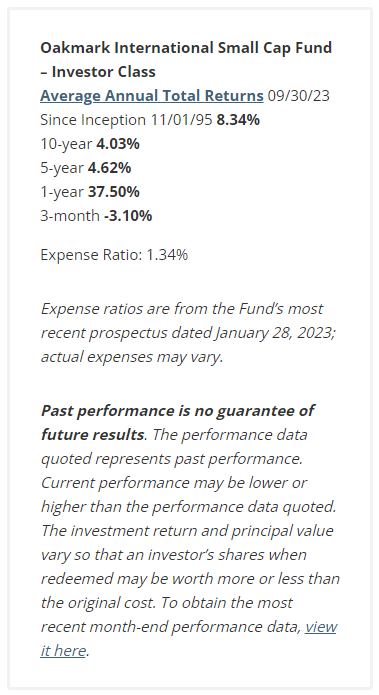

The Oakmark International Small Cap Fund (OAKIX, “the Fund”) returned 37.05% for the fiscal year ending September 30, compared to its benchmark, the MSCI World ex U.S. Small Cap Index (net), which returned 17.32% for the same period. The Fund returned -3.10% for the quarter, compared to the MSCI World ex U.S. Small Cap Index (net) return of -3.48%. Since the Fund’s inception on November 1, 1995, it has returned an average of 8.34% per year versus its benchmark’s return of 5.00%. For additional color on our views of the market environment during the most recent quarter end, please see our international market commentary.

Despite a softer final quarter of the fiscal year, the Fund produced strong absolute and relative returns over the previous 12 months. This reflects the benefits of a highly favorable starting point: On September 30, 2022, equity valuations, especially in Europe, were near historical lows as the market was overly concerned about record-high energy prices, the impact rising interest rates might have on economic activity, and other possible disruptions caused by the Russian invasion of Ukraine. Twelve months later, energy prices have declined significantly and economic growth has moderated, but to date higher interest rates have not pushed Europe or the global economy into a recession, and disruptions caused by the Russian invasion have been relatively limited. Most of our portfolio companies have been able to grow earnings and cash flow over the past 12 months, and their share prices have recovered meaningfully from one year ago. The biggest driver of the Fund’s outperformance over the past 12 months was strong stock selection within our industrial holdings. While our industrial names consist of a diverse group of businesses, one commonality was significant aftermarket exposure. For example, Konecranes (OTCPK:KNCRF), Fluidra (OTCPK:FLUIF) and Metso (OTCPK:OUKPF) all delivered strong absolute and relative returns because investors underestimated the stability of their earnings streams in a slowing economic environment. Our IT exposure also boosted performance as two businesses, Software AG and SoftwareOne (OTCPK:SWONF), were subject to private equity bids during the year.

As David Herro discussed in the international market commentary letter, despite the strong performance over the past 12 months, we believe the portfolio continues to be attractively valued as it trades at nearly 50 cents of our estimate of intrinsic value. We continue to maintain an overweight exposure to European equities as we believe geographically this is the most attractively valued area of the market. We are also maintaining our significant underweight exposure to Japan since Japanese equities trade at a premium to European equities, even though they typically grow more slowly and generate lower returns. Given the Japanese yen’s continued weakness, some modestly improved value opportunities are emerging within domestic-focused Japanese businesses. As a result, we added KATITAS (OTCPK:KTITF) to the portfolio in the quarter. We expect our underweight position toward Japanese equities to remain, however, until relative valuations improve or Japanese companies aggressively improve their operational and capital allocation performance.

Schibsted (OTCPK:SBSNF, Norway), a global media group, was a top contributor to the Fund’s return for the quarter. News broke during the period that a private equity consortium had submitted an indicative bid to take Adevinta (OTCPK:ADEVF) private, a boon for Schibsted as it owns 31% of Adevinta’s shares. The holding contributes a sizable portion of value for Schibsted, and receiving liquidity for the stake would allow the company to return capital to shareholders and selectively re-invest in its businesses. Meanwhile, the core of Schibsted performed in line with expectations. The classifieds business demonstrated resilient growth on recovering volumes and ongoing pricing power. News media’s operating environment remained challenging with advertising revenue down about 10%, but subscription revenues grew 5%, driven by a 14% increase in digital. Despite headwinds, news margins continued to improve sequentially with cost discipline a key focus by management. The classifieds business remains attractive to us because of its sticky network effect, robust long-term pricing power and compelling economics. In addition, we expect that customers’ increasing comfort with online transactions will allow Schibsted to extend deeper into transaction monetization, unlocking profit pools previously untapped. We believe today’s margins are depressed by the company’s investments in these opportunities that offer solid payoff potential.

St. James’s Place (OTCPK:STJPF), the largest wealth manager in the U.K., was the Fund’s largest detractor for the quarter. St. James’s Place released weak first half of 2023 results, and management noted that it will reduce fees on certain products ahead of the new consumer duty regulation. St. James’s Place plans to cap annual product management charges at 85 basis points for client bond and pension contributions after a client has been invested for 10 years, which will result in a four basis point impact to the group revenue margin. CEO Andrew Croft also believes this self-directed decision will create goodwill with the regulatory body. Both assets under management and cash earnings were slightly below our expectations, and the relatively low amount of net new money was mainly attributed to weak flows in unit trusts and individual savings accounts. Gross contributions within the unit trusts and individual savings accounts have been concentrated in lower value accounts, and these clients have been most impacted by cost-of-living pressures. Further, clients’ decision to allocate more money to cash products instead of traditional investments has put additional pressure on St. James’s Place as it does not have a cash management product. Lastly, market performance was lower than our estimates due to a strengthening British pound, up 5% year-to-date compared to the U.S. dollar. Despite these near-term headwinds, we continue to believe the company offers an attractive long-term investment. Pension reforms in the U.K. have significantly increased the number of defined contribution participants, which benefits St. James’s Place by providing a sustained flow of new clients and assets under management that we believe will continue. We also like that the company’s capital-light operating model generates a higher than average return on capital employed and robust cash conversion, the majority of which gets returned to shareholders.

Konecranes (Finland), an engineering company that specializes in lifting equipment, ranked as a top contributor for the fiscal year. The company’s results over the past several quarters have demonstrated impressive growth as well as margin improvement. The flagship service division, which accounts for the clear majority of profit and value, has grown organically by nearly 17% in local currency over the past two quarters, thanks to both spare parts and field service growth as well as price increases of 8%-10% that have more than offset inflationary pressures. As a result, margins have expanded 270 basis points in the first half of the fiscal year, hitting a record of 19.1% and leading to EBITA that significantly surpassed our and market expectations. In the company’s industrial equipment business, margins have greatly improved from negative a year ago to 6.2% in the first half, thanks to pricing actions, operating leverage and restructuring initiatives. This uplift is encouraging as the division has faced challenging profitability for some time. Konecranes also held a capital markets day in May and released new financial targets that called for a significant increase in profitability to 12%-15% EBITA margins, which was well ahead of our forecasts. Although these targets are ambitious, we found the strategy and rationale behind them credible. Despite reduced order intakes during the most recent quarter, the order books remain quite high, and we believe that the current management team can deliver higher profitability than in the recent past. We believe Konecranes remains an attractive investment.

Viaplay (OTCPK:NENTF, Sweden), a media and entertainment company, was the top detractor to the Fund’s performance for the fiscal year. The company issued a profit warning in June and replaced its CEO with immediate effect. We believe Viaplay’s difficulties are due to a convergence of a tough macro environment, an overpriced sports rights bid by a growth-oriented CEO, and a disappointing internal breakdown of visibility into costs and cash flow. These factors conspired into a perfect storm for Viaplay, compounded by an increasingly levered balance sheet that will force bank refinancing discussions through the end of this year. The board recruited CEO Jorgen Lindemann—the former CEO of Modern Times Group, which previously housed Viaplay—to lead the restructuring and turnaround. His plan is reasonable, aiming to restore Viaplay to its prior focus on the core Nordic business that has a 30-year track record of profitability, strong engagement metrics, and top position in local and sports content. The path to get there is challenging, though, considering the refinancing needs and content choices that may be forced by onerous long-duration contracts. During the quarter, three potential strategic and financial investors took sizable stakes in Viaplay, so future ownership of the business remains unclear. Given the uncertainty around future capital needs and the long-term ownership structure of the business, we exited our holding in Viaplay during the quarter.

We initiated new positions in the following during the quarter:

- KATITAS (Japan) is the dominant player in Japan’s single-family detached home remodeling industry, at around 15 times the size of its largest competitor. In our view, this size gives KATITAS a significant and growing competitive advantage both in terms of a lower cost structure and higher brand recognition, which in turn helps the company procure and sell properties. We have found that the Japanese attitude toward purchasing existing homes is improving, which helps drive demand for KATITAS’ remodeled homes. The large amount of vacant homes in Japan, which is estimated at over 8 million units, provides an ample supply of homes for KATITAS to remodel. Further, we believe impending changes to government policies will create new incentives for owners to sell these homes rather than keep them vacant, providing a tailwind for KATITAS’ procurement efforts. Longer term, we expect the maturing of the employee base will lead to a higher gross profit contribution per employee and an improved margin structure of the business.

- Intermediate Capital Group (OTCPK:ICGUF, U.K.) is a European alternative asset manager that offers clients access to direct lending, mezzanine, collateralized loan obligations, real assets, secondary equities and liquid credit strategies. We believe that Intermediate Capital Group is uniquely poised to benefit from the most attractive sub-segments of the growing private investments industry due to its scale positions and strong performance. As a result, we expect the company to take above-average market share of private assets under management growth in the coming years. In addition, we like that Intermediate Capital Group’s long-duration assets with multi-year lock-up periods provide predictable cash flows and downside protection through its management fees. We believe margins will expand as immature strategies reach scale, and the company has substantial opportunities to grow existing client relationships via cross-selling and also expand into underpenetrated client geographies.

- Essentra (OTCPK:FLRAF, U.K.), a former portfolio holding, recently completed its transition to become a pure-play components distributor, following the sale of its packaging and filters business last year. We have always regarded the distribution business (where it manufactures and distributes protective components typically used in product packaging and shipping applications) as Essentra’s highest quality business. The company’s share price has been weak year to date as the shareholder base has turned over following disposals and concerns about volume trends driven by soft industrial production. This has provided us with the opportunity to establish a position in this high-quality business at attractive valuation levels (less than 10x EBIT). We believe Essentra is considerably more valuable as a standalone distribution business. Its cash flow can now be invested in M&A for the distribution business and in shareholder returns rather than diverted to support the legacy packaging business.

As mentioned above, we sold Viaplay to fund other positions we believe offer more attractive opportunities on a risk-to-reward basis. In addition, Software AG (Germany) was eliminated from the portfolio following Silver Lake’s (OTCPK:SVLKF) acquisition of the company.

Geographically, we ended the quarter and fiscal year with approximately 78.7% of our holdings in Europe and the U.K., 6.4% in Asia, and 3.5% in Australasia. The remaining positions are in Japan with 4.8%, 5.4% in the Americas (Latin and Canada), and 1.2% in Africa/Middle East.

Thank you for your continued confidence and support.

David G. Herro, CFA | Michael L. Manelli, CFA | Justin D. Hance, CFA

|

The securities mentioned above comprise the following preliminary percentages of the Oakmark International Small Cap Fund’s total net assets as of 09/30/2023: Adevinta 0%, Essentra 0.2%, Fluidra 2.0%, Intermediate Capital Group 0.9%, KATITAS 0.3%, Konecranes 3.5%, Metso 1.5%, Modern Times Group 0%, Schibsted Cl B 1.8%, Software AG 0%, SoftwareONE Holding 2.1%, St. James’s Place 2.7% and Viaplay 0%. Portfolio holdings are subject to change without notice and are not intended as recommendations of individual stocks. Access the full list of holdings for the Oakmark International Small Cap Fund as of the most recent quarter-end. The information, data, analyses, and opinions presented herein (including current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) are for informational purposes only and represent the investments and views of the portfolio managers and Harris Associates L.P. as of the date written and are subject to change and may change based on market and other conditions and without notice. This content is not a recommendation of or an offer to buy or sell a security and is not warranted to be correct, complete or accurate. Certain comments herein are based on current expectations and are considered “forward-looking statements.” These forward looking statements reflect assumptions and analyses made by the portfolio managers and Harris Associates L.P. based on their experience and perception of historical trends, current conditions, expected future developments, and other factors they believe are relevant. Actual future results are subject to a number of investment and other risks and may prove to be different from expectations. Readers are cautioned not to place undue reliance on the forward-looking statements. EBITA refers to Earnings before the deduction of expenses for Interest, Taxes and Amortization which is a measure of operating income. EBIT is a measure of a firm’s profit that includes all expenses except interest and income tax expenses. It is the difference between operating revenues and operating expenses. The MSCI World ex US Small Cap Index (NET) is designed to measure performance of small-cap stocks across 22 of 23 Developed Markets (excluding the United States). The index covers approximately 14% of the free float-adjusted market capitalization in each country. This benchmark calculates reinvested dividends net of withholding taxes. This index is unmanaged and investors cannot invest directly in this index. On occasion, Harris may determine, based on its analysis of a particular multi-national issuer, that a country classification different from MSCI best reflects the issuer’s country of investment risk. In these instances, reports with country weights and performance attribution will differ from reports using MSCI classifications. Harris uses its own country classifications in its reporting processes, and these classifications are reflected in the included materials. The Fund’s portfolio tends to be invested in a relatively small number of stocks. As a result, the appreciation or depreciation of any one security held by the Fund will have a greater impact on the Fund’s net asset value than it would if the Fund invested in a larger number of securities. Although that strategy has the potential to generate attractive returns over time, it also increases the Fund’s volatility. The stocks of smaller companies often involve more risk than the stocks of larger companies. Stocks of small companies tend to be more volatile and have a smaller public market than stocks of larger companies. Small companies may have a shorter history of operations than larger companies, may not have as great an ability to raise additional capital and may have a less diversified product line, making them more susceptible to market pressure. Investing in foreign securities presents risks that in some ways may be greater than U.S. investments. Those risks include: currency fluctuation; different regulation, accounting standards, trading practices and levels of available information; generally higher transaction costs; and political risks. All information provided is as of 09/30/2023 unless otherwise specified. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here