September in review

- Gold lost 3.7% in September, with the bulk of the move occurring during the last three days of the month

- We attribute gold’s challenging month to an extensive run up in bond yields alongside a stronger dollar. The sell off at the end of the month was also likely the result of a strong adverse reaction to US economic data, a fall in the Chinese local premium and a negative technical breach.

Looking forward

- With bond yields continuing to move higher alongside a still buoyant US economy, gold is likely to face continued turbulence over the next few weeks

- But we don’t see a material downtrend being established as support remains from fragile equities, rising recession risk, inflation volatility and continued central bank interest in gold. This could represent a buying opportunity to some investors should the market become excessively short.

End-of-month woes

The gold price oscillated between US$1,900 and US$1,950 for most of September until a sharp dip on the 27th took the price to US$1,871 finish and a 3.7% m/m loss. A strong US dollar during the month led to more modest m/m drops in EUR, JPY and GBP (Table 1).

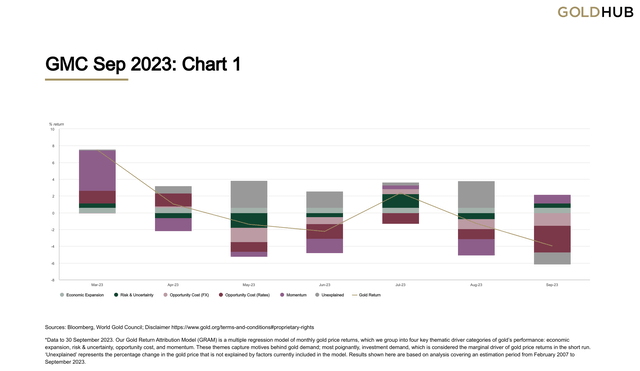

Our gold model GRAM suggests that gold’s downdraft was largely the result of higher opportunity costs, as the US 10-year yield gained almost 50bps during the month. US dollar strength, with a 2.5% rise in the DXY index also contributed. On a weekly frequency (not shown here), our GRAM model suggests that opportunity cost was insufficiently strong to explain the late-month price drop. In our view the following factors were at play: an overreaction to strong US Capital and Durable Goods data released on 27th September;1 A large drop in the China domestic gold price premium. And we can’t rule out technical triggering of limit orders as gold broke through US$1,900 and saw its 50-day moving average cross the 200-day moving average – sometimes viewed as a trend change signal (Chart 1).

Global gold ETFs saw further outflows in September to the tune of US$3bn(-59t), balanced between North American and European funds, while COMEX gold futures managed money net longs shed US$4bn(70t).

Chart 1: Gold pressured lower in September by soaring rates and a stronger US dollar*

Sources: Bloomberg, World Gold Council; Disclaimer

*Data to 30 September 2023. Our Gold Return Attribution Model (GRAM) is a multiple regression model of monthly gold price returns, which we group into four key thematic driver categories of gold’s performance: economic expansion, risk & uncertainty, opportunity cost, and momentum. These themes capture motives behind gold demand; most poignantly, investment demand, which is considered the marginal driver of gold price returns in the short run. ‘Unexplained’ represents the percentage change in the gold price that is not explained by factors currently included in the model. Results shown here are based on analysis covering an estimation period from February 2007 to September 2023.

Table 1: Gold prices were down across the board, but helped by FX weakness in Europe, Japan and the UK

Gold price and return in different periods across key currencies*

| USD (oz) | EUR (oz) | JPY (g) | GBP (oz) | CAD (oz) | CHF (oz) | INR (10g) | RMB (g) | TRY (oz) | AUD (oz) | |

| 30 Sep 2023 Price | 1,871 | 1,769 | 8,983 | 1,533 | 2,540 | 1,712 | 49,939 | 439 | 51,293 | 2,907 |

| September return | -3.7% | -1.3% | -1.1% | 0.0% | -3.5% | -0.2% | -3.4% | -3.2% | -1.0% | -3.2% |

| Y-T-D Return | 3.1% | 4.4% | 17.5% | 2.1% | 3.3% | 2.1% | 3.5% | 9.1% | 51.2% | 9.2% |

*Data to 30 September 2023. Based on the LBMA Gold Price PM in local currencies

Source: Bloomberg, ICE Benchmark Administration, World Gold Council

Looking ahead

- Bond yields continue to rage higher, as central banks, led by the Fed, are defiantly resisting a pivot in the near future, and higher supply chases reluctant demand.

- At the same time, underlying economic conditions remain buoyant, so a soft landing is still the consensus outcome.

- The cocktail of economic resilience and rising yields is likely to bring continued turbulence to gold.

- Yet, in our view, gold is more likely to experience choppiness than material weakness as support from a number of factors remains, including a poor risk reward for equities, rising recession risk over the next 6-12 months, inflation volatility and central bank buying.

- Opportunity in gold from a short squeeze will continue to present itself from COMEX short positions at levels not seen since March 2023 and persistent ETF outflows.

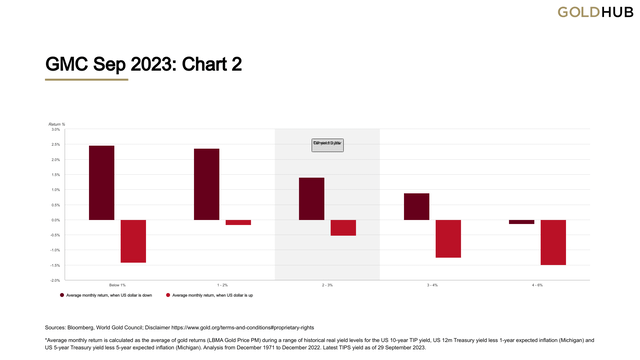

Yields, led by US Treasuries, are on the march. The US 10-year TIPS yield, historically closely linked to gold, has breached 2.3% for the first time in 15 years.2 This is territory that, combined with a rising US dollar3, has previously proven to be challenging for gold (Chart 2).

Chart 2: Real yields might be starting to bite*

Sources: Bloomberg, World Gold Council; Disclaimer

*Average monthly return is calculated as the average of gold returns (LBMA Gold Price PM) during a range of historical real yield levels for the US 10-year TIP yield, US 12m Treasury yield less 1-year expected inflation (Michigan) and US 5-year Treasury yield less 5-year expected inflation (Michigan). Analysis from December 1971 to December 2022. Latest TIPS yield as of 29 September 2023.

Figure 1: A supply glut has helped push Treasury yields higher, alongside hawkish policy statements

Source: Vanda Research

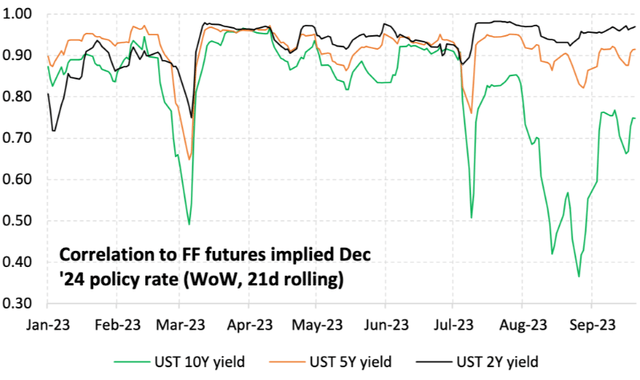

21-day rolling correlation between Fed Funds futures for Dec 2024 and US Treasury yields.

While August’s run-up in yields was probably driven as much by supply and demand as fundamentals, monetary policy is likely back in the driving seat and has been steadfastly hawkish over the past few weeks (Figure 1).

A double-edged sword

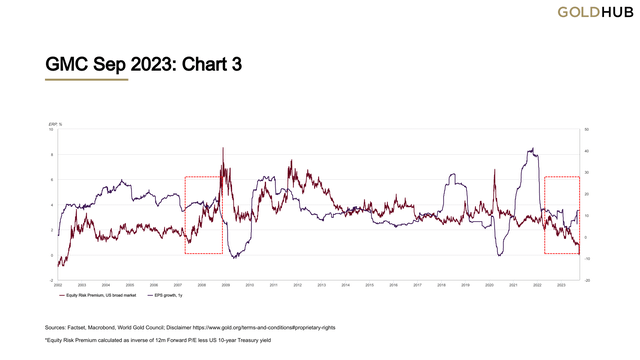

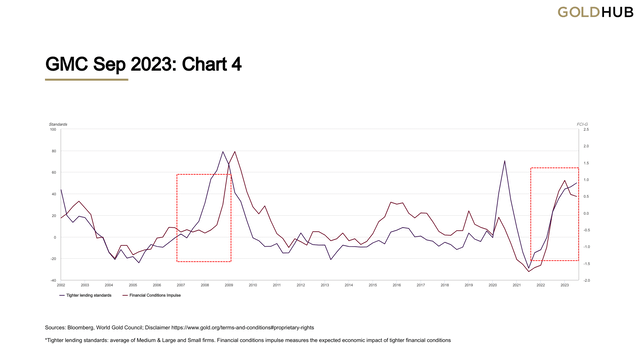

But gold is not the only casualty of soaring bond yields. Higher yields are depressing the equity risk premium and with rosy earnings growth forecasts (Chart 3) it is a set-up reminiscent of late 2007. Yields are also further constricting financial conditions, which on some measures are also similar to 2007 (Chart 4). This in turn could exacerbate recession risk over the next 6-12 months.

Chart 3: Equities continue to look fragile with a set up reminiscent of late 2007*

Sources: FactSet, Macrobond, World Gold Council; Disclaimer

*Equity Risk Premium calculated as inverse of 12m Forward P/E less US 10-year Treasury yield

Chart 4: Financial conditions at worrying levels*

Sources: Bloomberg, World Gold Council; Disclaimer

*Tighter lending standards: average of Medium & Large and Small firms. Financial conditions impulse, measures the expected economic impact of tighter financial conditions

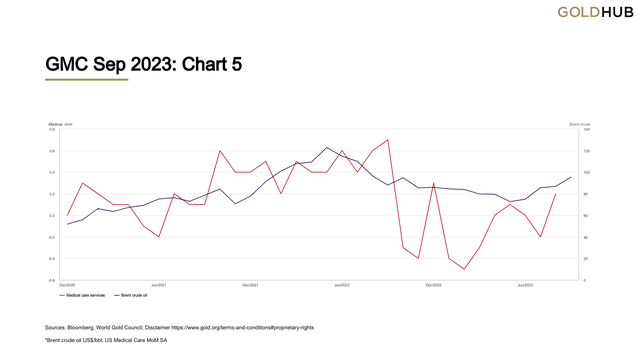

Higher yields are also likely reflective of inflation volatility. The inflation trend may be down, but is likely to be bumpy. In the US there are some things to watch:

- Alongside headline CPI, alternative measures of inflation climbed in August4

- Used car prices ticked up again and prolonged strikes by the auto workers union is a concern5

- Medical care services costs ticked up after falling almost every month for a year and are expected to rise again6

- Oil prices climbed towards US$100/bbl and look susceptible to a geopolitically motivated stand-off. Supply issues remain while demand is running at 2% higher than the pre-COVID level.7

High inflation is painful but so is inflation volatility. It is both an economic concern and, historically, troublesome for equities.

Chart 5: Tick up in oil and medical care prices a concern*

Sources: Bloomberg, World Gold Council; Disclaimer

*Brent crude oil US$/bbl, US Medical Care MoM SA

In summary..

Gold is likely to face some choppiness over the next few weeks as rising real yields, a firmer US dollar and a buoyant economy batter some sectors of investment demand. But longer-term concerns and continued central bank buying should, in our view, ensure that this turbulence doesn’t establish a more material downtrend.

As such, this could present potential gold buying opportunities for some investors. Historically, gold has tended to mean revert in instances when the market (futures positioning) becomes excessively short.

1US capital goods for August: +0.9% vs e0.1%, Durable goods were also strong (+0.2 vs -e0.5).

215 November 2008

3The US dollar index (DXY) has risen c. 5% since the beginning of August

4Cleveland Fed trimmed mean CPI, Atlanta Fed sticky CPI, core ex shelter

5CarGurus high frequency data suggests a pick-up in used car prices in September as well. Source: Vanda Research

6Axios: The next driver of inflation: health care

7 IEA 2019 world oil demand: 100.4 mb/d, 2023: 102.2mb/d.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here