Co-authored by Treading Softly

There’s a famous saying that “hard times make strong men and strong men bring good times.” I’ve never truly agreed with this viewpoint because, regardless of whether you’re in good times or hard times, great men exist – they are not always appreciated to the same degree or desired. It’s easy to be lulled into a false sense of security when everything seems to be easy or good around you. At that point, almost anyone can present themselves as being capable. Yet often, it’s those who present themselves as capable, but are not, that lead to the hard times that require strong men.

When it comes to day-to-day life, we often find that the products that present themselves as being the most reliable, are sometimes the ones that fall the hardest. I enjoy watching videos where they take apart boots or compare the strength of an old tool compared to a modern equivalent. Even though one presents itself as better, often the older tool has a higher degree of strength, and classic building styles for boots outlast those that are put together rapidly with modern machines. While this isn’t universally true, it does have an application that we need to consider.

As the market continues to struggle under the heavy weight of high interest rates and the economy continues to falter as well, we’re seeing that a number of companies that presented themselves as strong or capable and even had strong fundamental performance are starting to falter. Investors often judge a management team solely by recent share price action. When share prices are rising, they rave about how “great” management is. In reality, some management teams were making rash decisions to bolster near-term growth at the expense of long-term security.

Rising interest rates put pressure on the prices of most investments, especially investments where the main attraction is yield. After all, investors who want yield have the option to invest in U.S. Treasuries at much higher yields than they had a few years ago. Additionally, the entire purpose of raising interest rates from the perspective of the Federal Reserve is to increase the cost of capital and discourage growth. Higher interest rates make it more expensive for companies to expand and provide an incentive for them to slow down.

During this period, the prior decisions of management will be cast in a new light, and many companies are going to need to make tough decisions about how far they are willing to extend to maintain growth, or whether it is prudent to slow down even if it is unpopular among shareholders.

Investors today should favor stable and steady over speed. Today, we are going to take a look at an MLP that has chosen the stable and steady route. With a conservative payout ratio and methodical growth, over short periods many peers have seen faster growth rates. Yet when tough times arrive, its stable and steady business model really shines and outperforms.

The Grandfather of Energy Income Investments

Gas and oil have been the exception, as very strong fundamentals have overridden the negative headwinds created by rising interest rates. Enterprise Products Partners LP (NYSE:EPD), yielding 7.3%, is an MLP (Master Limited Partnership) that is particularly well-positioned to thrive, even in a tight monetary environment.

Note: EPD issues a Schedule K-1 tax form.

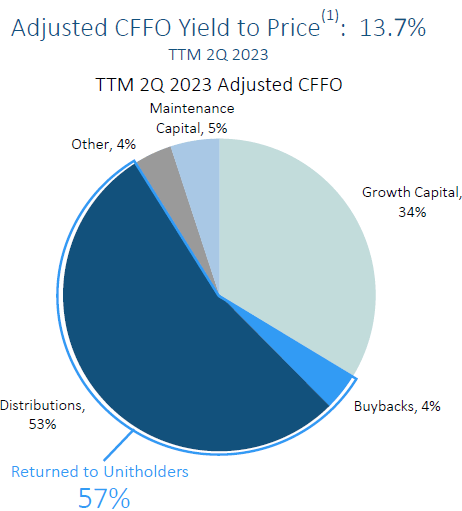

EPD is a rare MLP in that it is fully self-funding. It does not rely on issuing equity or debt to fund growth capital expenditures. Instead, it is able to fully fund cap-ex, the dividend, and buybacks from CFFO (Cash Flow From Operations): (Source)

EPD Investor Deck

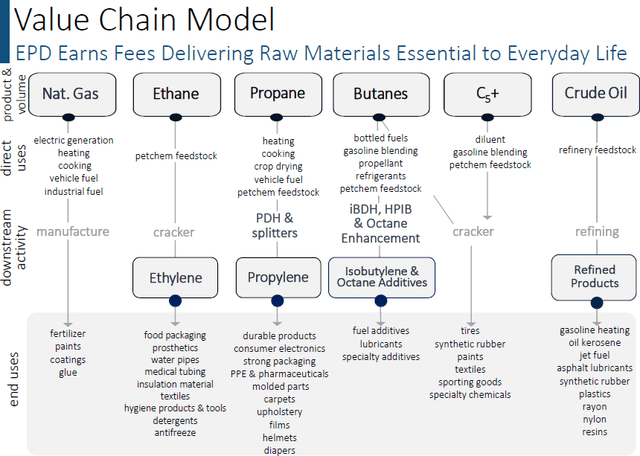

Additionally, with a diversified business model, EPD is not reliant on any one commodity – natural gas, NGLs, oil, petrochemicals, and refined products are all part of EPD’s business.

EPD Investor Deck

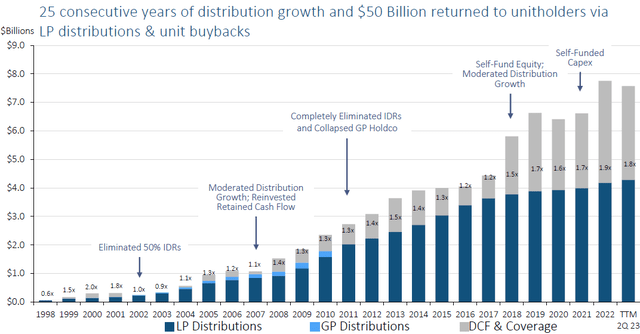

EPD’s “slow and steady” approach to the MLP model has proven to be extremely beneficial to shareholders over the years. EPD could have raised its dividend more aggressively and kept distribution coverage in the 1.4x range. Instead, EPD opted to moderate growth and turn to a fully self-funded structure. This has meant slower growth of the distribution but also an increasingly safe distribution.

EPD Investor Deck

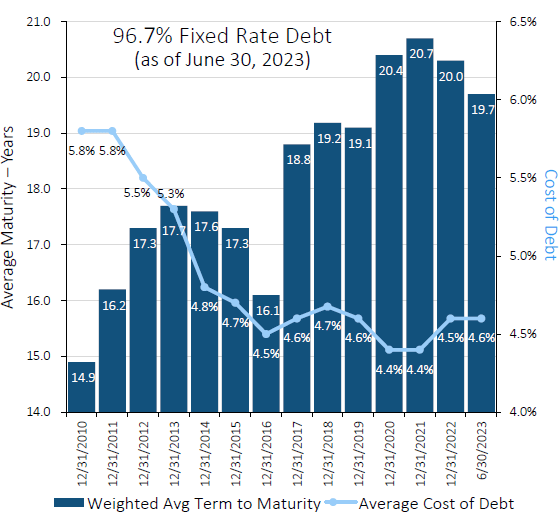

Investors are really seeing the benefit of this conservative structure now; as many companies struggle with the cost of capital, EPD has the luxury of not needing to worry about the cost of debt.

EPD’s existing debt is locked into low interest rates, with an average rate of 4.6% and an average maturity of 19.7 years.

EPD Investor Deck

EPD is a great option to enjoy a great dividend today, enjoy dividend growth, and have the confidence that it can ride out any turbulence the market has to offer.

Conclusion

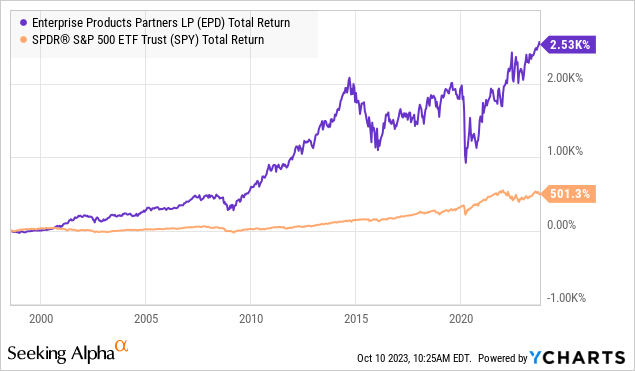

With EPD, we’re able to unlock strong income from a company that has been around for decades. Unlike so many other companies that claim to have strength, EPD, through the decades, has proven that they are capable of providing strong returns to their unitholders when good times are here or when hard times are here. Interestingly, while being the grandfather of so many other MLPs as far as style and relevance, the attractiveness of EPD has come and gone in waves. At times, investors claim that many other investments are better; all the while, this company has continued to generate outstanding income that is growing for its unitholders. As hard times in the market return, companies like EPD are the ones that people are going to start returning to and looking at again with a new level of appreciation after having been turned by others claiming to be just as strong.

As an income investor who loves to receive strong income, I need to note that look no further than a chart like the one above to know that EPD, whether it’s attractive or not to others, will remain a staple in my portfolio. Currently, it offers a +7% yield, making it still more attractive than even common money market funds, on top of the fact that they’re also going to be raising their distribution on a regular basis.

You don’t need to be chasing what is the new vogue thing or the latest fad investing. Currently, AI is all the buzz. Previously, we had the Blu-Ray versus HDDVD debate. Does anyone remember HDDs versus SSDs? Or maybe it was the Apple iPod versus the Microsoft Zune for you? So many battles or fads come and go. Yet, through all of those periods of time, we were able to enjoy strong income from holdings like EPD, which often falls into the background noise of the market. There are very few investors who don’t know that EPD exists, but simultaneously, so many of them shrug it off as a boring investment that their grandfather held. Perhaps, just like that old axe or hammer that your grandfather still has, EPD is worth another consideration for its strength.

At the end of the day, I want you to be able to enjoy your retirement, having an abundance of income pouring into your account quarter after quarter, month after month, year after year; so much income that you don’t have to worry about selling your shares to afford your daily bread. Instead, I want you to have so much income that you are able to choose a charity of your choice to be able to donate to without wondering where you’re going to need that money in the future. I want you to be able to pursue your passions without the worry of financial calamity on the horizon. I want you to have a dream retirement – you don’t need to be rich to have that! You just need to have income pouring into your account from the market.

That’s the beauty of my Income Method. That’s the beauty of Income Investing.

Read the full article here