In the ever-evolving clean energy landscape, solar energy and battery storage have taken center stage, reaching beyond the well-known domain of electric vehicles (EV). Enphase Energy, Inc. (NASDAQ:ENPH) is among the key players, renowned for its expertise in developing batteries and microinverters tailored for businesses and consumers. Enphase Energy showcases remarkable adaptability amid a fluctuating macroeconomic environment. This article offers a technical examination of Enphase Energy’s stock price to identify its potential trajectory and investment prospects. Currently, the stock appears to be trading at a robust long-term support level, suggesting a potential upward trend.

Navigating the Challenges of a Competitive Clean Energy Market

Although EVs capture much of the world’s attention, the clean energy sector encompasses more than just EVs. Solar power and battery storage play significant roles in this burgeoning field. Enphase Energy has an impressive presence in the market for producing batteries and microinverters designed for businesses and private households. The company has managed various operational hurdles amid a constantly evolving macroeconomic landscape.

It’s essential to recognize the considerable challenges confronting Enphase Energy at present. The intense market competition stands out as a primary concern. Industry giants such as Tesla, Inc. (TSLA) and SolarEdge Technologies, Inc. (SEDG) are all contending to share the same audience. To remain competitive in the market, many firms opt to cut prices, which could risk diminishing the perceived value of products among consumers. However, the difficulties don’t stop at that point. The present U.S. housing market introduces another hurdle. As borrowing costs surge and real estate prices climb steeply, achieving homeownership has grown more challenging for individuals. Considering the significant costs associated with solar installations, many prospective buyers lean towards loans or leases. But with the Federal Reserve’s assertive actions to combat inflation, leading to rising interest rates, securing financing for these projects may be unattainable for many.

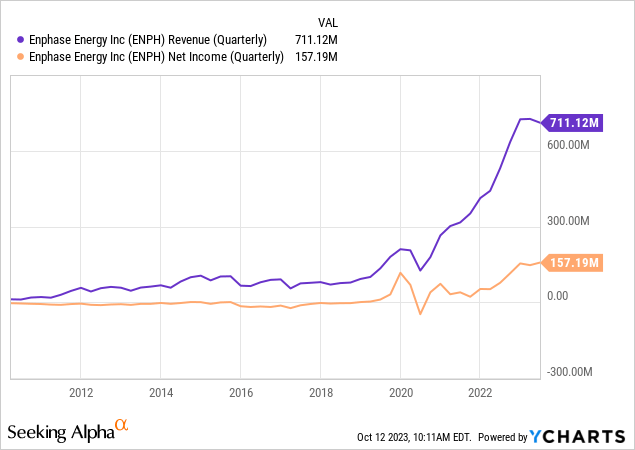

Despite these hurdles, Enphase Energy’s Q2 performance paints a robust financial performance. The company reported a quarterly revenue of $711.12 million and a non-GAAP gross margin of 46.2%. Throughout the quarter, the company shipped 5,198,441 microinverters, translating to about 2,121.3 megawatts DC and 82.3 megawatt hours of their IQ™ Batteries. Notably, the firm achieved a GAAP operating income of $170.3 million, with its non-GAAP counterpart at $230.5 million. Their GAAP net income was $157.2 million, whereas the non-GAAP net income reached $205.6 million. With GAAP diluted earnings per share of $1.09 and a non-GAAP figure of $1.47, the company further solidified its financial stance with a free cash flow of $225.2 million and ending cash and equivalents amassing $1.8 billion. The chart below illustrates a strong positive trend in both quarterly revenue and net income.

For the third quarter of 2023, Enphase Energy anticipates its revenue to range between $550.0 million and $600.0 million, supported by significant shipments of IQ Batteries, estimated between 80 to 100 megawatt hours. Their gross margin expectations are similarly strong, with GAAP gross margins predicted to lie between 41.0% and 44.0% and a slightly elevated non-GAAP range of 42.0% to 45.0%. These figures notably do not yet account for the net IRA benefit, estimated between $14.5 to $16.5 million, based on the projected shipment of 600,000 domestically manufactured microinverters. The company also projects its GAAP operating expenses to be between $159.0 million and $163.0 million, with non-GAAP operating expenses, after accounting for stock-based compensation and acquisition-related costs, to range from $101.0 million to $105.0 million.

Despite market challenges from industry giants and the evolving U.S. housing landscape, Enphase Energy’s strong Q2 performance and optimistic Q3 2023 projections highlight its resilience and continued prominence in the clean energy sector, particularly in battery storage and microinverters.

A Deep Dive into Long-term Support Dynamics

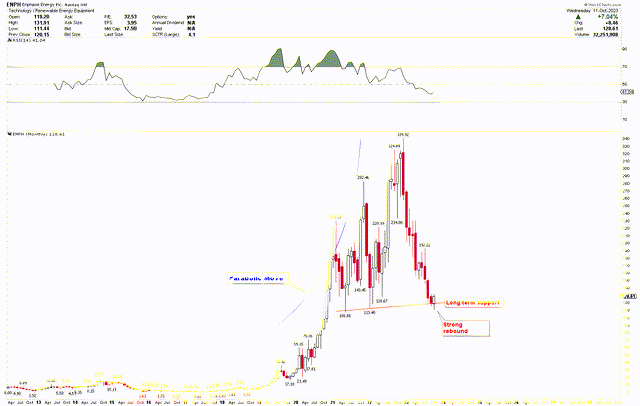

The long-term technical outlook of Enphase Energy is strongly bullish despite a substantial correction in 2023, as shown in the monthly chart below. This solid bullish outlook is supported by the parabolic move, which started in 2018, and the price has moved with intense volatility to hit all-time highs at $339.92. A combination of factors drives this strong uptick. The company emerged as a leader in the microinverter segment for solar energy systems, witnessing increased adoption of its innovative solutions. Their transition to the IQ7 and later the IQ8 series microinverters showcased technological advancement and higher efficiency, bolstering their market position. Furthermore, the global push for renewable energy sources and the growing demand for home energy storage solutions amplified Enphase Energy’s relevance in the energy sector. The company’s consistent financial performance, strategic acquisitions, and expanded partnerships also contributed to investors’ growing confidence, propelling its stock price upwards during these years.

Enphase Monthly Chart (stockcharts.com)

The chart highlights notable volatility during 2021 and 2022. In 2023, a pronounced decline brought the stock price to a crucial psychological level, identified by the red trendline as long-term support. Demonstrating resilience at this threshold signals bullish momentum. The appearance of a bullish candlestick near this support suggests a promising investment opportunity, particularly for long-term investors.

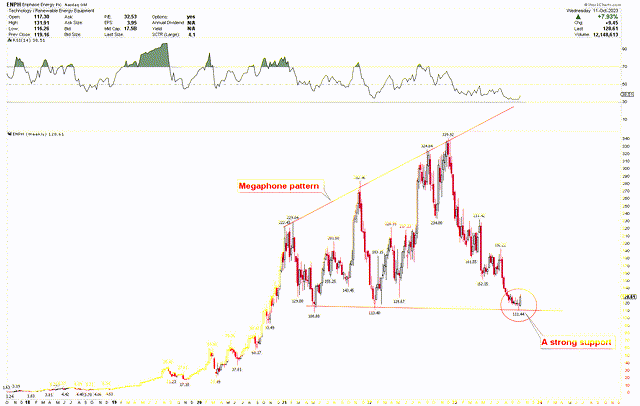

The weekly chart also highlights this robust long-term support, evidenced by the emergence of the Megaphone pattern between 2021 and 2023. The price is bouncing back from this pattern, indicating a potential upward trajectory. While the RSI is trending upward, it’s yet to cross the mid-level 50 threshold. Given these signals, investors might see this as an opportunity to invest, anticipating a favorable outlook.

Enphase Weekly Chart (stockcharts.com)

From the above discussion, it’s evident that the stock price is recovering from robust long-term support, evidenced by a significant key reversal candle over the past week. This notable reversal, set against the backdrop of a long-term megaphone pattern, underscores a compelling buy argument for long-term investors. Nonetheless, a monthly close below $109 could challenge this optimistic view.

Market Risk

Enphase Energy faces stiff competition in its market, with titans like Tesla and SolarEdge Technologies all competing for a finite pool of customers. In their bid to attract consumers, this has led many companies to reduce prices, potentially diluting their product’s perceived value and impacting profit margins. Further complicating matters for Enphase is the escalating costs of homeownership in the U.S., as rising borrowing costs and property prices make financing solar installations challenging. The Federal Reserve’s anti-inflationary tactics, which include interest rate hikes, could render these financing options even less accessible for many.

Regarding Enphase’s stock performance, it has experienced significant volatility in recent years. Notably, a sharp correction in 2023, juxtaposed against a generally bullish long-term outlook, underscores the stock’s vulnerability to market dynamics. The stock’s erratic movements in 2021 and 2022 and the 2023 correction highlight its inherent unpredictability. Furthermore, the RSI hints at caution, with its upward trend yet to breach the mid-level 50, indicating that the stock might not have firmly set on a bullish path. Technically, a monthly close below $109 will negate the long-term bullish outlook.

Bottom Line

The clean energy sector is vast and multifaceted, with solar energy and battery storage taking on pivotal roles. Enphase Energy, despite facing numerous challenges from competitive market dynamics and a complex U.S. housing landscape, continues to make strides in its domain. While its stock has seen fluctuations and faced a notable correction in 2023, its resilient performance, especially in the international arena, cannot be overlooked. Enphase’s strategic moves in technology and acquisitions have cemented its position in the market. The technical perspective is largely optimistic, as the price is anchored at a robust long-term support. The appearance of a bullish hammer on both monthly and weekly charts underscores a promising upward momentum. For investors, entering the market at this point might offer a chance to benefit from the anticipated uptrend due to the intense price action at the megaphone pattern. As long as the price consistently closes above $109 each month, the perspective on Enphase Energy remains positive.

Read the full article here