Consistency is the key to success.

In both life and investing, the power of consistency should never be underestimated. As the Chinese proverb goes: A journey of a thousand miles begins with a single step. This is why it is more sustainable to build wealth over the long haul than to try to generate it in a short period.

How can this be done? Through regular capital contributions to quality dividend-paying stocks, dividend reinvestment, and dividend raises. It isn’t the sexy answer that everybody is hoping for, but it is the only one that can be reliably reproduced time after time.

Sporting a market capitalization of just over $500 million, most investors aren’t probably familiar with The York Water Company (NASDAQ:YORW). While I don’t own the water utility, I do believe it can help dividend investors reach the promised land of financial independence (e.g., when passive income at least meets living expenses). Let’s explore why.

Since its founding in 1816 when James Monroe was the 5th POTUS, York Water has paid 611 consecutive dividends. The company’s 207-year streak of paying dividends to shareholders is thought to be the longest on record in the United States of America.

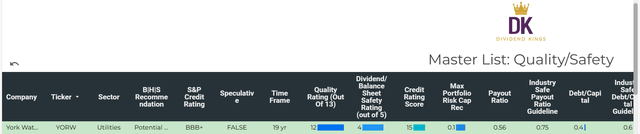

DK Research Terminal

Better yet, it likely won’t be ending in our lifetimes. This is because York Water’s EPS payout ratio is just 56%. That’s far below the 75% considered safe by rating agencies for its industry.

Thanks to its solid financial condition, York Water also had an A- credit rating from S&P on a stable outlook as of July 26 (per page 10 of York Water 10-Q). Therefore, the company’s 30-year risk of bankruptcy is estimated at just 5%. For these reasons, the water utility has a 4/5 dividend/balance sheet rating.

York Water is also priced at a 19% discount to fair value from the current $37 share price (as of October 11, 2023). This would equate to a 23% upside when the company reverts to its historical value of $46 a share. York Water’s 2.2% dividend yield, 4% to 6% annual earnings growth prospects, and 2.1% annual valuation multiple expansion could generate 8.3% to 10.3% annual total returns over the next 10 years. At the upper end of this range, the company could match the 10% annual total returns of the S&P 500 index. The appeal is that these returns also come with the low volatility that you’d expect from utilities.

USA’s Oldest Publicly Traded Utility

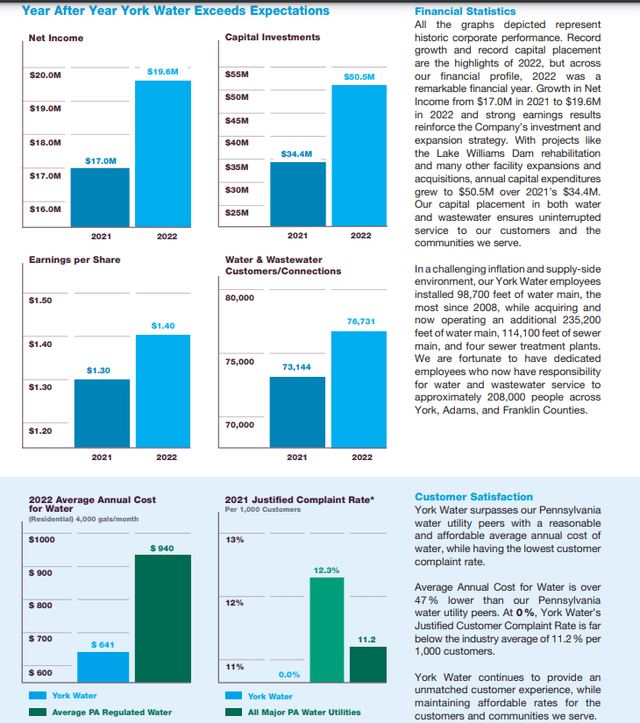

York Water 2022 Annual Report

In just about every way you can imagine, York Water is an exceptional water utility. At the heart of the company is its commitment to providing great service to its customers at affordable rates. This is reflected by the fact that the cost of 4,000 gallons of water/month was just $641 for York Water residential customers versus the $940 average for Pennsylvania residents. What’s even more remarkable about the company is that there were no complaints from customers that were deemed to be justified by regulators. This is well under the Pennsylvania state water utility average of 11.2% per 1,000 customers.

Despite operating for over two centuries, York Water also is far from running out of investment opportunities. This is evidenced by more than $50 million in capital investments in 2022, which was a record for the company. That is how the water utility grew its customer base by about 5% from 2021 to nearly 77,000 households in 2022 across York, Adams, and Franklin counties of Pennsylvania (details in previous two paragraphs sourced from York Water 2022 Annual Report).

As a result of an increase in rates effective March 1 of this year, York Water’s operating revenue rose by 17.3% through the first half of 2023 to $34.2 million. This also propelled diluted EPS higher by 9.2% over the year-ago period to $0.71 in the first half (info according to York Water Q2 2023 Earnings Press Release).

Aside from the 4% to 6% annual diluted EPS growth that analysts expect from York Water, it also has a solid balance sheet. This is supported by an interest coverage ratio of 4.6 during the first half of 2023. The company’s debt-to-capital ratio was just 0.4, which is comfortably lower than the 0.6 that is considered safe for the water utility industry.

Handing Out Slow And Steady Dividend Raises

In an environment where 10-year U.S. treasuries are yielding 4.6%, it’s easy to overlook York Water’s 2.2% dividend yield. However, having raised its dividend by 4% annually over the last five years, the company delivers reliable albeit slow dividend growth to its shareholders. It’s also important to note that a 2.2% starting yield today could match the current yield of 10-year U.S. treasuries in 19 years, assuming continued 4% annual dividend growth.

This is also likely far from an unreasonable assumption. That is because the company is going to pay out $0.8108 in dividends per share in 2023. Against the diluted EPS analyst consensus of $1.53 for the year, that is a modest 53% payout ratio. This is why annual dividend growth could arguably even come in slightly ahead of 4% in the decades ahead.

Risks To Consider

As a well-run water utility, the risk profile of York Water is less than most companies. But as a stock, it’s important to keep in mind that it isn’t risk-free.

One of the more obvious risks to York Water is that it is geographically concentrated in just three counties of Pennsylvania. This presents risks that investors need to consider.

Natural disasters could affect this tri-county area. That could damage York Water’s infrastructure beyond its insured amount, which could also disrupt operations and temporarily hurt its financial results.

Even though Pennsylvania is an attractive regulatory environment, operating in just one state is risky. The water utility should be able to recover higher interest costs from higher customer rates. But if regulators don’t want to play ball and approve higher rates, York Water’s fundamentals could be materially changed.

Summary: A Blue-Chip Water Utility With An Acceptable Margin Of Safety

Zen Research Terminal

The only reason that I am not rating York Water a strong buy is that interest rates may have a way to go before they are done rising. This could lead to additional downside, but the stock is a decent buy right now, trading 19% below fair value.

Due to this moderate undervaluation, York Water could realistically outperform the S&P 500 over the next couple of years. York Water’s 2.2% dividend yield, 4% to 6% annual earnings growth analyst consensus, and 2.1% annual valuation multiple upside could also translate into market-matching performance for the next decade. Scoring 12/13 overall for a quality rating, York Water is a world-class caliber business at an enticing valuation. This makes the stock a buy for more risk-averse dividend investors.

Read the full article here