“If you think nobody cares if you’re alive, try missing a couple car payments.”- Earl Wilson

To My Partners and Friends:

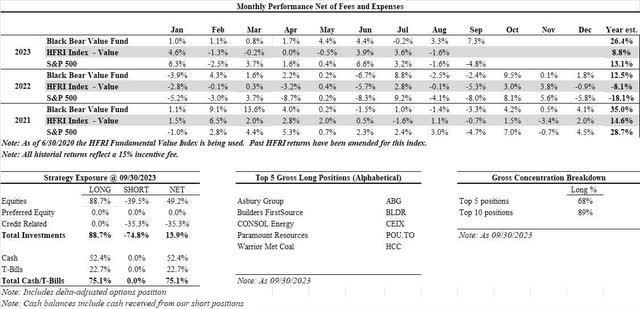

- Black Bear Value Fund, LP (the “Fund”) returned +7.3% in September and is +26.4% YTD.

- The S&P 500 returned -4.8% in September and +13.1% YTD.

- The HFRI Index returned +8.8% YTD thru August (Sep numbers N/A).

- We do not seek to mimic the returns of the S&P 500 and there will be variances in our performance.

| Note: Additional historical performance can be found on our tear-sheet. |

While our portfolio has been performing well, we must remember that returns can be lumpy, and we will encounter periods of underperformance as our portfolio does not resemble the broader indices. Having long-term LP’s and long-term capital is a competitive advantage that allows us to worry less about short-term noise. This is a core business principle for Black Bear and one that will continue to serve us well in the coming years.

In our Q2 letter we quoted George Carlin when he said “One tequila, two tequila, three tequila…. FLOOR.” As discussed, it seemed that the bar was open with animal spirits alive and well, providing us an opportunity to add to our short positions as excitement returned to broader markets. The rapid negative change in investor sentiment is quite a sight to behold as some element of fear/apprehension is beginning to percolate among investors/speculators.

One of the benefits of having a concentrated portfolio is not needing to have an opinion on too many things. People often think investing is the act of having many opinions. We do not subscribe to this belief and in a market that, on the whole, seems relatively expensive, we have remained focused on a few core areas of investment: energy/commodities, homebuilding, and auto dealers. These themes have and continue to dominate our portfolio. Despite the increase in some of their prices, our investments remain very cheap, especially considering inflationary risks. Our businesses can weather inevitable tough times and take advantage while weaker/more leveraged competition struggles.

I want to caution our LP’s that while I like how we are positioned, our returns of late are unusual. Things will not always go our way and we need to remind ourselves that short-term pain can lead to long-term gain. We continue to look for quality companies, run by ethical management who think like owners, at fair to cheap prices. In the absence of those opportunities, we will hold cash and not reach. Patience has its virtues if you can move decisively when the fat pitches come.

Short Credit Revisited

We remain short credit as spreads remain tight. As corporate profit margins compress, I expect weakening credit fundamentals to result in additional spread widening to compensate for the eventual corporate defaults.

From 2003-2007 borrowers, en masse, elected to borrow money via mortgages with no money down and/or teaser interest rates. These were 0-2% mortgage rates that would keep payments low for the borrower. For a time, there was a panic about the great “ARM Reset” (this was the risk of adjustable-rate mortgages increasing to market rates). As we all know, the mortgage debt increased, and ARM resets were the least of our concerns as the overall debt pile became unsustainable. It turns out that even at 0% interest rates…if you borrow money, you eventually need to pay it back. It gives me pause when contemplating the health and direction of both our sovereign and corporate debt.

For over a decade the government (and many companies) have been paying teaser rates on an ever-increasing pile of debt, funding all sorts of fiscal adventures, some warranted and many extraneous. Now debt is at alltime highs, the teaser rates are expiring, and we need to refinance at MUCH higher rates. Concurrently the Fed is no longer buying the debt and it seems China, among others, is taking a breather too. I wonder…who is the marginal buyer of US debt and what will it cost? What about corporate debt which is trading at average to below-average spreads? I’d be lying if I had the answers…but the risk is real and is one of the reasons we have a significant short position in credit instruments and companies with a need to refinance/depend on capital markets.

Top 5 Businesses We Own Asbury Group (ABG)

Asbury Group recently agreed to acquire the Jim Koons Automotive Companies in the largest auto retail acquisition since 2021. They will be taking on some leverage to consummate the acquisition. Asbury has successfully integrated past acquisitions and has a good track record of deleveraging the company. Longer term, this is an accretive deal and raises our “normal” free-cash flow per share by $5 to a range of $30-$40. At quarter end pricing this implies a 13-17% annual yield.

Asbury Group operates auto dealerships across the United States. While much attention is paid to the number of cars sold, the strength of the model comes from the back of the house in parts and services where more than 50% of the profits come from. We are exiting a period of high margins on new and used car sales. Shortages of inventory have allowed dealers to make record profits when selling a car. As inventories normalize and interest rates rise, I fully expect the dealers to make less profit (called the GPU) when selling a car. Car prices cannot go up ad-infinitum and at some point, there will be buyer pushback.

Less discussed is while profits per car are at all-time highs, the volumes sold have mirrored prior recessions. My expectation is that dealers will likely make less per car but will mitigate some of that pressure by selling more cars, especially used vehicles, as prices drop.

When an auto dealer sells a car to a consumer, they capture both the trade-in (inventory to sell) and the relationship for parts and services. It is a razor-razorblade model in a highly fragmented industry (many dealerships are owned privately by families). The large dealer groups have transitioned to an omni-channel model where much of the selling/pre-buy activity can be done online reducing the need for headcount and making the transaction smoother for their customers. The lower operating costs of the business are not appreciated by the market. They are appreciated by us and the management teams as most dealers, including ABG, have been buying in lots of stock with their free-cash flow.

Builders FirstSource (BLDR)

BLDR is a manufacturer and supplier of building materials with a focus on residential construction. Historically this business was cyclical with minimal pricing power as the primary products sold were lumber and other non-value-add housing materials. Since the GFC, BLDR has focused on growing their value-add business that is now 40%+ of the topline. The company has modest leverage and has been using their abundant free-cash-flow to buy in over 30% of the stock in the last 18 months.

While mortgage rates are higher, they are not unusual versus history. The low rates of the last 5-10 years are the outlier. We have a structural shortage of housing in the USA. With existing homeowners locked into lowrate mortgages, the aspiring homeowner may increasingly need to find a home from a homebuilder. The next 6-12 months could be rocky as people adjust to the increase in pricing and rates. Eventually the housing market should adjust to the new normal (or rates could go down).

The company has realized sustained higher gross margins as they have gained scale. I am now giving them credit for some increased margin and raised my normalized free-cash-flow per share to $13-$17 per year. At quarter end pricing of ~$124 that implies a free-cash-flow yield of 10-14%.

CONSOL Energy (CEIX) / Paramount Resources (OTCPK:PRMRF, POU.TO)

We have a large investment across the energy & commodity spaces. The thesis is simple…we haven’t developed enough energy or commodity resources to satisfy the near- and medium-term needs of the world as well as provide for a renewable/less-carbon intensive future.

CONSOL Energy is an American energy company focused on the coal sector. The business has undergone a shift from being a majority producer of coal for domestic energy purposes to an export-driven producer of coal for non-power generation purposes. Over the last few years, the Company has delevered to a near-zero netdebt position and is trading at a 25%+ unlevered free cash flow. While there is a negative stigma associated with coal (and some deserved) there are parts of the world that have limited energy alternatives and will require coal supply over the coming years. I expect the company to commit a large amount of the free-cashflow to buying in cheap stock and the per share intrinsic value to grow substantially over the next 3 years.

Paramount is an ENP (exploration and production) in the energy space. It has no debt and ~$580MM in cash/securities (14% of the mkt cap). Management is fully aligned with us as they own 47% of the Company.

Over the next 2 years the company should generate ~9-10% in annual free-cash flow presuming fairly bearish energy prices. I tend to believe this is on the lower end as China reopens, and the lack of worldwide energy developments becomes more pronounced.

Warrior Met (HCC)

Warrior Met produces met coal which is used for steelmaking. They are a largely export driven producer (97%) with a large cost advantage as they can ship to Europe and South America in ~2 weeks versus Australian competition of ~5 weeks.

Some rough math on HCC (quarter-end price of $49 and market cap of ~$2.6BB and $0 net debt)

- They have a current project coming online in 3 years with an estimated value of $1BB or $19 per share per management.

- I use a more modest discount rate and operating cash flow as the future is tough to know and get to $300-$500MM or $6-$9 per share.

- Excess cash of $5 per share

- The existing business requires $100MM in capex and generates midcycle operating cash flow of $500MM…. resulting in ~$8 in FCF per share. Some believe this number is closer to $800-$900MM per year.

- Let’s presume non-heroic FCF yield of 15-20% on $500MM = $40-$53 per share

- New project of $6/$9 + Excess Cash of $5 + Operating business $40/$53 per share = $51-$67 per share vs. current price of $49

Note the above is a very rough calculation and shows the wide margin of safety baked in the price. We may decide the operating business is worth more than a 15-20% yield…. but for now, we do not have to make any big leaps with respect to valuation.

The Company has not been active in the share repurchase market to preserve their NOL’s (avoid triggering a change in control). As the NOL’s are used up in the coming 12 months they should be able to aggressively repurchase stock and significantly increase the intrinsic value per share.

Wrapping Up

We will continue owning durable businesses that can benefit through a tough economic cycle. Most of our companies have little to no debt and can be opportunistic in either buying their own shares or distressed competitors in the event of market tumult. While I do not root for bad economic outcomes, we do prepare for them.

Thank you for your trust and support.

Adam Schwartz, Black Bear Value Partners, LP

Read the full article here