The first half of 2023 saw tremendous downside in the value of most office REITs. However, around June, the segment saw a surge in deep value recovery investment activity, leading to a significant positive revaluation of most top-office REITs. One of the largest, Vornado Realty Trust (NYSE:VNO), is roughly flat YTD but has risen by approximately 43% over the past six months. This “recovery rally” slowed in September, causing VNO to slide around 13% over the past month.

Vornado is one of the most interesting REITs today because it is large and exposed to issues facing commercial urban office properties. Vornado trades at a very low forward “P/FFO” of ~8X but has a high short interest of 12.5%, implying many are better against the firm. The REIT is among the few that currently does not pay dividends after suspending it over spring, implying the company is still concerned about liquidity and solvency risks and does not earn a notably positive income.

I covered Vornado last during the 2020 crash with a neutral outlook. At that time, I believed the company was trading below its NAV but that its fundamental value was still likely to decline. Over the following 18 months, the stock had a small rebound as investors purchased it as a discount opportunity. However, since the explosion in interest rates in 2020, the REIT’s NAV deteriorated much more quickly. The stock rebounded considerably over recent months but has begun to slow over the past month.

With VNO’s rebound recovery under pressure, I believe it is an excellent time to take a closer look at the company. Vornado will face immense pressure over the next year as its vacancy rate rises and its revenue slips on leasing pressures. Further, with interest rates remaining so high, Vornado’s fundamental value should continue to slip as capitalization rates increase. That said, the stock may be sufficiently discounted today to offset its significant risk factors.

Vornado’s Fundamental Pressure Still Growing

Vornado is unique among REITs because it is very concentrated in Manhattan, New York, office and retail properties. Last quarter, 88% of its NOI was from New York City, while 6% were from Chicago and San Fransisco, both facing similar issues to NYC. In the past, it was among the largest REITs on the market but has a very concentrated portfolio that lacks significant diversity. In the past, when NYC offices were among the “best of the best,” that suited the company. However, as office buildings become vacant, it is a significant issue for the firm.

Based on the latest surveys, Manhattan offices boast a vacancy rate of ~17.3%, which is near the national average and up significantly over its historical range. Manhattan has seen the greatest total selling volumes, with Class A building prices falling by a staggering 35% vs. last year. Despite this, Manhattan office space under construction remains high at ~6.5M square feet. Additionally, due to slowing leasing activity, asking rents are starting to slip, down 2% YoY but still the highest in the nation.

Still, there are some reasons for investors to be hopeful. Recent studies show that nearly 60% of Manhattan office workers are back at their workplace, with total office activity at ~73% of the pre-pandemic normal level. Manhattan’s office vacancy rate was also down very slightly in Q3 at 16.5%; of course, that measure differs slightly across survey providers. That said, leasing activity fell 33% YoY while asking rents slipped an additional 1% QoQ. Thus, while vacancies may be stagnating, that may be caused by growing rent discounts in prime office space.

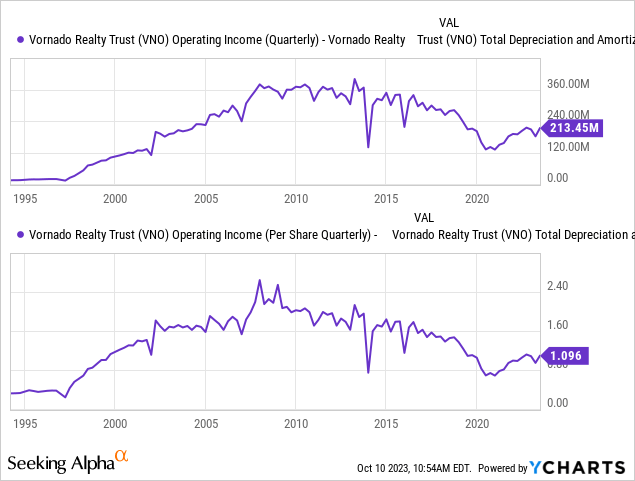

Vornado has fared better than average, with a Q2 office occupancy rate of 91.9% and total occupancy of 90.1% in New York City. The company’s NOI has also been decent despite the substantial decline in its stock value. Vornado’s NOI per share peaked around 2008 and has decreased since then. The company went into 2020 in a historically weak position and saw its NOI crash that year. However, since its 2020 lows, the firm’s NOI has risen by around $85M per quarter, or ~60%. See the data below based on operating income plus depreciation:

(note, unseen in charts, the depreciation and amortization measure is multiplied by -1)

Vornado is performing well despite the poor circumstances in leasing activity across the Manhattan market. As detailed in its last investor call, this is due to the company shifting its portfolio toward higher quality assets with better-starting leases per square foot. Its latest starting rent was $91.57 per square foot. That figure is roughly typical of Midtown Class A properties but above the norm for Manhattan overall.

Accordingly, Vornado is betting heavily that retail and office trends will be toward quality. In large part, the trend in central business districts over recent years has been highly negative for Class B and C properties and generally positive for Class A. If a company is going to pay for office space in the work-from-home environment, they’re expecting good amenities and lively business environments. Indeed, this trend will likely be critical as companies in the central business districts must attract workers who generally prefer to work from home.

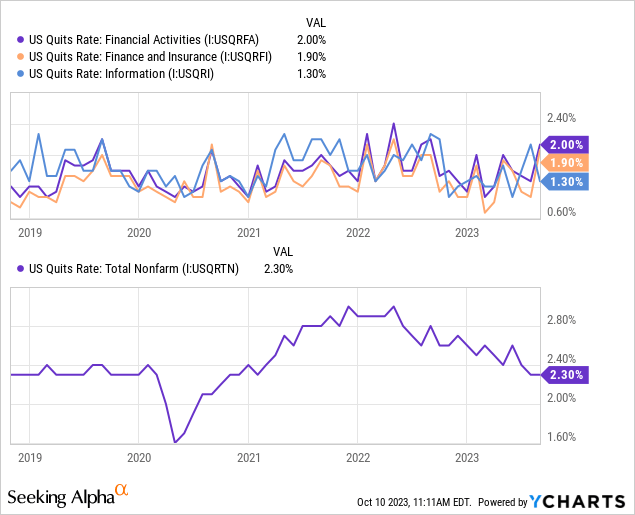

Crucially for Vornado, a recent survey showed that two-thirds of financial services industry leaders would leave their firm if required to work in the office full-time. Vornado’s prospects have benefited from the recent office work mandate trend amongst large financial and technology companies. An interesting 2022 McKinsey survey showed that just 13% of workers preferred to work in the office full-time, with most preferring hybrid work. These sentiments are mirrored in quit data. During the high-quits period of 2021 to early 2023, financial and information technology workers had a relatively low and stable quit rate. Conversely, despite the decline in the overall quit rate, financial and information technology workers have seen a rise in their quit rate over recent months. See below:

These typically higher-paid office workers still have a lower quit rate than the national average. That said, quits are rising for this segment (which is more critical for Manhattan offices) but falling overall. In my opinion, this shift may likely be due in part to office work mandates, given previous surveys suggested many would quit if made to return to the office. Still, while notable, this trend will not be crucial for Vornado unless it continues for some time.

Overall, I believe it remains unclear how long it will be before Vornado’s NOI declines due to these strains. For now, it has avoided the outcomes of most lower-quality office properties. Still, I can’t entirely agree with Vornado’s management’s view that they will not be impacted by this trend based solely on historical stability. As leases expire and more employees demand work-from-home, it will likely be difficult for Vornado to avoid seeing its occupancy level decline. Further, as other offices become cheaper, I expect even Class A Manhattan properties will face some competition. Still, the most significant issue for Vornado is not necessarily its NOI risk but valuation risks related to interest rates.

What is Vornado Worth Today?

Historically, property capitalization rates have a strong relationship with real interest rates on Treasury bonds, measured by inflation-indexed Treasury securities. Those bonds pay a small yield plus the inflation rate. Commercial mortgages tend to rise and fall with longer-term Treasury rates; however, real rates are more relevant because rents generally rise with inflation in the long run. Of course, that is not true for office properties in Manhattan today, where rents are declining, but that is accounted for in growing cap rate spreads for office space.

Capitalization rates lag behind real interest rates by 6-24 months, with that length being longer during times of lower property transaction volumes, such as today. At the 2021 US cap rate minimum, Tier 1 offices had average capitalization rates of around 5.5%, while high-quality retail was ~6.8%. As a generalization, about 80% of Vornado’s NOI is office, and 20% is retail, so its weighted average minimum cap rate was likely ~5.7%. The real interest rate on 7-year Treasury bonds has risen from -1.5% at the end of 2021 to 2.5% today, or a total increase of 4%. Commercial mortgage rates are up similarly over that period, currently at ~7.5% today, making it very unprofitable to buy properties at cap rates below 7.5%.

Since real rates began to rise, property prices have declined due to a sharp positive movement in fair-value capitalization rates. This trend has been more significant for office properties than others but has impacted all nearly equally. Capitalization rates had not entirely adjusted lower in 2021 with the huge negative real rate decline, so a total increase related to real rates will not likely be 4% but probably closer to 3%. For now, I will not value Vornado with a higher cap rate spread due to NOI decline risks associated with vacancies and rent cuts because it has thus far avoided an NOI decline. However, this factor remains a significant downside risk for Vornado.

Valuing Vornado’s properties at a 9.8% capitalization rate, up 3% from its 2021 estimated lows, its buildings are worth an estimated $11.7B based on an annualized NOI of $1.15B from its own NOI measurement (which includes a partially owned entity portions and deducts noncontrolling interests). Vornado also holds $3.76B in land, development, and improvement projects at the cost associated with its Penn project. I will account for those at cost, but the project may eventually be a net loss or gain depending on changes in market stability. The company also owns a total of ~$1.9B in other tangible assets, excluding intangibles and partially owned entities (which are accounted for in properties’ NOI).

Based on this estimate, I believe Vornado’s net asset fair value is likely around $17.36B. That is not necessarily its value today, but its fair value based on my outlook for capitalization rates in its property type. Against that value, Vornado faces $9.96B in total liabilities and $480M in redeemable noncontrolling interests. Additionally, the company has $1.18B in preferred stock, bringing the entire difference between its assets and common equity to ~$11.62B. Subtracting that from its estimated asset value, we arrive at an estimated NAV for common equity at $5.75B.

The Bottom Line

This tangible NAV estimate is 30% above Vornado’s current market capitalization, indicating a share-price target of $28.5. Of course, my estimate does not account for risks associated with NOI strains, but it also assumes that capitalization rates will continue to rise due to real interest rates. Further, the value of Vornado’s development projects and various intangible assets is debatable. That said, to me, these are all very reasonable assumptions about market conditions. I believe VNO is likely undervalued or, at least, trading near its fair value if it were to liquidate its portfolio and assets.

Since I believe VNO may be undervalued, I must be very bullish on the stock. Not necessarily; in fact, I am not bullish on it and have a relatively neutral outlook. While VNO is likely trading below its NAV, the risk in its property portfolio is skewed negatively. In other words, its portfolio has been remarkably resilient against the work-from-home trend, and I value the company essentially assuming that resilience will continue. Should economic pressures negatively impact the NYC financial sector or the WFH trend rebound, Vornado’s properties could be worth considerably less than I’ve estimated. Still, the fact is that its portfolio has operated very well despite strains, so there is little need to assume that will change very quickly soon.

Further, VNO is not too attractive to me from a technical standpoint. The stock is flat YoY but up tremendously over the past six months, so it is no longer priced for significant investor fear. Its performance has also slowed considerably over the past month, indicating it may soon be stuck in a trading range around its current price. Personally, I would wait to be bullish on VNO until its dividend is restored and it finishes its recent “quality shift” efforts.

Further, I will wait to be bearish until a significant catalyst points toward lower NOIs in high-quality Manhattan properties. Restoring its dividend would be another bullish catalyst that may occur around year-end. Of course, a more significant increase in real interest rates, which I do not strongly suspect, or a recession, which I do suspect, could soon be bearish factors facing VNO. Thus, its current price appears extremely reasonable but unlikely to deliver outsized price changes in either direction without a new market catalyst.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here