatement of quarterly dividends and a significant share buyback program, demonstrate a commitment to enhancing shareholder value.

Golar’s financial stability is notable, with robust liquidity and a manageable contractual debt burden. While the current share price seems to reasonably reflect the present risk profile of the company, the future holds promise. Golar’s market-leading position and cost-effective FLNG technology position it well for growth. The company’s ongoing focus on further expansion and opportunities suggests a compelling investment opportunity, especially if the share price experiences any weakness between the $20.00 – $21.00 mark, making it an enticing opportunity for investors to consider buying.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here