Written by Nick Ackerman, co-produced by Stanford Chemist.

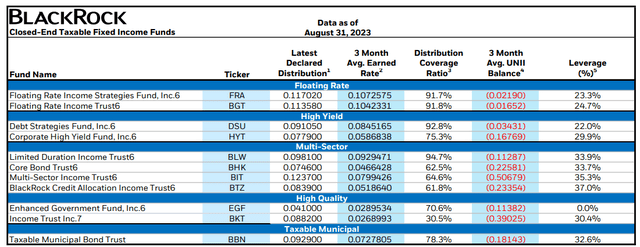

In the latest UNII Report, BlackRock Floating Rate Income Strategies Fund (NYSE:FRA) once again showed its income generation was growing. As the Fed is expected to raise one or two more times, the fund can continue to benefit going forward as well. While we may be near or at the peak of this rate hiking cycle, fewer cuts heading into next year are now projected. That should translate into FRA still being a decent place to have cash at work while investors collect a double-digit distribution yield. At the same time, FRA has also seen its discount narrow meaningfully from our last update, so we aren’t necessarily seeing the best entry point either.

The Basics

- 1-Year Z-score: 1.98

- Discount: -4.69%

- Distribution Yield: 11.15%

- Expense Ratio: 1.15%

- Leverage: 23.45%

- Managed Assets: $612.242 million

- Structure: Perpetual

FRA’s investment objective is “to provide shareholders with high current income and such preservation of capital as it is consistent with investments in a diversified, leveraged portfolio consisting of floating-rate debt securities and instruments.”

To achieve this investment objective, “at least 80% of its assets in floating rate debt securities, including floating or variable rate debt securities that pay interest at rates that adjust whenever a specified interest rate changes and/or which reset on predetermined dates.” As is typical with these sorts of funds – the portfolio “invests a substantial portion of its investments in floating rate debt securities consisting of secured or unsecured senior floating rate loans that are rated below investment grade.”

The fund’s expense ratio comes to 1.15%; however, the fund is also leveraged and that comes with its own costs. Those costs have been rising, and that’s brought up the fund’s total expense ratio to 2.17%. Despite the rising expenses for the underlying borrowings the fund has, the portfolio’s growing yield has more than offset that. The fund pays a rate of SOFR plus a spread of 0.80%.

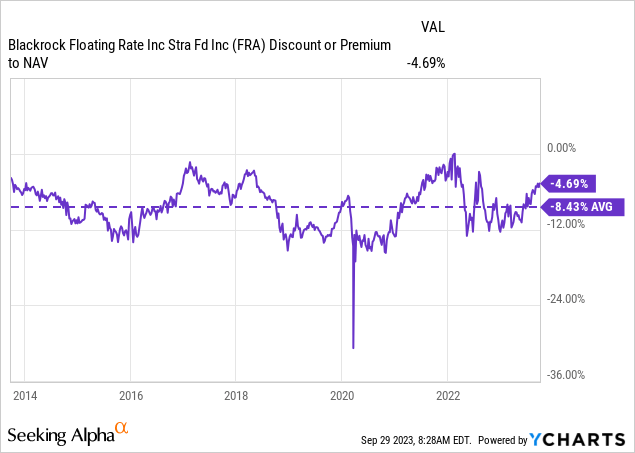

Discount Narrows Taking Away Some Appeal

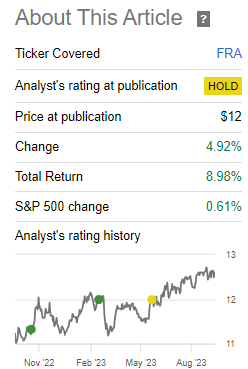

In the last update, I did end up going with a ‘Hold’ rating because my thinking was that we were getting closer to the peaks for the rate cycle. Additionally, the fund’s discount still wasn’t appealing relative to its longer-term history.

While I still think that is true now that we should be near peak rates, the outlook for cuts going forward was taken down in the Fed’s projections. That can make floating rate-focused funds more tempting, as they can provide these sorts of yields for longer to investors.

However, my problem with still being hesitant to provide a ‘Buy’ rating is that the fund’s discount has narrowed even further since then, too. The narrowing discount in this period also had the impact of boosting the total returns in this period.

FRA Performance Since Prior Update (Seeking Alpha)

The fund is trading well above its longer-term average. The prospects for the fund in the current environment are better than they were through most of this period. However, I still suspect that with some patience, investors could get a more opportune time to enter a position. At the same time, it isn’t at a level that would compel me to sell the fund either. That’s why I believe a ‘Hold’ rating here is still appropriate.

Ycharts

Distribution Looking Tempting

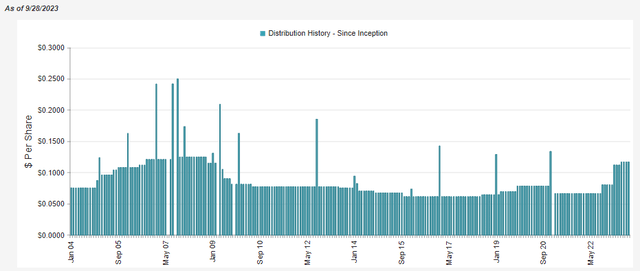

The fund’s current distribution is about as high as it was back before the global financial crisis. Though it still has just a touch to go. Perhaps this isn’t too surprising, given the current Fed target rate is now at a similar level when, through most of this period, it was at or near zero.

FRA Distribution History (CEFConnect)

As mentioned, the fund’s borrowing costs have been rising. The fund’s total expense ratio went from 2.17% at the end of 2022 to 2.76% by the end of their last semi-annual report period ending June 30, 2023. Despite this, we’ve seen the fund raise its distribution several times, and its income generation has risen materially. To put it into perspective, the net investment income (“NII”) ratio of the fund went from 6.36% to 9.35% during this same period of time.

At the end of that semi-annual report, NII per share came in at $0.60 for the preceding six-month period. If we give the latest UNII report a look, we actually see that it would annualize out to an even higher amount than the $1.20 that would have been reflected in that latest report. Now, the fund looks like it would annualize out at around a $1.28709 NII figure.

BlackRock August 2023 UNII Report (BlackRock)

That’s accelerating from the $1.18 annualized NII we saw in our previous update when we were looking at the 3-month average earnings rate for the end of Q1 2023. At that time, distribution coverage came in at 88.1%, so we are heading in the right direction still.

That means though, of course, FRA is still lacking being fully covered by NII. With another rate hike or two, it would push it closer to being covered. However, it is worth mentioning that it does mean that an NAV distribution rate of 10.63% might look enticing; they just aren’t there yet. Though the discount on the food – albeit a smaller discount currently – still helps provide a higher distribution rate to shareholders, which currently comes in at 11.15%.

For tax purposes, the entire distribution in 2022 was classified as ordinary income. This is to be expected as the fund is heavily invested in floating-rate loans paying interest.

FRA’s Portfolio

Heading into 2023, it looks like the turnover ratio for this fund has remained low but increasing from last year. The last six-month report showed a turnover rate of 14%, of which 14% was the portfolio turnover rate in the entirety of 2022. Both of these figures showed a deceleration in buying and selling for the fund from the 49 and 65% turnover rates in the years 2021 and 2020, respectively.

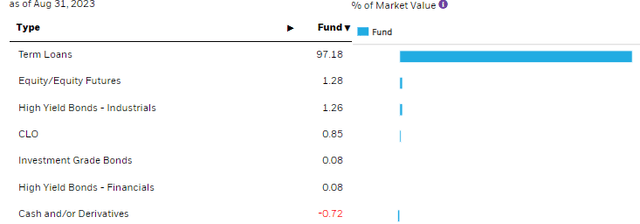

Even with higher turnover, the fund’s main focus has stayed largely the same, as one would expect it to stay consistent with its investment policy. The fund’s portfolio is overwhelmingly invested in term loans, also known as bank loans or floating-rate loans.

FRA Asset Type Allocation (BlackRock)

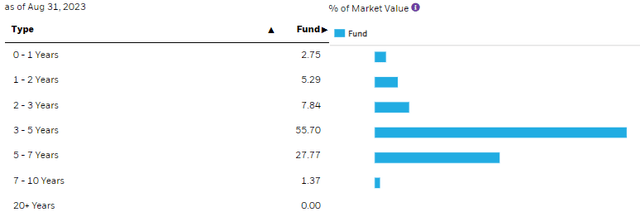

This is why the fund’s duration can be so low at just 0.21 years. This means that for every 1% change in interest rates, the portfolio’s underlying portfolio should move about 0.21%. A shorter maturity on this portfolio also helps keep its duration low, as most of the fund’s portfolio matures over the next 3 to 5 years only.

FRA Maturity Schedule (BlackRock)

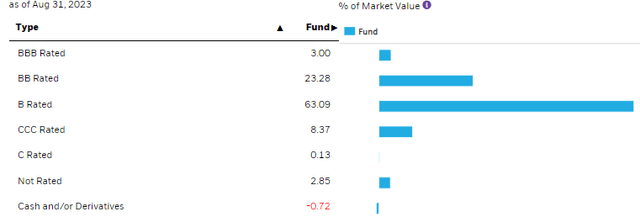

Also consistent with this fund is the fund’s lower credit rating than would be expected from floating-rate loans. Naturally, if companies can get financing at a decent fixed rate, they are going to go that route instead of subjecting themselves to interest rate risks. That doesn’t mean there aren’t investment-grade floating rate ETFs that an investor can invest in, but the reduced risk is reflected by a significantly lower dividend yield as well.

FRA Portfolio Credit Quality (BlackRock)

Higher rates are helping the fund now, but in a future where rates are cut, the income generation would come down.

In addition to that, it’s important to consider the fact of why interest rates may be cut in the first place. If they are gradually cut because inflation is coming down, and we go into a soft landing, then chances are the downside moves here wouldn’t be too bad.

However, if the Fed has to aggressively cut rates because of a major slowdown in the economy, which would likely be caused or coincide with defaults heading higher, then the moves lower for FRA could be substantial. That is really the trade-off we are looking at by investing in below-investment-grade, greater chance for yield now, but it comes with greater risks, as one would expect.

Conclusion

FRA continues to look like a solid fund to hold for the current environment. The valuation of the fund would still keep me from accumulating more at this time. Given the outlook of the latest Fed projections for cutting rates less than expected in the coming years, this fund has a better chance of providing its current distribution rate for a longer period of time than expected earlier this year.

Read the full article here