Introduction

It is time to summarize another quarter. The third quarter of 2023 saw the S&P 500 down 4% following a powerful Q2. September has seen the S&P 500 down almost 5%, thus turning this quarter red. The higher volatility we see right now results from the higher uncertainty in the world economy. The higher rates start to impact the markets, as we see the 10-year treasury yield climbing and REITs being hammered, as investors mostly fear the prospect of office rentals. Therefore, we see less optimism in the markets and more cautious investors.

The inflation is still above the goal of the Federal Reserve, and in the September numbers, we have seen a higher-than-expected increase. Yet, with inflation at 3.7% and core inflation at 3.6%, the inflation is manageable and doesn’t pose an immediate risk. Economists predict another possible rate hike before reaching the maximum, as we already have a positive real rate.

In Q3, my dividend growth portfolio outperformed the market by 1%. The results don’t surprise me, as dividend growth stocks tend to be more resilient with lower volatility. Thus, they declined less in 2022 and managed to enjoy the recovery to a lesser extent. In the long run, I should expect it to grow slower when the market is booming, but lower volatility is a plus when the uncertainty increases. I am not focusing on the total return in this portfolio but on its income.

I enjoyed several dividend increases during the quarter. Therefore, my dividend income has also been growing organically. My main goal is to achieve a growing stream of dividends, giving me more financial freedom. In Q3 2023, my dividend income increased by 18.03% YoY, and I am delighted with this achievement as I allocated more funds to my dividend growth portfolio than I planned initially.

I plan to keep executing my investment thesis. I will keep allocating funds to my portfolio monthly. I will invest in stocks I believe are cheap or fairly valued. I will strive to achieve a higher dividend income and a high total return. I see no reason to amend my investment thesis, as it has worked for me over the past decade.

I see any sign of volatility as an opportunity to buy a future income at lower prices. If the market is volatile due to a recession or any other reason, I will stick to the cheapest blue chips, which are usually expensive. Their dividend is generally extremely safe, and any price change is possible. I will also try to take advantage of significant drops and buy some of the stocks I find expensive now. I wish you all a great quarter.

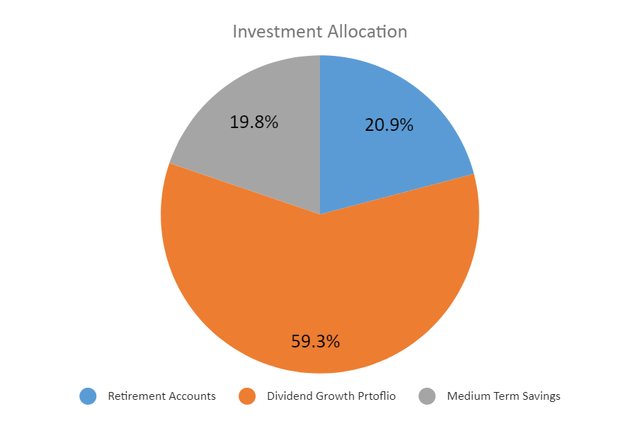

Investment Allocation

My dividend growth portfolio was more than 83% of my assets. To balance it, I allocated more funds to my other accounts. I want to balance it to hedge against possible strategy failures. Being overconfident in the financial world can lead to devastating results. Therefore, I am trying to allocate my funds and ensure that my assets stay diversified.

My current goal is to make my dividend growth portfolio below 50% of my assets and to do it while I keep increasing its value and achieving a 10% dividend growth. I am a believer in diversification. In the future, I believe that buying a house as an investment or to live in will lower the percentage of the dividend growth portfolio in my assets.

My dividend growth portfolio is very well-diversified and contains a collection of 85 blue-chip companies. While I am proud of my achievements as an investor, I must stay humble and diversify my investments wisely. The more I learn about investments, the humbler I become.

I already maxed out my Roth IRA in 2023. I have medium-term accounts that may serve as a down payment on a house. These two measures helped me diversify my holdings. While the Roth IRA, the retirement account, and the dividend growth portfolio are long-term investments, I plan to keep the rest of the funds liquid.

Author

My Goals

Since I started setting goals, I have managed to achieve most of my goals. My goals for 2023 are to achieve at least 10% dividend growth and diversify my investments, maximize my Roth IRA contribution, read at least twelve books, and travel abroad at least twice. I keep track of my goals so I can achieve them. I was lucky enough to travel five times this year and max my Roth IRA.

By setting goals, you can organize your time better. I highly recommend it to everyone. It allows you to see your progress during the year. Select some challenging but achievable goals, and make sure they are quantifiable. I believe I will achieve all my goals for 2023, as I am on track.

Sector Allocation

My brokerage account is my most significant asset, so I allocate money there according to my optimal sector allocation. As I am still accumulating, I don’t mind buying stocks from sectors I am over-allocated. I don’t want to ignore my optimal allocation.

I probably will not add to sectors exceeding the optimal allocation, like the energy sector, unless an outstanding opportunity arises. I will probably invest more in sectors in which I lack exposure in the coming quarters. I usually write articles regarding companies that I find attractive. I bought shares in some of them, while others are still on my radar.

In Q4, I will add more dividend growth companies in the consumer staples and consumer discretionary sectors.

| Sector | Current | Goal |

| Consumer Staples | 14.4% | 17.0% |

| Health Care | 11.6% | 12.5% |

| Industrials | 12.1% | 12.5% |

| Financials | 14.2% | 12.5% |

| Information Technology | 13.6% | 12.5% |

| Consumer Discretionary | 7.4% | 10.0% |

| Real Estate | 8.3% | 8.0% |

| Energy and Materials | 9.6% | 8.0% |

| Communication Services | 6.6% | 4.0% |

| Utilities | 2.3% | 3.0% |

My Portfolio

The following table shows the current holdings in my brokerage account. All the companies below are part of my dividend growth portfolio. Alphabet (GOOG) (GOOGL), Amazon (AMZN), Meta Platforms (META), and Disney (DIS) don’t pay dividends. However, they enjoy steady growth in their free cash flow. This metric is the basis of any dividend payment.

As a long-term investor, I don’t mind waiting until they are ready to share some of this wealth with their investors. Alphabet, Amazon, and Facebook have already started buyback programs. I hope that both will offer dividends in the years to come. Disney will hopefully reinstate the dividend soon. I kept a small portion of my Disney position as it was my first position (I don’t recommend having emotions in your decision-making process, but sometimes we can’t help it).

| Industry | Company | Ticker | % of Portfolio | % of Income |

| Information Technology | APPLE INC | (AAPL) | 3.83% | 0.65% |

| Health Care | ABBVIE INC | (ABBV) | 1.06% | 1.34% |

| Real Estate | ARBOR REALTY TRUST INC | (ABR) | 0.41% | 1.56% |

| Health Care | ABBOTT LABORATORIES | (ABT) | 1.62% | 1.16% |

| Consumer Staples | ARCHER-DANIELS-MIDLAND CO | (ADM) | 1.31% | 1.02% |

| Financials | AFLAC INC | (AFL) | 2.58% | 1.71% |

| Financials | AMERIPRISE FINL INC | (AMP) | 1.16% | 0.61% |

| Consumer Discretionary | AMAZON.COM INC | (AMZN) | 1.85% | 0.00% |

| Financials | AMERICAN EXPRESS COMPANY | (AXP) | 0.54% | 0.27% |

| Financials | BANK OF AMERICA CORP | (BAC) | 1.15% | 1.31% |

| Health Care | BECTON, DICKINSON & CO | (BDX) | 0.92% | 0.41% |

| Financials | BLACKROCK INC | (BLK) | 2.24% | 2.27% |

| Health Care | BRISTOL MYERS SQUIBB CO | (BMY) | 0.40% | 0.52% |

| Financials | CITIGROUP INC | (C) | 0.44% | 0.72% |

| Health Care | CARDINAL HEALTH INC | (CAH) | 1.67% | 1.13% |

| Industrials | CATERPILLAR INC | (CAT) | 2.87% | 1.77% |

| Information Technology | CISCO SYSTEMS INC | (CSCO) | 0.58% | 0.53% |

| Health Care | CVS HEALTH CORPORATION | (CVS) | 0.26% | 0.27% |

| Energy | CHEVRON CORPORATION | (CVX) | 2.34% | 2.74% |

| Communication Services | WALT DISNEY CO | (DIS) | 0.30% | 0.00% |

| Real Estate | DIGITAL REALTY TRUST INC | (DLR) | 1.31% | 1.66% |

| Utilities | DUKE ENERGY CORPORATION HOLDING COMPANY | (DUK) | 0.63% | 0.93% |

| Industrials | EMERSON ELECTRIC CO | (EMR) | 1.69% | 1.18% |

| Energy | ENTERPRISE PRODUCTS PARTNERS LP | (EPD) | 1.97% | 4.53% |

| Industrials | EATON CORPORATION PLC | (ETN) | 1.49% | 0.78% |

| Industrials | GENERAL DYNAMICS CORP | (GD) | 0.87% | 0.60% |

| Consumer Staples | GENERAL MILLS INC | (GIS) | 0.90% | 1.07% |

| Communication Services | ALPHABET INC CLASS C CAPITAL STOCK | (GOOG) | 2.97% | 0.00% |

| Financials | GOLDMAN SACHS GROUP INC | (GS) | 1.10% | 1.25% |

| Real Estate | HIGHWOODS PROPERTIES INC | (HIW) | 0.28% | 0.91% |

| Information Technology | INTERNATIONAL BUSINESS MACHINES CORP | (IBM) | 0.49% | 0.75% |

| Health Care | JOHNSON & JOHNSON | (JNJ) | 2.80% | 2.70% |

| Financials | JPMORGAN CHASE & CO | (JPM) | 1.59% | 1.43% |

| Consumer Staples | KELLOGG CO | (K) | 0.18% | 0.27% |

| Consumer Staples | KIMBERLY CLARK CORP | (KMB) | 1.29% | 1.61% |

| Energy | KINDER MORGAN INC | (KMI) | 0.92% | 1.92% |

| Consumer Staples | COCA COLA COMPANY (THE) | (KO) | 1.32% | 1.46% |

| Real Estate | KKR REAL ESTATE FINANCE TRUST INC | (KREF) | 0.28% | 1.36% |

| Industrials | LOCKHEED MARTIN CORP | (LMT) | 0.32% | 0.29% |

| Consumer Discretionary | LOWES COMPANIES | (LOW) | 0.35% | 0.25% |

| Real Estate | MID-AMERICA APARTMENT COMMUNITIES INC | (MAA) | 1.41% | 1.90% |

| Consumer Discretionary | MCDONALDS CORP | (MCD) | 2.66% | 2.27% |

| Health Care | MCKESSON CORP | (MCK) | 0.83% | 0.14% |

| Health Care | MEDTRONIC PLC | (MDT) | 1.03% | 1.25% |

| Communication Services | META PLATFORMS INC | (META) | 2.25% | 0.00% |

| Industrials | 3M COMPANY | (MMM) | 0.63% | 1.36% |

| Consumer Staples | ALTRIA GROUP INC | (MO) | 0.91% | 2.67% |

| Energy | MPLX LP COM UNIT REPSTG LTD PARTNER INT | (MPLX) | 0.77% | 2.11% |

| Health Care | MERCK & CO, INC | (MRK) | 0.74% | 0.66% |

| Financials | MORGAN STANLEY | (MS) | 0.28% | 0.39% |

| Information Technology | MICROSOFT CORP | (MSFT) | 2.34% | 0.68% |

| Industrials | MSC INDUSTRIAL DIRECT CO INC CL A | (MSM) | 0.74% | 0.72% |

| Utilities | NEXTERA ENERGY INC | (NEE) | 0.39% | 0.42% |

| Consumer Discretionary | NIKE INC CLASS B COM | (NKE) | 0.71% | 0.31% |

| Industrials | NORFOLK SOUTHERN CORP | (NSC) | 1.44% | 1.22% |

| Information Technology | NVIDIA CORP | (NVDA) | 3.29% | 0.04% |

| Real Estate | REALTY INCOME CORP | (O) | 2.71% | 5.22% |

| Real Estate | OMEGA HEALTHCARE INVESTORS INC | (OHI) | 0.49% | 1.22% |

| Energy | ONEOK INC | (OKE) | 0.74% | 1.30% |

| Consumer Staples | PEPSICO INC COMMON STOCK | (PEP) | 2.29% | 2.29% |

| Health Care | PFIZER INC | (PFE) | 0.23% | 0.37% |

| Consumer Staples | PROCTER & GAMBLE CO | (PG) | 1.55% | 1.28% |

| Consumer Staples | PHILIP MORRIS INTERNATIONAL INC | (PM) | 1.98% | 3.54% |

| Financials | PRUDENTIAL FINANCIAL INC | (PRU) | 1.68% | 2.83% |

| Information Technology | QUALCOMM INC | (QCOM) | 0.78% | 0.73% |

| Industrials | RTX CORPORATION COMMON STOCK | (RTX) | 0.52% | 0.54% |

| Consumer Discretionary | STARBUCKS CORP | (SBUX) | 0.65% | 0.52% |

| Financials | CHARLES SCHWAB CORP | (SCHW) | 0.37% | 0.23% |

| Consumer Staples | J M SMUCKER COMPANY | (SJM) | 0.40% | 0.48% |

| Utilities | SOUTHERN CO | (SO) | 0.71% | 0.95% |

| Real Estate | STARWOOD PROPERTY TRUST INC | (STWD) | 0.34% | 1.09% |

| Consumer Staples | SYSCO CORP | (SYY) | 0.45% | 0.45% |

| Consumer Discretionary | TARGET CORP | (TGT) | 1.20% | 1.50% |

| Financials | T ROWE PRICE GROUP INC | (TROW) | 1.08% | 1.66% |

| Consumer Staples | TYSON FOODS | (TSN) | 0.66% | 0.87% |

| Information Technology | TEXAS INSTRUMENTS INCORPORATED | (TXN) | 0.55% | 0.59% |

| Industrials | UNION PACIFIC CORP | (UNP) | 1.48% | 1.18% |

| Information Technology | VISA INC. CL A COMMON STOCK | (V) | 1.70% | 0.41% |

| Real Estate | VICI PROPERTIES | (VICI) | 0.31% | 0.56% |

| Energy | VALERO ENERGY CORP NEW | (VLO) | 0.45% | 0.46% |

| Communication Services | VERIZON COMMUNICATIONS | (VZ) | 1.10% | 3.02% |

| Utilities | WEC ENERGY GROUP INC | (WEC) | 0.59% | 0.71% |

| Consumer Staples | WALMART INC COMMON STOCK | (WMT) | 1.14% | 0.52% |

| Real Estate | W P CAREY INC COM | (WPC) | 0.77% | 1.94% |

| Energy | EXXON MOBIL CORP | (XOM) | 2.35% | 2.48% |

I currently own 85 companies in my portfolio. Over the quarter, I added to existing and new positions. I am not worried at all about the number of positions I hold. These blue-chip companies don’t need me to follow them daily. I wouldn’t mind keeping them even if the stock market is closed for a decade.

Acquisitions Made in Q3 2023

Real estate- I acquired shares of Realty Income Corporation (O) as the current downtrend in the market has sent this blue chip into attractive territory. With a dividend yield of 6%+, I believe it is a great long-term opportunity as the dividend is likely safe.

Sales Made In Q3 2023

During this quarter, I sold my shares in Medical Properties Trust (MPW) following the dividend cut. As part of my strategy, I sell shares in companies that cut their dividends. These companies have failed investors and showed flawed execution, and therefore, I sell my shares and will only reconsider if they manage to reignite growth.

What Am I Looking For?

When I look at my portfolio, I see a great collection of companies. I feel more confident about some companies yearly and less optimistic about others. That’s why diversification is critical. I am always looking for the weaker links in my portfolio and trying to measure the effect of a possible dividend cut on my income.

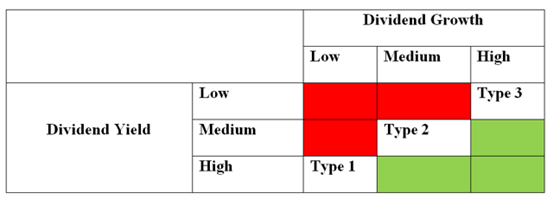

In Q4, I will closely follow the consumer discretionary and consumer staples sectors. You probably recognize the chart below as part of my stock analysis. Using this chart contributes to my analysis thesis. I mostly keep looking for Type 2 stocks as they offer the best combination of growth and income.

Stock types (Author)

Conclusion

Q3 2023 was a challenging quarter for investors but offered some long-term opportunities. I managed to maintain the dividend income growth during the quarter. In the next quarter, I will keep executing my investment thesis as I invest in companies monthly. Hopefully, I will be able to achieve my goals and get closer to my long-term objectives.

The macro events will keep affecting the business environment in the short term. Yet, in the long term, the fundamentals of the companies I own will decide the fate of my portfolio, and they’re solid. I constantly learn there is always a reason to avoid investing or be scared. Investors should ignore the noise and keep executing their plans. I wish you all a great quarter. I hope you all stay safe and healthy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here