Private sector investments into the space industry have been growing, and SpaceX (SPACE) has been one of the most prominent names in the industry.

However, there is another little-known company called Rocket Lab USA, Inc. (NASDAQ:RKLB) that is ranked second compared to SpaceX but trading at a 98% discount to SpaceX’s latest valuation.

Today, I will be going deeper into Rocket Lab and what the opportunity is for the company.

Brief description

Rocket Lab is an end-to-end space company providing both launch and spacecraft services, design, components and manufacturing.

It is actually the second most frequently launched U.S. orbital rocket behind SpaceX.

As a result, it has an established track record of successful missions.

Rocket Lab is known for Electron, a two-stage rocket which provides its customers with frequent, reliable and also cost-effective access to orbit for the new generation of smaller spacecraft. With technological advancement as well as improvements in components and materials, spacecraft has gotten smaller and as a result, this also led to lower costs.

Electron is described as a full carbon composite launch vehicle that is powered by Rocket Lab’s own electric turbopump 3D printed engine, called Rutherford. Rocket Lab’s Electron has achieved many milestones since its first launch and in 2022, Electron was ranked the second most frequently launched rocket by companies that are operating in the US, and the fourth most frequent launcher in the world.

Rocket Lab’s first Electron launch was in 2017, and until the end of 2022, the company sent 152 spacecraft to space across 29 missions for both government and commercial customers.

Some of these customers include the U.S. Department of Defense, NASA, the Defense Advanced Research Projects Agency, and the National Reconnaissance Office, along with other domestic as well as international commercial spacecraft operators. These include Canon, Capella Space, BlackSky, Planet, amongst others.

On top of Electron, the company is also developing its Neutron launch vehicle. This next launch vehicle will be used more for large constellation deployments, interplanetary missions and even, potentially, human spaceflight. The two-stage Neutron is expected to have a payload capacity of about 15,000 kg for expendable launches to low Earth orbit and lighter payloads for higher orbits and reusable configurations. Rocket Lab expects Neutron to benefit from the growing demand for constellation missions.

The company has been able to maintain a frequent launch cadence as a result of the unique and innovative manufacturing techniques used for Electron. This includes the use of automation and 3D printing. The other advantage is the launch infrastructure that Rocket Lab has.

I think that one of Rocket Lab’s advantages is its launch infrastructure. I will explain more about this below but allow me to give a brief introduction about the company’s launch infrastructure.

The company has two launch complexes.

Firstly, in New Zealand, Rocket Lab is operating its own private launch complex called Launch Complex 1. This launch complex is enabled by a treaty signed between the New Zealand and United States, allowing Rocket Lab to be able to launch from foreign soil. As a private launch complex, Rocket Lab has exclusive access to the launch pads and does not need to share it with others, thereby allowing full control over the availability of the launch pads and the launch schedule. Launch Complex 1 has two launch pads that are operational, and thus it is the company’s high volume launch complex, able to support almost 120 missions annually.

In addition, Rocket Lab operates a dedicated launch pad at NASA’s Wallops Flight Facility, referred to as Launch Complex 2. This second complex is licensed for 12 missions every year and is meant for urgent constellation replenishment and for 24-hour rapid call up capability meant for defense needs.

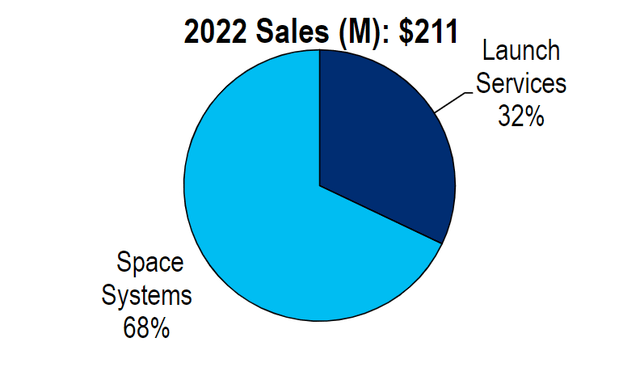

In terms of business and revenue mix, most of 2022’s $211 million in sales came from space systems, while 32% came from launch services. Rocket Lab’s space systems business provides customers with an end-to-end space solution that ranges from the design, building, launching and operating of spacecraft. Launch services, as the name suggests, are where Rocket Lab provides customers with the service of launching and deploying spacecraft, whether for commercial or government customers.

Rocket Lab business segment (Author generated)

Neutron is key to Rocket Lab

While Electron has been rather successful, I think Neutron will be key for Rocket Lab to supplement and improve on its product portfolio for the longer term.

Neutron, as I have introduced earlier, is a new rocket that Rocket Lab is developing that will provide heavier lift and enables the company to position itself to meet the varying needs of its customers, especially for those in the defense and national security sector.

The company expects that Neutron will be developed, constructed and tested until 2024, and in 2025 the first launch that is revenue generating will happen. By the end of 2023, Rocket Lab expects to do its first “hot fire test” of the Neutron’s Archimedes engine.

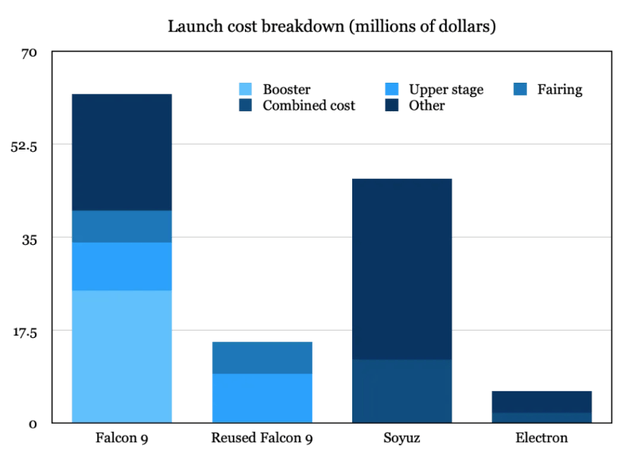

Neutron will compete directly with SpaceX’s Falcon 9, with a price tag of $50 million, compared to Falcon 9’s price tag of $67 million. In addition, management expects that Rocket Lab’s reusable Neutron boosters will match the reuse rate of the Falcon 9 booster of about 10 to 20 times. As a result, Neutron is expected to drive margin upside as its margins are expected to be in the range of 50%, with most of the costs coming from the non-reusable part of the rocket.

It is important to watch the key development milestones as there are often difficult circumstances that may result in delays in one way or another. Another thing that Rocket Labs needs to show that it is able to achieve is the serial reusability of the rocket, which will enable considerable upside to margins.

At the end of the day, Neutron will be key for Rocket Lab to win new contracts to meet the different needs of its clients, while enabling margin upside in the long-term.

Success as a fast follower

As I have mentioned earlier, Rocket Lab’s Electron is only second to SpaceX in the U.S. Rocket Lab was able to achieve this by being a successful fast follower in the launch segment.

As an orbital small launch vehicle, Electron is designed for a high launch cadence business model to meet the needs of its customers that require small spacecraft launch services.

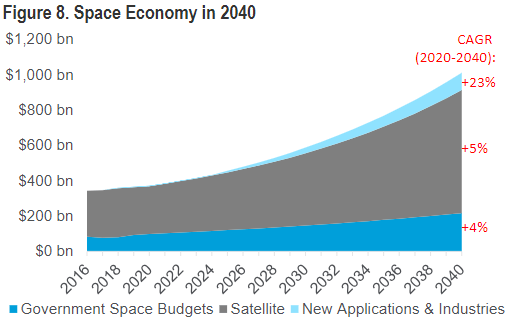

The segment is expected to grow by mid-single digits until 2040.

Space Economy 2040 (Citi Research, Satellite Industry Association )

As highlighted before, Electron has been optimized for frequent and reliable launches as a result of innovative manufacturing technologies, including automation and 3D printing. Rocket Lab has made many industry-leading innovations like a private orbital launch complex, fully carbon composite fuel tanks, 3D printed electric turbo pump rocket engines, a kick stage that can be configured to convert into a highly capable spacecraft on orbit as well as the potential ability to be reused.

Electron is meant for deploying spacecraft weighing up to 300kg to low Earth orbit for either dedicated or rideshare missions. It has two primary stages and an innovative third kick stage. As carbon composites were used for its structures, and because carbon composite lowers mass by almost 40%, it helps Electron to achieve superior mass-to-orbit performance.

Electron’s Rutherford engines, as well as its composite tanks and structures are assembled in-house. This helps to improve the rate of production and increase cost efficiency.

Rocket Lab is actually the global market leader in dedicated small launches. In 2022, it made 32 launches and deployed 152 satellites. I think it is also worth noting that Rocket Lab has been increasing its focus on more reliable government customers.

In addition, Rocket Lab showed its strong abilities in having the fastest turnaround between successful launches for small launch providers. It launched a NASA CAPSTONE moon mission and a dedicated launch for the National Reconnaissance Office within 15 days of each other.

Also, with multiple launch complexes, Rocket Lab is able to make two launches just days apart in its two complexes, with its launch with BlackSky in Launch Complex 1 and its launch with Capella Space in Launch Complex 2.

Competitive advantages

I have probably highlighted the company’s competitive advantages above, but let me consolidate and emphasize them here.

Firstly, as highlighted above, Rocket Lab has deep vertical integration. In terms of its designing as well as manufacturing capabilities, these are all extensively vertically integrated. What this means is that the company is able to have better control over each part of its business and to deliver lower costs.

Secondly, also highlighted above, Rocket Lab’s two launch complexes are a competitive advantage on its own as it allows the company to have more launches than would be typically possible. In fact, with the launch complex in New Zealand capable of 120 launches each year, according to the company, this is significantly more launches than possible from all the launch ports in the United States in a year. As a result, this means that Rocket Lab has also has the ability to control its own launch schedule.

Thirdly, Rocket Lab offers a comprehensive, end-to-end space solution for its customers. As a result, customers need to rely on different suppliers and partners for their own missions and with the full suite of services and solutions available from Rocket Lab, this brings a one-stop service to its customers.

Fourthly, Rocket Lab has been innovating and been leading the industry with new technologies. For example, it was the first company to use 3D printing to make its orbital rocket engine, an electric turbo pump-fed rocket engine that is an improvement over the traditional gas generator cycle engines, carbon composite tanks and structures that improves cost efficiencies, amongst others.

Last but not least, Rocket Lab is a leader in the small launch vehicle space through Electron and with its history of successful missions since 2017, customers are increasingly growing their relationship and trust with the company. As a result, this helps enable Rocket Lab to have some competitive advantage against up-and-coming competitors in the space.

Management team

Peter Beck is the founder and CEO of Rocket Lab. He founded Rocket Lab in 2006 and has been instrumental in the progress and development of the company. He was the one to lead the development of the Electron launch vehicle that was designed from ground up. As a result of his leadership, Rocket Lab achieved many of the innovations that I have mentioned above, including the 3D-printed rocket engines and fully carbon composite fuel tanks. In addition, he was also the one to lead Rocket Lab’s development of its Launch Complex 1 site in New Zealand, which required a bilateral treaty to be signed. He holds about 11% of the company, owning 54.6 million shares, which amount to $327 million based on the current share price.

Adam Spice is joined Rocket Lab as its CFO in 2018, and prior to joining the company, spent seven years at MaxLinear (MXL), and has more than 20 years in finance roles. He has 5.4 million shares of the company, amounting to $32 million based on the current share price.

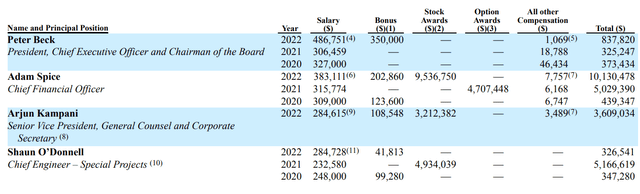

This is what the executive compensation looks like for Rocket Lab. Significant stock awards are given to Adam Spice, the CFO, Arjun Kampani, Senior Vice President, General Counsel and Corporate Secretary. and Shaun O’Donnell, Chief Engineer – Special Project. These stock awards are vested if conditions such as service-based conditions are met.

Executive compensation of Rocket Lab in 2022 (Proxy Statement)

Comparison with competition (SpaceX)

One very important question that several members of Outperforming the Market asked me was how does Rocket Lab competes with SpaceX, and I will address this here.

As mentioned earlier, Rocket Lab’s Neutron competes against SpaceX.

While Rocket Lab is now almost a $3 billion market capitalization company, SpaceX is worth $150 billion as a private company, based on latest valuations.

However, is Rocket Lab really worth 98% less than SpaceX or is SpaceX really worth 50x more than Rocket Lab?

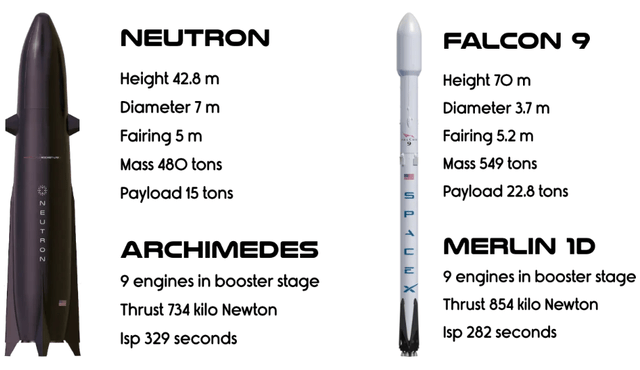

To evaluate this, we must compare Rocket Lab’s Neutron to SpaceX’s Falcon 9 rocket.

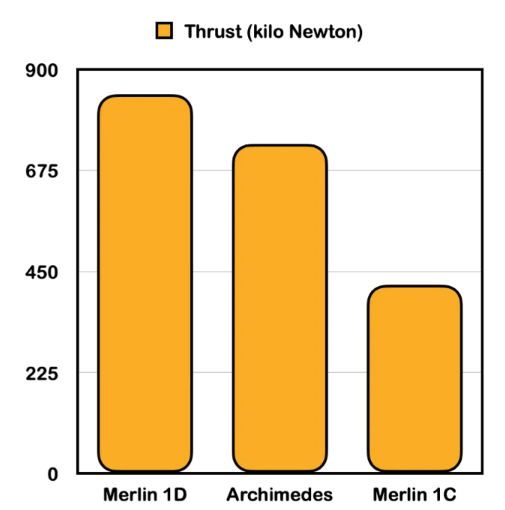

First, I would point out that I am sure that Neutron will have many improvements made after the first version is release given that the Falcon 9 has been optimized many times over the years. For example, Falcon 9 uses the Merlin 1D rocket engine today, which is an improvement in terms of thrust from 420 kilo Newtons (“kN”) to 854 kN in the Merlin 1D rocket engine. As a result, SpaceX could extend the length of Falcon 9 from 48 meters to almost 70 meters today.

As a result, I think that from what we can see below, Neutron has a nice starting ground where it is starting at a height near where Falcon 9 used to be at around 43 meters. In addition, Neutron has its 9 Archimedes engines in the booster stage, with a thrust that is just slightly less than that of the Merlin 1D.

Comparison of key characteristics between Neutron and Falcon 9 (Medium)

First, I come to the engines of the Falcon 9 and Neutron. As can be seen below, Neutron’s Archimedes engine is expected to have stronger thrust than the older Merlin 1C and the Merlin 1D is expected to have a stronger thrust than the Archimedes. What this means is that Falcon 9 has an advantage over Neutron in the first stage as rockets should ideally lift off the ground as quickly as possible so that less fuel is used to combat gravity.

Thrust comparison between Neutron and Falcon 9 (Medium)

Second, one key difference between Neutron and Falcon 9 is that Falcon 9 is made of aluminum, which is the most common material used in the space industry, but Neutron is made of carbon fiber composite, a radically different approach. Why is Rocket Lab using carbon fiber? New Zealand, where Rocket Lab is based, has strong expertise working with composite materials, Peter Beck, Rocket Lab’s founder himself has worked a lot with composites before founding Rocket Lab. In addition, its Electron rocket is also made from carbon fiber composites. The crucial thing about carbon fiber is that it is able to achieve the same strength as aluminum, but it only has a quarter of the weight of aluminum. This has huge advantages for Electrons given that the lower the mass, the less propellant needed and the smaller the rocket can become.

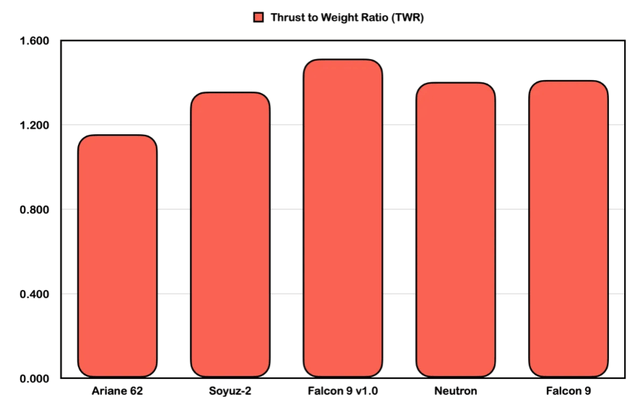

In addition, while the Neutron’s thrust was less than the Falcon 9, the material used results in a similar thrust-to-weight ratio between the two, as shown below. This means that both Neutron and the Falcon 9 have similar abilities when it comes to being lifted off the ground, all thanks to Neutron’s carbon fiber composite advantage.

Thrust to weight ratio of Falcon 9 and Neutron (Medium)

Third, Neutron is designed for better unit economics than the Falcon 9. Neutron does not require a launch tower and it just needs a flat launch pad. Neutron does not need to be landed on a drone ship, which Falcon 9 requires and is costly to maintain. Neutron is also designed in such a way that it can be turned around within 24 hours for another launch after landing. As a result, Neutron will likely achieve more frequent launches than SpaceX can, thereby improving the unit economics and achieving a lower launch cost for Neutron. However, SpaceX is focused on achieving as high reuse rate of the rocket as possible.

In fact, I found that the cost to build a rock makes up one-third of the total cost, while the remaining two-thirds of the cost comes from the operations and services required for the launch. In short, by having a faster turnover, Neutron will have far better margins and improved economics than the Falcon 9.

Launch cost breakdown of Falcon 9 and Neutron (Medium)

Overall, I actually can see the Electron competing meaningfully with the Falcon 9, although there will be improvements that need to be made from the first release.

Potential cash flow risks

It is important to note that Rocket Lab had $472 million in cash as of the end of 2022. In addition, in 2022, the company burnt $149 million in free cash flows.

The Neutron launch vehicle development cost is expected to be about $250 million, and there is a $100 million debt maturity in 2024.

As a result, the company may face some cash flow risk if the company needs to organically fund the construction of the launch sites needed for Neutron for 2025 and beyond.

As the revenue and cash flow from operations ramp up, free cash flow is expected to turn positive by the end of 2025. Thus, you can see how tight the cash flow situation is for Rocket Lab.

Valuation

Rocket Lab is not profitable today, but free cash flows are expected to turn positive in 2025.

Today, Rocket Lab trades at 5x 2024 P/S.

My 1-year price target is based on 8x 2024 P/S multiple. Given that Rocket Lab is expected to grow at almost 60% in 2024, I think that this P/S multiple is justified for a company growing strongly and expected to turn free cash flow positive in 2025.

Thus, my 1-year price target for Rocket Lab is $7.60.

Conclusion

Rocket Lab is looking to be a real contender in the space industry.

The company is a successful fast follower, being only second to SpaceX in the U.S.

The competitive advantages of Rocket Lab USA, Inc. include deep vertical integration, having control over its launch complexes, being an innovator and leader in the industry, and providing an end-to-end space solution to its customers.

Electron is proving to be a leader in its field while Neutron is expected to be able to compete meaningfully with SpaceX’s Falcon 9.

Neutron is key to the investment thesis of Rocket Lab because it offers both margin upside and adds meaningfully to the product portfolio of the company.

Read the full article here