Q3 Earnings Review for Top US Banks

JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C), and Wells Fargo (NYSE:WFC) reported Q3 earnings on October 13. Below we review the relative performance of these 3 banks and evaluate insights from segment trends and management outlooks. This data provides a useful guideline for investors adjusting portfolios for Q3 and Q4.

JPMorgan is best positioned for the high-rate environment

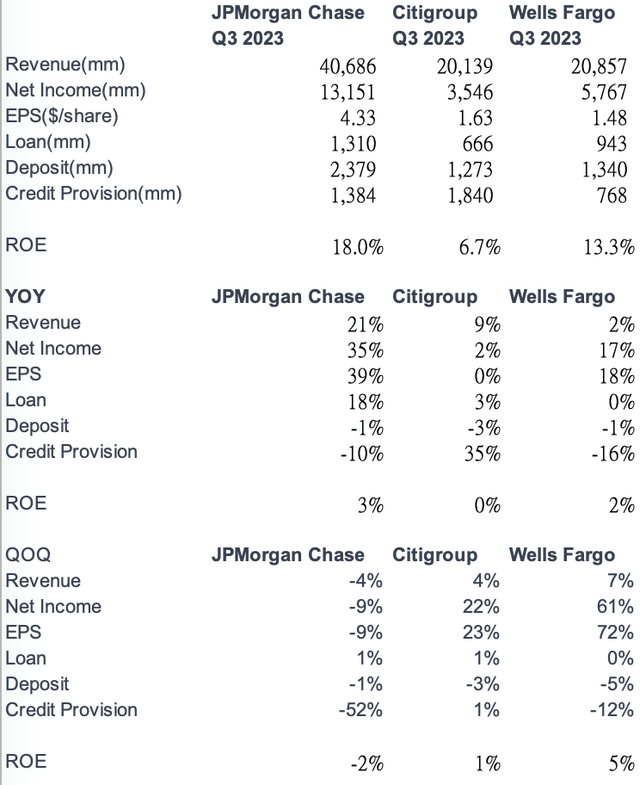

JPMorgan’s results were boosted by the acquisition of First Republic Bank. Thus, its year-over-year performance looks stronger than Citigroup and Wells Fargo. Analyzing quarter-over-quarter, JPMorgan lagged the group as its ROE deteriorated from Q2 while the others improved. Looking ahead to 2024, ROE will be a key indicator as the Fed maintains high rates. Based on the CAPM model, with a 5% risk-free rate and 6% equity risk premium, the required return on bank equity is 11%. From this perspective, JPMorgan is still better positioned than its peers with an 18% ROE, well above its cost of equity.

Earnings reports, LEL

Resilient Consumer Lending Supports Loan Growth

The above chart shows that the deposit runoff continued reducing bank deposit balances as clients shifted funds to higher-yielding assets like money market funds. This should limit loan growth capability. However, resilient consumer spending, with credit card loans as the main driver, kept loan balances growing positively, relatively strong compared to declining deposits. JPMorgan led in loan growth given its consumer base is more resilient than the others, while Wells Fargo lagged as its real estate lending focus still faces headwinds from higher mortgage rates.

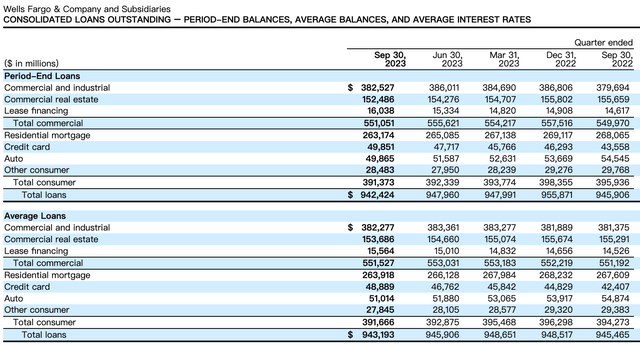

Wells Fargo’s results provide insights into the housing and auto sectors. Loan balances continued dropping in Q3 amid headwinds from higher rates. The decline accelerated in residential mortgages with the average loan balance down $3 billion in Q3, double the $1.8 billion drop in Q2. The commercial real estate loan book also shrank further from Q2. The good news is credit quality is held stable. Given persistently high rates, Wells Fargo faces more difficulty than peers with its rate-sensitive mortgage and auto exposure.

WFC

Net Interest Income Headwinds Emerge

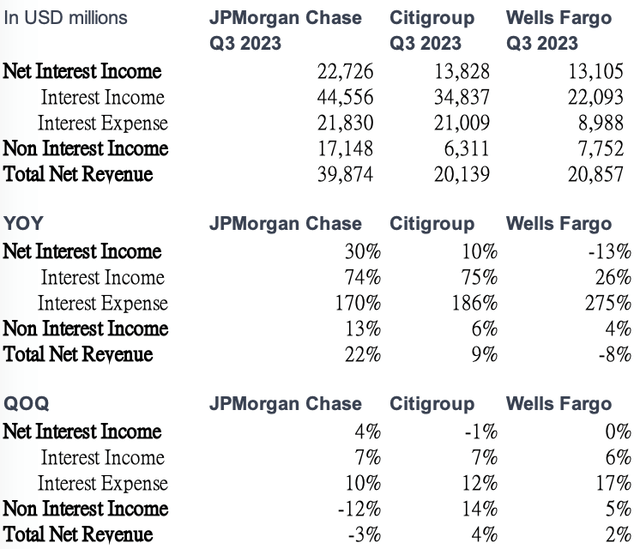

The three banks showed divergent net interest income growth. JPMorgan outperformed by best-containing interest expense increases, signaling stronger bargaining power and customer loyalty. However, all three banks faced top-line headwinds with declining net interest margins sequentially. This likely results from deposit costs rising faster than banks can increase rates on loans due to regulatory caps on credit cards and weakening loan demand if banks raise rates significantly. Though JPMorgan is best positioned, the trends show mounting net interest income challenges for banks as the Fed hikes rates again in Q4, pressuring margins.

Earnings reports, LEL

Offsetting Interest Income Declines

The banks offset the net interest income drags by growing non-interest income like lending fees, asset management fees, and card fees. The deposit runoff created an offsetting tailwind, generating asset management fees even as deposit balances fell.

Expense Discipline Maintained

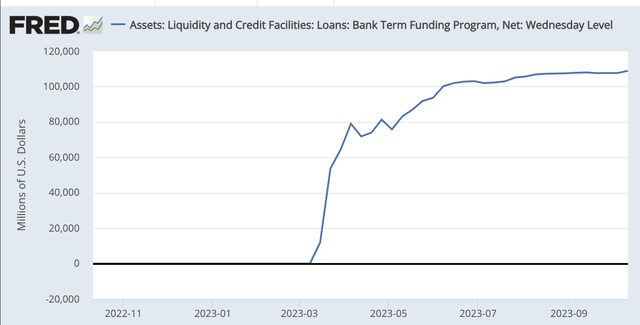

All three banks kept non-interest expenses flat sequentially, demonstrating cost discipline. Loan loss provisions also decreased or held steady, pointing to stabilized credit conditions after the March liquidity crisis. This is corroborated by the Fed’s Bank Term Funding Program balance plateauing in Q3.

FED

Outlook and Risks

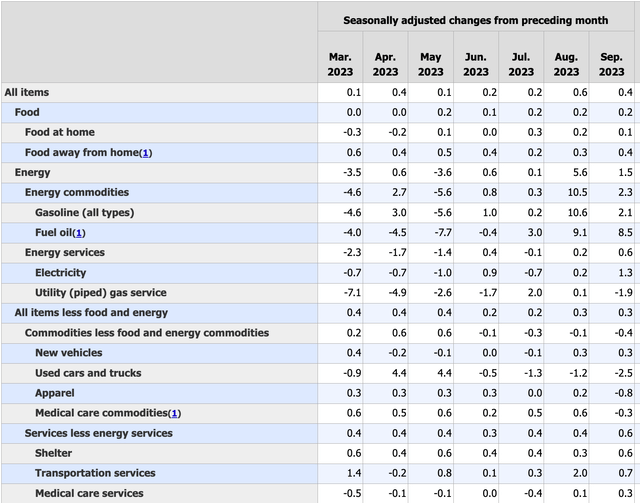

The high-rate environment impacts bank business models. While the Fed is likely to hike again in Q4 given still high inflation and strong economy and job market, larger US banks less reliant on mortgages and autos are less affected as consumer discretionary spending remains strong.

The data available at the time of the September 19-20 meeting suggested that real gross domestic product [GDP] was rising at a solid pace in the third quarter. The labor market continued to be tight, with the unemployment rate low and job gains slowing but remaining strong. Consumer price inflation was still elevated.

There are also signs the Fed believes rates are reaching a restrictive level as members noted higher bond yields could substitute for further hikes. If Treasury yields rise further, it may have less impact on banks than in recent quarters due to this “Fed put” on rates. Geopolitical tensions like the Israel-Hamas conflict could also cap Treasury yields amid risk-off sentiment.

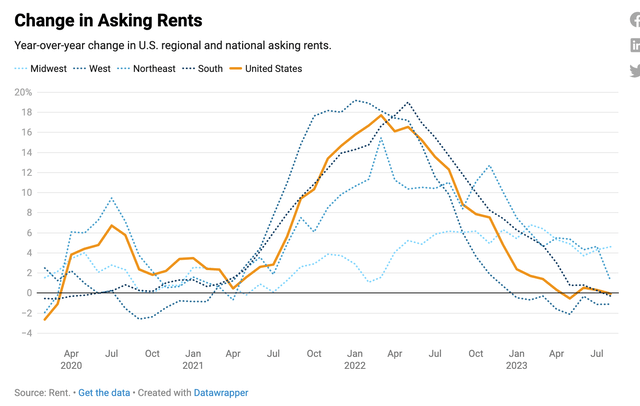

Although September core CPI increased 0.3%, there is room for shelter inflation to moderate in upcoming months, helping offset broader price pressures. Rent growth has historically lagged behind housing prices, and recent declines in home values should begin filtering through to slow rent appreciation. This shelter component makes up one-third of CPI and tends to be sticky, so any cooling would meaningfully impact the inflation outlook.

BLS Rent.com

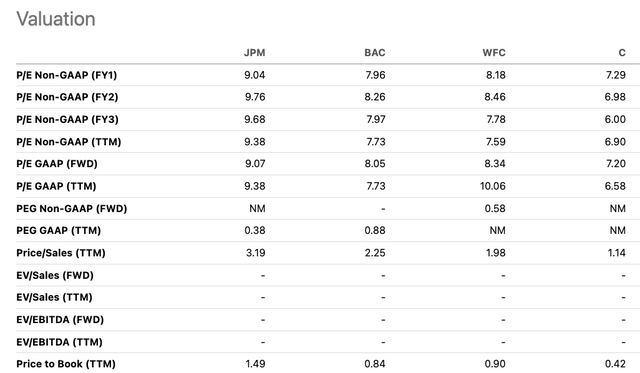

Valuations

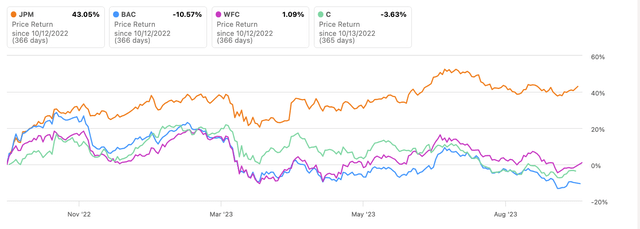

JPMorgan remains the best positioned among peers, but this seems priced in with its stock outpacing Wells and Citi by 40% over the past year.

Seeking Alpha

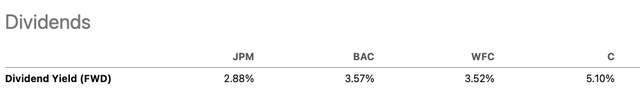

Based on dividend yields and valuation metrics like P/B and P/E ratios, JPMorgan’s stock does not look very attractive relative to banking peers Wells Fargo and Citigroup. We believe Wells Fargo and Citi’s lower valuations stem from sector positioning and lower profitability [ROE].

Specifically, Wells Fargo’s mortgage and auto loan focus makes it more exposed to rate-sensitive sectors facing headwinds in the rising rate environment. As we’ve seen in recent quarters, higher rates have weighed on originations, margins, and loan demand in these areas.

Seeking Alpha

Seeking Alpha

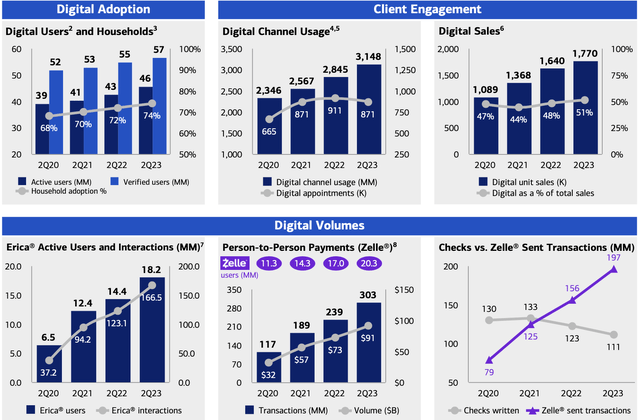

Preview of Bank of America Earnings

Bank of America (NYSE:BAC) reports next week. With its consumer banking focus, BAC is relatively attractive versus peers with lower P/B and P/E than JPMorgan and higher Q2 ROE above 11%. We especially like BofA’s digital banking and wealth management strengths providing competitive advantages against fintech rivals.

BAC

Conclusion – Prefer Bank of America

The bank earnings point to resilient US consumers and improving credit conditions outside of rate-sensitive sectors. We prefer banks with strong consumer loyalty like JPMorgan and Bank of America. While JPMorgan’s valuation is somewhat expensive but justified by profitability, Bank of America looks most attractive on a relative basis. If US consumers remain strong, we’d buy Bank of America over its peers.

Read the full article here