Introduction

I’m extremely bullish on oil and gas, which is why I have been buying drillers rather aggressively since 2020. One of the reasons I’m so bullish is the spending shift from fossil fuels to renewables, which has caused the fossil fuel industry to neglect production growth spending, causing a strong tailwind for oil and gas prices.

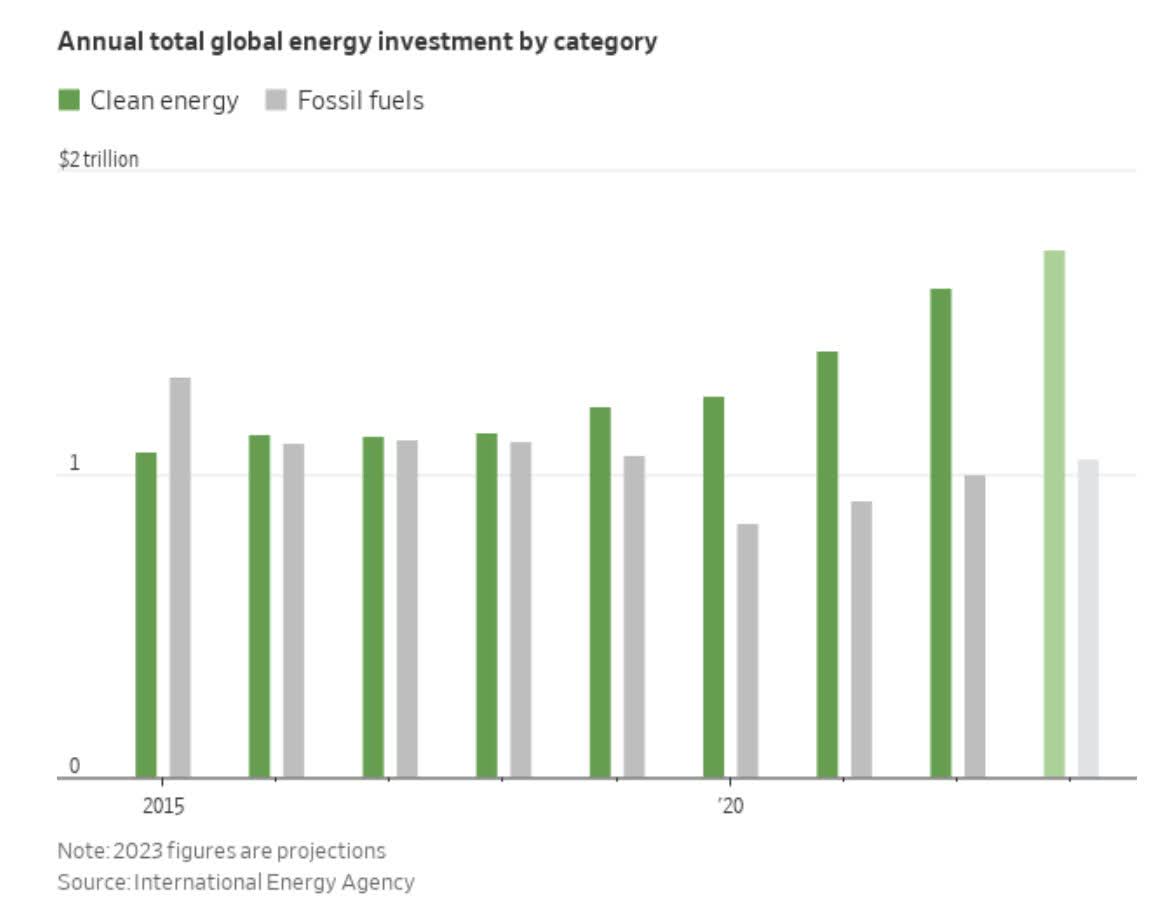

Before the pandemic, spending on clean energy and fossil fuels was roughly the same. Now, renewable spending is much higher.

Wall Street Journal

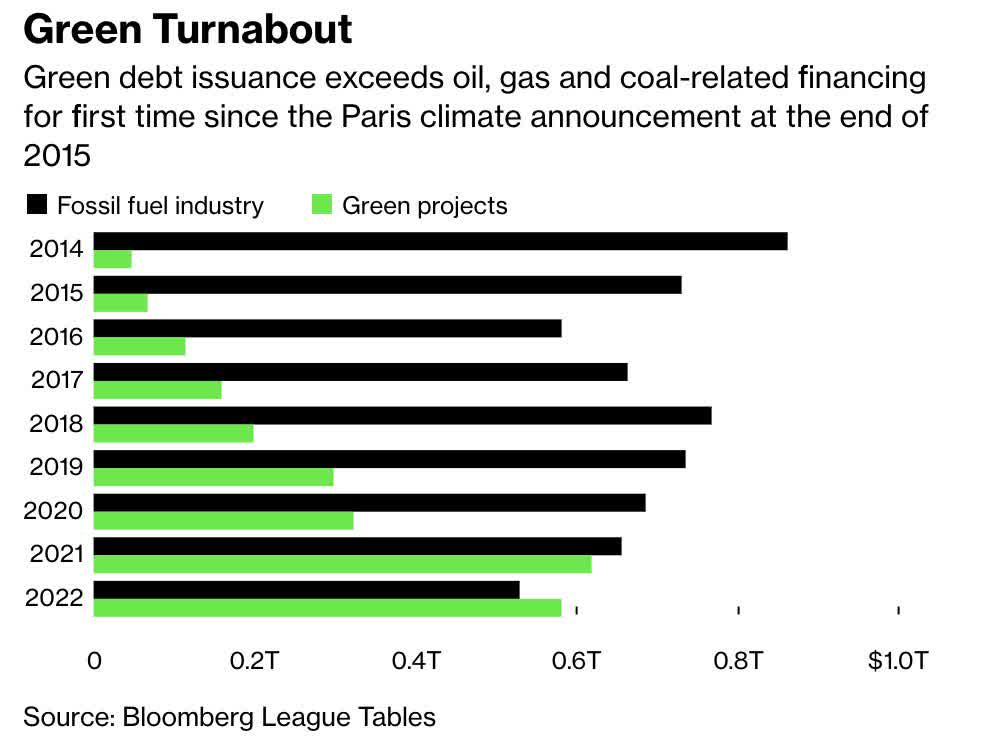

Green debt issuance alone is now higher than oil, gas, and coal-related financing!

Bloomberg

According to the June 2023 Renewable Energy Market Update from the International Energy Agency, renewable power capacity is projected to witness a significant increase this year, with a 33% jump driven by robust policy support, rising fossil fuel prices, and energy security concerns.

The surge is expected to persist into next year, taking the world’s total renewable electricity capacity to 4,500 GW, equivalent to the combined power output of China and the United States!

Global renewable capacity additions are set to skyrocket by a historic 107 GW, marking the largest absolute increase ever, to surpass 440 GW in 2023.

This dynamic expansion is unfolding across major global markets, with Europe, the United States, and India experiencing significant increases due to new policy measures.

Meanwhile, China is solidifying its position as the leader, accounting for nearly 55% of global renewable power capacity additions in 2023 and 2024.

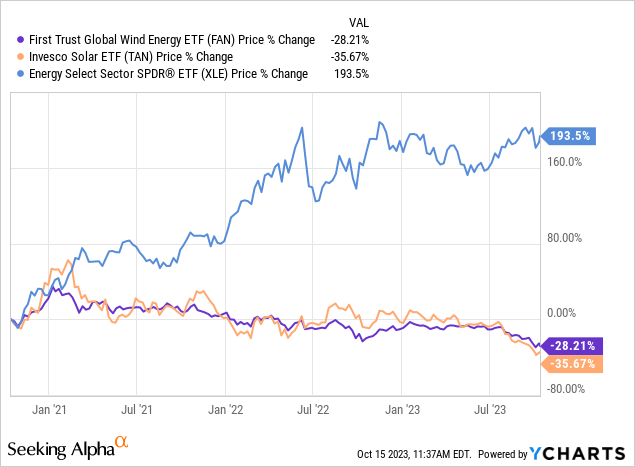

Having said that, a lot of renewable companies are not in a good spot.

Both wind and solar stocks have massively underperformed the market and fossil fuel stocks over the past three years, pressured by higher inflation and elevated rates that make financing expensive renewables a lot less attractive.

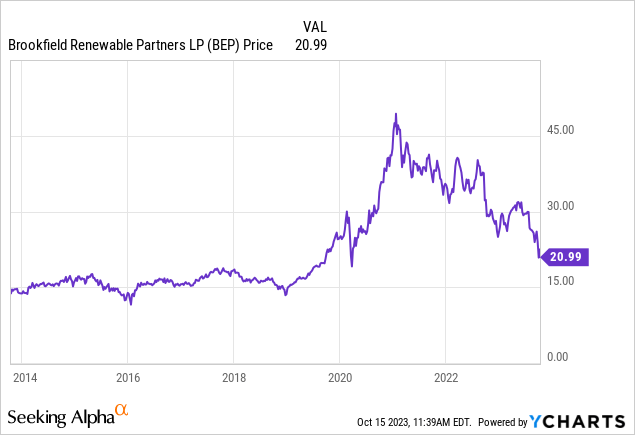

One victim in this industry is Brookfield Renewable Partners L.P. (NYSE:BEP), which has given up almost all of its post-pandemic gains (excluding dividends).

The good news is that this has made the risk/reward much more attractive.

BEP now yields 6.4%. It has a top-tier balance sheet and a portfolio that makes it a cornerstone of the current energy transition.

Although I prefer to hold fossil fuel companies, adding high-quality renewables makes sense for well-diversified income-focused portfolios.

Even better, I would make the case that BEP is a high-yielding stock that comes with income growth! The company has strong operating cash flow growth and a track record of consistent dividend growth.

In this article, we’ll discuss all of this and more.

So, let’s get to it!

BEP, The Renewable Giant

When it comes to renewables, I do not invest in smaller startups or companies that have big plans but no proven track record. That may limit my potential upside, but it also limits my risks.

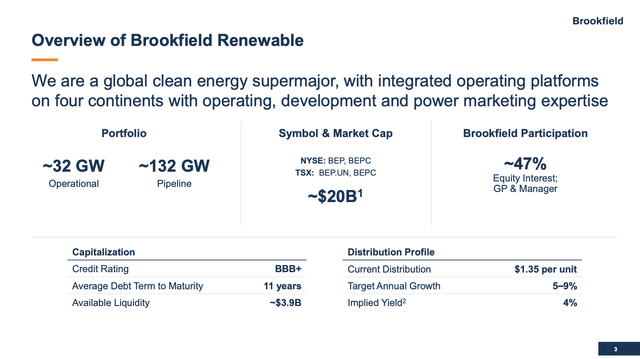

With that in mind, Brookfield Renewable Partners operates a leading publicly traded platform globally, focused on renewable energy and solutions for decarbonization.

Brookfield Renewable Partners

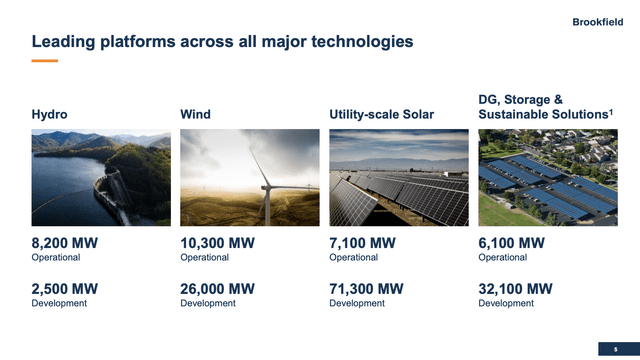

The company’s extensive portfolio includes hydroelectric, wind, solar, distributed energy, and sustainable solutions across multiple continents.

Brookfield Renewable Partners

As the overview above shows, the company has an operational installed base of more than 31,000 megawatts. It has more than 130,000 megawatts in development!

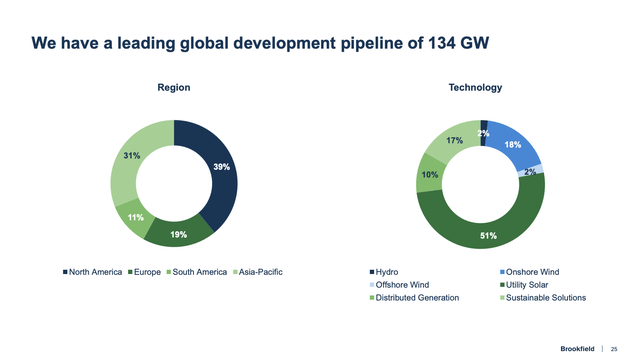

Most of this is located in North America and Europe, with a focus on utility solar.

Brookfield Renewable Partners

Investors have the option to access this portfolio through Brookfield Renewable Partners, a limited partnership based in Bermuda, or Brookfield Renewable Corporation (NYSE:BEPC), a Canadian corporation.

Essentially, BEPC was established to offer investors increased flexibility in accessing BEP’s well-diversified global portfolio of high-quality renewable power assets.

The Class A shares of BEPC are designed to deliver an economic return equivalent to BEP units within a conventional corporate structure. Each BEPC Class A share corresponds to the same distribution as a BEP unit and is exchangeable for one BEP unit.

So, technically speaking, BEP shareholders are called unitholders. Its dividends are called distributions. However, in this article, I may use both, as this makes it less confusing for a lot of people – although it may not be correct.

Having said that, because of its size, BEP is a great way to get exposure to renewables without having to bet on small players.

During its 2Q23 earnings call, the company outlined its substantial progress in development, commissioning approximately 1,500 megawatts of new capacity in 2023.

They are on track to commission almost 5,000 megawatts in 2023, a significant increase from previous years.

Looking ahead, they plan to deliver nearly 18,000 megawatts of new capacity over the next three years, with most projects already de-risked in terms of permitting, interconnection, financing, and contracts. This sets BEP apart from many of its smaller peers!

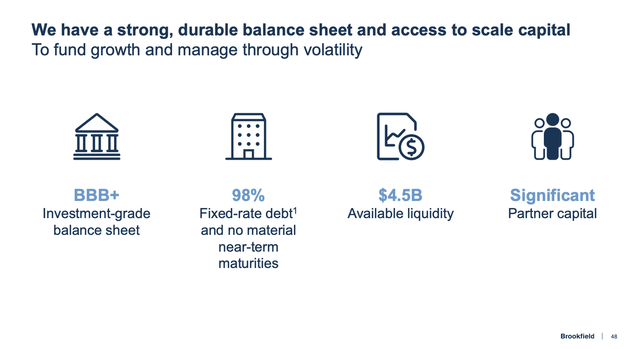

It also helps that the company has a BBB+ credit rating, 98% fixed-rate debt, and $4.5 billion in available liquidity!

Brookfield Renewable Partners

According to the company:

As Connor mentioned, our balance sheet is in an excellent position and our available liquidity remains robust at over $4.5 billion, providing significant flexibility to fund growth and be opportunistic. Following our first equity issuance in seven years, we are well positioned to deliver on our growth targets, utilizing our normal sources of funding and our advancing non-recourse financing initiatives and our asset recycling program.

Furthermore, their development approach emphasizes matching costs with future cash flows to mitigate cost escalation risks and secure project economics.

Speaking of cash flows, BEP is a monster when it comes to growing cash flows.

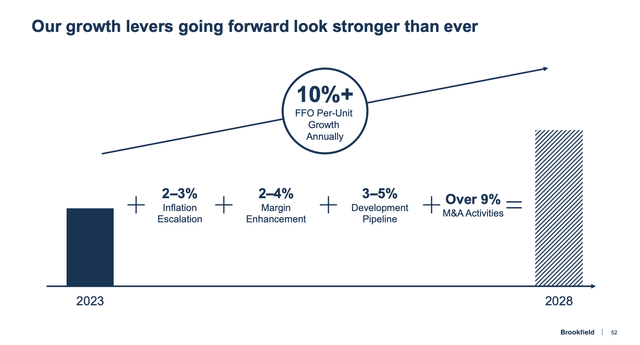

Through 2028, the company expects to grow its funds from operations (per unit!) by 10% per year. Note that per-share numbers mean that it includes potential share dilution, which makes 10% annual compounding growth even more impressive.

This growth outlook is based on a strong development pipeline, inflation escalators in existing projects, higher margins, and M&A opportunities.

Speaking of M&A, in the second quarter, the company announced a significant acquisition, agreeing to purchase Duke Energy (DUK) Renewables for approximately $1 billion in equity.

Duke Energy Renewables is a fully integrated developer and operator of renewable power assets in the U.S., with 5,900 megawatts of operating and under-construction assets and a 6,100-megawatt development pipeline.

Brookfield Renewable Partners

With the Duke Energy Renewables acquisition, Brookfield Renewable Partners is set to boost its presence in the U.S. market.

Following the deal’s closure, they will have 14,000 megawatts of operating capacity and a massive 76,000 megawatts in development capacity across all major renewable technologies, establishing themselves as one of the largest clean energy providers in the U.S.

The BEP/BEPC Dividend & High Total Returns

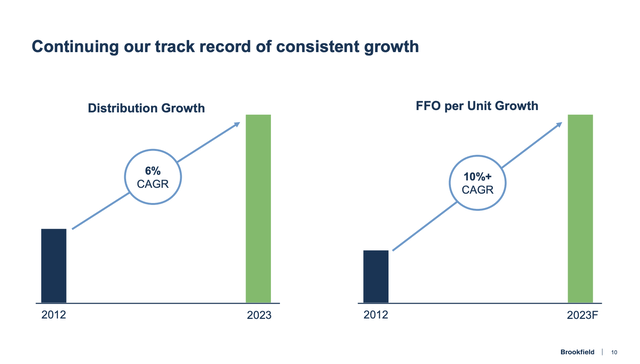

Having said that and going back to FFO growth, between 2012 and 2023E, the company has also compounded its FFO per unit by 10%.

BEP has used this growth to grow its dividend/distribution by 6% per year during this period. The most recent hike was on February 3, when the company announced a 5.5% dividend increase.

Brookfield Renewable Partners

BEP currently pays a $0.3375 per share per quarter dividend. This translates to a yield of 6.4%.

This dividend is protected by its cash flows. Next year, for example, the company is expected to generate $960 million in free cash flow. This is operating cash flow minus capital expenditures. This translates to a 9.4% free cash flow yield and a 68% dividend payout ratio.

Even better, on top of aiming to grow unit FFO by 10% per year, the company aims to target 12% to 15% annual shareholder returns, which should be doable if it is able to maintain its 10% FFO target. After all, the company also yields 6.4%, which tremendously adds to its long-term total return potential.

For convenience, I added the bullet points to the quote below:

In closing, we remain focused on delivering 12% to 15% long-term total returns for our investors. To do this,

- We will continue to leverage our differentiated growth capabilities,

- Advancing our significantly de-risk pipeline of projects,

- Being opportunistic in the current market

- And investing in our operating to add value.

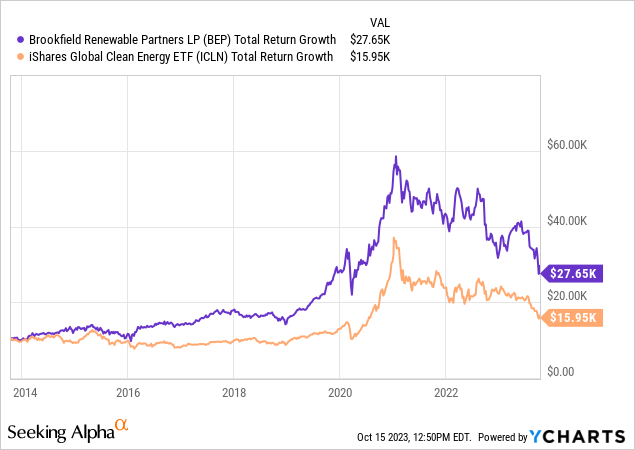

Over the past ten years, NY-listed BEP shares have turned a $10,000 investment into $27,650. This includes the dividend. This translates to a 10.7% CAGR, even after the recent stock price slump.

While it is unlikely that BEP will start a strong uptrend in an environment of elevated rates due to the pressure on companies with high funding requirements, the company has a solid balance sheet and an attractive valuation that should pave the road for juicy returns on a long-term basis.

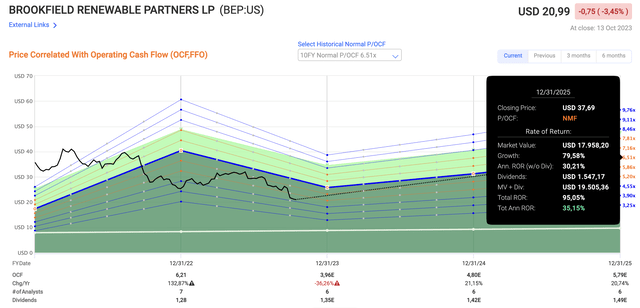

Valuation-wise, BEP is trading at 5.7x operating cash flow. This is a multi-year low and well below the 5-year normalized valuation of 6.5x operating cash flow. A return to that valuation and more than 20% OCF growth in both 2024 and 2025 would pave the road for 35% annualized returns through 2025.

FAST Graphs

While I cannot promise that BEP will return that much, I have to say that I really start to like the valuation of BEP at these levels.

The current consensus price target is $36, which is 71% above the current price. Over the next 4-5 years, I believe that BEP has the potential to double (on a total return basis).

I like BEP so much that I will likely buy it for a few accounts that I advise that require a mix of higher income without completely neglecting growth.

BEP is a great mix of a high yield and growth potential – especially for accounts that want to somewhat diversify fossil fuel exposure.

And, although I do expect that elevated rates will keep the pressure on renewables high, the attractive valuation makes for a good long-term risk/reward.

Takeaway

BEP stands out as a reliable investment option in the renewable sector.

Its substantial operational and development capacity, coupled with a strong balance sheet, make it a cornerstone of the energy transition.

With a promising growth outlook, consistent dividend increases, and a compelling valuation, BEP offers a blend of high yield and growth potential, making it an appealing choice for well-diversified income-focused portfolios.

Read the full article here