Thesis

In today’s world, solar power is not just a technology; it’s a vital solution. As the world races to meet Environmental, Social, and Governance (ESG) goals, the solar sector shines brightly. Its impact on sustainability and energy independence aligns perfectly with the shift towards greener, more responsible practices. Additionally, key US government policies and incentives, such as the solar tax credit and the climate bill, are fueling the solar revolution, making it a compelling investment opportunity for those seeking both financial returns and positive societal impact.

Company and Management Overview

Complete Solaria (NASDAQ:CSLR) was formed as a result of the merger of two distinct but complementary businesses Complete Solar and Solaria in 2022. Complete Solaria manufactures and distributes end-to-end residential solar solutions. The company agreed to and entered a ~$888 million SPAC deal with Freedom Acquisition I Corp. (FACT) late last year. Complete Solaria closed its business combination deal with Freedom Acquisition in Q3, and its stock began trading on Nasdaq under the ticker CSLR.

Since the forming of the merged company, Complete Solaria has worked to have a footing in the solar technology space, earning partnerships and business deals with well-established companies in the solar technologies industry. Recently, Maxeon Solar (MAXN) and CSLR entered an Asset Purchase Agreement that permits MAXN to supply some of its proprietary products, like its high-performance and high-efficiency solar panels, to Complete Solaria. Under the agreement, Maxeon Solar will also acquire Complete Solaria’s shingled cell solar panel technology patent and its dealer channel operations and contracts.

The company is backed by and enjoys the leadership of notable and wealthy investors, including John Doerr, chairman of venture capital firm Kleiner Perkins, who made a $10 million investment in Complete Solaria. On the executive board of Complete Solaria, billionaire scientist and entrepreneur T.J Rodgers holds the position of the Executive Chairman of the Board. Other notable board members include financial services business veteran and former Credit Suisse CEO Tidjane Thiam.

Market Opportunity

The solar panel household market has been growing steadily in recent years due to increased awareness of renewable energy and its benefits, and the decrease in solar panel costs. The cost of solar panels has decreased over the years due to technological advancements in solar panel technology, like the introduction of photovoltaic (PV) solar panels. PV panels are composed of cells made from silicon which capture photons from sunlight and convert them into electrical energy. Silicon is one of the most abundant elements on Earth, making up a significant portion of the Earth’s crust. The large and stable supply of silicon has a direct impact on the cost of silicon-based panels, as they enable cost-competitive manufacturing of solar panels.

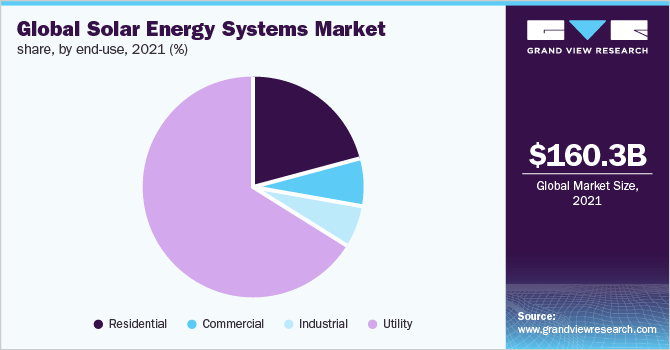

Global Solar Energy Systems Share by End Use (Grand View Research)

The global solar energy systems market size was valued at $160.3 billion in 2021, and an annual CAGR of 18% is expected between 2022 and 2030. The US solar energy systems market is projected to grow at a CAGR of 15.4% between 2022 and 2030.

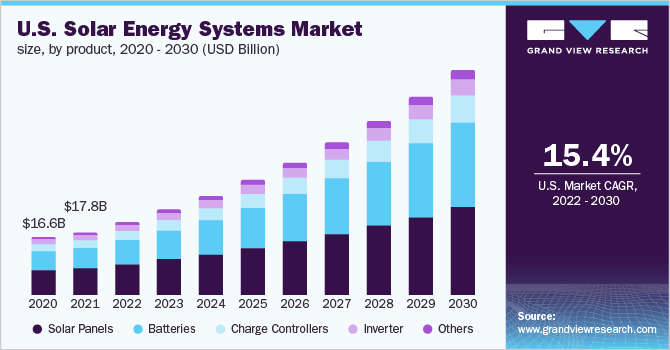

US Solar Energy Systems Market (Grand View Research)

In terms of power capacity, the solar energy market is expected to see a CAGR of 12.72%, growing from 1.17 terawatt to 2.12 terawatt between 2023 and 2028, research by Modor Intelligence shows. Overall, I believe these projected growth rates are attainable as the world is constantly implementing policies and technologies to cut greenhouse gas emissions.

Financials and Valuation

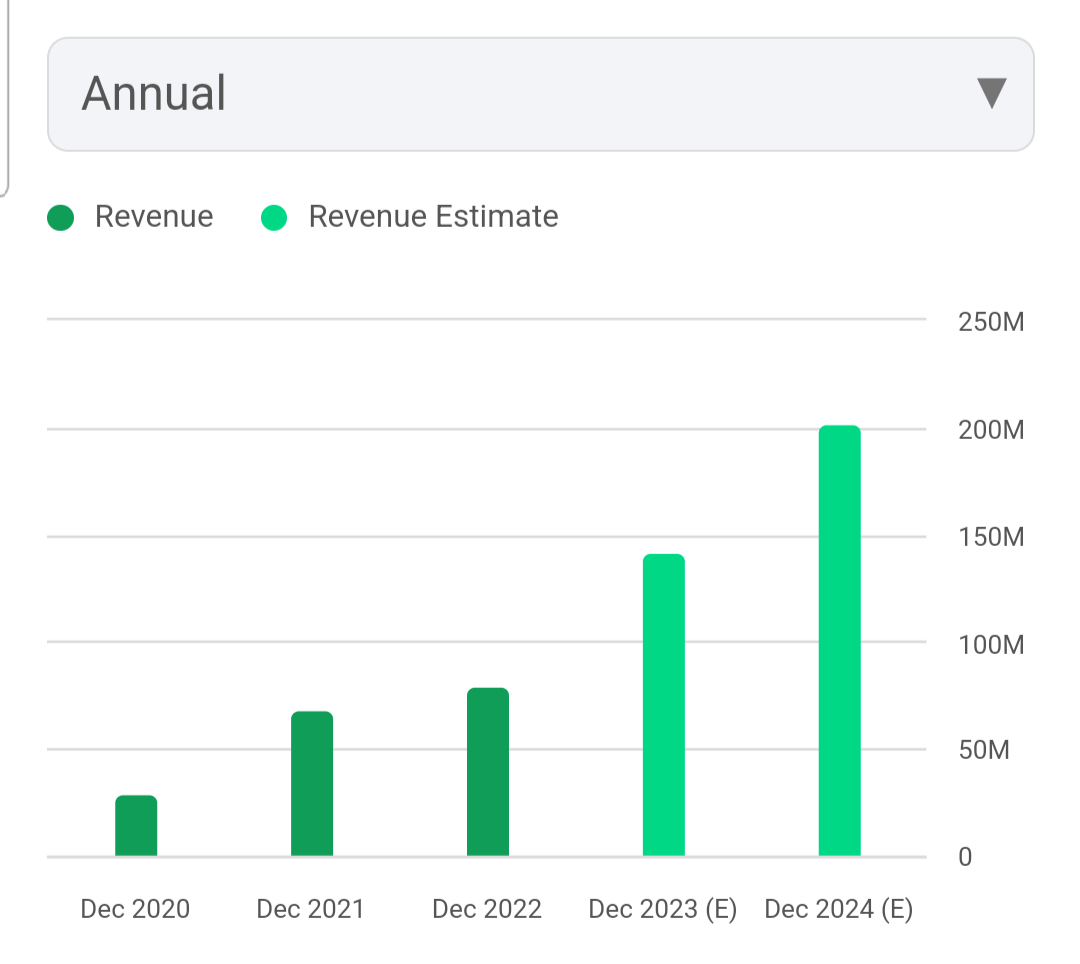

Annual Revenue (Seeking Alpha)

CSLR’s annual revenue has been on the upside for the past three years. The consensus estimate for the end of FY2023 projects a ~77% increase in revenue, which is an expected increase from $79.8 million (current TTM) to $142 million by the end of 2023. In the latest financial results (Q2 2023), Complete Solaria recorded a decrease in its top line over the previous quarter (Q1) which the company management attributed to a surge in orders, resulting in an operational problem at one of its fabs.

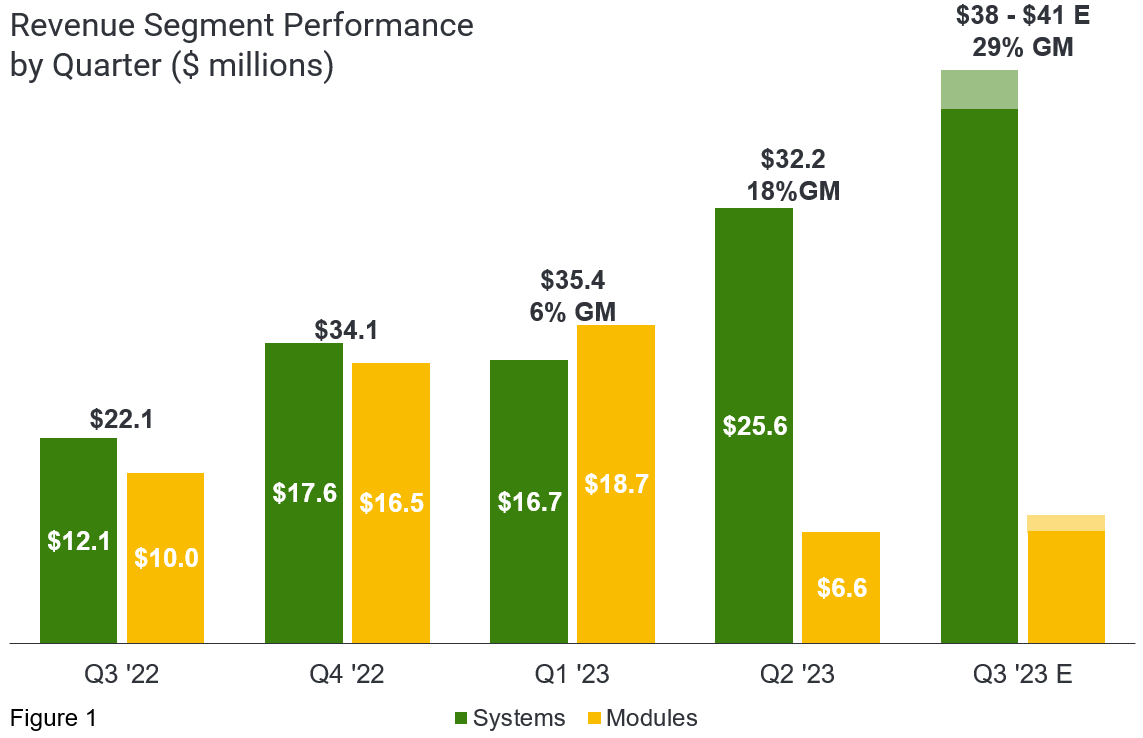

The company’s gross margin for Q2 was 18%. Despite the decline in its top line over the previous quarter, Complete Solaria’s Systems revenue saw a 54% QoQ growth, representing 80% of Q2’s top line. Modules revenue saw a 65% QoQ decline. Complete Solaria has indicated that it will continue to wind down its Module business (the company’s segment focused on the manufacture and sale of individual solar panels or solar modules) and focus more on its Systems business (its segment focused on the design, sale, and installation of complete solar power generation systems), as the sales price from its Systems business is $3.60 per watt compared to sales from the Modules business which is $0.50 per watt. The company believes this will increase the gross margin by over 10 percentage points from Q2 to Q3.

Revenue by Segment (Complete Solaria)

In my view, the strategy to shift focus from the Modules business to the Systems business appears to be a well-founded approach for achieving gross margin growth. The company’s assertion that this transition will increase gross margins by over 10 percentage points is reasonable, given the broader industry trends. Solar module prices continue to see a steady decline because there are many solar panels available for sale due to high inventory levels, and manufacturers are reducing their prices to sell them faster; this problem is further compounded by the prevalence of solar products from Chinese manufacturers in the solar modules global supply chain. I believe the cost (sales price) of modules will continue to decline for the foreseeable future as more readily available raw materials, like Perovskite, become mainstream and engineered to be efficient in the production of solar panels.

Since Q4 last year, Complete Solaria has reported a negative operating income. Its cash flow trend also seems bleak. The company has reported a negative net change in cash since Q1. Q2’s net change in cash was $(68.5) million, implying that the company burned an average of ~$23 million monthly in Q2. This cash position is a legitimate cause for concern and is one of the main reasons I won’t recommend a buy for this stock at the moment. In the Q2 press release, the company stated that it “plans to sell certain Modules assets to a global tier-1 solar panel manufacturer, which will provide cash to the company.”

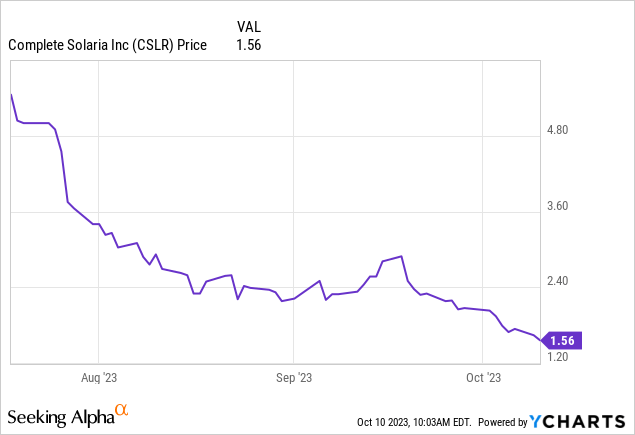

Since listing on Nasdaq on July 18, CSLR has fallen by ~70%. While I consider this an unsurprising price correction, following the listing and the initial momentum, and I’d typically expect a price rebound, the company’s cash position makes this stock unattractive, in my view. Valuation metrics for CSLR show an EV / Sales (TTM) of 44.58x which is significantly higher than the sector median of 1.63x. This shows how overvalued this stock might be. While in some cases a high EV/sales multiple can be a positive sign, indicating that investors are optimistic about the future sales prospect of a company, this is not the case for CSLR. On the balance sheet, both current and long-term liabilities are higher than the company’s current and long-term assets; this debt load impacts CSLR’s EV/Sales.

Risks

Financial Stability and Debt Position

The company’s cash flow situation is a concern. The negative net change in cash and the high monthly cash burn rate raise some concerns. The planned sale of certain assets may provide a temporary cash infusion, but it’s essential for investors to monitor the company’s cash flow and liquidity closely.

Competition

The solar industry is highly competitive, with many major players vying for market share. Complete Solaria faces competition not only in the solar panel manufacturing sector but also in the broader renewable energy market.

Execution Risks

CSLR’s strategic shift from the Modules business to the Systems business carries execution risks. Successfully winding down the Module business while expanding the Systems business will require management and operational prudence. Any missteps in this transition could impact the company’s financial performance.

Takeaway

While the solar industry offers great potential due to sustainability efforts and government incentives, CSLR’s cash position is a cause for concern. The company’s strategic shift toward the Systems business is a positive move, but execution risks must be closely monitored. CSLR’s stock has also experienced significant price volatility since its Nasdaq listing. With a high EV/Sales ratio and a debt-laden balance sheet, the stock appears overvalued relative to its financial position. At the moment, I would not recommend buying or holding this stock.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here