ZoomInfo Technologies (NASDAQ:ZI) operates a leading go-to-market intelligence platform, providing sales, marketing, and recruiting professionals with highly accurate B2B data and insights to drive business growth. While the business fundamentals are strong, the current environment has hampered revenue growth, resulting in a plummeting stock price as Mr. Market heavily weighs the short term. However, long-term reacceleration prospects look bright once macro headwinds abate. Investors should wait for a more attractive entry point before starting a position.

Investment Thesis

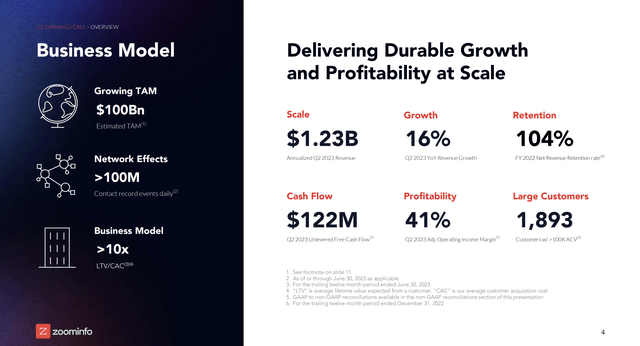

ZoomInfo boasts an attractive niche in providing accurate and comprehensive B2B data and intelligence to enhance sales, marketing, and recruiting motions. This drives strong customer ROI and retention. Growth has slowed recently but the long-term opportunity remains vast given low penetration of ZoomInfo’s TAM. However, software customers are cutting back hard near term, pressuring revenue growth to just 15% YoY as of the latest quarter. This may continue for a few more quarters given the macro backdrop. The stock trades at a historically low Price/Sales ratio of near 6x. But more negative estimate revisions could pressure shares further. Long-term prospects look bright, but a better entry point may emerge down the road.

Business Overview

ZoomInfo provides a modern B2B data and intelligence platform leveraging AI/ML to enhance go-to-market motions for sales, marketing, operations, and recruiting teams. Highly accurate and comprehensive data on companies and business professionals helps customers shorten sales cycles, increase win rates, and optimize marketing spend. Customers range from large enterprises to SMBs across diverse verticals like software, financial services, healthcare, and retail.

The company boasts deep competitive moats from its proprietary data asset built over 17 years, combining public data with contributed data from customers and its own data gathering. Cleansed and enriched via AI, ZoomInfo data reaches relatively higher accuracy levels. Customers leverage this data through cloud-based SaaS products including:

- SalesOS – Maps out org charts and contact info to identify key buyers and decision-makers for sales teams

- MarketingOS – Enriches marketing data and powers account-based marketing campaigns

- TalentOS – Sources and contacts top talent for recruiting teams

- Data-as-a-Service – Provides ZoomInfo’s data and signals via API to integrate directly into CRM, MAP, and data platforms

This integrated suite helps land new customers and expand spend within existing accounts, driving strong net revenue retention historically above 100%. ZoomInfo leverages efficient inside sales and digital marketing to keep CAC low. Gross margins are 85%+ thanks to the automated and scalable data platform. ZoomInfo boasts close to 40% unlevered FCF margins.

Recent Slowdown in Growth

ZoomInfo delivered torrid growth since its 2020 IPO, with revenue expanding over 50% consecutively in 2020 and 2021. But growth began decelerating in 2022 as the macro environment weakened. Software customers in particular clamped down on spending as layoffs mounted.

Full-year 2022 revenue growth landed at 47%, but exited Q4 at just 34% growth, followed by the recent quarterly disappointment at 15%. Guidance calls for a further slowdown to just 12% growth in 2023 as software headwinds continue.

Management deserves credit for maintaining profitability. Adjusted operating margins should remain around 40% in 2023 But the sharp growth deceleration has weighed heavily on shares, which now trade around 7x Price/Sales, far below 20x+ multiples in 2021.

On the Q2 2023 earnings call, CEO Henry Schuck noted “As we look forward, reviewing our customer health, we no longer believe that these budgetary pressures and their corresponding downward pressure on renewals will ease in the near term.”

Business Model and Performance (Zoominfo)

Long-Term Reacceleration Prospects

While the macro weakness persists, ZoomInfo’s long-term prospects look bright. The company estimates its TAM at around $100B, potentially providing a long runway for growth after macro stabilization.

International expansion is still early at just a small fraction of current revenue, offering an additional growth lever. Recent sales reorganization and added management talent also set the stage to unlock more enterprise potential long term. As software customers resume hiring and spending, ZoomInfo is well positioned to drive reacceleration.

But the timing remains uncertain. Macro uncertainty persists, and software layoffs continue. Until stabilization signs emerge, revenue likely stays pressured. The comps also get tougher, with high growth embedded in 2023’s exit run rate. Reacceleration may not spark until 2024 or beyond, likely depending on macro recovery.

On the Q2 2023 call, management said “Once we’re through the renewal cycle that lapsed that, I do believe that there’s the opportunity to reaccelerate growth, particularly as the macroeconomic environment potentially stabilizes or improves.”

Short-Term Further Negative News

While shares look cheap at 8x revenue and 20x earnings, the near-term outlook remains challenging. Q3 and Q4 renewal cycles may see further software customer downgrades. Continued layoffs at software firms loom given uncertain macro conditions.

Q2 results in late July badly missed expectations as renewal downgrades accelerated, triggering a sharp decline in the stock price. Even management seems cautious on the macro backdrop, evidenced by the heavily lowered full-year guidance.

Additional negative estimate revisions could spark another leg lower in shares as analysts digest the long road back to re-acceleration. ZoomInfo likely muddles along at low-teens growth until the backdrop improves.

Cash Flow and Debt Profile

The growth hiccup has not impacted ZoomInfo’s cash generation. The company still expects to generate over $440M in FCF. While leverage jumped to fund acquisitions, the healthy FCF covers interest expense 10 times over. Net leverage ratio stands at 1.1x TTM EBITDA.

ZoomInfo exited Q2 with $685M in cash & cash equivalents against $1.2B in long-term debt. The balance sheet easily supports modest leverage, and liquidity remains strong. The company has ample flexibility to ride out a prolonged downcycle.

Valuation

Despite plummeting 75%+ from highs, ZI shares still aren’t exactly cheap at 6x EV/Revenue, especially considering the growth slowdown. Thanks to profitability, however, shares do look somewhat cheap at 17x forward earnings. If growth can re-accelerate to 20%+, shares would warrant a higher multiple down the line. Peers like Trade Desk (TTD) and Datadog (DDOG) trade at 23x and 15x revenues.

Upside still likely remains limited until growth stabilizes and starts reaccelerating. But the downside also looks somewhat capped given the reasonable earnings multiple. The cheap multiple likely limits downside barring a severe recession, though multiples could compress further in a protracted downturn.

Conclusion

ZoomInfo operates an attractive platform providing mission-critical B2B data and intelligence. But revenue growth has slowed sharply from reduced software customer spending. Further deterioration may continue in the near term before stabilization signs emerge. Long-term reacceleration seems likely but the timing is uncertain. While valuation looks reasonable on an earnings basis, cheaper entry points could emerge given persistent macro uncertainty. Waiting for more clarity on growth prospects seems prudent.

Read the full article here