Investment Thesis

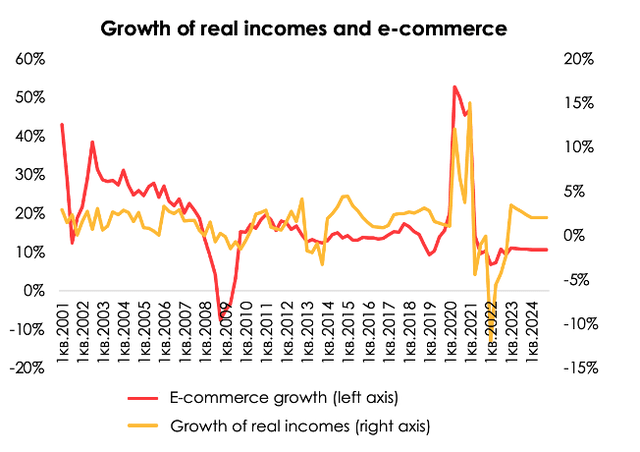

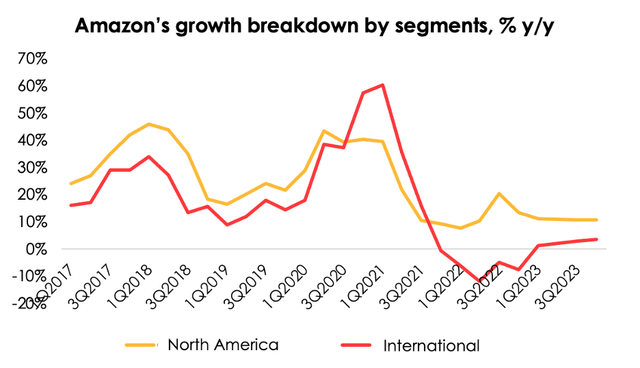

The reporting season is almost over, which means a more in-depth look at the e-commerce market from the perspective of Amazon.com, Inc. (NASDAQ:AMZN), which we previously covered here. Why is this important? We believe that bets on e-commerce players by large investment companies do not look reasonable, primarily due to significant slowdown in real income (usually income dynamics go along with e-commerce market growth). Moreover, the cloud computing segment showed the slowest revenue growth rate in the last couple of years, which creates risks for maintaining so low margins and revenue growth rates. Rating for Amazon.com, Inc. stock is HOLD.

The AWS Segment

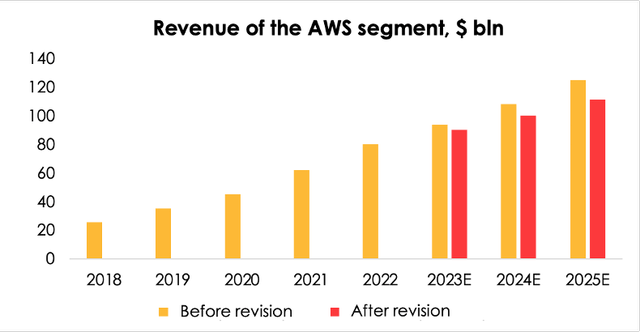

The Amazon Web Services, or AWS, segment jumped by 16% y/y to $21.4 bln in 1Q 2023 compared with our forecast for $21.3 bln. The results matched our expectations.

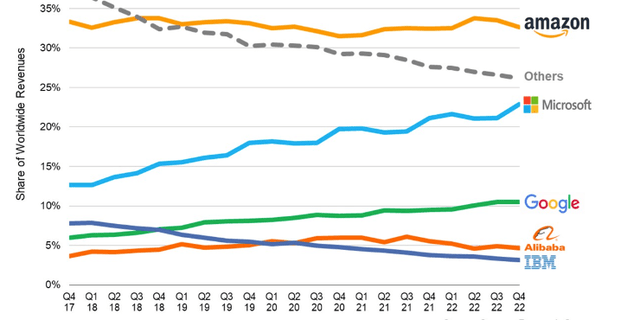

The segment’s growth was the slowest since its establishment. As we pointed out earlier, AWS’s organic growth was bound to slow down soon, given Amazon’s high market share (34%). As a reminder, AWS will be able to maintain the high momentum only through minor acquisitions the way CRM does it, for example, as the amount of physical infrastructure is limited.

Also, the segment’s growth is negatively affected by the cooling demand from corporate customers, who are recalibrating their budgets downwards, despite the general trend toward digitalization. As demand is weakening faster than we previously expected, we have lowered the projected growth of the AWS segment over the forecast period until 2025 from the average of 12% y/y to 10% y/y.

Invest Heroes

Techcrunch

Retail Segment

As we pointed out earlier, Amazon, like the entire e-commerce market, is quite sensitive to personal real incomes. U.S. real household incomes climbed by 3.4% y/y in 1Q 2023, while they declined by 1.4% y/y a quarter earlier. We expect that the growth of real incomes will decelerate to an average of 2% a year.

Invest Heroes

We expect that Amazon will move forward at the same pace as the U.S. e-commerce market: at least 10% y/y.

Invest Heroes

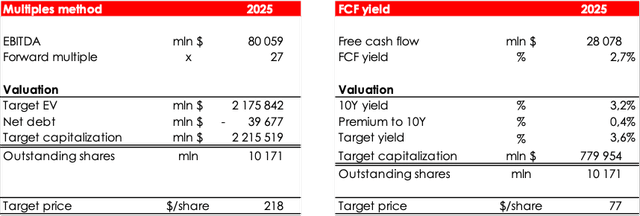

Valuation

The valuation of $120 was achieved by discounting the average target prices of the year 2025, which were obtained through two valuation methods (EV/EBITDA and free cash flow, or FCF, yield), at the rate of 13% per annum.

Invest Heroes

Risks:

- A stronger-than-expected drop in real incomes in the U.S. amid the recession

- An increase in the price of oil above $90 per barrel, which will put pressure on the company’s margins

- A stronger slowdown in the cloud computing segment.

Conclusion

Amazon.com, Inc. hasn’t yet entered the buy area when the risk-profit ratio would be justified. Amazon’s valuation is fairly shaky and to a great extent hinges on the future growth of its margins. Also, the recent acquisitions of iRobot and One Medical don’t boost the business’s upside. Rating for Amazon.com, Inc. is HOLD.

Read the full article here