Investment thesis

Our current investment thesis is:

- CBIZ currently has a strong foundation from which to achieve MSD/HSD growth into the end of the decade. With a vast range of services across different segments and a diversification in the nature of services (recurring or project-based), we see scope for growth through an expansion of particular services, underpinned by stability from its core solutions.

- Within this industry, brand/reputation and personnel are absolutely key. The company has done well to grow in notoriety and recruit quality talent. With increased scale, we believe this can only be developed further, improving its competitive positioning.

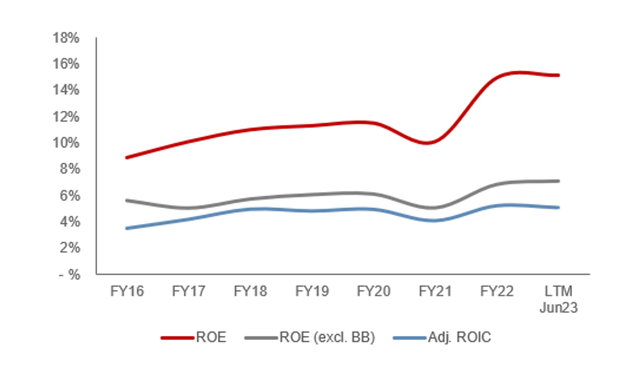

- Management has managed capital efficiently, contributing to a consistent improvement in ROE. Although the business is not a clear-cut leader relative to its peers, we do see the delta in its weaknesses declining.

Company description

CBIZ, Inc. (NYSE:CBZ) is a leading provider of professional business services, including accounting, tax, advisory, and consulting solutions. CBIZ serves a diverse client base, ranging from small businesses to large corporations, with a focus on delivering high-quality financial and business consulting services.

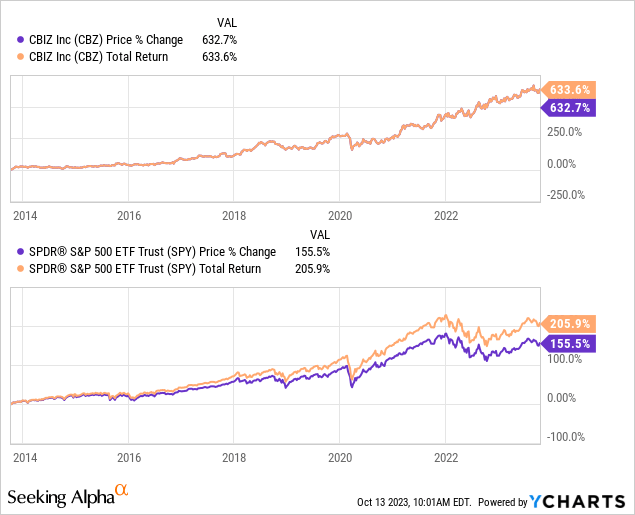

Share price

CBIZ’s share price performance has been exceptional, returning over 550% to shareholders. This is a result of perfect strategic execution by Management, contributing to strong growth and improved profitability.

Financial analysis

CBIZ financials (Capital IQ)

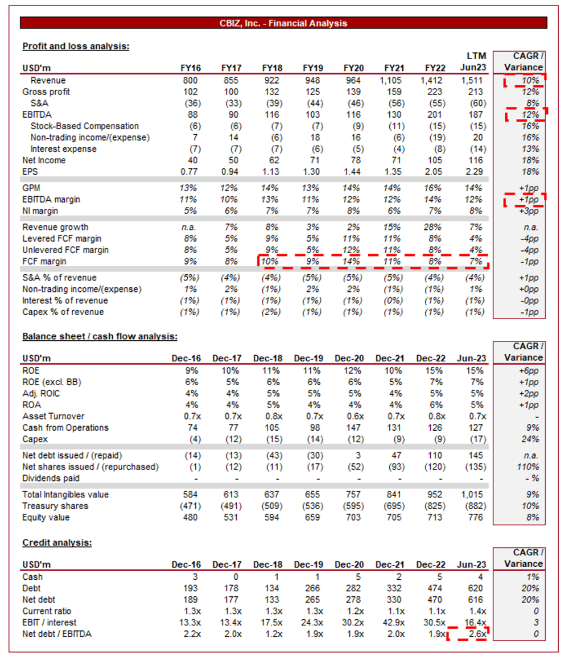

Presented above are CBIZ’s financial results.

Revenue & Commercial Factors

CBIZ’s revenue has grown at a respectable 10% during the last 6 years, with EBITDA exceeding this at 12%. Growth has been broadly consistent, although the business (like so many) experienced a material bump during the post-pandemic period.

Business Model

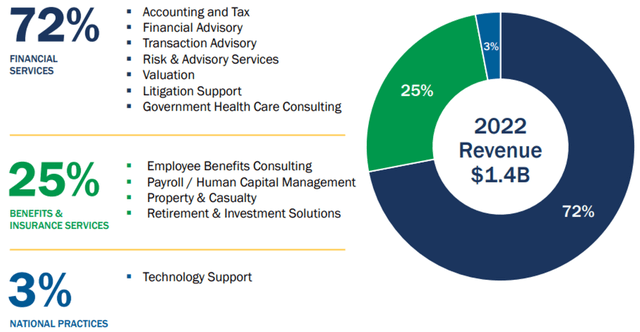

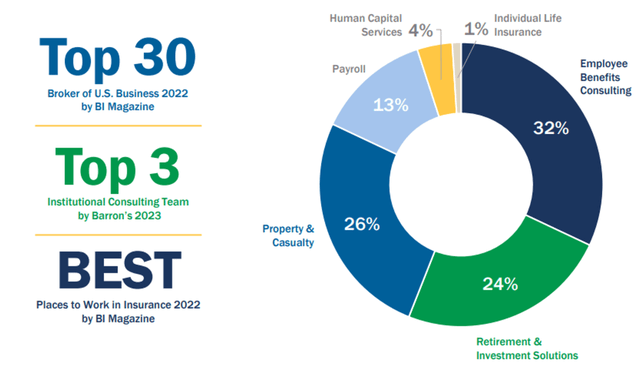

CBIZ offers a range of financial services, including accounting, auditing, tax consulting, and financial advisory. Many of its core services are vital for businesses and so represent recurring/recurring-like revenue. This is due to regulatory requirements for businesses, such as Audit and Tax, or areas where expert assistance is required to operate effectively (Advisory). In addition to FS, CBIZ provides employee benefits services, including benefits consulting, health and welfare plan design, retirement planning, and insurance services.

CBIZ faces competition from the leading accounting firms outside of the big four, namely RSM, Grant Thornton, and BDO, as well as various regional players.

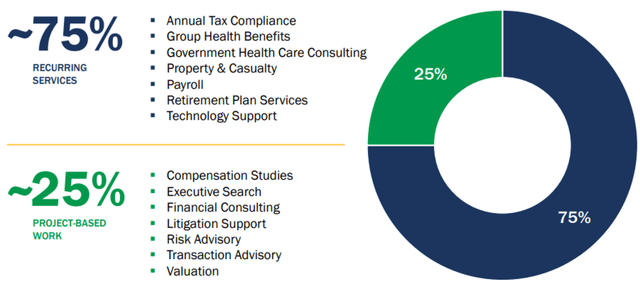

Management currently estimates that ~75% of its services are recurring in nature, with ~25% project-based. This is a good balance in our view. The 75% will incrementally achieve growth through annual inflationary rate card increases, with scope for cross-selling and client growth-related price hikes. The 25% on the other hand will be more volatile but will contribute to margin appreciation and growth outperformance.

Services (CBIZ)

CBIZ’s business consulting services, which include risk management, valuation, and M&A directly assist businesses in making strategic decisions, managing risks, and optimizing operational efficiency. For this reason, these segments generally earn higher margins, while benefiting from cross-selling (subject to regulatory requirements) and brand development due to the core financial services.

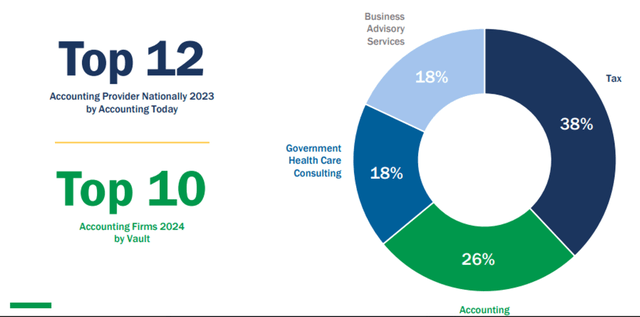

Currently, 72% of its revenue is from financial services, with an additional 25% from benefits & insurance services, and the remaining from technology support. CBIZ is seeking to expand its higher-margin services, such as technology and M&A, with positive development thus far.

Services (2) (CBIZ)

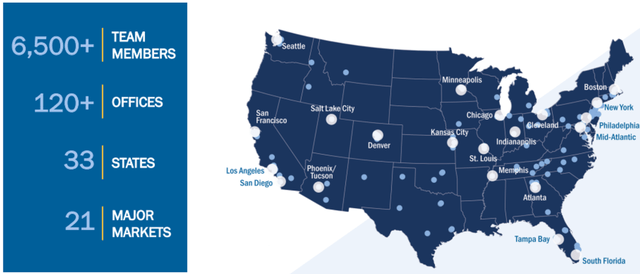

CBIZ currently operates nationally in the US with ~120 offices and ~6500 employees. As the following map illustrates, there is still good room for growth as many of its major markets can comfortably operate with several offices. Further, many US consulting firms have had success expanding internationally following the development of a strong brand in the US, with regions such as the Anglosphere and Europe being reasonable next steps.

Geographical reach (CBIZ)

One of the primary reasons for its success is CBIZ’s focus on serving the mid-market segment. These companies often require specialized services but may not have the resources for in-house expertise. CBIZ’s tailored solutions meet the specific needs of mid-sized corporates, allowing it to substantially cross-sell services between departments. By comparison, a large US corporate may only need Audit services because most other functions are in-house. Additionally, its mid-market focus means less regulation around the provision of multiple services (namely restrictions around audit and other services being provided together).

Within the consulting industry, brand development and recruitment are critical to success. This is a reputation-driven industry where perception (in many cases) is just as important as output. CBIZ’s recruitment is an important part of its wider strategy, with many of its leadership/senior staff from market-leading peers. The business has shown a willingness to target high-performing staff from peers and compensate them accordingly to attract talent. The result is a client retention of ~90%, which is impressive given its breadth of services outside of core FS.

CBIZ is currently a top 12 Accounting firm according to Accounting Today and Vault, while also having a respectable (and leading) reputation in its other business segments. With its aggressive growth strategy, we see further improvement ahead relative to bulky partnerships whose employees are not incentivized to grow the business as a whole but their own bottom line.

Accounting recognition (CBIZ) Other services recognition (CBIZ)

Looking ahead, we see growth being achieved through two key avenues:

- Expansion of services – Continued investment in its capabilities will contribute to the development of its brand and the scope for revenue generation. Given the human-capital nature of the industry, this can be achieved through the recruitment of teams from its peers.

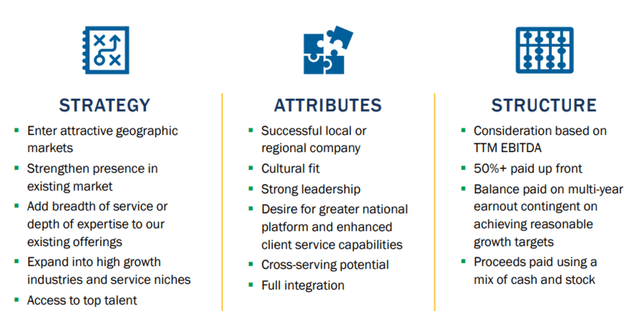

- M&A – CBIZ has consistently acquired smaller peers, spending over $250m in the last decade. Management’s objective is horizontal or vertical development, as the following eloquently describes, supporting organic growth. Given the human-capital nature, the structuring of acquisitions is critical. We appreciate Management’s stringent requirements regarding this.

Strategy (CBIZ)

Margins

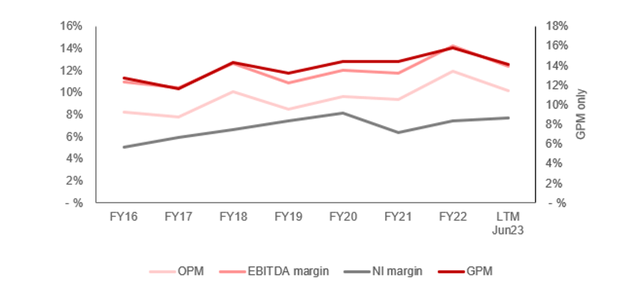

Margins (Capital IQ)

CBIZ’s margins have broadly improved over the historical period, with minimal volatility when relative to its size. We attribute this to operating cost leverage and an improvement in its national brand, allowing CBIZ to increase its rate cards comfortably. Finally, this also reflects a mix shift in services away from its core Accounting and Tax services (which generally are lower margin but consistent) to Advisory and other higher-margin services (tech, healthcare, etc.).

Alternatively, we can consider this from a labor efficiency perspective. Average revenue and EBITDA per employee in FY16 were $174k and $19k, respectively. This has now increased to $234k and $29k.

Quarterly results

CBIZ’s recent performance has been strong, with top-line revenue growth of +28.5%, +21.5%, +16.1%, and +10.1% in the last four quarters. In conjunction with this, its margins have softened since its strong performance in early FY22, falling back to its FY20 level. Given the macro environment, its current performance is good in our view, with the resilience a reflection of the nature of the services it provides. These are not costs that companies can cut, although naturally there will be an increase in bankruptcies and a reduction in growth into CBIZ’s threshold.

Key takeaways from CBIZ’s most recent quarter are:

- Demand for its “core” financial services, including accounting, tax, and advisory services, as well as its benefits and insurance offerings, continues to be high. This is as our analysis explains. CBIZ can realistically earn inflationary rate increases (at a minimum) for the foreseeable future, with reasonable scope for +1-2%.

- Despite the strong performance, the company has faced headwinds with contract delays in its Government Health Care segment and changes to tax filing deadlines in California. As these normalize, we suspect CBIZ will experience a small bump in future quarters.

- These factors have contributed to Management raising revenue guidance and reaffirming its EPS guidance for FY23. Given the broader weakness we are seeing in the market, we see this as a highly attractive characteristic that will draw investor interest.

- From an M&A perspective, CBIZ has completed three strategic acquisitions and two bolt-ons. Management expects these to contribute ~$68m in annualized revenue (4.5% growth on LTM).

- Multiple of these companies are in the cyber and information security segment, contributing to an expansion of their advisory services. Additionally, another deepens its exposure to the retirement and investment solutions segment. This is exactly what we would like to see, an expansion of its services as a primary objective, with incremental inorganic growth of existing solutions.

- Management is of the belief that the M&A pipeline continues to remain active, implying it is positioned well to continue this into FY24.

Balance sheet & Cash Flows

CBIZ’s capital allocation is extremely efficient in our view, successfully maximizing shareholder value. Debt has laddered up during the historical period, remaining within a reasonable level, with interest only representing 1% of Revenue. This debt has been used alongside FCF generation to return capital to shareholders through buybacks (which have grown well) and strategic acquisitions. We have very little to criticize and broadly consider this strategy to be maintainable going forward.

Looking at this in a single snapshot, the company’s ROE, both reported and adjusted for buybacks, is on a consistently upward trajectory, illustrating accretive returns over time.

Return on equity (Capital IQ)

Outlook

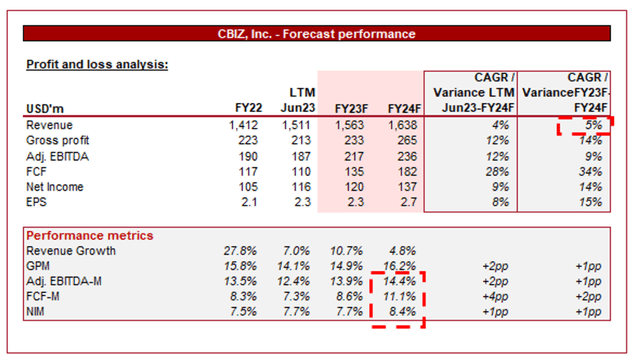

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 2 years.

Analysts are forecasting a continuation of its normalized growth rate (i.e. excluding the uptick in business post-pandemic), alongside incremental margin improvement. We consider these assumptions to be reasonable, although do see scope for growth outperformance relative to this (although may extended into the FY25+ period). With a focus on expanding its services and delivering higher margin projects, CBIZ should be able to add 1-3% of organic growth onto its existing level. When married with M&A, 5-10% is achievable.

Industry analysis

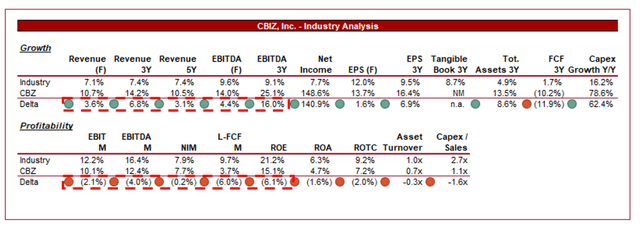

Research and Consulting Services Stocks (Seeking Alpha)

Presented above is a comparison of CBIZ’s growth and profitability to the average of its industry, as defined by Seeking Alpha (30 companies).

CBIZ performs well relative to its peers. The company’s growth has substantially outperformed its peers across both revenue and profitability, Given the maturity of the industry and its slow-moving nature, this is an exceptional performance and reflective of an effective growth strategy. As CBIZ approaches scale, it will inevitably experience a slowdown in its organic trajectory but its forward guidance implies the current level is sustainable.

CBIZ’s margins are currently below the industry average, which we attribute in part to its lack of relative scale, limiting its benefits from operating cost leverage. Further, the peer group includes several technology-enabled research firms that benefit from high-margin subscription revenue. From an absolute basis, we believe the business is in a good place when contextualized by its trajectory, although we would like to see it normalize at a higher level at maturity.

Nevertheless, we would expect CBIZ to trade at a small premium to its peer group. Usually, our preference is toward margins in a mature industry, however, given the company’s scope for margin improvement alongside its continued growth, and the downside protection of critical services, we see an attractive future position.

Valuation

Valuation (Capital IQ)

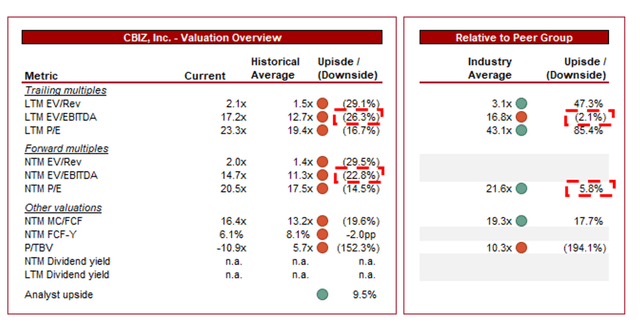

CBIZ is currently trading at 17x LTM EBITDA and 15x NTM EBITDA. This is a premium to its historical average.

A premium to its historical average is warranted in our view, owing to the company’s strong financial development thus far and importantly, the improvements in its commercial positioning. Management is scaling the business exceptionally and we agree with the current strategic direction.

Further, the company is currently trading at parity with its peers on an LTM EBITDA and NTM P/E basis. This is broadly within the ballpark we would expect, although a small premium is justifiable.

Based on CBIZ’s current valuation, we do not see material upside. This said, we still consider the company attractive, with its near-term performance looking positive. With this in mind, the scope for positive share price performance is high and at an NTM FCF yield of 6%, it is still attractive at today’s price.

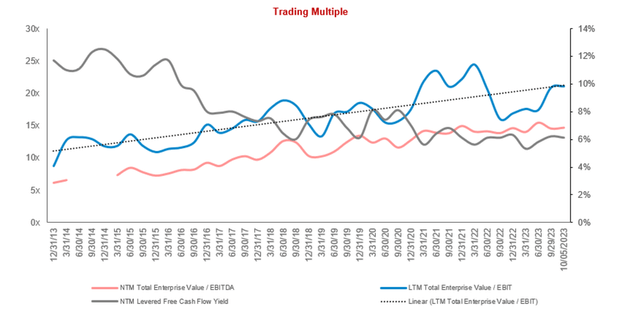

As the following growth illustrates, CBIZ’s valuation has consistently trended up during the historical period, with a small lull in recent quarters. We expect the current trajectory to soften but is unlikely to reverse.

Valuation evolution (Capital IQ)

Key risks with our thesis

The risks to our current thesis are:

- Economic impact on project work – Current economic conditions could potentially slow the company’s overarching trajectory through a decline in advisory work. Given the high valuation, any weakness in growth would have an immediate impact on the share price.

- Increased competition eroding margin – As the company grows, it will face greater competition to achieve new client wins, particularly as it competes with the global players who have more efficient operations (utilizing overseas staff in low-cost centers). This could slow its growth trajectory.

Final thoughts

CBIZ is a fantastic business in our view, led by an astute Management team. The company’s impressive growth and margin trajectory is a reflection of its quality delivery across a range of services, contributing to brand development. It cannot be understated the difficulties associated with scaling capabilities in a labor-intensive business.

With a strong brand, sticky customers, and broad expertise, we believe the business has a strong competitive advantage, particularly in the mid-market segment. From this point, we suspect M&A and progressive organic development will drive long-term improvement.

Although its valuation has trended up consistently during the last decade, at a NTM FCF yield of 6%, we still see value.

Read the full article here