Investment Thesis

SMART Global Holdings, Inc. (NASDAQ:SGH) presented investors with disappointing results. Initially, I was optimistic about the stock, anticipating that its operations would stabilize following the spin-off of its Brazil business. However, this expectation proved to be incorrect. Instead of doubling down on my rating, I have decided to disengage from this stock.

I am now neutral on this stock. If I held shares in this company, I would admit that I had doubts from the outset. Nevertheless, I believe that SMART’s remaining business, particularly its Intelligent Platform Solutions (”IPS”) segment, would be a valuable asset worth retaining. Unfortunately, the recent results have shown that my belief was mistaken.

Quick Recap

This is what I previously said about SMART:

This was my contention. SGH’s IPS is terrific. This provides customized high-performance computing manufacturing solutions.

That side of the business is performing substantially above most investors’ expectations, my own included, too. With ”bumpy” but fast organic growth rates, which last quarter crossed 100% y/y, and substantially more inorganically.

The problem weighing on the stock had been its Memory Solution (under the brand SMART Module).

This segment is sometimes described as SGH’s Brazil Memory business. This side of the business was suffering. It was being operated to maximize cash flows, but I had my doubts over how much one can ultimately cut back on a memory business and still be able to sell memory.

My initial thesis was that SMART, after the spin-off of its Brazil business, would be able to move forward as a leaner, albeit smaller, and more agile business. Unfortunately, this turned out to be a faulty assumption. Here’s why.

Revenue Growth Rates Look Bad, But Not So Bad:

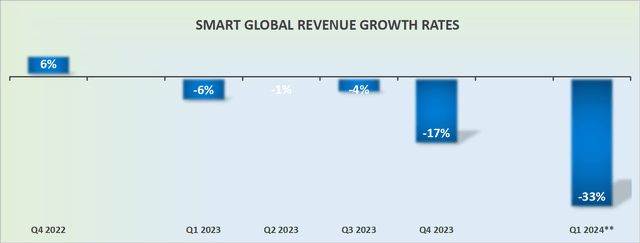

SGH revenue growth rates

SGH’s guidance necessitates interpretation. As previously mentioned, SMART Global’s Q1 guidance does not encompass the discontinued Brazil business. Hence, while the guidance indicates negative 33% year-over-year growth rates, it is crucial to understand that these are not direct comparisons.

SMART is currently navigating a series of challenges within its operations. One of the primary difficulties lies in the unpredictable and sporadic nature of its business, which is influenced by the timing and concentration of customer engagements. As Mark Adams, the company’s executive, mentioned on the earnings call:

It’s not just the GPUs. It’s also some networking components, as you know. And all that combined…just the visibility is a little choppy and that’s what kind of led into our guidance today.”

This opacity is further intensified by supply chain constraints, resulting in a decrease in inventory for both the specialty memory and Intelligent Platform Services (”IPS”) segments.

Moreover, the company is grappling with obstacles in its memory solutions division, with pricing stabilization and dwindling demand for consumer memory products. Back to Adams’s words:

The consumer memory market and the demand for the end product phones and desktop notebooks, the global basis is down dramatically.

These factors have significantly impacted the company’s revenue projections and overall performance in recent quarters.

SMART’s guidance for its IPS segment has raised questions due to certain challenges the company is currently facing. Adams highlighted that the timing and concentration of customer engagements have contributed to the business’s lumpiness.

He emphasized:

It’s not just the GPUs. It’s also some networking components, as you know. And all that combined…just the visibility is a little choppy and that’s what kind of led into our guidance today.”

This remark indicates that the company’s ability to forecast accurately is hindered by the irregularities in its customer engagement patterns and the uncertain supply chain dynamics.

Additionally, the shift in the timing of certain projects from the fourth quarter to the first quarter has impacted its Q4 revenues, as stated by CFO Ken Rizvi:

There was a miss, as we talked about, in terms of IPS and some of the orders moving from Q4 into Q1. So those are the two factors relative to our original guidance for Q4.

This adjustment highlights the intricacies in projecting the company’s performance, especially in the IPS segment, where order timing significantly influences financial outlooks.

Valuation Too Unpredictable

SMART will sell 81% of its Brazil business, which is involved in assembling and testing modules for OEMs in Brazil, for $166 million in cash. However, even with this figure, SMART’s balance sheet will still carry approximately $230 million of net debt. Moreover, the company is dealing with wildly unpredictable revenue growth rates.

Thus, while the business appears to be attractively priced at around 8x forward earnings, I believe that without stabilization of its operations, it is not a suitable investment. It is likely that this business, currently inexpensive, will become even cheaper in the next twelve months. Indeed, I anticipate that investors will look back at $17 per share in the coming year and view it as a mirage.

The Bottom Line

My optimism about SMART Global Holdings, Inc. was dampened as the company delivered disappointing results following the spin-off of its Brazil business.

Despite initial hopes for stability, the business encountered challenges in its Memory Solution segment, leading to unpredictable revenue growth rates and an uncertain outlook.

As uncertainties persisted within the supply chain and customer engagements, my earlier positive outlook on its Intelligent Platform Solutions segment was challenged.

Consequently, my stance on the stock has shifted to a neutral position, acknowledging the need for the business to address its operational instabilities before considering reinvestment.

Read the full article here