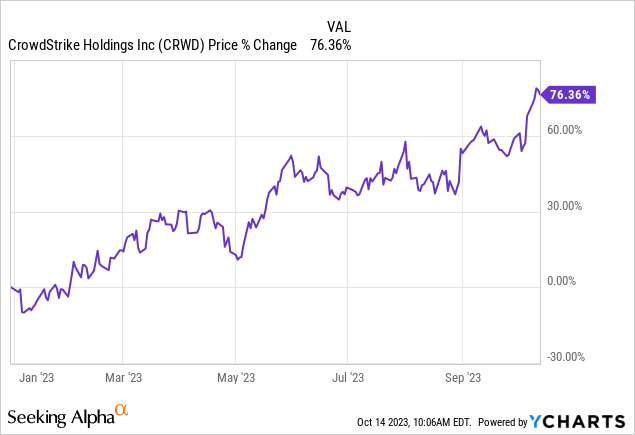

Shares of CrowdStrike Holdings (NASDAQ:CRWD) have seen a strong revaluation since December 2022 which is when I last worked on the cybersecurity company. CrowdStrike continued to grow in the last nine months as well, especially in regard to its top line expansion and the company maintained its customer acquisition momentum. However, shares now appear overvalued based off of revenues and the risk profile has deteriorated greatly, in my opinion. Additionally, the company’s top line growth is slowing as more companies compete for customers in the sector. With decelerating top line growth and a stretched valuation based off of revenues, I believe CrowdStrike is not much more than a hold right now!

Previous rating

My last rating on record was submitted in December 2022 which is when I recommended the cybersecurity company’s shares as a buy — CrowdStrike: Strong Long-Term Value — due to the firm’s impressive top line growth, strong value proposition for companies that want to protect against cyber threats and robust customer retention. While CrowdStrike’s valuation was not cheap back then, the strong revaluation that has taken place now translates to a very unfavorable risk profile. As a result, I would recommend investors to wait for a drop before engaging at such a high valuation level.

CrowdStrike’s core value proposition

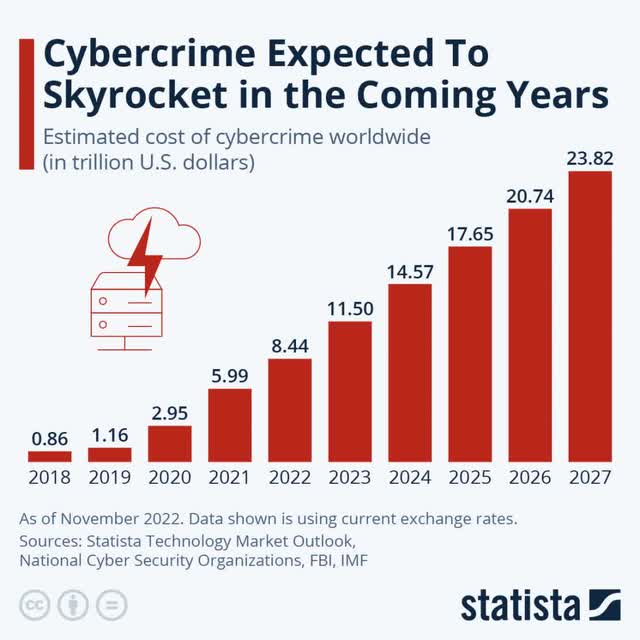

CrowdStrike offers cybersecurity software to protect computers, networks, and data from malicious cyber-attacks. CrowdStrike’s core Falcon platform, which is a cloud-native endpoint security solution, offers companies advanced threat detection and protection services. With cybercrime on the rise, and there being evidence that data breaches can cause significant damage to companies in terms of reputation and costs, CrowdStrike offers critical cybersecurity services for corporations around the globe.

Source: Statista

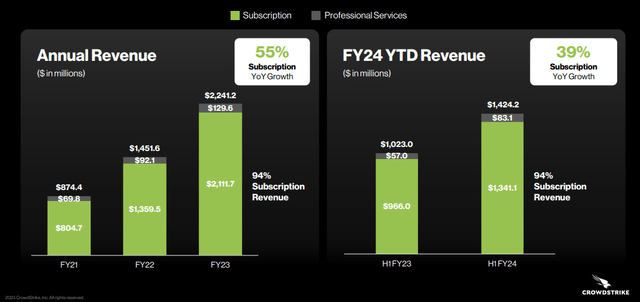

Strong revenue growth

CrowdStrike is a growth stock in the truest sense of the word and the firm’s strong value proposition for the corporate sector has translated into aggressive top line growth in the last several years. For the first six months of the current fiscal year, CrowdStrike reported record revenues of $1.4B, 94% of which were recurring subscription revenues. In total, CrowdStrike’s YTD revenues grew 39% year over year in the first half of the year. While the firm is still growing rapidly, it is not growing as rapidly as it did in the past. In FY 2023, the last completed financial year for CrowdStrike, the firm achieved 55% growth. So while the company is still expanding, chiefly through customer acquisition, top line growth rates are decelerating considerably and investors should take this issue seriously… as this is likely to lead to headwinds for CrowdStrike’s multiplier factor expansion.

Source: CrowdStrike

Customer retention dropped off in the last quarter

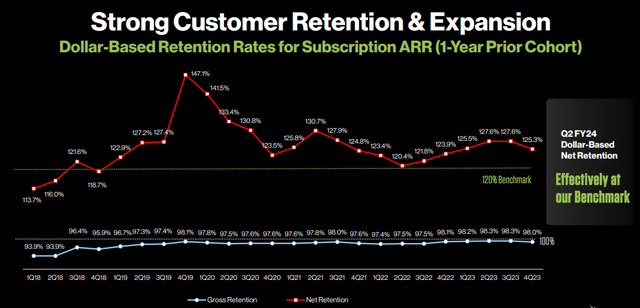

CrowdStrike is doing a solid job in terms of customer retention, which has been key to the firm’s organic revenue growth. Key to internal revenue growth is the so-called Dollar-Based Retention Rate which measures to what extent customer cohorts are increasing their product spend from one reporting period to the next. In a very simple case, a Dollar-Based Net Retention Rate of 125.3% shows that a customer has increased its spending on the CrowdStrike platform by 25.3% year over year.

CrowdStrike’s DBRR recently dropped off to 125.3% in FQ4’23, from 127.6% in the previous quarter, which was the first drop-off since Q2’22. While this is not yet worrying, it could indicate a weakening of CrowdStrike’s monetization efforts… especially if the company were to report additional DBRR declines in the coming quarters.

Source: CrowdStrike

CrowdStrike’s valuation

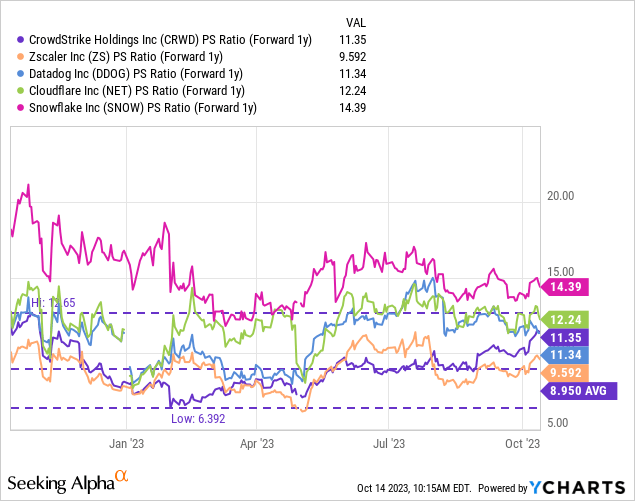

Analysts expect CrowdStrike to grow its revenues 36% this year, 29% in the following year, and 25% after that. The consensus estimates clearly show a down-trend in top line growth, indicating that competitive pressures are expected to lead to an increasingly saturated market. I believe the current valuation multiplier factor of 11.4X for CrowdStrike is very high and the industry group as a whole appears to be very richly valued as well. Shares of CrowdStrike have appreciated 76% this year and are now trading 27% above their 1-year average P/S ratio.

Risks with CrowdStrike

The biggest risk that I see, as of right now, is the risk of a correction considering how much CrowdStrike’s shares have advanced in the last nine months. The cybersecurity is also at risk of seeing further decelerating top line growth and I don’t believe that this growing risk is adequately reflected in CrowdStrike’s valuation. Additionally, there is a risk of a sequential DBRR decline which could result in growing valuation pressure as well.

Final thoughts

I like CrowdStrike and its value proposition, especially for the corporate sector: cybersecurity threats are constantly evolving which leads to a changing threat landscape… which in turn means companies need to invest in the most up-to-date cybersecurity defenses at all times.

However, CrowdStrike’s top line growth is decelerating rapidly and while the company has so far done a great job retaining clients, headwinds are increasing, in part due to growing competition in the industry. CrowdStrike saw a 76% valuation gain this year… with shares now selling at 11.4X forward revenues and top line growth decelerating, I believe that CrowdStrike is priced for perfection. Investors who like CrowdStrike’s product and value proposition may want to wait for a drop before engaging!

Read the full article here