Investment Rundown

The share price for Albemarle Corporation (NYSE:ALB) has been steady downwards in the last 12 months. However, this has not stopped the company from expanding and reaching new markets. Quite recently the company announced a non-binding agreement to acquire Liontown for A$6.6 billion in total. This adds further exposure for the mobility and energy industry and diversifies the revenue streams even more for ALB.

However, the market doesn’t seem to be rewarding ALB with the price premium I think it could have. A FWD p/e of under 7 is a significant discount to the 24 it has averaged over the last 5 years. I think the downside is limited from here, even though the chart might look like it’s a falling knife scenario. I think however that the demand for lithium will eventually push the prices upwards and even though ALB is facing risks in Chile’s productions, it’s bound to offset some of this. Over the long-term ALB looks solid and a buy rating is the only fitting in my opinion.

Company Segments

ALB is a global company specializing in the development, manufacturing, and marketing of engineered specialty chemicals. The company operates through three primary segments: Lithium, Bromine, and Catalysts. Historically, ALB has been primarily known as a specialty chemicals company. However, in recent years, it has strategically shifted its focus towards becoming a prominent lithium producer, making lithium production its top priority.

The most important and prominent segment though I think investors are watching is the Lithium segment, ALB offers a range of lithium compounds, including lithium carbonate, lithium hydroxide, and lithium chloride. This strategic transition reflects the growing demand for lithium in various industries, particularly the EV sector, where lithium-ion batteries are a critical component.

Investor Presentation

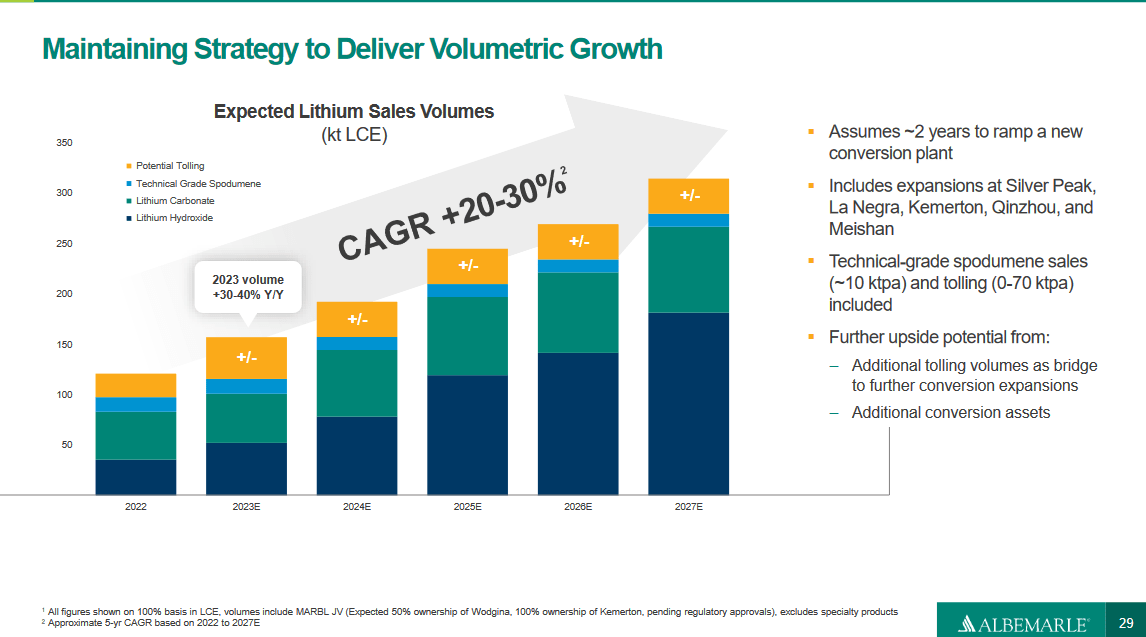

Over the long term, ALB continues to see lithium sales growing at a rapid rate. Until 2027 it’s expected to see CAGR sales growth of 20 – 30%. The demand is fueled by the growing EV industry and the need to establish more clean energy sources. The material used there is lithium for example.

Markets They Are In

Lithium has garnered substantial interest from investors in recent years, primarily driven by its pivotal role in the EV industry. As an essential component in EV manufacturing, the demand for lithium has outpaced its availability, leading to significant price surges in 2021 and 2022. This surge in demand has been primarily fueled by the rapid expansion of the EV market, with both 2021 and 2022 witnessing a remarkable uptick in the adoption of electric cars.

Investor Presentation

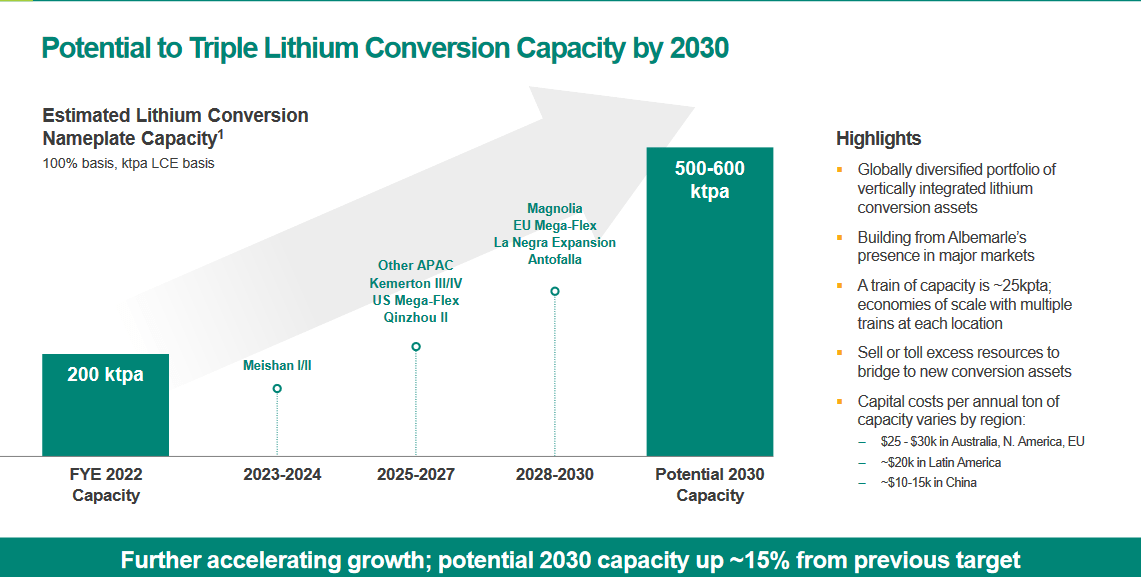

The demand for lithium has been very visible and ALB is aiming to further capitalize on this as they aim to triple the lithium conversion by 2030. Given that some are estimating there to be a shortage of lithium in the coming decades, this switch and acceleration from ALB I think will result in strong earnings growth and shareholder value. What we need to look out for though is favorable prices. If the market for some reason turns softer and prices drop, the incentive to increase production like this quite quickly falls.

Investor Presentation

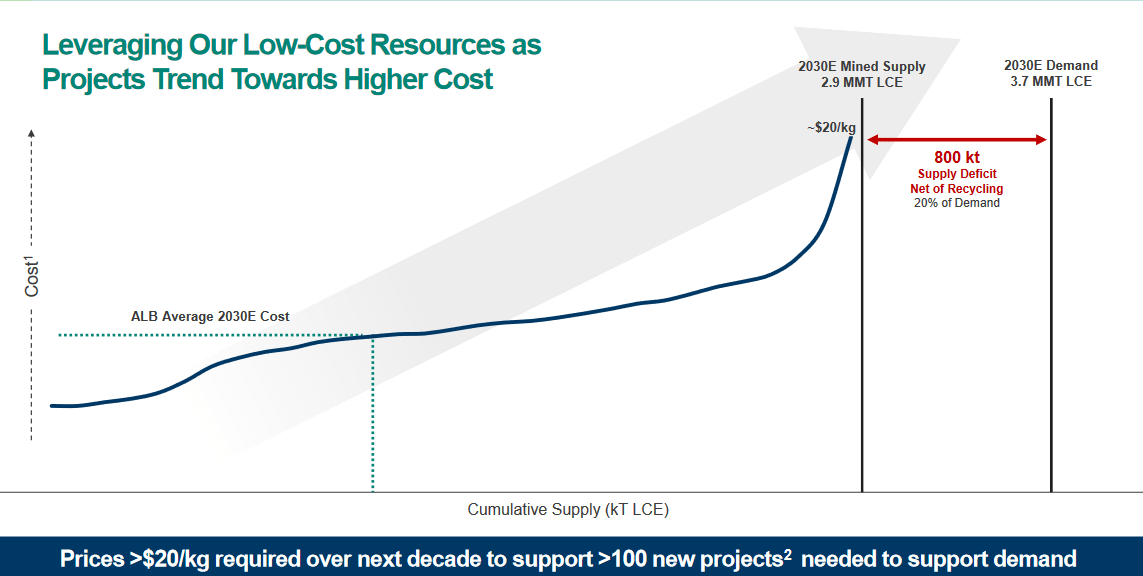

Further strengthening the fact that lithium will see demand is that prices need to be above $20/kg to fund over 100 new projects to ease demand. If the prices remain lower projects won’t begin and that will eventually create an even bigger gap between demand and actual production levels. Eventually, we might see a catalyst for the prices, a little like we saw in 2022 when prices shot up to almost $ 60,000 per tonne.

In quite recent news, Rinehart acquired a significant stake in Liontown, but I don’t think this is going to deter the case that ALB can finalize the deal. There still seems to be a strong conviction that ALB is suitable to acquire Liontown. I think this is short-term noise that doesn’t really affect the deal too much, in my opinion.

Risks

The announcement of Chilean lithium nationalization has significantly impacted ALB stock performance, pushing it to its lowest point starting in April. The Chilean government’s initiative to establish a national company with the potential to assume control of all existing lithium mines once current leases expire has introduced a considerable element of risk. This move has raised concerns in the market and triggered speculation that the government may seek to increase royalties on lithium mining operations.

Investor Presentation

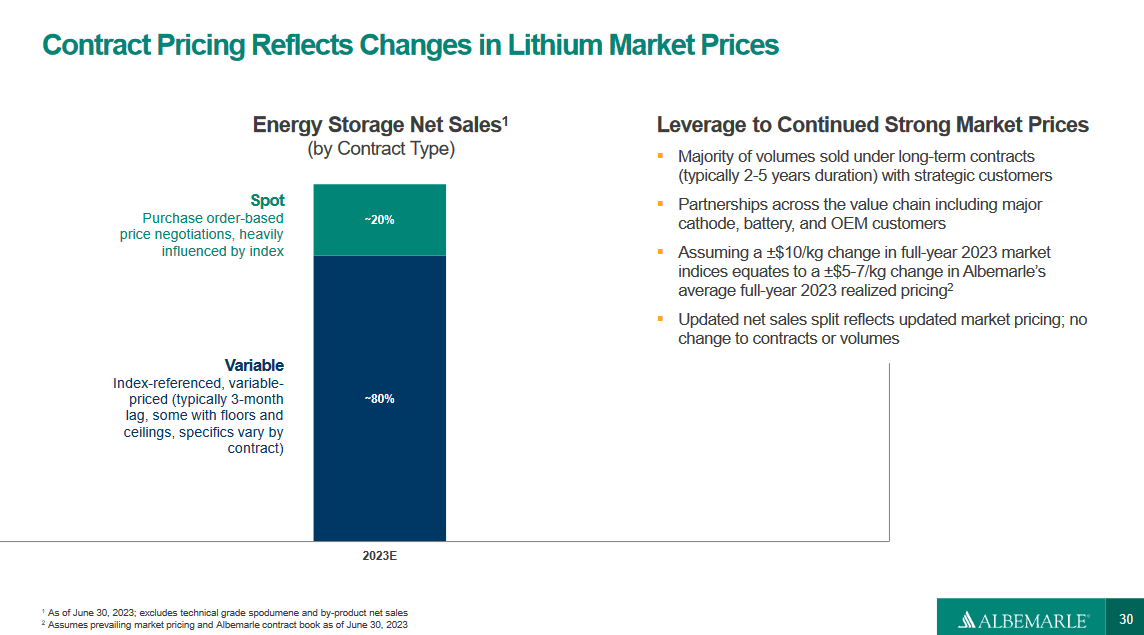

Volatile commodity prices are of course a risk for ALB as it makes the future earnings quite unpredictable. This quite often results in a lower multiple for a company, but I think that what ALB is receiving is too low. Where I can see investors being worried is the inconsistent cash flows over the years. This is making it difficult to see how the dividend may be growing. In my view though, rising lithium prices will improve the cash flows and also the likelihood that the dividend gets a raise in the medium term. It has grown for 28 years straight and I think ALB is in a position still where they can maintain this tradition. With more contracts for ALB, they are securing their revenues and I would expect less volatile earnings reports as a result of this.

Financials

Balance Sheet

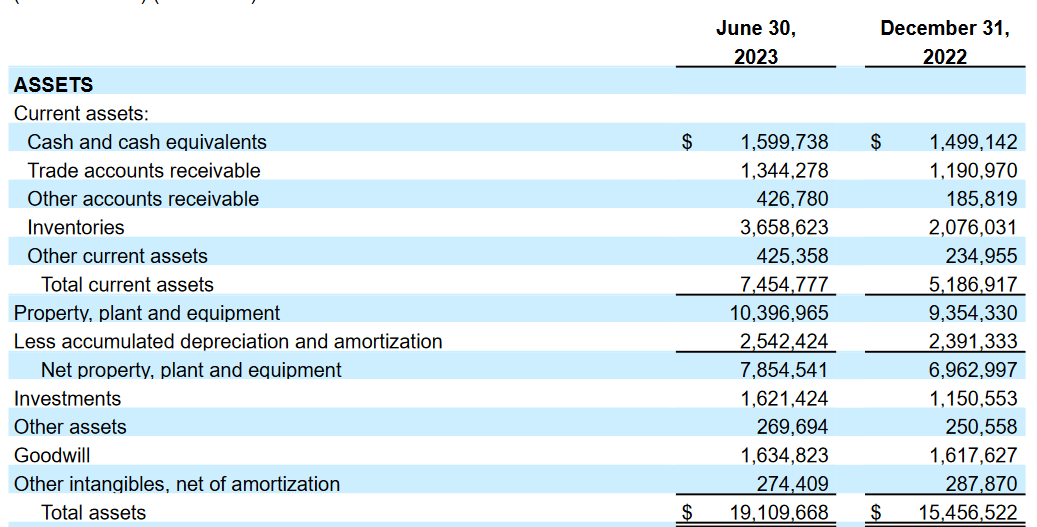

Looking at the asset base for ALB, I think it has managed to make some very solid improvements since December 31, 2022. The total assets have grown by almost $4 billion, a large leap upwards. This has come largely from inventory levels rising in anticipation of stronger prices I think. What I am worried about though is that high inventory levels are going to backfire and ALB will be left to cut production instead and resuming could cause some slightly temporarily higher operating expenses.

Final Words

The lithium market has proven to be very volatile and investing in it brings some inherent risks. However, I think that over the long term, prices will appreciate and ALB will be able to yield even higher earnings. The company is continuing to diversify its portfolio of revenue streams and the acquisition of Liontown is yet another. ALB has shrunk over 30% in the last 12 months in terms of the share price. I think we are finding a bottom here and will be starting to head higher eventually. My view on ALB is a buy right now.

Read the full article here