While the S&P 500 (SP500) and Nasdaq (NDAQ) are up 13.17% and 29.48%, respectively on a YTD basis, the rally has been fueled by big tech. Many sectors have been crushed in 2023 as the following ETFs are all the red, Utilities Select Sector SPDR® Fund ETF (XLU) -15.89%, Financial Select Sector SPDR® Fund ETF (XLF) -3.23%, Consumer Staples Select Sector SPDR® Fund ETF (XLP), and SPDR® S&P Telecom ETF (XTL) – 17.51%. Real Estate funds have been on the decline, with The Real Estate Select Sector SPDR Fund ETF (XLRE) -7.36% and Vanguard Real Estate Index Fund ETF Shares (VNQ) -8.56%, while bonds haven’t been a place to hide either as the iShares 20+ Year Treasury Bond ETF (TLT) is down -15.17%. The PIMCO Dynamic Income Opportunities Fund (NYSE:PDO) was crushed in 2023, falling -14.60% as rates continued to move higher, and several economic events put stress on the credit markets, bonds, and mortgage-backed securities (MBS). Since August 9th, shares of PDO have continued to fall, descending from $13.11 to $11.17. Investing in funds such as PDO isn’t for the faint of heart, but if you’re an optimist and believe that PIMCO’s fund managers can sift through the carnage and allocate capital strategically, this could be a winning CEF in 2024 and 2025. There is an economic argument that can be made for the bull and bear case, and I believe that PDO will emerge stronger when the dust settles. Until then, I plan to add to my position and continue to reinvest the ongoing streams of distributions that are rapidly approaching 14% annually.

Seeking Alpha

Following up on my previous PDO article

Back in February, I wrote an article on PDO (can be read here) and discussed why I was adding to my position. The article covered PDO’s historical pricing, its discount to premium history, and why PDO was interesting from an income-producing methodology. Since the article was published, the macroeconomic landscape has experienced significant changes. Not only is inflation still an issue, but rates have continued to increase, putting additional strain on the areas PDO allocates capital. I wanted to follow up on my previous article and discuss what’s occurred, what can still go wrong, and why I am still bullish on PDO’s future.

Providing a quick synapsis on PDO

PDO is a closed-end fund [CEF] from PIMCO that utilizes an asset allocation strategy among multiple fixed-income sectors in the global credit markets. PDO’s investment mix includes allocating capital in the global credit markets across corporate debt, mortgage-related and other asset-backed instruments, government and sovereign debt, taxable municipal bonds, and other fixed, variable, and floating-rate income-producing securities of U.S. and foreign issuers, including emerging market issuers. PDO is a leveraged fund through reverse repurchase agreements and obtains its borrowed capital through bank loans, commercial paper, other credit facilities, and other transactions. PDO’s exposure to reverse repurchase agreements is 43.87% of its total managed assets, and its current total effective leverage is 44.58% of total managed assets. PDO went public on 1/29/21 at $20 per share, and since then, its share value has declined by -$8.83 (-44.15%) while generating $5.39 of income.

A lot has changed in 2023 within the macroeconomic environment, and it hasn’t been favorable for PDO

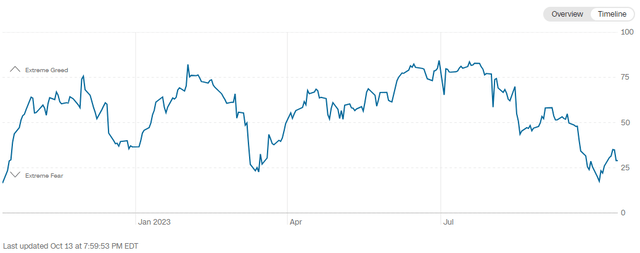

The Fear and Greed index was actually created by CNN in an attempt to track the overriding emotions driving the stock market at any given time. The index is measured on a scale of 0-100 and is constructed from 7 indicators, including market momentum, stock price strength, stock price breadth, put and call options, junk bond demand, market volatility, and safe haven demand. In February, the Fear & Greed Index entered extreme greed levels prior to the Regional Banking Crisis, which took the index to extreme fear within the span of a month. Things got more bullish upon the artificial intelligence [AI] renaissance that emerged as extreme greed was reached again at the beginning of June and lasted the majority of the time until July 31st. Since the end of July, the Fear and Greed Index has embarked on a downward trend, and we’re currently tittering in between fear and extreme fear.

CNN

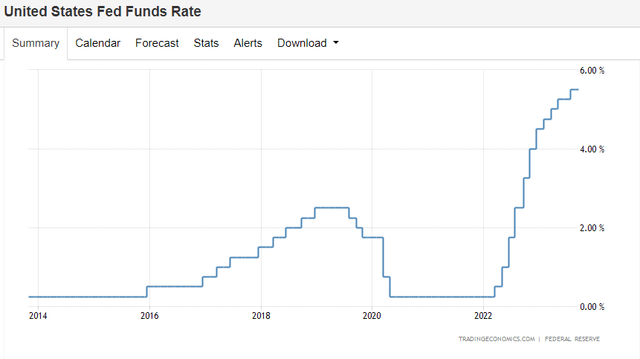

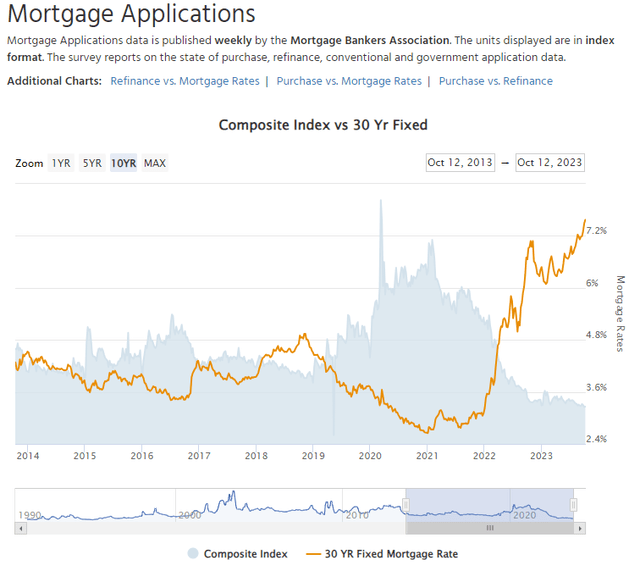

Despite the Fed pausing and becoming more data-dependent in recent months, they have taken rates higher at a pace not seen since the early 1980s. Their dual mandate of stabilizing prices and maintaining maximum employment overrides what the stock market wants. The Fed is in a difficult position because if they tighten too much, they can cause a recession and wreak havoc on banking, credit, and the overall business environment, which can work against their goal of maintaining maximum employment. The Fed has taken rates to a level where the current 12-month treasury yields 5.4%, and the 10-year treasury yields 4.61% while the cost of capital continues to increase. Mortgages are at 10-year highs over 7%, while mortgage applications are at 10-year lows.

Trading Economics

PDO’s largest underlying assets consist of corporate bonds and notes, convertible bonds and notes, municipal bonds and notes, Non-Agency Mortgage-Backed Securities, asset-backed securities, and Sovereign debt. As we have seen in PDO’s share price, the rising rate environment has destroyed shareholder value. Higher rates are often negative for funds such as PDO because existing bonds and MBS become less valuable. Hypothetically, If you purchased a bond with a 5-year maturity rate in 2021 that came with a 3% coupon and the same 5-year maturity bonds today have a 5.5% coupon, the previous bonds will be less valuable because they have a lower yield. As rates go up, the new bonds issued have larger yields, causing existing bonds to trade at a discount. A perfect example of this concept is looking at a chart of TLT. The rising rate environment has caused TLT to decline by roughly -38% since the Fed started tightening with the bonds in its underlying portfolio declining in value as new debt was issued with higher coupons. The same concept holds true for MBS products, as these are investments in debt to produce yield. When rates increase, so does the interest paid on mortgages, and older MBS products with lower-yielding debt can’t be sold for as much as new debt with higher yields.

Seeking Alpha

PDO hasn’t increased its distribution since July of last year, and its yield continues to increase for the wrong reasons. PDO’s assets are throwing off the same levels of income, but its cratering share price continues to push its yield further into the double digits. While PDO has a portfolio that exceeds $1 billion in assets, they are not as valuable as they once were. A rate environment that continues to rise or stays higher for longer isn’t optimal for PDO because a portion of the fund’s underlying assets will continue to be less valuable than those issued over the past year that come with higher yields. PDO is an income play, and if the Fed tightens too much, it could cause companies to default on their debt, whether that’s in the form of issued bonds or mortgages. The bear case for PDO has merit, and its success is predicated on several economic factors outside of its control. PDO isn’t an investment that will be right for everyone, and there is a level of risk that could increase if rates go higher.

Taking the other side of a deteriorating picture and looking at why PDI could be attractive

The stock market is the one place where an overwhelming number of people don’t like discounts, regardless of whether you’re at a supermarket or Best Buy (BBY). People want to pay lower prices for products because it leaves additional money in their pockets. The stock market is different, and when the market declines, we enter periods of fear and extreme fear. While some individuals think about the value of their assets declining, I look at things as an opportunity to purchase shares of equities at a lower price than I was willing to pay previously. I invest for the long term, and when I am allocating capital outside of retirement accounts, I have a 5-10-year horizon for the investments unless something makes me change my investment thesis. While there are certain factors that don’t paint the best picture for equities in the short term, I think we’re at a point where there are some great long-term opportunities if you are willing to take additional risks.

It’s no secret that we’re experiencing tighter financial conditions, additional geopolitical risks, and diverging growth cycles. PIMCO has navigated global multi-sector credit markets for several decades and has been successful in managing investments through different cycles. As the data indicates that we’re at the end of a tightening cycle, focusing on discounted fixed-income assets could be beneficial as they are starting off with higher yields if the underlying fundamentals are relatively strong. PDO is managed by Sonali Pier and Daniel Ivascyn, and by investing in PDO, I am putting my belief that they are able to sift through the discounted market and position PDO to benefit from shifting monetary policy. In 2021, Ms. Pier won the Investing Excellence in the Rising Talent Morningstar award, and prior to joining PIMCO in 2013, she was a senior credit trader at J.P. Morgan. Mr. Ivascyn won the Morningstar award for fixed-income fund manager of the year in 2013 and was inducted into the fixed-income analyst’s Society Hall of Fame in 2019. I think that the fixed-income markets will turn over the next 2 years and that Ms. Pier and Mr. Ivascyn can lead PDO higher.

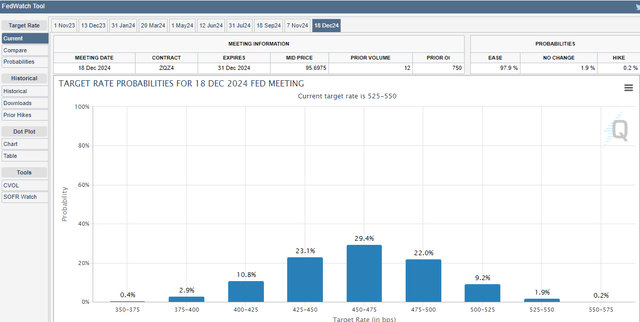

Core CPI continues to fall, and it has now reached its lowest level since September 2021. The CME Group Fed Watch Tool is now forecasting an 11.8% chance of a .25 bps increase in rates in November and a 31.4% chance for a .25 bps increase in December. Overall, the percentages of another rate hike continue to decline, and as CPI continues to decline, there is less of a reason for the Fed to increase rates. Looking out to the end of 2024, CME Group has the highest conviction that rates will be between 450 – 475 bps and a 63.3% chance rates will be between 4 – 4.75 bps.

CME Group

The rising rate environment has caused mortgage applications to hit their lowest point in over a decade as rates reached their highest point since 2000. The Fed has left the door open for another rate hike based on the data, but even if we get another hike in 2024, all signs point to a Fed pivot in 2024. CPI has remained under 4%, and Core CPI has fallen for 6 consecutive months to 4.1%. We’re headed into an election year, and there are elevated chances that the Fed will face political pressure from both sides of the aisle to lower rates, as no elected officials want to go into an election cycle with a restrictive economy. Credit has been tightening, and the average consumer has arguably been hurt more by rising rates than inflation. Seeing a 5% increase in the stores isn’t fun, but the tightening credit market has significantly increased interest on credit cards and made buying a home out of reach for many Americans. On the business side, the cost of capital has increased, so businesses are less inclined to expand, and there is a wall of debt coming due that needs to be refinanced. In some instances, the unit economics of refinanced debt at higher rates could turn some assets upside down, causing the operators to hand unwanted assets over to the banks, which could cause unemployment to skyrocket, recession, and a banking crisis.

My prediction is that the Fed will pivot in the first half of 2024 if Core CPI continues to fall into the low to mid-3 range. When rates decline, yields on newly issued debt and bonds will also decline. As this cycle progresses, we should see bonds and MBS products appreciate as the yield spread between older-issued debt and newly-issued debt tightens. I believe that the older assets with lower yields in PDO’s portfolio will regain some of their lost value and that the newer assets that they have invested in at higher yields will trade at a premium as future debt will have lower yields.

Mortgage News Daily

Conclusion

PDO hasn’t been a stellar investment from an appreciation aspect in 2023. The data indicates we are at the end of a tightening cycle, which is bullish for funds such as PDO. I think there is a long-term opportunity in the fixed-income markets for appreciation and to establish an above-average yield on capital. If the Fed pivots and the yield spread between newly issued debt and older debt tightens, then PDO’s underlying assets should appreciate, causing the yield PDO generates to decrease. I have to trust that PIMCO’s team has positioned PDO to benefit from where economic conditions are headed, not where they were. Based on everything I have looked at, I plan on adding to my position in PDO, and while some will say I am trying to catch a falling knife, I am looking at this as an opportunity to possibly buy at the bottom when there is more fear than greed in the markets.

Read the full article here