Consumer prices continued their increase in September following its largest monthly gain of 2023 in August. The Labor Department reported Thursday that the consumer price index (“CPI”) rose 0.4% in September, slightly above consensus estimates of 0.3%. Driving the increase was the continued ascent in energy prices, as well as shelter costs, which accounted for over half of the increase.

Excluding volatile food and energy items, core prices rose 0.3%, also on mark with expectations of a 0.3% increase. The September increase in core prices reflected higher costs for categories such as airfares and vehicle insurance.

On an annual basis, overall prices were up 3.7% from a year ago, slightly above estimates and the same as in August. Annual core, on the other hand, came in at 4.1% versus 4.3% last month. This also represented the lowest reading since September 2021.

Immediately following the print, equity markets resumed their upward March following their current four-day winning streak but wavered in the morning hours, with the Dow (DJI) swinging between 50 and 150 points. Meanwhile, the broader S&P (SP500) and NASDAQ Composite (COMP.IND) indexes were in the positive but to a lesser degree.

The mild core reading most likely validates those who believe the Federal Reserve is likely to remain on hold on interest rates at their meeting later this month. According to data from CME Group, the probability of interest rates remaining unchanged at this meeting is around 90%. The reading may also quell future uncertainty of whether the Fed will need to raise again in later months.

Here are three more takeaways from Thursday’s relatively mild CPI report.

Gasoline Prices High But Further Pullback Likely In October

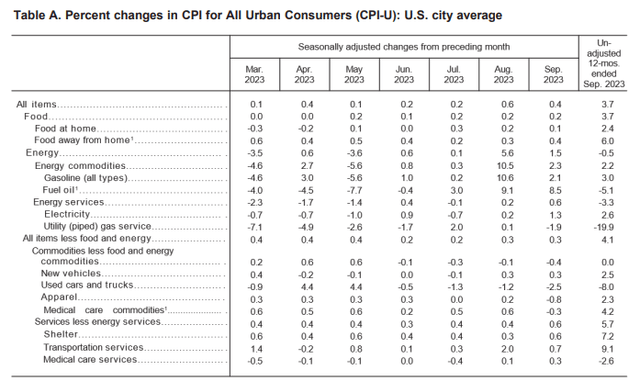

The rate of overall price increases has slowed. But this may not necessarily be resonating with many Americans who have seen gas prices surge in recent months. In September, energy prices rose 1.5%, including a 2.3% increase in gasoline. This follows increases of 10.5% and 10.6%, respectively, in August.

Rising energy costs are one significant barrier in taming overall inflation. Though its stripped out of the core component, energy is used as an input in most products, and its rise could feed into other categories in later months, such as airfare.

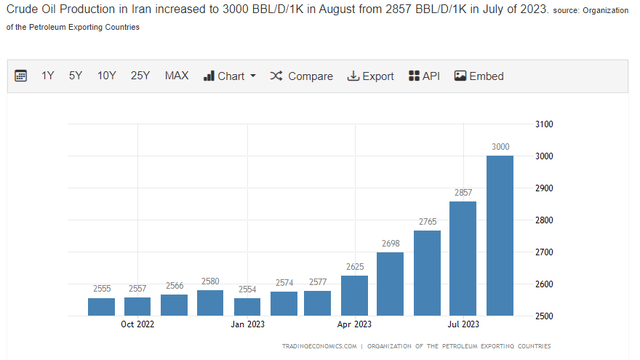

The escalating war in the Middle East also risks a further rise in the component. Following the initial shock attack on Israel by Hamas, Brent crude surged to $88 a barrel (CL1:COM). Though it has since pulled back, it could regain ground if Iran’s direct role in the assault, as reported by The Wall Street Journal, is ultimately confirmed by the White House and acted upon. In this scenario, Iran’s production, which has increased significantly in 2023, would likely come off the market just as the market is expected to see record demand.

Trading Economics – Data On Iranian Oil Production To Show Increases Through 2023

The war also threatens the potential deal on Saudi relations, which would have resulted in increased production out of Saudi Arabia.

Barring war-related disruption, gasoline will likely head lower in October. Prices have fallen in recent weeks, and the nationwide average has dropped by about 7 cents. Analysts at GasBuddy also believe the prices have further to fall. This would come as a welcome relief to motorists, and it would also ease the job of tackling overall inflation.

Rising Labor Costs May Continue To Impact Services Inflation

Inflation in services has been on a tear through 2023, particularly in the transportation component. YOY, the component is up 9.1%. And in the month of September, it was up 0.7%. The two core drivers of the increase in 2023 have been vehicle repair and insurance costs, each of which is up over 4x the overall CPI rate.

BLS – September 2023 CPI Summary

And in September, airfares continued their climb following a rise in August and several months of notable declines prior to then. This increase was likely due to the rise in gasoline prices. Recent labor agreements could also be another factor.

Likewise, strikes by the United Auto Workers (“UAW”) and the Kaiser Permanente healthcare employees could result in a spike in services-based costs in future CPI readings. At the very least, it could likely hold prices of basic services at levels too high for comfort for both everyday Americans and for Fed policymakers.

Shelter Component Still Driving Inflation But A Decline Is Expected

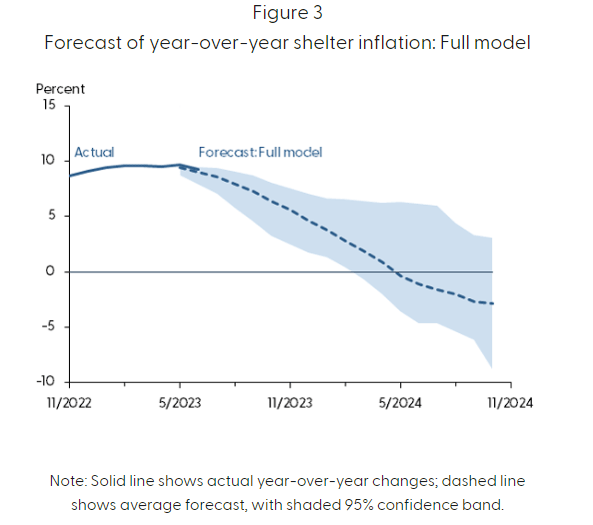

In September, shelter costs climbed 0.6% following a 0.3% rise in August. Within the shelter component, the rent of primary residence rose 0.5% for the month and 7.4% YOY, while owners equivalent rent rose 0.6% and 7.1%, respectively.

Though housing is still having an outsized impact on overall inflation, rent growth has slowed significantly in recent months, as shown in Zillow’s (Z) most recent asking rent report, which showed that asking rents increased just 0.2% in September, down from August’s 0.3% reading.

Given that it takes months for the CPI data to catch up to the current data surrounding asking rents, I remain confident that the component will begin turning into a large tailwind in the 2024 reporting months. Researchers at the San Francisco Fed even had suggested that YOY inflation may turn negative by mid-2024.

Federal Reserve Bank Of San Francisco Research – Graph to Illustrate Expected Trend In Shelter Costs

Will The Fed Raise Rates Again In 2023?

The Fed is likely to remain on pause for the remainder of the year. While overall inflation is still well above the Fed’s 2% target, the downward trend in the core rate, as seen in the September CPI report, is likely providing policy makers with confidence that their cumulative actions thus far are working.

Zillow’s leading indicator of asking rents also indicates the primary residence component of shelter has further to fall from its high of 8.8% earlier in the year to 7.4% in September. The YOY growth in current asking rents, for example, is now below the pre-pandemic pace at 3.2% compared to a growth rate of between 4% and 4.2 in 2019, according to Zillow Senior Economist, Jeff Tucker’s monthly rent report.

The steep climb in bond yields since the Fed’s last meeting is another key reason why the Fed may remain steady moving forward. On September 20, the last time the Fed met, the yield on the 10-year Treasury yield was 4.346%. Less than a month later, at the close of the trading session last Friday, the yield settled over 40 basis points higher at 4.783%.

In a meeting last week, San Francisco Fed President Mary Daly commented on the recent rise, noting that it was the equivalent to a quarter-percentage point rate increase. It’s hard to disagree here, considering the long-term yield is the benchmark for most debt, including mortgages, auto loans, and business debt. While the higher mortgage rates could inadvertently keep the shelter component higher-for-longer by keeping tenants in place, I still believe overall shelter rates will continue tracking lower in the months ahead.

My Main Takeaway From The September CPI Report

Core inflation is falling. It may not feel as such, however, for most Americans who remain pinched in key categories, but particularly at the pump. For the Fed’s part, the decline is promising but likely not enough to signal a complete end to their rate cycle.

While this may disappoint investors to a degree, observers can still cheer the relatively low-key inflation reading. For one, declining core inflation certainly doesn’t bolster the case for a rate hike. And two, in conjunction with the recent rise in bond yields, which could reasonably be viewed as the equivalent of a rate hike, the lower reading likely increased the conviction of the more dovish policy makers.

Taken together, the report met most of my expectations and reaffirmed my view that the Fed will remain on hold at their Oct. 31-Nov.1 meeting.

Read the full article here