In two articles published last August and October, we recommended speculators stay away from ProShares UltraPro Short QQQ (NASDAQ:SQQQ) because the extremely high levels of bearish sentiment made speculating in SQQQ far too risky. Basically, you want to avoid this fund when everyone is buying it and far too many people were buying it.

This article updates those two articles and brings the indicators they were based on up to date.

While current buying levels in SQQQ are much less than last year, making conditions better, we believe the risk of higher stock prices is still too great to warrant speculating in SQQQ.

A key idea

Since SQQQ is a bear fund that advances when the market goes down, the amount of buying and selling in SQQQ becomes a strong indicator of what investors expect from the market. In other words, analyzing what other investors are doing in SQQQ is a powerful tool to decide if one should buy or sell the fund.

While this is true with all ETFs, it is much more so with the two, highly leveraged ProShare ETFs TQQQ and SQQQ. Because of this, most of the charts in this article show what investors are currently “doing” in SQQQ.

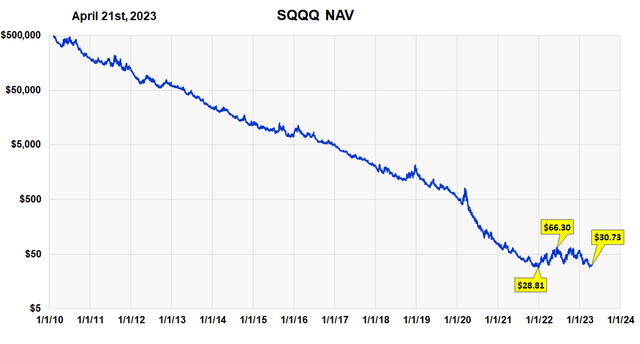

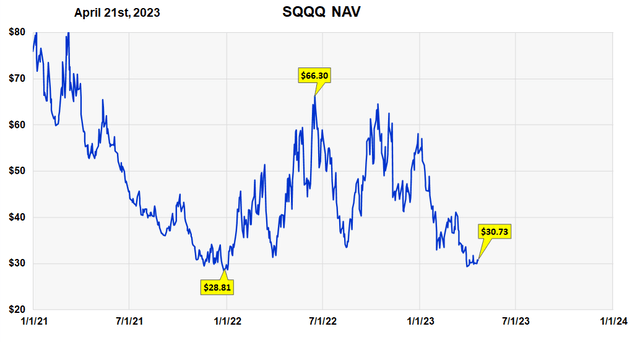

SQQQ NAV

These two charts show a long and short term view of the fund’s NAV. The first chart goes back to inception and it clearly shows why this fund is for short term trading only. Holding it over the long term has produced a continual declining NAV, for two primary reasons.

The first is the statistical fact that, over the long term, markets advance 66% of the time and decline 33%. Add to this the “carrying costs” and negative bias that the Proshare trading strategy produces, and you get the long term chart.

The other chart graphs the NAV since 2021. This closer look shows the profit potential of SQQQ for those traders accurate and nimble enough to catch short term market declines. Twice last year the price of SQQQ rose 100% from low to high with short swings in the market.

Long term chart of SQQQ (Michael McDonald) Two Year Chart of SQQQ (Michael McDonald)

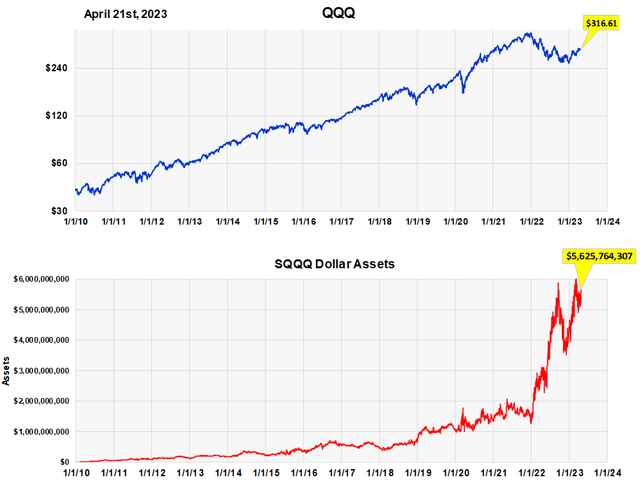

The surge in SQQQ assets is not positive

The chart below graphs the value of total assets in SQQQ since inception. In our opinion, the growth in assets as the stock market has advanced over the last five months shows far too much interest in SQQQ.

Notice that the surge in assets last year occurred at the low in the market in October and it is not a good sign to see it rising again as the market rallies. As we said, it’s not good to be interested in SQQQ when everyone else is too.

Total Assets in SQQQ since inception (Michael McDonald)

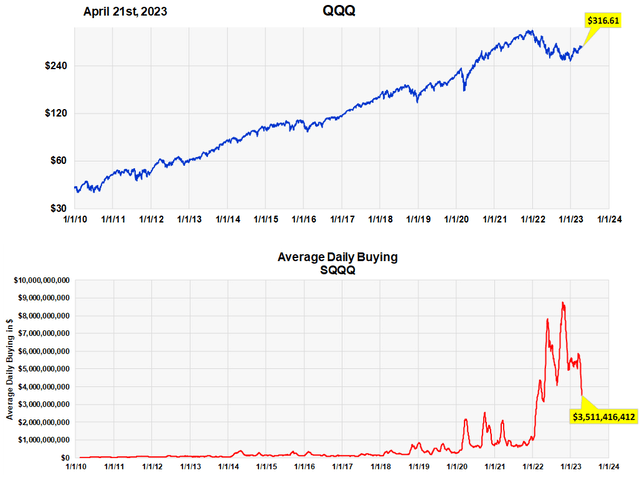

Average daily buying in SQQQ is declining

While assets are near record levels, daily buying in SQQQ is averaging $3.5 billion a day, which is about half the level of fund buying last year. This decline in buying is a positive development since history shows speculators should become interested in this fund when other are avoiding it.

As the chart below shows, the two peaks in purchase levels in SQQQ last year occurred right at the June and October bottoms. Even though buying is now far below those levels, we don’t believe it is low enough yet to signal a short term buying opportunity in SQQQ.

Average daily dollar buying in SQQQ (Michael McDonald)

Buying SQQQ as percent of assets is the lowest since the start of last year’s bear market

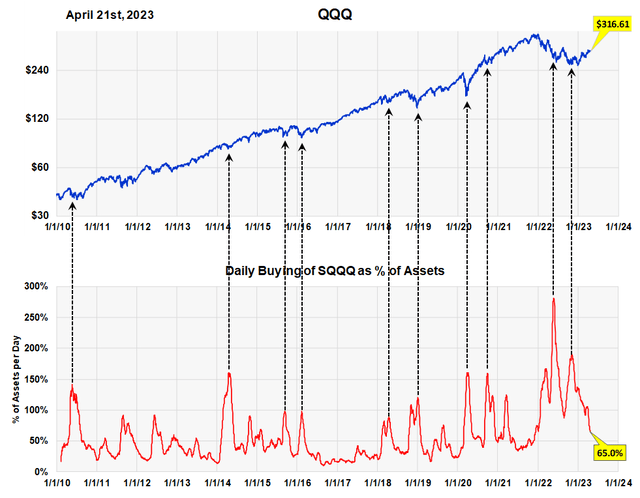

The next chart shows the buying levels in SQQQ from a different angle. Instead of absolute buying levels, it compares buying to total assets. When we do this we see that average daily buying of SQQQ is at 65% of assets, which is the lowest percent since the start of the bear market. Near the bottom of the market in late May, purchase levels rose to a record high over 250% of assets a day.

While this is a distinct improvement, and might warrant taking a short term, bearish stance on the market, it is not yet low enough in our opinion.

Daily buying in SQQQ as a percent of Assets (Michael McDonald)

Broader sentiment indicators still too bearish

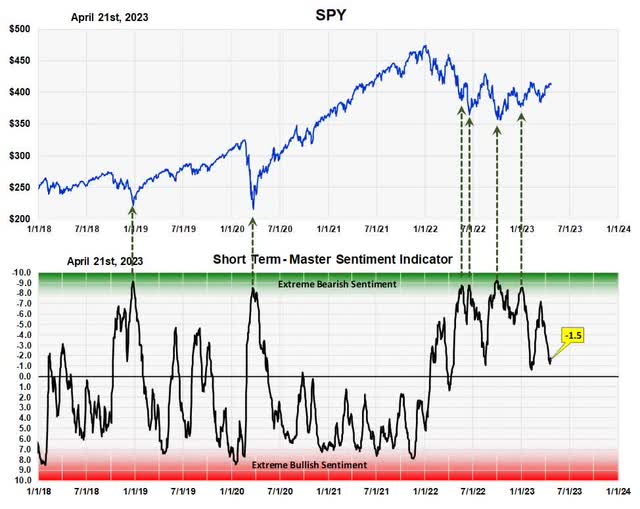

In our opinion broader sentiment indicators are still to bearish to assume an investment risk of 3X short the Nasdaq QQQ. The chart below shows the current level of the Short Term – Master Sentiment Indicator. This a daily indicator, made from seven underlying sentiment indicators. The green arrows show the four extreme readings last year. Each occurred a short term market low. It was these readings that prompted last year’s negative articles on SQQQ.

While we are no longer at an extreme reading, at -1.5 we are still above the zero line and on the bearish side of the ledger. Because of this we don’t believe there is much risk of a major decline. So, we continue to recommend investors and speculators avoid buying SQQQ; it is not the right time to take a highly leveraged short position expecting prices to fall.

Short Term – Master Sentiment Indicator (Michael McDonald)

Warning

There are large risks using SQQQ to try to profit from market moves. There is a constant downward bias and the risk of loss grows the longer one holds the fund. This is especially true with higher interest rates as carrying cost to leverage the fund 3X go up with higher rates. Both the ProShares website and the SEC have detailed messages on the risks inherent in leveraged ETFs.

Read the full article here