Schwab U.S. Large-Cap Growth ETF (NYSEARCA:SCHG) is a low-cost, tax-efficient investment option for investors that seek to invest in large U.S. companies, especially in the information technology sector. The ETF has posted double-digit, long term returns for the portfolio and the Schwab U.S. Large-Cap Growth ETF is an effective way for investors to gain exposure to the largest tech companies in the U.S. With the Schwab U.S. Large-Cap Growth ETF offering investors a concentrated portfolio that includes leading tech companies in the U.S. (and the world), I believe investors that want to build long term wealth could use the ETF to invest in the sector without accepting the risks that would come with owning single names outright!

Why investors should consider buy the Schwab U.S. Large-Cap Growth ETF

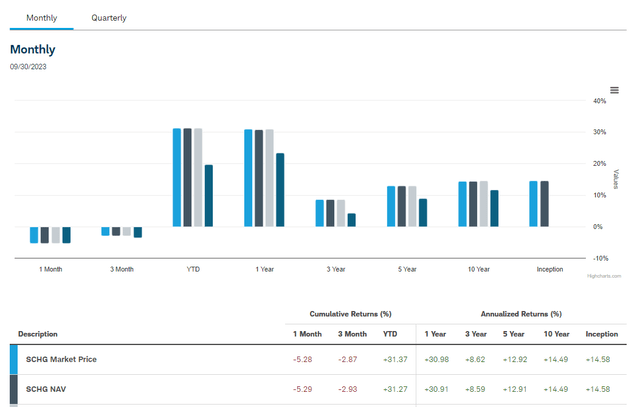

The Schwab U.S. Large-Cap Growth ETF did not do very well during 2022 which is when tech stocks especially, the ETF’s largest holdings, were brutalized by a market that simultaneously had to deal with higher inflation, higher short term interest rates and a softening of the digital advertising market. The 3-year returns of the Schwab U.S. Large-Cap Growth ETF are therefore dented, but the ETF has seen a strong recovery in the last year (1-year return of 30.98%). However, in the long term, the Schwab U.S. Large-Cap Growth ETF has performed rather well and achieved a 14.58% return since the ETF’s inception in 2009. The ETF is benchmarked against the Dow Jones U.S. Large-Cap Growth Total Stock Market Index.

Source: Schwab

A Concentrated Growth Play On The IT Sector

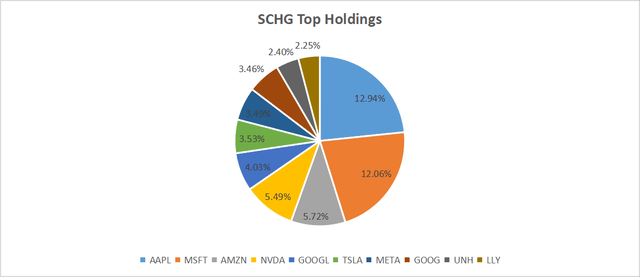

What I like the most about the Schwab U.S. Large-Cap Growth ETF is that the ETF is hugely overweight the information technology sector which includes, of course, large-cap tech players such as Apple (AAPL) — which is the ETF’s largest holding with a concentration of 12% — Microsoft (MSFT), Amazon (AMZN), Nvidia (NVDA) and Alphabet (GOOG) (GOOGL).

Source: Author

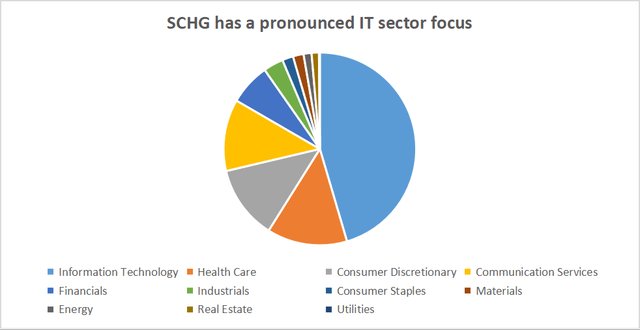

Information Technology in general accounts for nearly half of the Schwab U.S. Large-Cap Growth ETF’s asset allocation (as measured by fund assets). About 46% of the fund’s net assets were invested in the IT sector, by far the largest concentration in the ETF. The second-most heavily weighted sector was Health Care with a weighting of 13.5%.

Source: Author

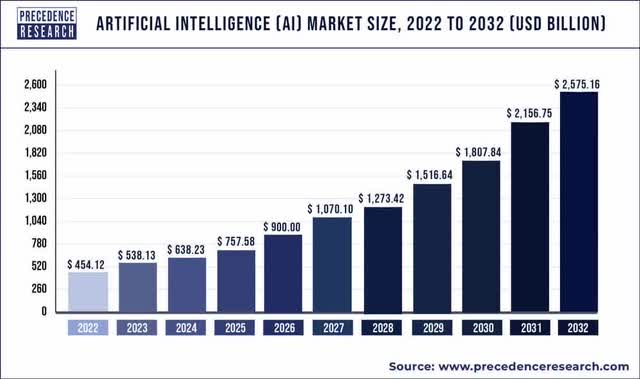

Since the ETF’s portfolio includes the fastest-growing tech companies in the U.S., investors may also benefit from the growing AI theme that many of those companies are set to profit from as well. Companies like Microsoft, Google and Nvidia are heavily investing into their AI capabilities… from creating new AI-capable high-performance chips to including Chat.GPT rivals into their product offerings. The market size for artificial intelligence solutions, according to Precedence Research, is projected to explode over the next decade and increase by a factor of 5.6X between FY 2022 and FY 2032.

Source: Precedence Research

I believe there are three reasons especially why investors might want to choose the Schwab U.S. Large-Cap Growth ETF as their primary vehicle to invest into U.S. large-cap securities with a technology focus:

- The Schwab U.S. Large-Cap Growth ETF offers investors an easy and low-priced investment option (the ETF charges only 0.04% in fees which is even lower than the 0.06% that the Schwab U.S. Dividend Equity ETF deducts as fees)

- The Schwab U.S. Dividend Equity ETF creates an opportunity, with a single purchase, to acquire a concentrated portfolio of the largest U.S. tech players in the stock market

- The ETF allows investors to benefit from growing AI product adoption in both the software and hardware sectors.

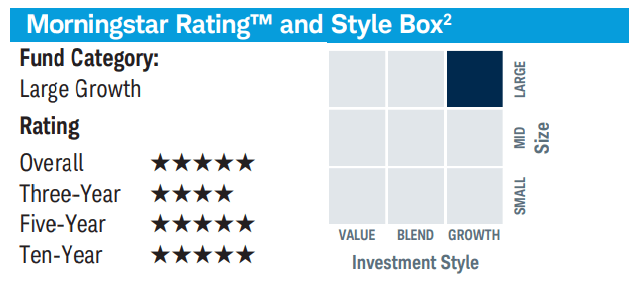

As an added benefit, the Schwab U.S. Large-Cap Growth ETF has a 5-star Morningstar rating due to its impressive performance history in the last decade:

Source: Schwab

The Schwab U.S. Large-Cap Growth ETF pays a distribution

Not that a distribution is really important for a tech-focused ETF, but the presentation of the Schwab U.S. Large-Cap Growth ETF would not be complete without mentioning that is pays a distribution that calculates to a 0.5% yield.

Risks with SCHG

Any time an investor buys an ETF or an investment fund that is concentrated in one particular sector, as is the case here with Information Technology, investors accept the risk that they miss out on gains generated in other sectors which may out-perform the IT sector.

Since the ETF is concentrated in the IT sector, the Schwab U.S. Large-Cap Growth ETF may see a large valuation drawdown during a recession, even though industries like Health Care and Consumer Discretionary are recession-resistant. Given the ETF’s large investments in technology companies, the Schwab U.S. Large-Cap Growth ETF may do especially well during economic upswings and underperform during economic recessions.

Higher-for-longer rates may hurt all companies in the economy, not only large-cap growth companies. Considering that the Schwab U.S. Large-Cap Growth ETF generated double-digit returns since the fund started to invest in 2009, I believe the risks of investing are properly balanced out by the benefits of investing in SCHD.

Final thoughts

I believe the Schwab U.S. Large-Cap Growth ETF is a great option for investors that want to gain particular exposure to the Information Technology sector and also view the AI trend as a potentially lucrative investment theme. Research projections show that AI hardware and software products are going to be in more demand in the future than they are now and by investing into the Schwab U.S. Large-Cap Growth ETF investors immediately own a tech-heavy large-cap portfolio of the most recognized names in the IT/AI industries.

Considering that the Schwab U.S. Large-Cap Growth ETF is a cost-effective way to invest into a portfolio of leading U.S. technology companies, I believe the SCHD is an attractive long term investment option for investors, especially for those that don’t want to be concerned with picking individual names and accept the risk that comes with it!

Read the full article here