Our September Cyclical Forum was the first to be held in London, where the economic situation today reflects what’s happening around the world.

The Bank of England (BOE) is nearing the end of a long journey to raise interest rates. This tightening of monetary policy has fueled increased volatility in U.K. financial markets, and there are concerns that the British economy could soon stall or slip into a recession.

Similar scenarios are playing out globally as countries continue their efforts to quell the post-pandemic inflationary spike. Central banks are reaching the end of their tightening cycles on different schedules and with different peak policy rates in sight.

We believe both growth and inflation have peaked. We expect growth across the developed market (DM) economies to slow to varying degrees, and in some cases to contract. This year’s broad-based economic resilience will likely give way to weakness next year as sources of fiscal support diminish and the delayed effects of tighter monetary policy exert a stronger global influence.

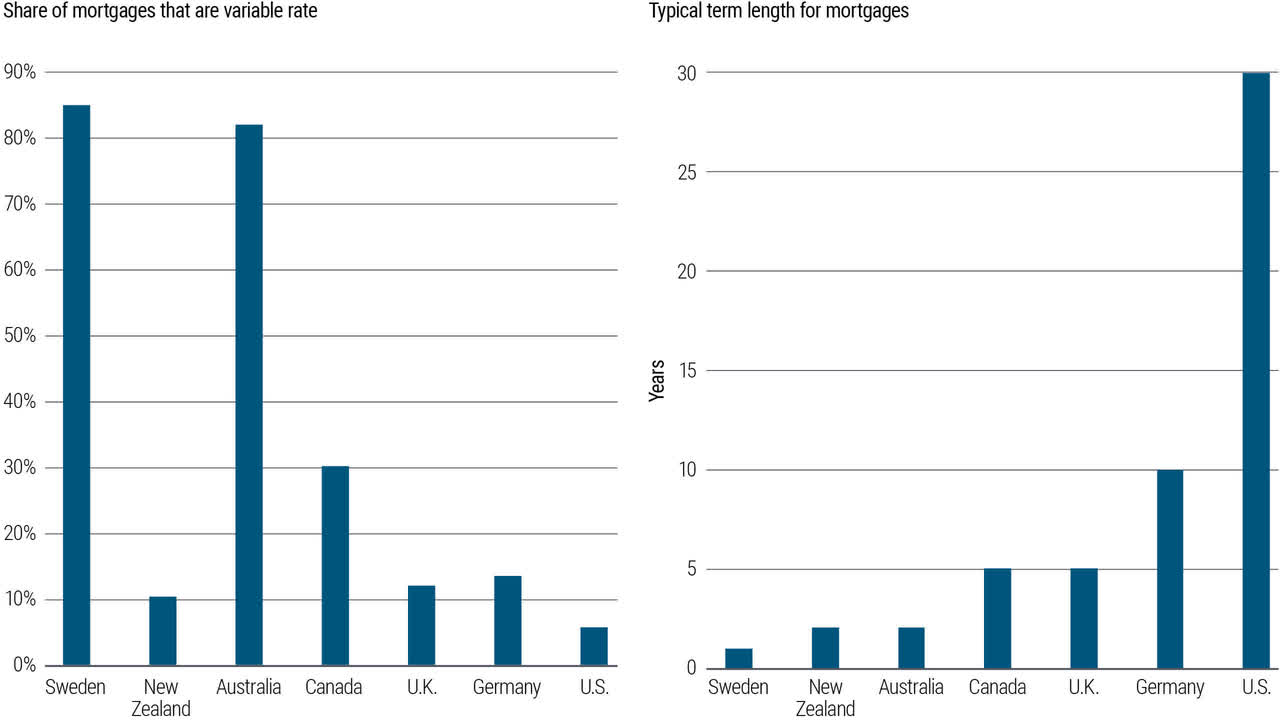

This collective slowdown may also play out differently across countries depending on their sensitivity to changing interest rates. Structural differences in housing markets and mortgage financing will play a role. We arrived at five key economic themes and three investment themes for our 6- to 12-month cyclical horizon, which we discuss in the next sections.

In this environment, we look to emphasize global investment opportunities and diversify our sources of interest rate exposure across debt maturities and countries. At current price levels, riskier assets such as stocks do not price sufficient downside risk for the possibility of a deeper recession, in our view.

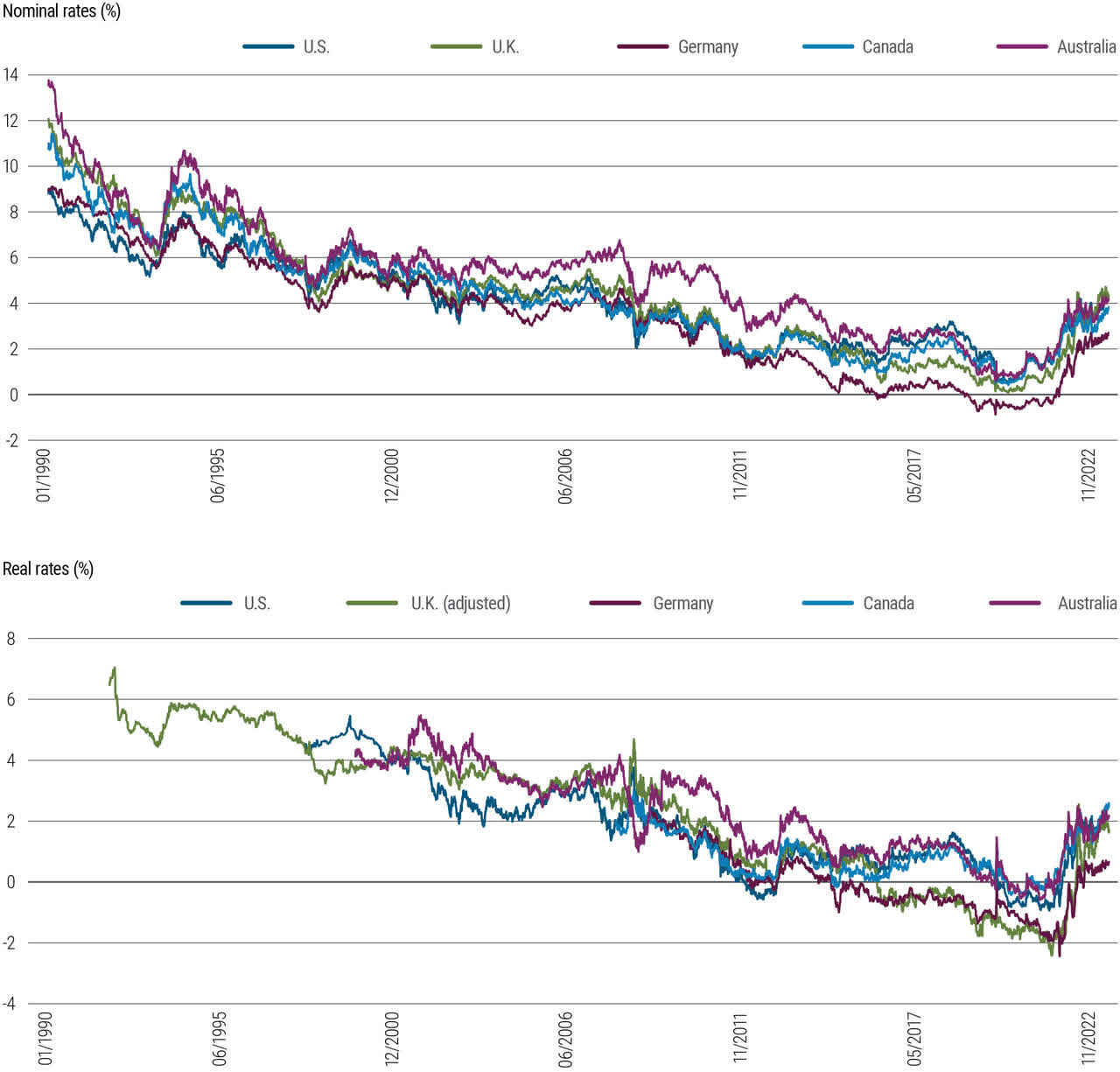

Higher yields – both nominal and inflation-adjusted – than have been seen over the past decade, and cooling inflation makes us more sanguine about the prospects for fixed income. As always, we position portfolios for a broad set of macroeconomic and market outcomes beyond our baseline scenario.

Economic outlook: weakness and divergence ahead

This year marks the 25th anniversary of the opening of PIMCO’s London office. Today, the U.K. is the second-largest asset management center in the world and home to PIMCO’s second-largest trade floor, underscoring the importance of our international client base. London is our headquarters for the Europe, Middle East, and Africa (EMEA) region, which has grown to include eight offices.

Hosting the Cyclical Forum outside of the U.S. for the first time advanced some key objectives of our forum process, such as fostering a global mindset and challenging our own assumptions and biases.

A year ago, the U.K. liability-driven investment (LDI) market faced a crisis that started when the British government proposed unfunded spending increases. That led to a sell-off in U.K. sovereign bonds, known as gilts, and caused the British pound to tumble.

In our June 2023 Secular Outlook, “The Aftershock Economy,” we said the LDI crisis could be a canary in the coal mine for long-term fiscal issues globally. This is particularly relevant now, as governments worldwide grapple with growing debt burdens. That includes the U.S., the world’s largest issuer of sovereign bonds, which in August was stripped of its AAA credit rating by Fitch. During our forum, we were fortunate to have Sir Charles Bean, the former deputy governor for monetary policy at the BOE, as a guest speaker as we discussed these and other issues.

While the location helped shine a brighter spotlight on markets outside of the U.S., we used our Cyclical Forum as we always do: to discuss the latest opportunities and risks across the economic and investment landscape and to develop a 6- to 12-month outlook. We emerged with five key economic themes.

1) Resilience and fiscal support to fade as monetary drag kicks in

Milton Friedman said monetary policy acts with “long and variable lags.” We think the same can also be said of fiscal policy. Economic resilience this year owed much to fiscal support, with the U.S. deficit widening and with households having ample savings from pandemic-related stimulus.

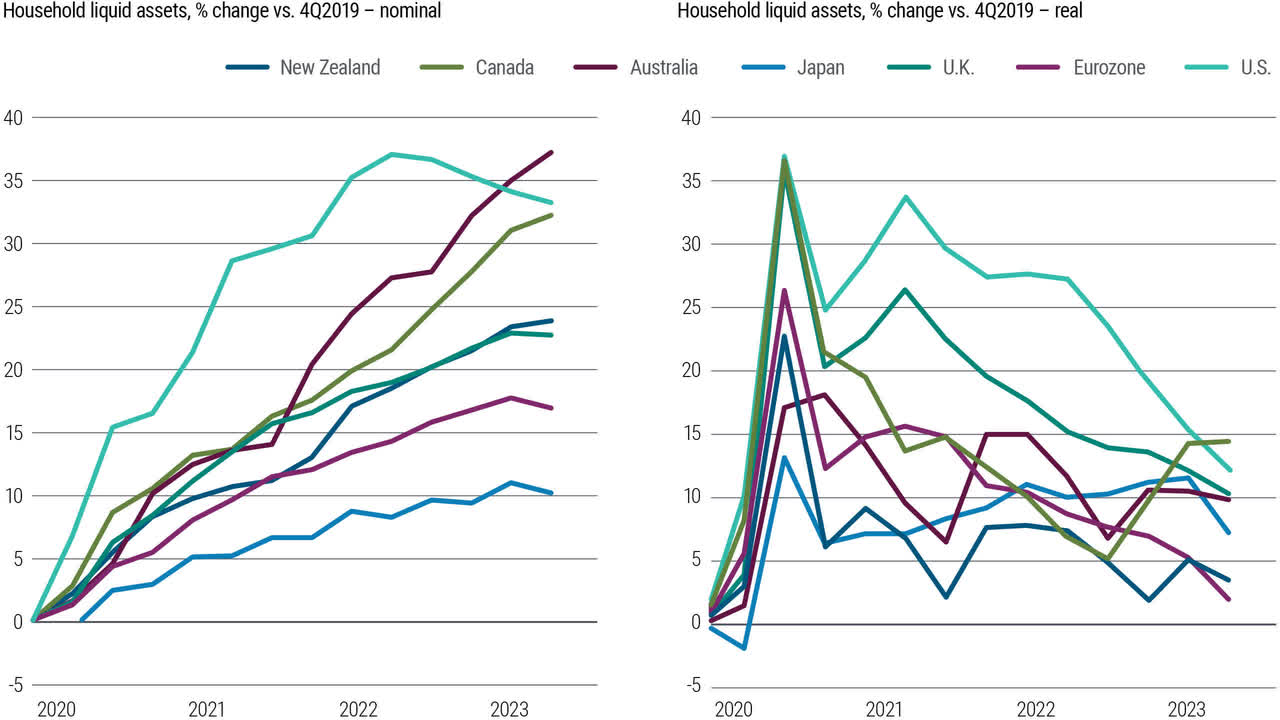

This support looks set to diminish. U.S. fiscal policy will turn contractionary, while recent elevated inflation erodes the real value of wealth, including the excess savings accumulated as a result of government payments to households during the pandemic. Our analysis suggests that household liquid assets built up during the pandemic (see Figure 1) will likely deplete in real terms over our cyclical horizon.

Figure 1: Household liquid assets across DM economies look set to diminish in real terms following post-pandemic peaks

Household liquid assets are defined as currency, deposits, and money market funds held by households.

Source: PIMCO, OECD, national statistical offices, and central banks as of 11 September 2023.

As fiscal support fades, the drag from tighter monetary policy will intensify. As we noted in our Secular Outlook, any future fiscal support may also be constrained due to high debt levels and the role of post-pandemic stimulus in fueling inflation.

Granted, there are factors that could weaken the impact of monetary policy this time. The private sector holds substantial cash that is earning high interest rates. This is also the first major tightening cycle in which central banks are paying interest on reserves.

An inverted yield curve, with short-term debt yielding more than long-term bonds, benefits net interest income for households, which tend to have short-duration assets and long liabilities.

Additionally, households and businesses have extended the maturity of their debts, resulting in a more gradual pass-through of rising interest rates. Central banks’ significant purchases of fixed-income assets mean that governments are also absorbing a larger share of recent bond price losses.

Still, we believe economic weakness is coming. We expect unemployment to rise next year, leading to a normalization of central bank rates back toward neutral levels.

2) Growth and inflation have peaked

The global economy, led by the U.S., has shown remarkable resilience despite one of the most rapid tightening cycles in modern history, raising questions about the effectiveness of monetary policy.

We discussed whether monetary policy lags might be longer as a result of the pandemic and the related policy response, or whether more tightening is needed, perhaps because the neutral real long-run policy rate has risen. (That neutral rate, or r*, is the estimated interest rate that over time is consistent with the economy operating at capacity and target inflation.)

Our view is that it is mostly a lag. We believe growth has peaked. We expect resilience to turn into weakness as growth slows later this year and into 2024.

Fiscal headwinds – especially in the U.S. – will soon come into play. We think that monetary policy is still working, as evident in a clear slowing in credit growth and a meaningful tightening in bank lending standards.

We expect resilience to give way to weakness as global growth slows later this year and into 2024.

We believe inflation has peaked as well. In most DM economies, both headline and core inflation have decreased from their highs, albeit at different rates. Sticky wage inflation is likely to support core inflation longer unless there is some weakness in the labor market. We forecast core inflation in the 2.5%-3% area in the U.S. and Europe at the end of 2024. We anticipate that falling growth and rising unemployment will lead to more disinflation, helped also by other factors (for more, please see our Viewpoint, “Fiscal Arithmetic and the Global Inflation Outlook”).

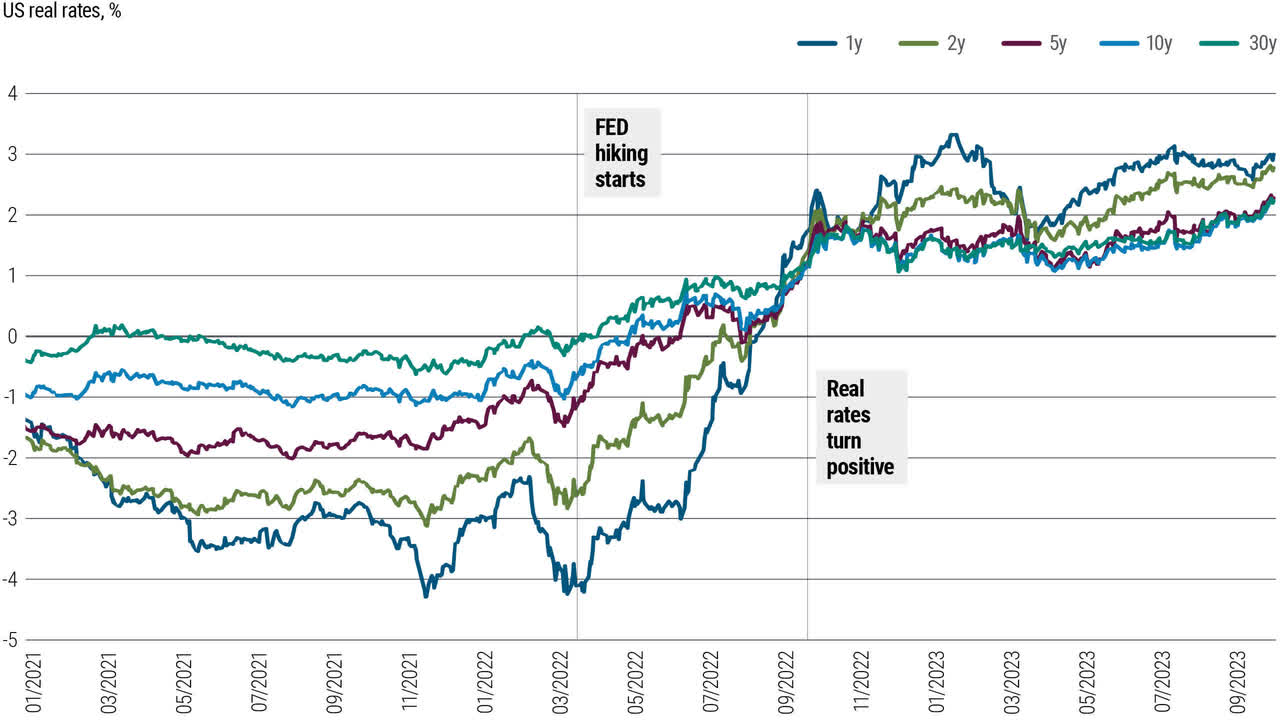

Figure 2: U.S. real rates have been above zero only since late 2022

PIMCO, Bloomberg as of 29 September 2023

3) A soft landing would be an anomaly

It’s worth noting the historical rarity of central banks achieving a soft landing – or avoiding a recession – when inflation is high at the start of a cycle.

We analyzed 140 tightening cycles across developed markets from the 1960s through today. When central banks hiked policy rates by 400 basis points (bps) or more – as several have done this cycle, including the U.S. Federal Reserve (Fed), the European Central Bank (ECB), and the BOE – almost all such instances ended in recession.

Notably, better economic outcomes in the face of past hiking cycles were often associated with supply expansion. The post-pandemic supply-chain normalization could help here, as well as a possible AI-fueled productivity boom. However, it’s yet to be seen how much these factors contribute to boosting productivity over our cyclical horizon.

Healthy starting conditions for household and corporate balance sheets, as well as proactive financial stability policies – think of the BOE’s intervention in the LDI crisis, or the U.S. Federal Deposit Insurance Corporation quickly extending bank guarantees under exceptional circumstances earlier this year – could be another source of assistance. These policies have so far successfully thwarted a recession.

However, history suggests that tight financial conditions create a high risk of financial market accidents, and there are areas of vulnerability within markets, such as in private credit, commercial real estate, and bank loans.

There are also risks related to China. The country’s recovery has been weaker than expected, weighed down by the property market. Housing investment, which had been expected to stabilize, is down 7.5% year-over-year as of August, according to China’s National Bureau of Statistics.

More stimulus is likely needed to stabilize China’s property sector and the economy more broadly. There are risks if the stimulus is insufficient or too slow to arrive. In a downside scenario, growth could further decelerate in 2024 (to 3%, versus our current baseline of 4.4%). This would suppress China’s demand for global goods and services, weighing on the global economy.

The government still has the capacity and tools to avoid such a downside scenario. We expect continued policy easing to support growth.

More fiscal supports, including a wider central government deficit and higher local government special bond issuance, could help lift domestic demand via infrastructure capital spending or tax cuts. We believe further reduction to China’s policy rate, currently at 2.65%, is likely. The government has recently called for more countercyclical macro policies to prevent the economy from sharp deceleration.

4) Recession risk appears to be higher than markets are pricing

Our baseline implies growth underperforming and inflation falling. Markets, and risk assets in particular, appear to be priced for an “immaculate disinflation” scenario, in which growth remains solid and core inflation drifts toward central bank targets fairly swiftly. We think such pricing may reflect complacency.

We see growth in DM economies falling to varying degrees in coming quarters, with the most interest rate sensitive faring the worst. Europe and the U.K. also look vulnerable due to trade links with China and the lingering effects of the energy shock on terms of trade and investment. U.S. growth also looks set to slow, hovering between stagnation and mild recession.

We see unemployment rates rising by more than both consensus and central banks anticipate – by about one percentage point in the U.S. and just shy of that in Europe.

5) Monetary paths set to diverge

The extent of this expected slowdown remains uncertain and will vary across economies.

The relatively gradual decline in inflation means that central banks are unlikely to come to the rescue quickly to revive growth. Major central banks – including the Fed, the ECB, and the BOE – are at or very near the end of their tightening cycles, in our view, but will likely proceed cautiously with rate cuts given their mandates to control inflation.

We see plenty of room for monetary policy divergence. More rate-sensitive economies such as Australia, New Zealand, and Canada, which have generally higher household debt and a higher share of variable-rate mortgages (see Figure 3), may get hit harder. We see potential there for faster rate normalization than what market pricing suggests.

Figure 3: Mortgage structure can vary greatly across countries

Sources for variable rate shares: Australian Bureau of Statistics, Bank of Canada, Bank of England, European Central Bank, U.S. Federal Housing Finance Agency, Reserve Bank of New Zealand as of August 2023 (U.K., New Zealand), as of July 2023 (Sweden, Australia, Canada, Germany), and as of June 2023 (U.S.). Sources for most common term length: Reserve Bank of Australia (RBA), European Commission, Fitch Ratings, Morgan Stanley Research as of September 2023.

Elsewhere, we see the People’s Bank of China (PBOC) continuing to cut its policy rate, albeit only modestly. We see the Bank of Japan (BOJ) bucking the trend and raising its policy rate next year given a higher inflation trend compared with the past.

In emerging markets (EM), we see scope for a great deal of differentiation, with the more orthodox group of central banks, such as those in Brazil and Mexico, that hiked early (in many cases ahead of the Fed) able to ease policy relatively quickly. We see several other central banks, such as those in Poland and Turkey, being more constrained.

Investment implications: strong prospects for bonds across scenarios

Our baseline scenario sees inflation continuing to decline toward central bank targets, even as wage pressures take longer to cool.

While this is our baseline, we consider the relative risks under alternative scenarios when formulating investment conclusions, and we remain vigilant about building portfolios to mitigate against both upside and downside surprises. These other scenarios range from a “hard landing” (where growth and inflation fall quickly) to “further overheating” (where growth remains firm and inflation reaccelerates).

We see three key investment themes:

1) The outlook for fixed income looks compelling given starting yields and the economic outlook

We believe growth and inflation have peaked, and we see greater recession risk than markets are pricing in, which supports a positive outlook for fixed-income returns. After their recent rise, starting yield levels, which are historically strongly correlated with returns, are extremely attractive, with both real and nominal yields at levels not seen for a decade or more (see Figure 4).

Figure 4: Nominal and real 10-year rates across DM jurisdictions

Source: PIMCO, Bloomberg as of 2 October 2023. U.K. real rates adjusted to be shown on a CPI basis. All rates are for 10-year sovereigns.

High-quality bond funds today yield about 5%-8%. This looks very attractive versus expected equity returns and offers downside protection in the event of a recession. At today’s elevated yields, bonds look attractive even if inflation were only to decline toward the upper end of our forecasts, and these yields can provide investors with much more cushion against uncertainty.

We also expect bonds and equities to resume their more typical inverse correlation – in which bonds perform well when equities struggle, and vice versa – as inflation returns closer to central bank targets over the next year.

Higher inflation uncertainty and concerns over government debt, such as the U.K. LDI episode and Fitch’s 1 August 2023 downgrade of the U.S. credit rating, should help reestablish proper term premiums (a gauge of compensation for holding longer-term debt compared with shorter-term debt) across DM. As an example, the New York Fed’s measure of the U.S. Treasury 10-year term premium rose to a positive level last month for the first time in more than two years.

Our assessment is that r* will remain anchored at similar levels to those that prevailed before the pandemic. That would tend to anchor fixed income returns and, combined with higher term premiums, over time should lead to re-steepening of yield curves.

2) We emphasize the global opportunity set and diversified sources of bond risk and return

The impact of monetary policy, fiscal policy, and depletion of excess savings will play out at different speeds among countries. There will be different local impacts of energy prices, the Russia-Ukraine war, and exposure to China. We therefore expect greater differentiation in terms of returns from high-quality fixed-income investments across countries.

Global fixed-income yields are very attractive today and already look high relative to the levels we expect to prevail over the cyclical horizon and beyond. We expect to maintain overweight duration positions and to increase those with any further rise in yields.

The U.S. has led the rise in global yields in recent weeks, and U.S. duration – a gauge of a bond’s sensitivity to interest rate movements – in itself offers the potential for an attractive return. We also see very good opportunities in other regions – such as Australia, Canada, Europe, and the U.K. – given different interest rate sensitivity and different paths for quantitative tightening, or the running off of bond holdings from central bank balance sheets.

We see the potential for different timing in the rate-cutting cycle, with central banks setting different thresholds for tightening given inflation and labor market dynamics.

Historically, global diversification has contributed to higher risk-adjusted returns in fixed income.

After decades of sluggish growth and inflation, the BOJ is still in the phase of exiting its yield curve control (YCC) policy, and will likely raise rates as other central banks are cutting them. We see the potential for Japanese yields to move higher.

We see broad benefits to diversifying positions in duration and yield curve positioning, which can help investors target higher risk-adjusted returns. Historically, global diversification has led to higher returns per unit of volatility. This is especially important in the current environment, given the divergence in expected returns and the range of risks around the baseline.

3) We need to position for a broad set of macro and market outcomes

We recognize and monitor the range of risks around our baseline outlook, and we need to manage portfolios accordingly. That means maintaining flexibility and liquidity, while also emphasizing relative value across investment opportunities. Overall, we believe it is still a very good environment for high-quality bonds.

In today’s climate, cash can be attractive, with short-term yields high relative to history and the flexibility to reinvest as other opportunities arise. But that flexibility comes with risks: Cash yields are fleeting.

We believe that longer-duration bonds provide greater resilience in portfolios, offering attractive yields today, which can be locked in over a longer time horizon, and the potential benefit of price appreciation in a recession. We think risks are becoming more symmetrical between high inflation and downside growth scenarios, while bond yields and valuations have become increasingly appealing. Given risks to our baseline, inflation-linked bonds could bolster a portfolio’s resilience to higher-than-expected inflation.

We maintain a cautious stance on corporate credit, given recession risks, and an up-in-quality bias across the board. A focus on individual sectors can help mitigate broader economic uncertainties (for more, see our recent Viewpoint, “Navigating Credit Markets Today: A Q&A With Mark Kiesel and Jamie Weinstein”).

We remain concerned about lower-quality, floating-rate corporate credit assets, such as bank loans and some legacy private credit assets, where we are already beginning to see strain from higher rates.

In many of our strategies, we will look to emphasize U.S. agency mortgage-backed securities (MBS), given their high quality, government backing, robust liquidity, and attractive valuation. Within credit, we also broadly favor securitized investments and structured credit.

Elevated interest rates, challenged bank balance sheets, and regulatory pressures are creating attractive opportunities in consumer and non-consumer private lending. We see a strong backdrop for opportunistic private investing in corporate credit and real estate.

We see diversification benefits to investing in select EM countries given their progress on disinflation and current levels of real rates. Similar to DM, we expect EM disinflation to occur at varying speeds. Some EM central banks with high real rates and declining inflation have already started easing policy, and inflation has come down faster in many EM countries relative to DM.

As a result, the economic backdrop within many EM countries has already turned supportive of growth, asset prices, and currency appreciation. That said, EM growth may still face challenges in 2024 as Chinese growth remains lackluster and the impact of tighter global monetary policy feeds through.

After its recent strength, we are broadly neutral on the U.S. dollar, with a focus on carry-in foreign exchange trades.

Disclosures

All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Mortgage- and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and while generally supported by a government, government-agency or private guarantor, there is no assurance that the guarantor will meet its obligations. References to Agency and non-agency mortgage-backed securities refer to mortgages issued in the United States. U.S. agency mortgage-backed securities issued by Ginnie Mae (GNMA) are backed by the full faith and credit of the United States government. Securities issued by Freddie Mac (FHLMC) and Fannie Mae (FNMA) provide an agency guarantee of timely repayment of principal and interest but are not backed by the full faith and credit of the U.S. government. Private credit involves an investment in non-publically traded securities which may be subject to illiquidity risk. Portfolios that invest in private credit may be leveraged and may engage in speculative investment practices that increase the risk of investment loss. The value of real estate and portfolios that invest in real estate may fluctuate due to: losses from casualty or condemnation. Derivatives may involve certain costs and risks, such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. The credit quality of a particular security or group of securities does not ensure the stability or safety of an overall portfolio. Diversification does not ensure against loss.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be interpreted as investment advice, as an offer or solicitation, nor as the purchase or sale of any financial instrument. Forecasts and estimates have certain inherent limitations, and unlike an actual performance record, do not reflect actual trading, liquidity constraints, fees, and/or other costs. In addition, references to future results should not be construed as an estimate or promise of results that a client portfolio may achieve.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision. Outlook and strategies are subject to change without notice.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023, PIMCO.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here