FTC Solar — a Diamond in the Rough!

FTC Solar (NASDAQ:FTCI), a global provider of solar tracker systems, software, and engineering services, went public in early 2021 and looked like a sure bet. However, unexpected solar panel trade restrictions causing supply chain disruptions, along with high steel prices due to inflation and massive logistics price increases, resulted in a ~75% drop in revenue and negative gross margin of almost 50%. Many companies would have folded, but FTC Solar persevered, and at this coming earnings call, may show the world that they are well on the road to prosperity. Their Q1 earnings call will be a milestone for the company if they post their first positive, single-digits gross margin since IPO, with double-digits on the horizon.

FTC Solar IPO’ed at $13 a share in late April, 2021; they hit a 52-week low of $1.78 in October, and are now selling for ~$2.50; they have ~110mm shares outstanding. For those who bought at or around the IPO price and are still holding, if this quarter’s results do show a turnaround has occurred, then it will be a godsend; for new investors, it would offer an even greater opportunity.

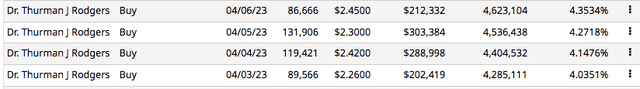

Since 2015, I’ve invested in Cypress Semiconductor (CY), SunPower (SPWR), Enphase Energy (ENPH), Enovix (ENVX) and now FTC Solar (FTCI). Who do they all have in common? The answer is: Silicon Valley’s TJ Rodgers. In early April, Rodgers bought an additional 427,559 shares of FTC Solar. It should be noted that Rodgers was a co-founder of FTC Solar and Chairman of the Board for five years; the fact that he has invested in the company most recently, given its beat-down status, should raise eyebrows.

TJ Rodgers Recent Purchases (BarChart.com)

When FTC Solar’s revenue crashed 75% back in 2021, the company experienced departures of the CEO, and then the COO in 2022. These events occurred while Rodgers was at the Board’s helm, so this was possibly his way of fixing things, just like he had done at some of the previous companies aforementioned. The CEO’s exit reminded me of Paul Nahi leaving Enphase Energy with Badri Kothandaraman taking the reins in 2017, and for any of you familiar with that company, that transition saved them. Rodgers had chosen Kothandaraman for his operational excellence, for he had led Cypress India and had built that division from nothing to 700 employees. The new CEO at FTC Solar, Sean Hunkler, had also been chosen by Rodgers and had a similar pedigree.

From 2021 onwards, FTC Solar had hit new lows primarily because of destructive government regulations and massive inflation; the company’s predicament was truly a microcosm of what happens when government gets in the way of business and tries to fix things.

The regulations that caused a major drop in revenue were 1) the Department of Commerce tariffs enacted to prevent the Chinese from bypassing the anti-dumping/countervailing duty tariffs (AD/CVD) 2) the U.S. Customs and Border Protection Withhold Release Orders which were enacted on silicon-based products made by Hoshine Silicon Industry Company located in China’s Xinjiang province, and 3) the Department of Homeland Security’s Uyghur Forced Labor Prevention Act enacted to keep solar products made in Xinjiang from being imported into the US.

As of this writing, these regulations have either been waived or lessened with solar module availability improving. The AD/CVD tariffs were waived by the Biden WH in June, 2022, for 2 years. CBP’s WRO rules were updated in November 2021 to be more lenient. On the UFLPA, the CEO stated at the last earnings call that they “have seen some early signs and reports of improvement“. Most importantly, FTC Solar will be able to source solar modules from outside of China starting in 2024 which will make UFLPA practically moot altogether.

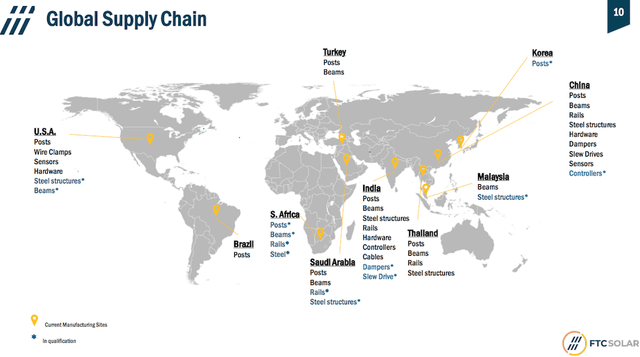

In February, FTC Solar announced a JV with Alpha Steel in Seely, Texas, to produce solar tracker parts for their utility-scale solar projects; the margin upside from this JV depends on receiving tax credits from the IRA 2022 Act and details are still being worked out by the US Treasury Department; the manufacturing plant is expected to be operational by mid-2023.

Global Supply Chain (FTCsolar.com)

With regards to inflation, FTC Solar experienced “historically high logistics and steel costs” in 2021-22; basically, the cost of steel used to produce the company’s solar tracker products doubled, and logistics costs increased more than tenfold.

Prior to the pandemic, everything was shipped in big metal containers on cargo ships for ~$2,500 per container. During the pandemic, that price rose, hitting an all-time high of ~$26,000 per container. FTC Solar started losing millions of dollars, so they transitioned to contracting entire vessels which they referred to as a “breakbulk solution“; this at least gave price certainty, and although prices were higher than the traditional $2,500, they were still much lower than the extortionist pricing aforementioned. Currently, containerized shipping costs are back to normal, so FTC Solar has transitioned back, and those enormous logistical losses are no longer being incurred.

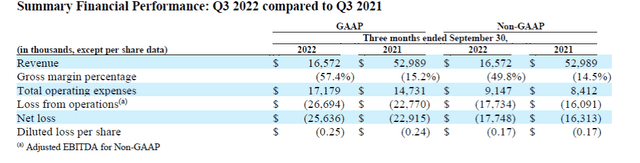

Q3-2022 Financial Performance (FTCsolar.com)

The logistics and inflationary issues experienced during the 2021-22 timeframe were very destructive, but if you look at last quarter’s results, it looks like things are rapidly improving. The company went from a -49.8% gross margin in Q3 to almost breakeven in Q4, and appears to be headed towards gross margin positive territory this quarter and overall profitability this year. In my opinion, a guarantee of that health is in TJ Rodgers making room for the Board to appoint a new Chairman and stepping down to focus on other things, meaning he has done his job. The new Chairman, Shaker Sadasivam, has ridden alongside Rodgers since 2017 at FTC Solar, so he really is not “new” at all, and that should be comforting to investors; if you have followed TJ Rodgers through the years, he seems to have a skill for finding the right people for the right job.

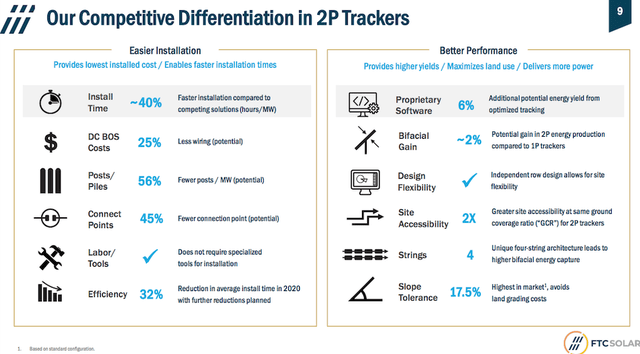

2P Solar Tracker System (FTCsolar.com)

In 2021, FTC Solar introduced a 2P tracker called “Voyager“, basically a system with rows of two solar panels in portrait mode on a single-axis system that tracks the Sun and provides constant optimal pitch; tracker systems like these increase energy output of a solar farm by up to 30%, and that is a very big deal. FTC Solar’s Voyager single-axis tracker leads the solar industry on installed cost, performance, design flexibility, and reliability.

Solar panels work when the sun is shining, but they work optimally if the sunshine hits them at a perpendicular angle. Making sure this happens is the job of a solar tracking system. FTC’s system gets the highest grades in the industry for such attributes like speed and ease of constructibility. In the past year, the company has expanded its product portfolio by announcing 2P tracker compatibility with (FSLR) First Solar’s thin-film modules, and by introducing a new 1P tracker called “Pioneer“; both add major revenue channels for the company and will affect this year’s bottom line.

2P Product Advantages (FTCsolar.com)

FTC Solar in the past year has reduced the steel content in its products by 20%. This has caused a reduction in costs and according to the CEO will “enable double-digit gross margins“.

FTC Solar started out in the US market only with its Voyager™ 2P tracker, and they were not compatible with US-produced First Solar modules; this turned out to be their Achilles Heal in 2021-22 when the regulations aforementioned went into effect. However, as of last quarter, FTC Solar now has accumulated business in 10 countries outside the US, and 80% of their Q4 awards were international; this will protect them should regulations from any one country inhibit their business. With their international expansion, FTC Solar’s TAM has expanded, and that will add to their bottom line going into this Q1 earnings call.

Last quarter, the company issued the following guidance for Q1:

- Revenue $35mm-$40mm or growth of 37-53%

- Non-GAAP gross margin $0.7mm-$3.2mm or 2-8% of revenue.

- Non-GAAP operating expenses $10mm-$11mm

- Adjusted EBITDA loss ($10.3mm)-($6.8mm)

The company had $44.4mm cash on their books as of last quarter, and commented that they expected to be at a similar level this quarter due to receivables and/or customer deposits. It’s important to note that FTC Solar has no debt and also has a $100mm undrawn credit revolver; so, share dilution is not even a concern. FTC Solar will continue with their cost reductions, and according to their last report, Q2 should offer even better results, maybe even posting a profit. The crux of the speed of their growth and profitability depends upon “solar module availability“, and that seems to be improving; by 2024, the Chinese product-sourcing concentration should no longer be a potential bottleneck.

It’s important to note that even though FTC Solar was still in the negative margin territory last quarter, they came in above “the midpoint of their guidance on all metrics” with revenue growing 58% from the previous quarter. Maybe they will do better this quarter. Their current order backlog as of last quarter stood at ~$1.2 billion. Although they produce the components and software to optimize the usage of the Sun, the name of the game is still supply and demand. From that $1.2 billion backlog, clearly there is no problem with demand, but it does reflect one with supply. On the horizon, those supply issues look pretty much resolved or will be resolved in 2024. Regardless though, there are always political issues potentially throwing a monkey wrench into the gear box. The geo-political theatre seems to change daily, so there are no guarantees for the future. FTC Solar seems well on its way to diversifying its solar panel supply which is important, so that is a major issue to be watchful of as an investor.

In summary though, there are good signs coming from FTC Solar since Q4, so for a company whose stock is currently selling at all-time lows, they may be a diamond in the rough and may well be experiencing a serious turnaround; hopefully this earnings call will demonstrate that. As always, please do your own due diligence, and good luck.

Read the full article here