Gilead Sciences (NASDAQ:GILD) is a $95-billion market cap biopharmaceutical company headquartered in Foster City, California, that specializes in researching, developing, and selling treatments for various medical conditions, including HIV, hepatitis B, hepatitis C, and certain cancers. The company operates in over 35 countries and employs around 17,000 people.

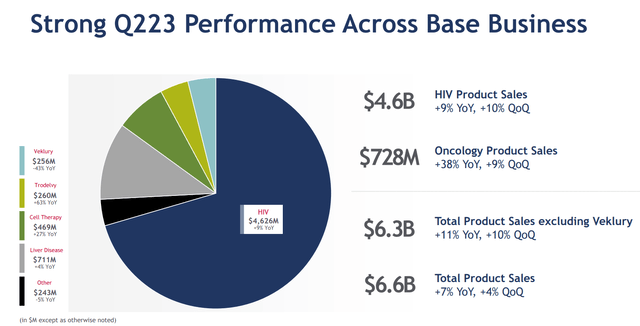

In Q2 2023, Gilead Sciences reported strong financial performance across various segments. Their HIV division, accounting for 70% of product revenue, saw a 9% increase in sales, primarily driven by the success of Biktarvy. Additionally, the Oncology segment demonstrated a robust performance with a 38% increase in sales, largely attributed to Trodelvy. Sales in the Liver Disease segment, encompassing products for hepatitis B, C, and D, rose by 4%. However, Veklury, the COVID-19 treatment, experienced a significant drop in sales, falling by 43% due to a decline in COVID-19 hospitalizations. This decrease came in the context of Gilead’s overall strong financial performance, characterized by an 11% top-line growth excluding Veklury, despite increased expenses.

GILD’s IR materials

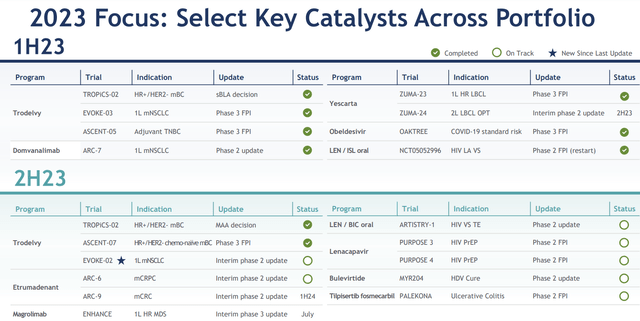

I’m not really an expert in pharma, but Gilead looks well-diversified across indications and stages. GILD’s pipeline is active, with multiple therapies progressing through clinical trials. The company remains committed to developing innovative solutions for HIV, liver diseases, and oncology. Notably, Gilead presented positive data readouts for Trodelvy, Yescarta, Tecartus, Sunlenca, Hepcludex, and Veklury.

While Gilead faced a setback with the discontinuation of the Phase 3 ENHANCE study for Higher-Risk MDS, the company continues to explore new opportunities in oncology and inflammation therapy. The pipeline includes novel mechanisms and a commitment to addressing high unmet needs in various therapeutic areas.

GILD’s IR materials

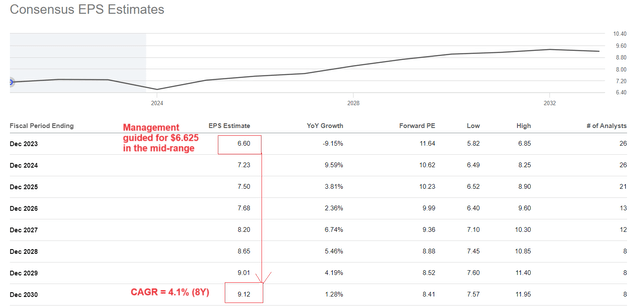

Management also updated their guidance for FY2023, with a projected total product sales range of $26.3-26.7 billion. The guidance assumes total product sales, excluding Veklury, of $24.6-25.0 billion and Veklury sales of ~$1.7 billion. Adjusted EPS for the full year is expected to be between $6.45-6.80.

Interestingly, the market doesn’t believe that GILD will actually report $6.625 [mid-range] earnings per share in FY2023, even though the company already beat consensus last year (and 62.5% of the time over the last 8 years).

Seeking Alpha, author’s notes

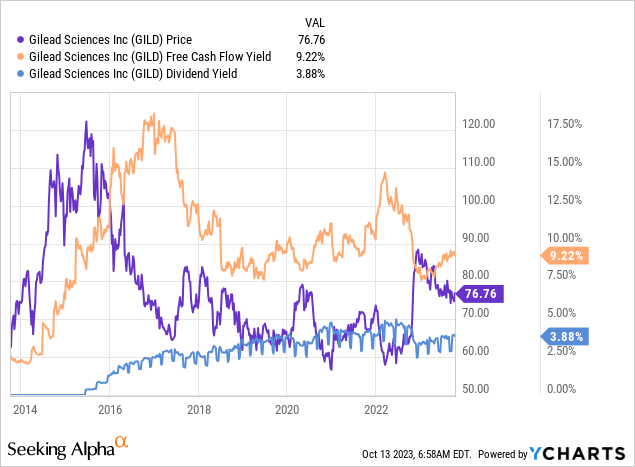

In my opinion, GILD is very cheaply valued due to its broad pipeline (more revenue growth ahead), profitability (EBITDA margin is quite solid), and valuation multiples (~30% lower than the sector median) – I would even call this stock dirt cheap.

Judge for yourselves: Apart from the serious slumps of the last few years, when the FCF yield reached an unreasonably high level, in normal times GILD doesn’t have the combination of the current high level of dividend yield and such a high FCF yield as it has today:

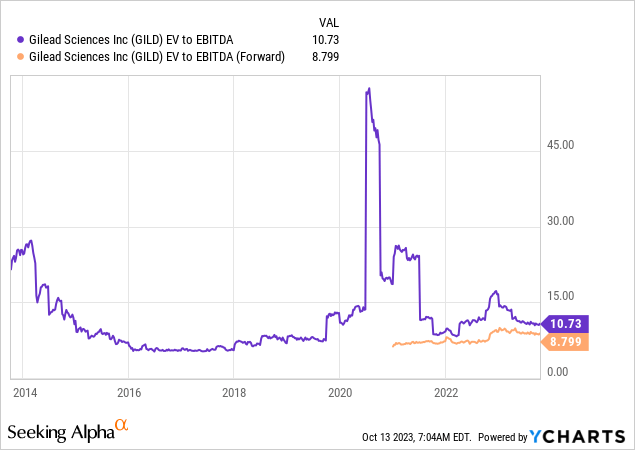

Another ratio – forward EV/EBITDA – is at its historical lower end today, suggesting that GILD is favorably valued.

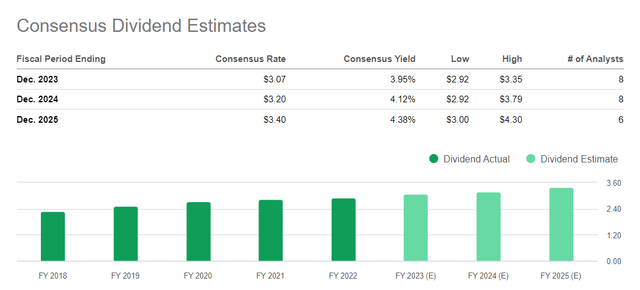

However, what I like most about GILD at the moment is its high dividend yield, both relative to the industry and relative to the existing historical norm. More importantly, this yield is set to increase as earnings per share increase, reaching 4.38% by FY2025, according to consensus forecasts:

Seeking Alpha, GILD’s Dividend Estimates

Thanks to its high profitability ratios and relatively normal cash dividend payout ratio of 42.09%, GILD’s stock also has an “A” rating in terms of its dividend safety from Seeking Alpha’s Quat system, which tells me that the current dividend is stable and most likely The consensus is not far from the truth.

As Bank of America’s analysts suggest, in the current financial landscape dividends play a more significant role in overall market returns compared to the past decade. They advise investors to focus on companies with above-average and secure dividend yields, specifically looking at the Quintile 2 of the Russell 1000 index [based on their proprietary model], which includes companies with the second-highest dividend yields. This can help avoid investing in distressed companies that might shift into Quintile 1 if their stock prices drop before potential dividend cuts. Quintile 2 has historically shown the highest total return and the lowest loss ratio since 1984 when compared to other quintiles and non-dividend payers within the Russell 1000 index.

BofA’s research paper [October 2023, proprietary source]![BofA's research paper [October 2023, proprietary source]](https://ifintechworld.com/wp-content/uploads/2023/10/49513514-16972721758795273.png)

Gilead Sciences is included in Quantile 2, according to the most recent BofA list:

BofA’s research paper [October 2023, proprietary source], author’s notes![BofA's research paper [October 2023, proprietary source], author's notes](https://ifintechworld.com/wp-content/uploads/2023/10/49513514-16972726917088628.png)

The Bottom Line

Surely, investing in Gilead Sciences stock comes with several risks to consider. The company faces competition, patent expirations, and its earnings are still tied to the unpredictable demand for its COVID-19 treatment. Plus, the pharmaceutical industry is tightly regulated, and clinical trial setbacks can hit hard. Currency exchange rates can also affect GILD’s revenue. So, consider these factors when thinking about Gilead Sciences as an investment.

However, we can’t ignore the combination of high FCF yield and dividend yield I wrote about above – the stock looks really dirt cheap to me at its current levels. With a pretty strong pipeline, continued sales growth, and maintaining relatively high margins, GILD offers some sort of protection for buyers. GILD’s total return over the next 2-3 years should outperform the broad market, in my humble opinion.

So with this article, I am initiating coverage of GILD stock with a “Buy” rating.

Thanks for reading!

Read the full article here