Investment Thesis

Juniper Networks, Inc. (NYSE:JNPR) designs and sells high-performance network products and services to help businesses create secure and efficient networks.

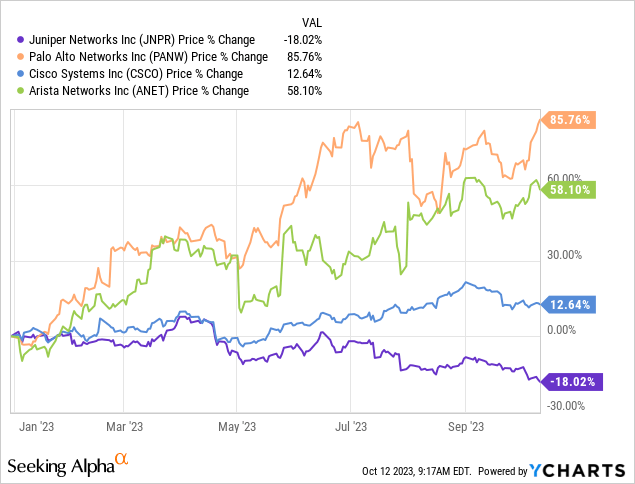

Its stock has been the worst performer amongst its networking and network infrastructure peers. Typically, this is fertile ground to look for bargains: stocks that investors have soured on, but have reasonable prospects.

Despite the current underperformance, it’s important to note that Juniper’s turnaround and the return of attractive top line growth rates may require some time, as we’ll soon discuss.

Juniper Networks Near-Term Prospects

Juniper Networks is a company that designs, develops, and sells high-performance network products and services to help customers create scalable, reliable, secure, and cost-effective networks for their businesses.

They offer a range of network solutions, including routing, switching, Wi-Fi, network security, AI, and software-defined networking (SDN) technologies. Additionally, they provide services such as maintenance, support, professional services, and education and training programs. Juniper serves customers in various verticals, including Cloud, Service Provider, and Enterprise, by focusing on innovations in networking, security, and software automation. Their goal is to simplify network operations while addressing the evolving needs of the cloud, service provider, and enterprise markets.

In the near term, Juniper Networks is experiencing strong momentum in its Enterprise segment, which is its largest and fastest-growing vertical. Furthermore, Juniper’s AI-driven solutions, particularly those powered by Mist AI, have delivered remarkable results. Also, new customers are recognizing Juniper’s leadership in AI-driven operations, leading to healthy growth and expanding opportunities. The introduction of innovative solutions like AI-driven network Access Assurance and the integration of Marvis Virtual Network Assistant showcase Juniper’s commitment to delivering real AI solutions.

However, Juniper also faces challenges related to the Cloud and Service Provider segments. Cloud orders have recently shown weakness due to customers digesting previous purchases and deferring projects.

Furthermore, the timing and extent of this slowdown remain uncertain. Even as AI adoption in the Cloud is seen as a long-term opportunity, it’s impacting near-term growth.

Given this background, let’s discuss Juniper’s financials.

Revenue Growth Rates Are Fizzling Out

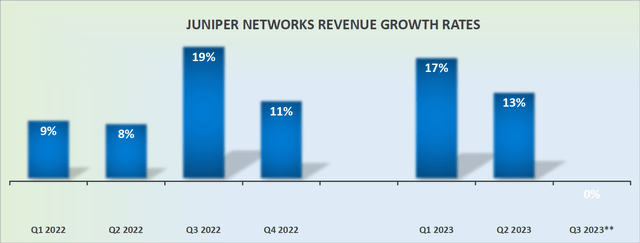

JNPR revenue growth rates

Juniper is up against its toughest comparable quarter, Q3 of last year. Accordingly, investors have already braced themselves for a quarter with practically no top line growth.

However, the question that investors are eager to know is, what will its guidance be for Q4 2023? And, as a corollary to that, what sort of growth rates can investors expect in 2024? JNPR Q3 earnings are expected on October 26th post-market.

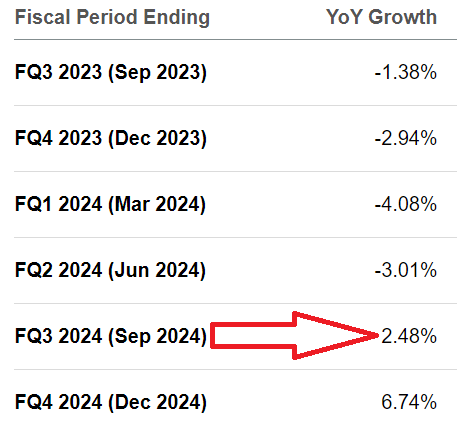

SA Premium

At present, analysts following the stock anticipate that Juniper’s revenue growth rates won’t see improvement until the latter half of 2024.

In practical terms, this implies that Juniper’s most promising days are behind it, at least in the short term. This means that Juniper will require some time to address its challenges and overcome the obstacles before returning to growth.

This is a crucial factor to consider as we delve into JNPR’s valuation.

JNPR Stock — A Complex Valuation

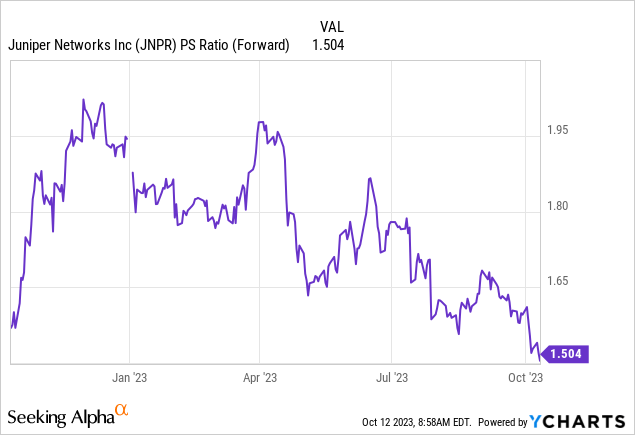

In the past year, we’ve seen Juniper Networks’ multiple expanding slightly to around 1.9x forward sales and now retrace back to 1.5x forward sales. On the surface, that speaks of investors’ slight apprehension about getting involved with Juniper.

However, in the grand scheme of things, despite the graphic above showing that its multiple has compressed, we must acknowledge that in reality, this multiple hasn’t compressed all that much, only slightly.

Making this more straightforward, last year, investors anticipated Juniper would achieve high single-digit growth rates. However, as we approach Q3 2023, the best-case scenario is for Juniper’s Q4 guidance to indicate flat year-over-year revenue growth, which would already be an improvement compared to analysts’ expectations.

The Bottom Line

As an investor, I find myself in a state of uncertainty when it comes to Juniper Networks stock. While the company specializes in high-performance network products and services, it has been the underperformer amongst its peers in the networking and network infrastructure sectors.

The potential for bargains often lies in such situations, where stocks have fallen out of favor but still hold reasonable prospects. However, Juniper’s path to recovery and a return to attractive top line growth rates seems elusive, and it’s unclear how long this journey will take. The near-term outlook shows promise in their Enterprise segment, driven by AI-driven solutions, but challenges loom in the Cloud and Service Provider segments due to weakening orders.

Until Juniper Networks, Inc. demonstrates a substantial return to growth, JNPR stock doesn’t appear to be an appealing bargain.

Read the full article here