Investment Thesis

Lowe’s Companies (NYSE:LOW) is the second-largest home improvement retailer globally, operating in a $830 Billion market. The company offers products for construction, remodeling, maintenance, repair, and decorating. It has been successful in the past by improving affordability through sales incentives, lowering base prices, and building smaller homes in response to the housing shortage.

CEO Marvin Ellison had this to say after the Q2 earnings report:

Our investments in our Total Home strategy continued to drive growth across Pro and online this quarter. And we are excited by our recent launch of same-day delivery nationwide and the expansion of our rural merchandising framework to roughly 300 stores. Our ability to reduce expenses while improving customer service is the result of excellent execution by our team, and we remain confident in the mid- to long-term outlook for the home improvement industry.

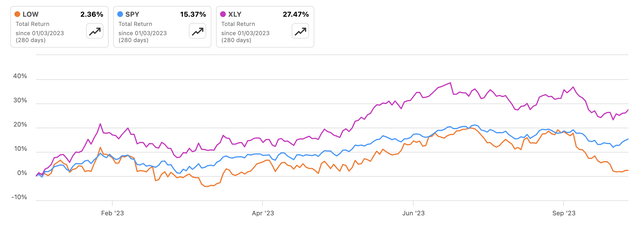

Lowe’s Companies stock has undoubtedly been struggling recently. Year to date, LOW has a total return of just 2.36%, compared to the S&P 500’s 15.37% and the Consumer Discretionary (XLY) ETF’s 27.47% total return. At the stock’s current price of around $202, I see a 4x risk-to-reward ratio with a base case next twelve-month fair value price target 11% higher at $224 and a bull case scenario price target of $263 (30%).

LOW Total Return Comparison (Seeking Alpha)

I believe the stock’s 11.5% pullback in the last three months is a gift to investors, and I suggest buying at $200 per share or lower. I see multiple catalysts that could give Lowe’s (and Home Depot) a multi-year run higher. The company is executing well, innovating, and consistently returning capital to shareholders.

Lowe’s offers a roughly 2.2% dividend yield, which has increased for 51 consecutive years. Its payout ratio is only 30.8%, and it has a five-year annualized dividend growth rate of 19.97%. I see plenty of room for this trend to continue.

Lowe’s is a cash cow, with $6.69 billion in free cash flow (FCF), or $11.60 per share. This translates to an FCF yield of 5.72%, which shows the strength of the company’s operations.

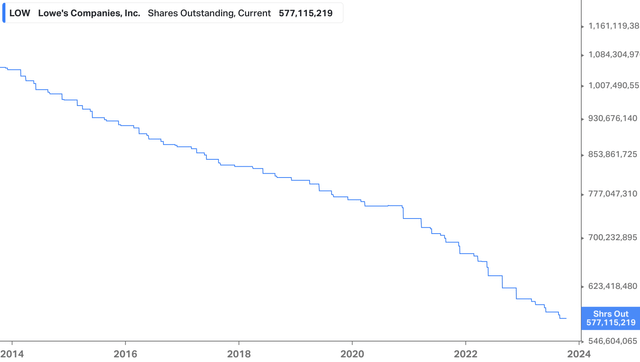

Lowe’s excess cash has also helped management reduce the number of shares outstanding by 45% in the past year, from 1.05 billion to 577 million. Lowe’s currently has a $15 billion share buyback program in place after buying back $14 Billion in 2022.

LOW Shares Outstanding (Koyfin)

Lowe’s management’s financial discipline is crucial, and the company’s duopoly in the home improvement industry gives its stock a wide moat. Lowe’s is one of two global home improvement retailers, and its sales have steadily grown at a 5.75% five-year compound annual growth rate (CAGR). Net income has grown even faster, at an 8.9% five-year CAGR. With the business consistently expanding and economic conditions soon to become tailwinds, I rate Lowe’s a Strong Buy for long-term value investors given its favorable upside potential with minimal downside risk.

Economic Tailwinds

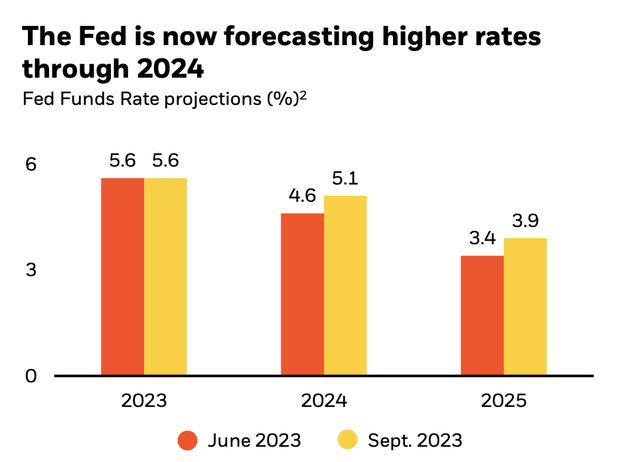

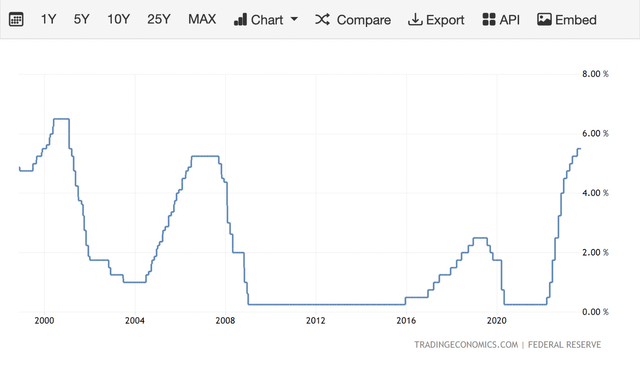

Interest rates are high, inflation is persistent, and the consumer appears to be weakening. This is no secret. The Fed has been trying to slow the market for almost two years now by raising interest rates from nearly nothing (0.25%) to 5.25%–5.5%. It has also been using a new tool, quantitative tightening, to reduce the money supply. Despite all of these measures, inflation remains above the Fed’s 2% target. This has led analysts to expect higher rates for longer.

Higher Rates For Longer (BlackRock)

What does this mean for Lowe’s?

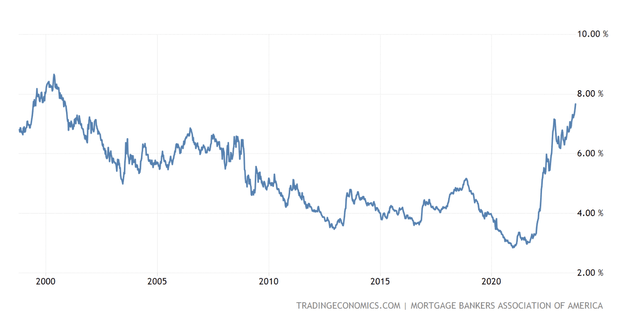

Mortgage rates are reaching new 20-year highs. The average US 30-year mortgage rate is now 7.67%, which we haven’t seen since 2000-2001. Buyers haven’t seen the average rate over 6% since 2009, and there’s no sign of it coming down anytime soon. This means that people will be less likely to move, buy a new home, or relocate without a good reason.

That’s why I believe Lowe’s will see massive tailwinds as people are forced to stay in their current homes longer, boosting home improvement sales and projects. People who bought homes between 2020 and 2022 likely locked in a rate below 4%, and they’re not going to trade that for a nearly 8% mortgage. 80% of Americans have locked in a fixed mortgage rate under 5%, and over 38% of people have completely paid off their mortgage and are free and clear. They’re not moving either.

In my opinion, that’s why Lowe’s will see a hefty move higher as demand picks up for people renovating their current homes and embracing the do-it-yourself (DIY) theme.

United States MBA 30-Yr Mortgage Rate (Trading Economics)

The economy is slowly weakening. Consumers will continue to spend less, businesses will experience slowdowns, and some may even go out of business, causing job losses. Layoffs will occur to protect margins, and GDP growth will continue to stall at 2.1% (below the Fed’s 3% target). Last week, on October 3rd, JOLTS numbers came in well above analyst estimates, at 9.61 million (vs. 8.88 million estimated).

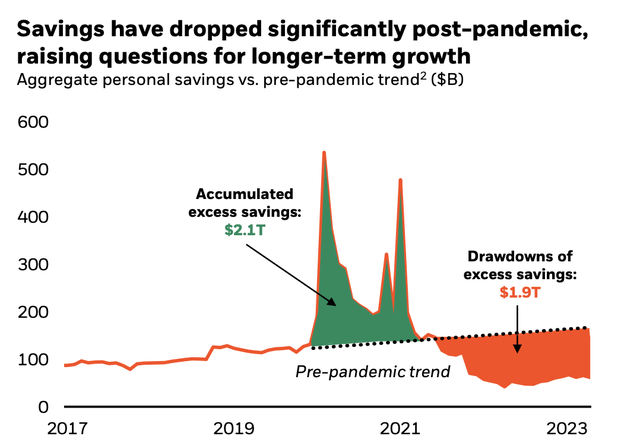

Summer travel is over, and the numbers show that COVID-stimulus savings and excess cash are starting to deplete. The holiday season will be a key catalyst to see how resilient consumers are.

Consumer Savings Dropping (BlackRock)

Whether the economy experiences a soft or hard landing, I believe Lowe’s will still benefit from current conditions. People will be in their current homes longer, whether they want to be or not, and that will spark demand for Lowe’s products and services.

Personally, I see a softer landing and believe in the strength of the consumer, despite rising oil prices and expected higher rates for longer. Although unemployment numbers are a lagging indicator, they remain sticky, showing the underlying strength and demand in the economy. I believe that when the full effect of the rate hikes is felt, it will help slow down the consumer enough to help bring inflation back down to the Fed’s target.

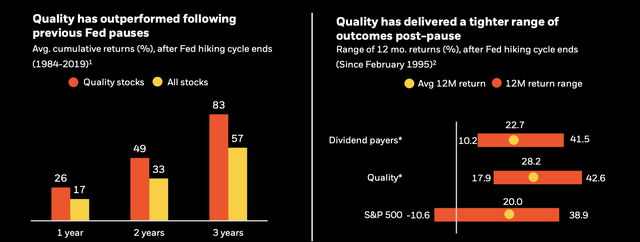

CME group provides a great analyst estimation tool for what the street and money managers expect for the next Fed meeting in November. 86.8% of them believe that the Fed will not raise rates in November, while 13.2% believe that it will. I agree with the herd. Signs show that the economy is slowing, and I believe that the Fed will choose to wait to change rates so that it can let the most recent hikes take effect. History shows that when rates tend to find their peak and the Fed chooses to pause, high-quality, dividend-paying, and blue-chip companies with fortress balance sheets tend to outperform.

Quality Stocks Performance after FED pause (BlackRock)

The second reason I love Lowe’s as a long-term value investor is that the stock has been neutral over the past year and is waiting for a catalyst. This past summer, it saw a brief rally to a 52-week high of $237.21 in July. Now roughly 15% lower, I believe the stock is a great buying opportunity for a blue-chip dividend stock with a business model that is here to stay.

Home improvement saw a big boost because of the pandemic in 2020 and 2021, which has since made the stock stagnant in the past year and a half. However, demand will pick up, and soon headwinds will become tailwinds, pushing the stock higher. Cash flow and the balance sheet are not an issue, and are arguably a strength, which leads me to believe that Lowe’s will be one of the best stocks to own in the next 10+ years.

Fundamentals

Margins

Lowe’s has consistently improved margins, which is impressive for an industry with low margins (4.4% sector median). Lowe’s has used economies of scale to build its business and increase top- and bottom-line margins. Gross profit (33.25%), EBIT (12.72%), and net income (6.48%) margins are all above the company’s 5 year average. Net income margins have contracted since 2022’s high as the cost of debt has increased, but this leaves room for margin improvement and growth over the next five to ten years.

Home Depot has net income margins just above 10%, and I believe Lowe’s will reach that level in the coming years, as both companies have similar services, brand equity, and margins. With margin expansion, growing demand, and an undervalued stock, I believe Lowe’s can return a mid-teen rate to investors compounded annually over the next decade.

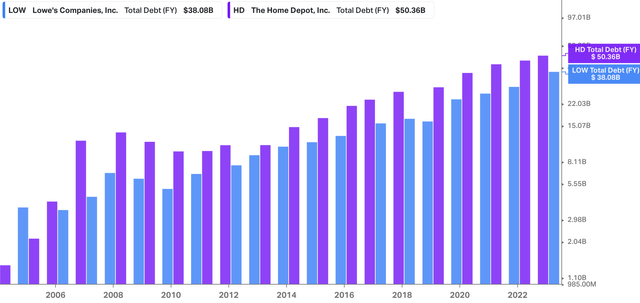

Debt

LOW has a moderate amount of debt, but this is understandable given its investment in new stores, small homes, and R&D. HD has a similar financial structure with high debt to support internal growth and investment.

LOW generated $8.5 billion in cash from operations (CFO), which helps alleviate the pressure of its steadily increasing debt load. Lowe’s also has an 8.6x interest coverage ratio (EBITDA/interest expense), which shows that it generates enough cash flow to comfortably service its debt.

LOW .vs. HD Total Debt (Koyfin)

Valuation

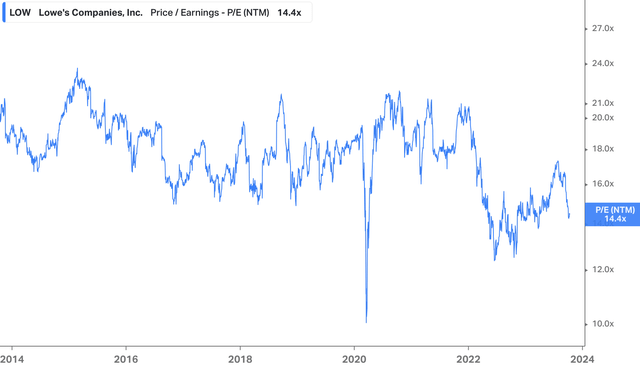

The stock’s current cheap valuation is a main reason why I recommend a Strong Buy. Lowe’s is currently trading at a P/E of 15x for FY 2024 earnings and 13.8x for FY 2025 earnings. Its 5 year average forward P/E is 17.6x, showing significant room for multiple expansion given the stock’s undervalued appearance. If the stock were to trade at a P/E of 17.6x on analyst estimates of $14.60 for FY 2025 earnings, it would theoretically reach $256, roughly a 27% upside.

The stock’s 10-year low P/E is around 12.5x (excluding the pandemic low), which resulted from the 2022 market sell-off. Before COVID, the stock’s P/E typically bottomed in the high 14s. Conversely, the stock’s P/E high is around 20x-21x, which further supports my belief that the stock is significantly undervalued.

LOW P/E History (Koyfin)

On an enterprise value to sales (EV/S) basis, the stock does not look as cheap because sales growth has stalled as demand was pulled forward during the pandemic, when people were forced to stay home and had increased home improvement needs. However, this will not last forever, and sales will pick up again. This is one reason why I do not like the EV/S valuation when looking at Lowe’s or Home Depot.

Lastly, based on EV to EBIT or EBITDA, the stock looks cheap again compared to its historic valuation averages. Forward EV/EBIT is currently 13x, below its five-year average of 14.5x. Forward EV/EBITDA is currently 11.22x, 8% lower than its five-year average of 12.25x.

My point here is that the stock looks cheap based on profits and earnings. It may consolidate down to the low $200s after the recent sell-off, but this would be a perfect buying opportunity for investors. The stock is currently undervalued and has the potential for multiple expansion and price appreciation.

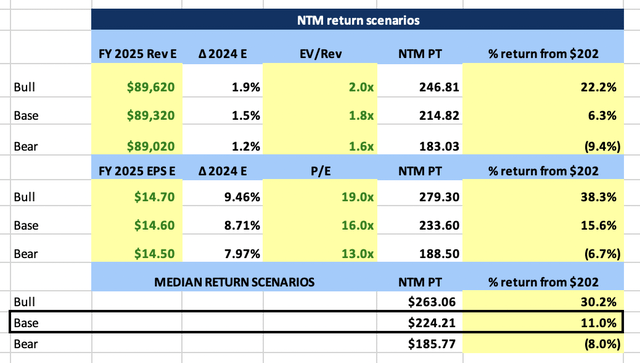

Price Targets

First, I created a next twelve-month price target table with three scenarios: bull, base, and bear. I based my estimates on the stock’s current and historical valuations, as well as current analyst estimates. This is how I arrived at my 4x risk-to-reward (R:R) ratio and base case price target of $224 over the next twelve months. However, my bull case price target is 30% higher at $263, with only 8% downside to my bear case scenario of $185.

LOW NTM Price Target Scenarios (Author Calculations Based on Analyst Estimates From Data on Koyfin)

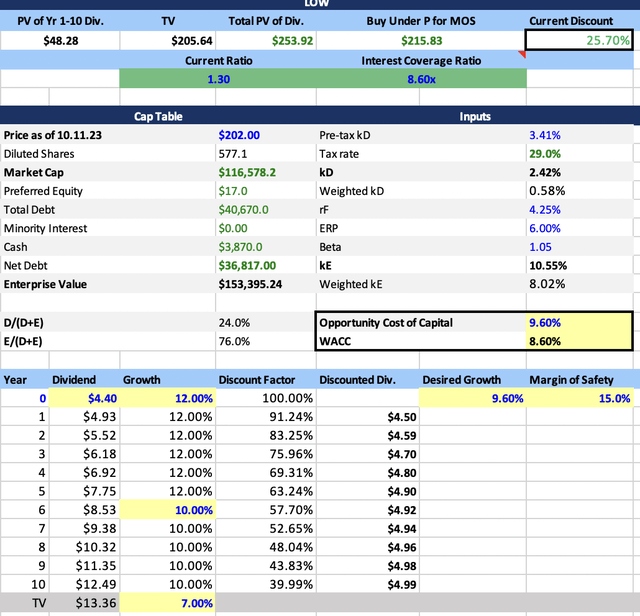

Second, I conducted a dividend growth model (DGM) to get a second opinion on a price target, supporting my thesis that the stock is well undervalued and trading at a roughly 25% discount. My DGM showed that fair value lies around $253 a share, with a strong buy under $215. I expect that Lowe’s will not be able to maintain its nearly 20% five-year dividend growth rate, but I still expect low teens growth in the near term and a consistent high single-digit long-term dividend growth rate.

LOW Dividend Growth Rate (Author Calculations)

If it is not already clear, the stock is significantly undervalued based on its long-term potential, valuation, and industry dominance. Over the next 6-8 months, the stock has 11%-15% upside potential, with 25%-30% upside potential over the next 12-18 months. I continue to suggest buying LOW.

RISK

The great thing about LOW is that there are no major risks. Lowe’s is a well-established company that has been around since the early 1920s. With a beta of 1.05x, the stock generally moves in line with the overall market (S&P 500). The stock is also trading at a cheap valuation, so we don’t need to worry too much about multiple contraction at current prices and valuations.

However, the main risk I would like to note is that the company operates in a very cyclical industry. The company’s strong brand reputation and overall duopoly of the industry help stabilize sales and margins, but it is still a risk to note. The industry relies heavily on consumers and homeowners spending money, so as the economy strengthens or weakens, it will affect Lowe’s overall revenue and profits.

Interest rates are another key risk factor. As interest rates rise, profits (net income) will be negatively affected, and vice versa if rates fall. Lowe’s operates in an industry and has a business model that requires large amounts of debt for internal growth, so rates will be a key factor affecting the company’s return on invested capital (ROIC).

US Fed Funds Rate (Trading Economics)

Turnover of homes is another cyclical driver of demand for LOW. With low mortgage rates, many people will be buying and selling homes constantly, using Lowe’s and Home Depot to fix up a home they are trying to sell and adjust the home they just bought. High mortgage rates could cause demand to slow as people are less likely to move, but they could also cause people to increase DIY home projects to add a new attachment to their existing home or fix up aging pieces.

Overall, I believe the risks are something to keep in mind, note, and look out for periodically. However, in the long term, I do not believe they will cause the stock or company to stop growing. LOW is too big, demand is too high, and execution is too good for investors not to find it appealing, especially at current levels.

Conclusion

To sum up, Lowe’s Companies is a duopoly that supplies home improvement and construction materials, which are a necessity to most laborers and homeowners.

The stock, however, is undervalued, has a safe and solid dividend yield, and strong management steering the ship. Lowe’s has committed to buying back shares and investing in the company’s growth to continue to improve margins and return capital to shareholders. Lowe’s has one true competitor in a $830 billion home improvement industry, showing there is room for both.

LOW is a classic dividend appreciation stock with 51 consecutive dividend increases and a high dividend growth rate. Lowe’s has a low payout ratio, which indicates that dividend increases can and will continue. Cash flow is high and consistent, supporting the company’s dividend payout, R&D, and share buyback program.

Don’t let this boring business stop you from being a smart investor. LOW is trading at a discount with a great risk-to-reward ratio at current prices. That is why I rate LOW a strong buy and will look to add a position myself here, as I have held out and missed this great long-term value stock in the past.

Read the full article here