Summary

I am recommending a buy rating for Live Nation (NYSE:LYV), as I believe it has a strong competitive advantage that is difficult for a second player to replicate easily. Moreover, LYV is set to continue growing larger and stronger as it gets bigger. This flywheel effect enables LYV to continue growing in line with the industry, which should continue to support the valuation premium compared to peers.

Business

LYV is a global leader in live entertainment, ticketing, and talent management services. And it is supported by a management team focused on and compensated for the continued monetization of artist, tour, and venue content. They have a vertically integrated business model and cover all aspects of the live music production process, from booking an artist to selling tickets and maintaining fan websites. It has the #1 market share in almost every business line.

Financials / Valuation

Based on author’s own math Based on author’s own math

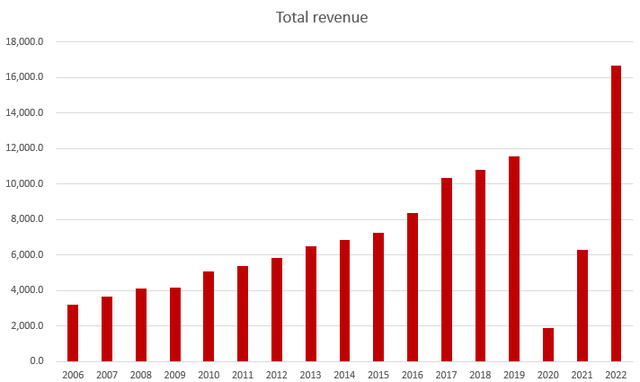

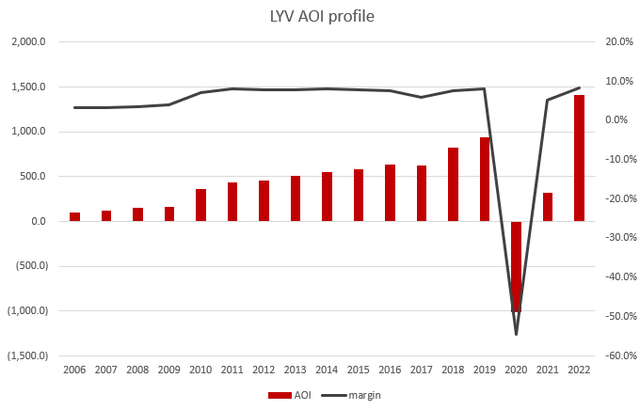

LYV has demonstrated solid performance throughout the last decade, growing in line with the industry at an 8% CAGR. The notable part of the last few years was the rebound in revenue post-COVID period, which is indicative of the structural demand for live events. One of the favorable characteristics of LYV is that management is on point with regards to profitability. Measured as adjusted operating income, we can see that AOI has grown accordingly, with margins being stable in the 10% range. The latest quarter’s results continued to be positive. LYV had a total revenue of $5.6 billion and an AOI of $590 million. With the strong results, management reiterated its outlook for a record 2023. The underlying data provided was what led me to become more positive. Ticket sales to Live Nation events are up 20% year-to-date, and event-related deferred revenue of $4.3B is up 37% from 2Q22, according to the company’s management. Additionally, Live Nation’s sponsorship and advertising book is 90% committed, and fee-bearing gross transaction value is up 25% to $8.7 billion in 2Q23. The results of 2Q23 and these data, in my opinion, corroborate my bullish view that interest in attending live events is robust despite the prevalence of covid. With a growing TAM for live events and solid execution against its flywheel (discussed below), LYV is clearly well positioned for continued strong growth.

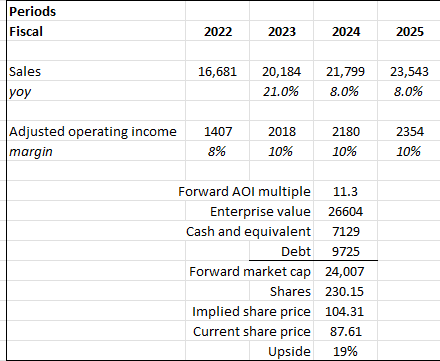

Based on author’s own math

Based on my view of the business, LYV should see growth realign back to the industry growth rate (8%) after the strong FY23. I modeled 21% for FY23 by assuming the growth rate will continue to decelerate in 3 and 4Q23 to 8% from 27% in 2Q23. Adjusted operating income should have no issues reverting back to 10%, just like how the margin has trended historically. In my model, I believed LYV would still continue to stay premium to peers as it is the market leader with a very strong competitive position (remember that scale matters a lot in LYV’s industry, and LYV is almost 10x the size of the 2nd player, CTS). At 11.3x forward adjusted operating income, LYV enterprise value is worth $26.6 billion, which translates to a share price of $104 (19% upside).

Comments

I expect LYV to continue exerting dominance in the industry and growing strongly.

For starters, LYV is effectively a one-stop shop for artists, as the artist will have access to millions of concertgoers, a database of more than 100 owned and operated venues, merchandising services, and fan website management. Its value proposition to venues is that it brings to the table their extensive database of concertgoers, the best content, and the security and reliability of Ticketmaster. Security and reliability are important, as no concertgoers want to be scammed or face issues with their tickets (especially for popular celebrities, whose tickets are hard to get).

Scale is extremely important in the industry; without scale and ancillary revenue streams, upstart promoters could face severe financial difficulties with only a small number of failed shows (precedent to the 2016 bankruptcy of SFX Ent). Specifically, LYV scale and dominance in concert promotion allow the company to earn high margin dollars in ticketing and sponsorship, which allow it to bid on or acquire the most shows, creating a “flywheel” effect. In simpler terms, given LYV bidding power and venue locations, it is in the position to book the most acts, which gives it leverage with venues and marketers, and so farming a virtuous cycle: LYV wins bid -> more location -> leverage -> venue use LYV -> repeats. Also notably, given the LYV scale, it has a lot of negotiating power against venue operators that are not owned by them. Those that do not use LYV exclusively face the risk that LYV uses another venue for the concert; hence, LYV is in a better position to negotiate the terms.

LYV

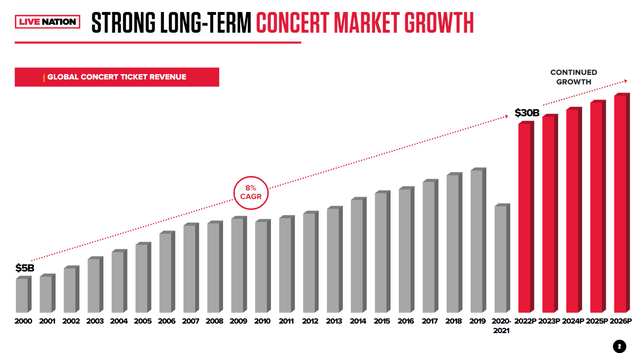

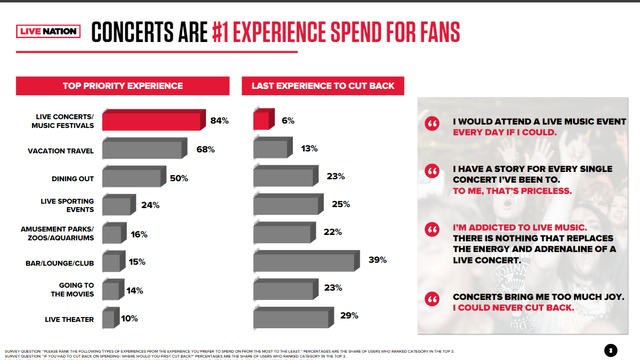

The more important point to note is that the larger LYV gets, the stronger it becomes, which puts it in a much more favorable position to capture the growing global concert business of TAM. To put things into perspective, the global concert business TAM has grown at 8% for the past 2 decades, and I expect the industry to continue flourishing as domestic demand should persist, driven by an increasing desire for live entertainment among millennials. International demand for concerts should see an increase from rising incomes, improved venue infrastructure, and greater familiarity with artists (due to social media and YouTube). For international penetration, the typical expansion path is via a JV or acquisition, which I believe is the right strategy as it speeds up the time to market and reduces the uncertainty of building an entire new brand.

LYV

Another positive benefit of scale is that LYV scale gives it an unmatched platform from both a reach and capability standpoint for attracting high-margin ad dollars from marketers looking to gain exposure to live music. LYV’s wide array of festivals and shows, as well as its knowledge of its fan base (supported by Ticketmaster’s millions of consumer databases), allow it to structure unique and engaging content for advertisers.

Risk & conclusion

Concert, sports, and family event ticket sales could suffer from an extended economic downturn like the one experienced in 2009–10. Live Nation is vulnerable to sharp declines in attendance before shows because it guarantees artists’ incomes up to several months in advance.

In summary, I recommend a buy rating for LYV due to its robust competitive advantage and strong growth potential. LYV’s vertically integrated business model and dominant market share across various business lines in live entertainment, ticketing, and talent management make it difficult for competitors to replicate. The company has consistently demonstrated solid financial performance, even rebounding post-COVID, emphasizing the sustained demand for live events. Notably, LYV’s focus on profitability and the strong results from the latest quarter support a positive outlook. With a growing TAM for live events and a competitive position bolstered by its large scale, LYV is well-positioned for continued growth.

Read the full article here