After Coke (KO) and Pepsi (PEP), Keurig Dr Pepper (NASDAQ:KDP) is the third-largest beverage company in North America, with annual revenues of approximately $14 billion. It was formed as a reverse merger between Keurig Green Mountain and Dr. Pepper Snapple Group. Keurig Green Mountain had been publicly listed and at the end of 2015 was taken private by Luxembourg-based equity firm, JAB Holding Co., for $13.9 billion. In July of 2018, Keurig acquired Dr. Pepper for $18.7 billion. The current market cap of the combined company, KDP, is $39.2 billion. According to Dealogic, this merger was the biggest nonalcoholic drinks deal on record. The logic to the transaction was that Keurig would use Dr Pepper’s distribution network to market such brands as Peet’s Coffee and Forto coffee shots and Dr. Pepper would use Keurig’s online presence to sell more soft drinks. It was also a vehicle to take Keurig public again and to help it compete with Starbucks (SBUX).

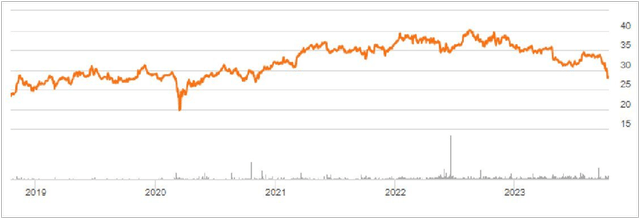

Today, the combined company produces and sells a range of hot and cold beverages. It has three operating divisions: i) Cold Beverages (consisting of packaged beverages and beverage concentrates), ii) Coffee Systems, and iii) Latin American Beverages. Cold Beverages represent almost 60.0% of income. Coffee Systems are about 35.0%, and Latin America the balance. The current Beta for the company is 0.58, so shares are less volatile than the market as a whole. KDP began trading on, July 10, 2018, at a price of $24.57. Today shares are at $28.08, down 29.7% from their August 2022 peak of $39.96. Below is a chart of the share price performance since the merger.

Share Price Since Merger (Seeking Alpha Charting)

On September 20th, the company named packaged foods industry veteran Tim Cofer as Chief Operating Officer, as a prelude to his taking the CEO role in the second quarter of 2024. Cofer recently led Central Garden & Pet (CENT) and previously held executive roles at Mondelez International (MDLZ) and Kraft Foods (KHC) totaling 25 years.

2022-2023 Overall Performance

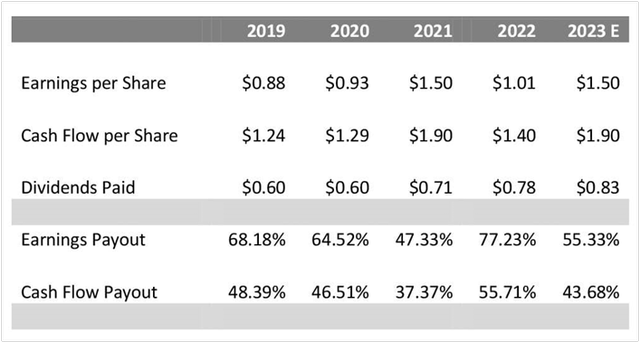

Earnings per share were lower in 2022 ($1.01) than in 2021 ($1.52). However, this was due largely to two issues. These included a write down of goodwill on two brands and increased selling, general and administrative costs. Otherwise, 2022 was a strong year for the company, per the 2022 Annual Report. Sales increased $1.4 billion, or 10.8%, to $14.1 billion for the year ended December 2022 compared to $12.7 billion in the prior year. This growth was generated across all segments through a combination of increased prices and higher volumes. Price growth across brands has averaged about 4.5% per year since the merger. Gross profit increased 5.0% to $7.3 billion in 2022 compared to $6.9 million in the prior year. While sales were strong, the gross margin decreased 290 basis points versus a year ago to 52.1%. SG&A expenses increased to $4.6 billion in 2022 compared to $4.2 million in the prior year. This was caused by higher logistics costs, the result of inflation and elevated labor costs. The write down in 2022 was a non-cash charge of $477 million, primarily due to a revaluation of Bai Antioxidant Drinks and Schweppes brands. Without these items, I estimate that earnings per share would have been $1.35.

Per Share Numbers Since Merger (Value Line)

During the first half of 2023, net sales picked up 7.4% over the prior year, and earnings per share were up 5.6%. In the Second Quarter 2023, KDP reaffirmed its 2023 guidance for adjusted EPS growth of 6.0% to 7.0%, with an EPS consensus of $1.78.

Cold Beverages, or Packaged Beverages plus Concentrates

Primary Brands: Dr. Pepper, Canada Dry, 7UP, A&W Root Beer, Crush, Sunkist, Squirt, Mott’s, Schweppes, Hawaiian Punch, ReaLemon, Snapple, Yoohoo, RC Cola, Bai, Big Red, Mr. & Mrs. T, Rose’s Lime Juice, Xyience Energy.

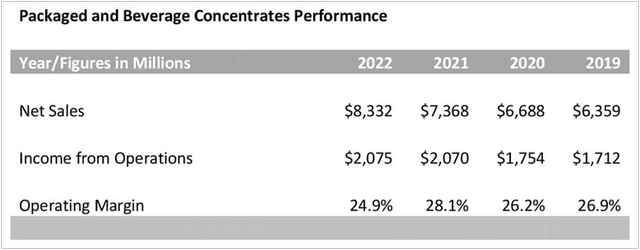

This segment was basically the Dr. Pepper Snapple Group before the merger. Dr. Pepper is the #2 overall flavored carbonated soft drink in the US; Canada Dry is the #1 US ginger ale, and A&W the #1 US root beer. During calendar 2022, net sales increased 12.3% to $8.33 billion, compared to $7.36 billion in the prior year, driven by favorable price increases and slight volume growth of 0.3%. The operating margin dropped from 28.1% to 24.9%, a decrease of 320 basis points, due primarily to the goodwill impairment charges related to Bai and Schweppes. This was somewhat offset by lower restructuring expenses from the merger. These revenues include income from partnered brands like Evian and Polar Beverages where KDP has a distributorship agreement.

Cold Beverages Performance and Margin (Author Calculated and 2022 Annual Report)

Sales increases in beverage concentrates were led by Dr. Pepper, Squirt and Canada Dry, and partially offset by Schweppes and Crush. The beverage strength of Dr. Pepper concentrate enabled the company to raise prices there by 4.5% last year, and Dr. Pepper has a 100% penetration in the top 10 fast-food chains in the U.S., because it is a basic soft drink alternative, whereas Coke only has a 70% penetration for its cola, which is often an either/or choice with Pepsi. If we separate the operating margins by category, packaged drinks had a margin of 15.3% and concentrates a margin of 61.5%. In cold beverages, in the future, revenue growth outside North America will be limited since Dr. Pepper Snapple sold the international distribution rights to its top brands, including Dr. Pepper, to Coca-Cola and PepsiCo. During the first half of 2023, cold beverage sales remained strong, growing by 10.7% over the same period in the prior year.

Coffee Systems Performance

Primary Brands: Green Mountain, Swiss Miss, Tully’s, Donut Shop, Krispy Kreme, McCafe, Cinnabon, Gloria Jean’s, Newman’s Own, Kahlua.

Partnered Brands: Starbucks, Folgers, Gevalia, Lipton, Twinings, Bigelow, Café Bustelo, Seattle’s Best, Illy, Maxwell House, Tim Horton’s.

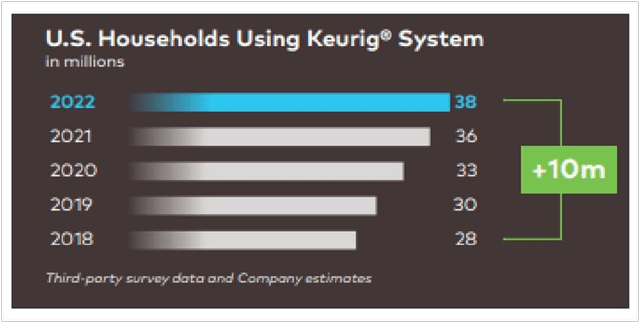

This division was the core of Keurig Green Mountain’s business before the reverse merger. Keurig Dr Pepper has the number one position in North America for single-serve coffee brewers. About 29.0% of the estimated 131.2 million households in the US have a Keurig brewing system, as illustrated below. The company’s goal is to drive growth by adding 2 million households with machines annually, and since it was created in 2018, it has generally met or exceeded this goal. It uses a very thin profit margin for its brewing machines to get the system into households and profits from the sale of pods. There is a variety of Keurig compatible pods from most of the top-selling coffee brands including Starbucks, Peet’s, Dunkin’, and Folgers, which has been made possible through Keurig’s licensing and manufacturing agreements with these brand owners. According to the 2022 Annual Report, the company has an 80.0% share of manufactured pods in the U.S. The company’s main competition in this segment is Nespresso from Nestle (OTCPK:NSRGY).

Keurig Machine Numbers (2022 Annual Report)

Following accelerated at home coffee consumption over the 2020–2021 pandemic period, at-home coffee consumption declined in 2022, as consumers were able to get outside the house and experience other options. During 2022, Keurig introduced the K-Café SMART, which makes “barista-quality” specialty coffee beverages at home and connects to wifi. The price point on this machine is around $249. It also expanded availability of the K-Slim + ICED brewer and brew-over-ice pods, with iced coffee representing a significant growth opportunity for Keurig.

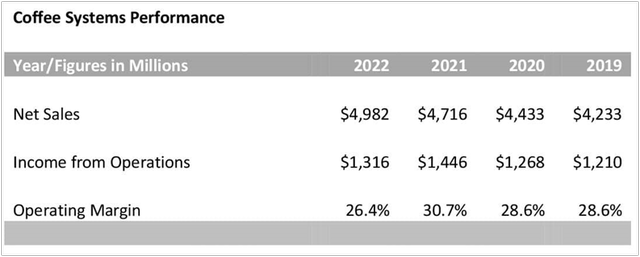

In 2022, coffee sales increased 5.6% to $4.98 billion compared to $4.72 billion in the prior year, driven by favorable price increases. However, income from operations decreased $130 million, or 9.0%, to $1.31 billion in 2022, compared to $1.44 million in the prior year, as a result of cost inflation, particularly in green coffee and packaging. K-Cup pod sales volume increased 1.4% for all of 2022, but decreased by 2.3% in the first half of 2023. Volume will grow, however, as the number of brewers in households increase.

Coffee Systems Margin & Performance (Author calculated and annual reports)

Brand Growth through Acquisitions & Partnerships

Coke, Pepsi and Keurig Dr Pepper have all tried to increase their share of the growing markets for juices, sparkling water, and coffee and tea. In July of 2023, KDP announced a cash investment of $300 million in La Colombe Coffee, in exchange for a 33% ownership stake in the company. It the second largest investor behind its majority owner and Chairman, Hamdi Ulukaya. La Colombe plans to use the proceeds to accelerate growth and open new locations. KDP made a long-term sales and distribution agreement for La Colombe ready-to-drink coffee and a long-term licensing, manufacturing and distribution agreement for La Colombe branded K-Cup coffee pods. This company is private and had 2022 revenues of $94.0 million.

In June 2022, Keurig Dr Pepper acquired the global rights to the non-alcoholic, ready-to-drink cocktail brand Atypique. The company offers non-alcoholic beverages in cans, such as Gin & Tonic flavor, Mojito flavor and Spice Rum & Cola. It currently has a 40% market share in Canada and will add to Cold Beverages net income. KDP also acquired a 30.0% stake in Nutrabolt’s popular energy drink C4. The C4 brand is expected to have revenues over $650 million in 2023.

Substantial Goodwill and Debt Post-Merger

Keurig Dr Pepper’s balance sheet is about 38.7% goodwill, while that of Coke is 20.2% and Pepsi is about 19.7%. This large ratio of goodwill is related to Keurig’s reverse takeover of Dr. Pepper Snapple Group. Goodwill is created when a company pays more for an acquisition than the fair market value of the net assets acquired, so the difference represents a premium paid. According to an SEC Memo on the merger issued in 2018, it resulted in $10.1 billion of goodwill. This is about half of the company’s $20.1 billion of goodwill on the balance sheet today. Keurig, the acquirer, said this was created by the brands “operational and general and administrative cost synergies from the warehouse and transportation integration, direct procurement savings on overlapping materials, purchasing scale on indirect spend categories and optimization of duplicate positions and processes.”

Keurig (owned by JAB Holding Company in 2018) paid $18.7 billion for the acquisition. Under the terms of the merger, Dr. Pepper Snapple shareholders received a special cash dividend of $103.75 per share ($74.25 of this was return of capital) and retained shares in the combined company. At closing of the transaction, Keurig shareholders held 87% and Dr. Pepper Snapple shareholders held 13%. JAB Holding Company made an equity investment of $9.0 billion and the balance of the transaction, some $9.7 billion, was provided through debt brokered by JPMorgan Chase Bank, Bank of America and Goldman Sachs. JAB reduced its stake in KDP to 27.0% in 2023, down from 33.0% in 2021, and down from an initial 71.0% in 2018. So while it is a major shareholder, JAB no longer controls the company.

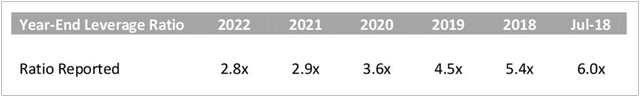

Keurig’s debt, including commercial paper, term loans and senior unsecured notes, has been going down steadily. It was $15.8 billion in 2018 post-merger, $14.6 billion at the end of 2019, $13.7 billion at the end of 2020, $12.0 billion in 2021 and $12.1 billion at the end of 2022. KDP’s leverage ratio, calculated here as total debt principal/adjusted EBITDA is presented below and has gone down considerably during the five years the company has been in business. For 2023, KDP is targeting a leverage ratio of 2.0-2.5x.

KDP Leverage Ratio (2019-2022 Annual Reports)

Dividend History

Since Keurig Green Mountain and Dr. Pepper Snapple Group merged in July 2018, the first dividend paid as the new company was in October 2018, in the amount of $0.15 per quarter, or 2.6% at the time. It stayed at this level for the next two and three-quarter years while the company paid down debt. Finally in June of 2021, the dividend was increased to $0.188 per quarter (a yield of about 2.1%), then $0.20 in September 2022 (2.2%). There was just an increase of 7.5% announced raising the quarterly payout to $0.215 for September 2023, so the current yield is 3.08%. The payout ratio for KDP is estimated at 55.3% for 2023. The payout ratio for Coke is about 74.7%, while for Pepsi it is 82.6% and the yields for these companies are 3.48% and 3.06% respectively. I believe there is room here for KDP to raise its dividend, and to keep raising it above the rate of inflation, without any cash flow problems while it pays down merger debt.

KDP Payout Ratio (Author calculated)

Share Valuation

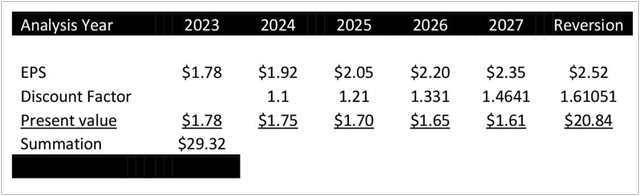

I estimate the current value of KDP shares to be $29.32, so at the current price of $28.08 they about 5.0% undervalued. I used a discounted cash flow cash to value the company’s shares, using the average analyst consensus earnings per share, beginning in 2023, and then projecting forward. This estimate was $1.78 for 2023 and $1.92 for 2024. I have used a five-year time period then capitalized the last year into a perpetuity. For the discount rate, I looked to the average annual return of the S&P 500. The long-term average is about 9.25% while over the last 10 years it has been 10.4%. In valuing this company, I have elected to use a discount rate of 10.0%, discounting beginning in the second year. For calculating the reversion, I have used a rate of 7.5%, 250 basis points below the discount rate. The annual growth rate estimate was trickier, as the company was just formed in 2018, so there is not a long track record. The compound annual growth rate since 2019 ($0.88 per share) up to the 2023 estimate of $1.78 per share would be 19.3%. I am not comfortable using anything close to this, so I have used a rate of 7.0%, just above the Keurig machine growth estimate of 5.5% and equal to the growth rate projected for this year’s earnings, or 7.0%. The results are presented below:

Discounted Cash Flow (Author calculated)

Risks to Outlook

The primary risks to share valuation for Keurig Dr Pepper seems to be in the coffee segment where there is some dialogue about the reusable pods, and how environmentally friendly the plastic is. This may encourage consumers to limit use of pods or look for an alternative. Carbonated beverages have faced changing consumer tastes for years, as many switch to flavored drinks without the fizz. However, KDP has expanded its portfolio of beverages like Hawaiian Punch and Snapple and mixes like Rose’s Lime Juice and Mr. & Mrs. T’s, as well as energy drinks like Xyience. Probably the main risk to the share price valuation is the assumption of a sustained annual growth rate of 7.0%, which may be difficult to achieve.

Conclusion

I believe there will always be a certain demand for carbonated beverages and Dr. Pepper certainly has a unique position with its recipe that is a fundamentally different flavor alternative from Coke and Pepsi. The latter two are more or less substitutes for each other. From Dr. Pepper to Canada Dry to A&W Root Beer, the company has a well-regarded and important portfolio of brands. The coffee brands like Green Mountain, Swiss Miss, and Tully’s help diversify the business in the way that snacks diversify Pepsi. I believe this company is well-positioned and if you are a long-term investor, it looks more appealing than if you are a short term investor. At 3.1%, the dividend could be higher, but it is likely to go up at a faster rate after merger debt is paid down. It is important to note that during 2023, KDP supported its share price by repurchasing about 7.0 million shares at a weighted average price of $32.34, totaling approximately $226.0 million. The Company has approximately $3.2 billion remaining under its current share repurchase authorization, expiring on December 31, 2025.

Read the full article here