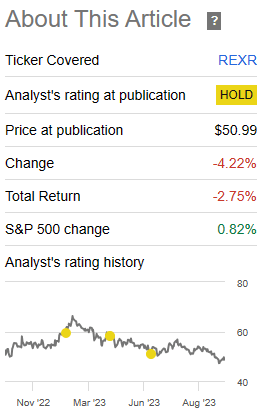

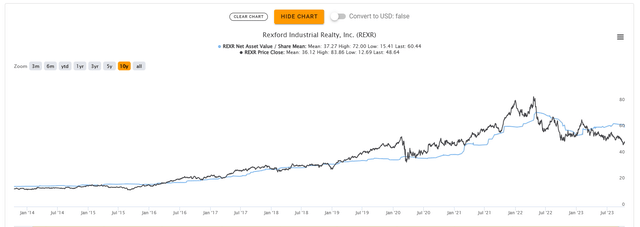

In our last coverage of Rexford Industrial Realty, Inc. (NYSE:REXR), we reiterated that the return prospects while improved, remain on the low side. Rexford’s valuation compression cycle has advanced, but likely not close to being completed. The stock moved a bit lower and has now been trading under $50 for some time.

Seeking Alpha

We look at the recent results and tell you why we bought one piece of the capital stack.

Q2-2023

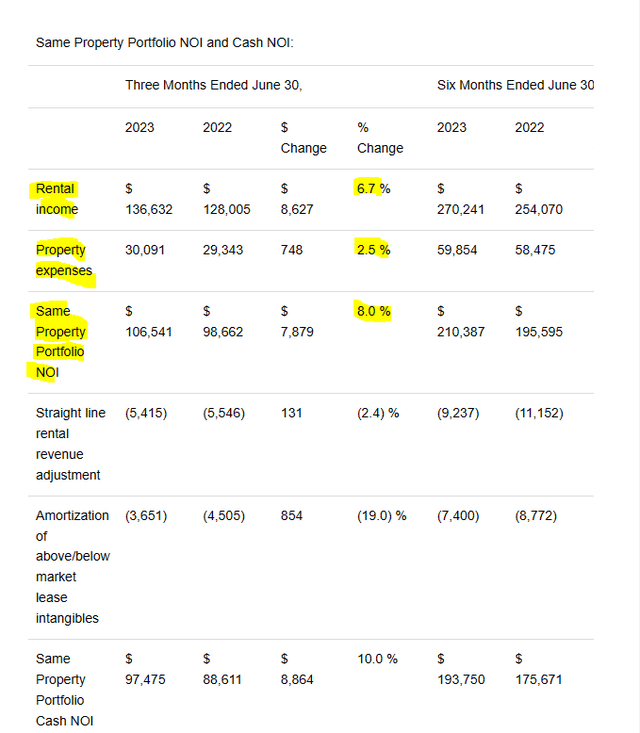

Rexford is generally a highly predictable REIT and there are few if any surprises. This quarter was no different with rental income continuing its steady year over year ascent.

REXR Q2-2023 Financials

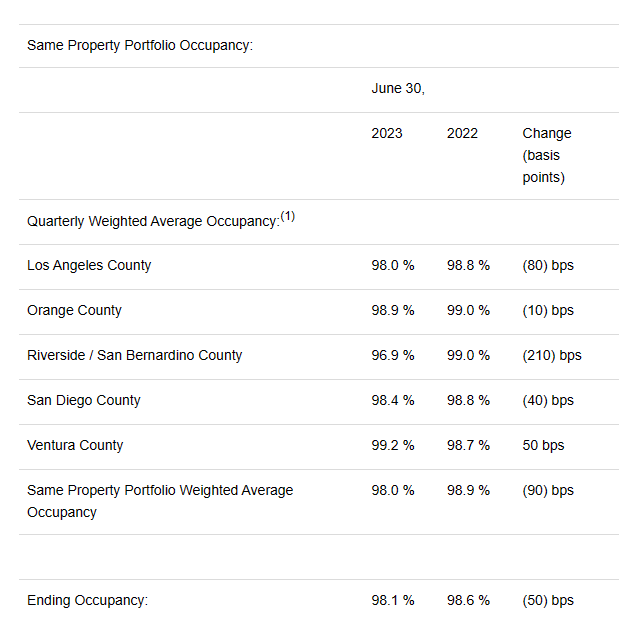

The very strong expense control powered the same property net operating income (NOI) to an 8% increase. Cash (versus GAAP just discussed) was even more scintillating at a 10% year-over-year increase. Portfolio occupancy edged up versus Q1-2023, but was down slightly in context of Q2-2022.

REXR Q2-2023 Financials

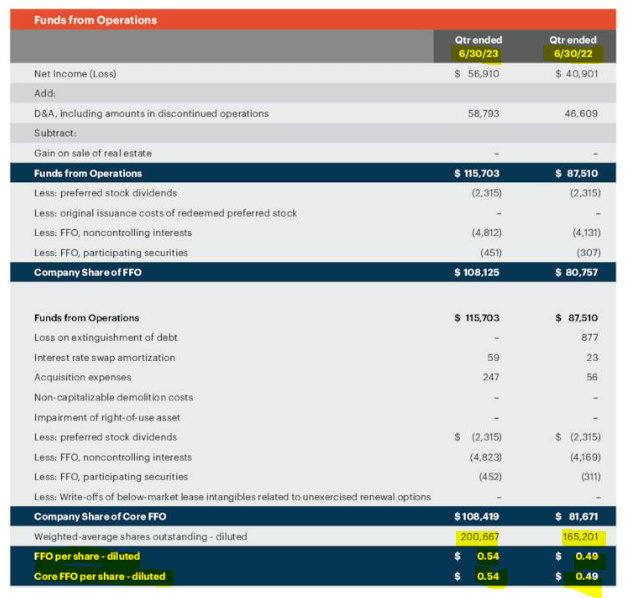

Overall funds from operations (FFO) were up over 32% from Q2-2022. FFO per share though was up only 10%, reflecting the massive secondary that was conducted in November of last year.

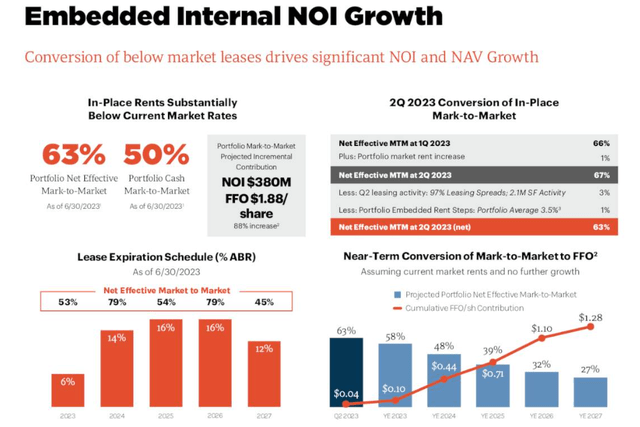

REXR Q2-2023 Presentation

Of course nothing here that is remotely bad and the REIT has delivered one of the best growth profiles with the least amount of volatility in its annual metrics. Note that we are referring to volatility in the fundamentals. The share price itself has had some big swings as investors have tried to put a fair price on this growth story.

Outlook

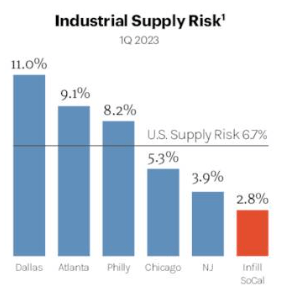

Rexford’s story is about tight supply meeting unrelenting demand. Industrial properties are a hot commodity and they are an even hotter commodity in the supply constrained Southern California market. Now don’t get us wrong. Supply is coming on everywhere as the returns on putting up new industrial space is extremely high. This is even after the big jump in land costs, labor and interest expense. It is just that Southern California market remains relatively resilient.

REXR Q2-2023 Presentation

On the demand side, onshoring trends have continued to add to normal demand levels and this is going to be at least a modestly tight market, outside a severe recession.

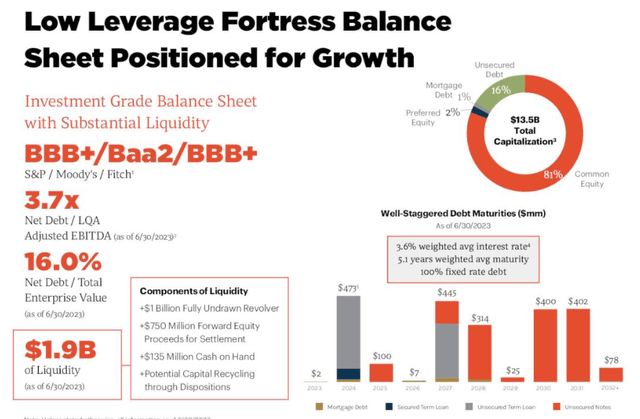

Rexford is also one of the most responsible REITs in terms of balance sheet maintenance. You can see those BBB+ ratings below, but they really don’t remotely do justice to the setup.

REXR Q2-2023 Presentation

The debt is well laddered with a good weighted average maturity of 5.1 years. 16% net debt total enterprise value is pretty much unheard of in the REIT space. Most investment grade REITs run about 5.0X debt to EBITDA on average and Rexford’s 3.7X is about as fortress level as one can get. All of this is without giving credit for the NAV and rent uplifts you will get down the line.

REXR Q2-2023 Presentation

So in effect, this is about as close as one can get to a REIT that can withstand higher interest rates.

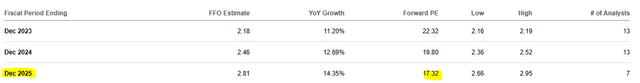

While those are the positives, valuation itself has not become that attractive, yet. Everyone knows about that embedded growth and every analyst is modeling that into the FFO. There is little room for surprise and you are still paying 17.3X 2025 estimates.

Seeking Alpha

There is nothing that says a REIT cannot trade at 17X multiple (two years out that too) in a 5.5% risk-free interest rate world. So this growth will take time to chew through the excesses of the past.

Analysts have similarly modeled the NAV. Rexford does trade at a slight discount which is pretty rare for this REIT. The current discount is the second largest in percentage terms.

TIKR

The FFO multiple is still expensive here relative to 2015-2016, an era marked by ZIRP (zero interest rate policy). The Red Circle on the chart below is where we put our Sell rating on the stock. We show that to demonstrate that valuation can get crazier even after all rational thinking is abandoned.

TIKR

Verdict

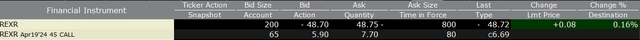

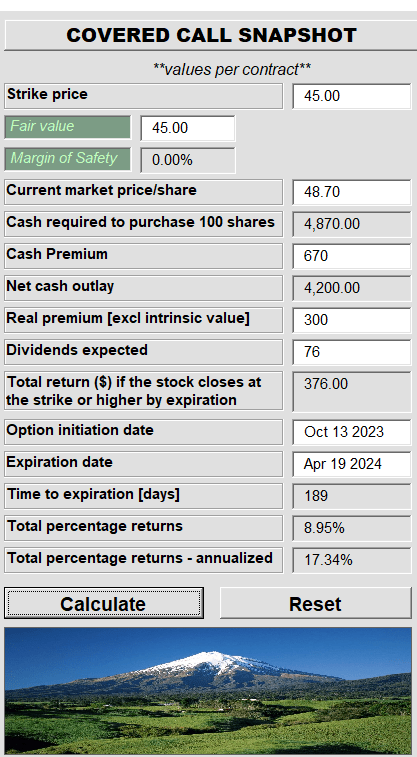

We are now getting closer to the last one-third of this valuation compression and the lower it goes, the better your forward return prospects become. Last time we had suggested a $45 covered call entry point and that remains valid today.

Interactive Brokers

17% returns are a good way to start to put your bid in.

Author’s App

We would not rule out even a $40 price at some point. At $48.72, we think you will still get positive albeit low returns 10 years out. There is just too much demand for these properties to get too negative down here, even with the high hurdle of interest rates. We rate the common shares as a Hold/Neutral.

Rexford Industrial Realty, Inc. 5.625% CUM PFD C (NYSE:REXR.PR.C)

As we have recently discussed, fixed income is getting quite attractive and REXR.PR.C briefly crossed a 7% stripped yield. We see this as a pseudo A rated credit security. Sure the official rating here is BBB-, but our own assessment puts this light years ahead of competing preferred shares in terms of quality. We are upgrading these to a Buy.

Rexford Industrial Realty, Inc. 5.875% PFD SER B (NYSE:REXR.PR.B)

This one has a similar return profile with the only difference being that REXR.PR.C was cheaper at the time we went and placed the order. One other small difference is that REXR.PR.B has a slightly higher chance of being redeemed if rates decrease in the future.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here