After my initial article on Runway Growth finance (NASDAQ:RWAY) I was eagerly waiting the next batch of results to see how the company has been performed over the last quarter. Now that some time has passed post the collapse of SVB and several other smaller banks we could get a peek into the impact, if any, this has had on the Venture Capital (VC) markets in general and the roster of clients on the RWAY rolodex in particular.

Let’s dig in.

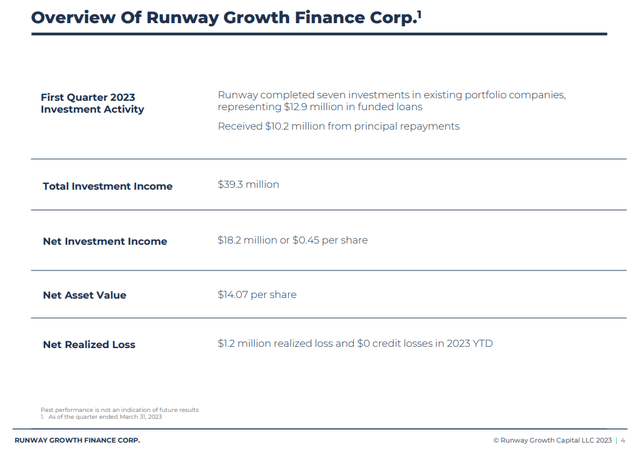

Earnings

Total Investment income came in at $39.3m (vs $36.8m last quarter) whilst net investment income settled at $18.2m (vs $18.4m last quarter). On a per share basis this net income figure translated into 45c for the period which was in line with consensus and flat on a quarter-on-quarter basis. Expense growth jumped a bit too however, higher interest expense was the largest driver here, management fees were a bit higher and incentive fees were a tick lower. The expense figure of $21.1m was up from $18.4m in Q4 2022.

Overall higher costs offset higher income and resulted in flat earnings for the quarter-on-quarter period.

Investments/Portfolio

Over the quarter there were seven new loans issued for a total of $12.9m and at the same time $10.2m worth of repayments were received. There were some losses on investments too which totalled $1.18m. The total investment book rose to $1.16bn from $1.14bn last quarter.

Quarterly Activity (Company Presentation)

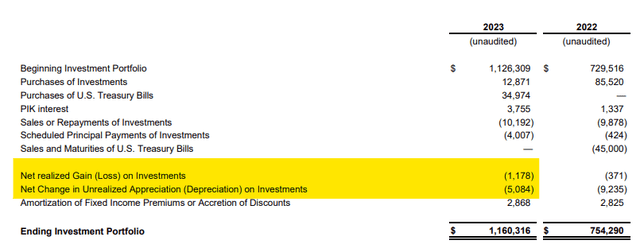

Of the portfolio 95% sits in senior secured loans and the remaining 5% is in warrants and equity related investments spread out in forty-nine portfolio companies. Mark to market changes in this smaller part of the portfolio from certain restructuring efforts weighed on the Net Asset Value (NAV) of the portfolio. The realised loss and what looks like an unrealised depreciation on investments (loss) figure weighed in too and caused NAV to dip to $14.07 from $14.22 last quarter. These figures are highlighted below and was a turnaround from the last quarter where realised/unrealised gains or losses were a positive $132k.

Portfolio Reconciliation (Earnings Release)

This tells me two things, firstly the debt portion of the book (95% of the portfolio) is steady. It’s the equity/warrant part which is of course subject to far more volatility and mark to market pricing which is causing some pain this quarter. Although an unwelcome weight to earnings now this is the part of the portfolio that stands to post potentially larger gains when economic activity and business conditions stabilize and turn positive again.

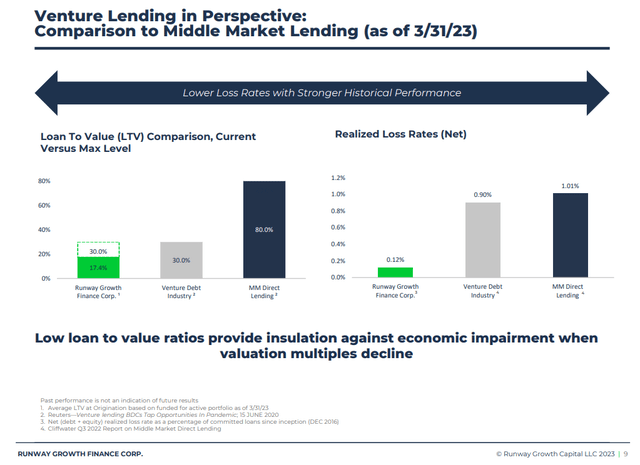

LTV and Loss ratios vs industry and peers (Company Presentation)

Losses are part of the lending game as we know, they are par for the course. It’s comforting to know however that loss rates are RWAY are well contained and a lot lower than the VC and direct lending industry as a whole.

Commentary

What was interesting to note was that the entire $12.9m of new loans deployed came from existing agreements where original draws were delayed. On top of this they still have about $63m worth of loans approved but undrawn that can be used this year. This points to pretty conservative positioning by management as they haven’t brought ‘new’ loans or customers onto the balance sheet. At the same time though it does provide some line of site to where we can see some growth come from for the rest of year should no new loans or customers come onto the books from here. It seems to me that for the first quarter anyway management have adopted a wait and see attitude.

I’m going to assume that this conservative behaviour has something to do with the current ‘state of things’ in the market and economy and I’m pretty comfortable that management are playing it safe until we get more clarity on whether or not inflation and interest rates have in fact peaked, how the economy eventually digests all the current hikes and of course whether we see a recession or not as the year progresses.

Leverage bumped up a little but is still below the 1.1x level the company said they’d like to get to and well below the peer group average which is around the 1.3x mark. So, there still is flexibility and leeway with some room to maneuver if an opportunity presents itself.

Conclusion

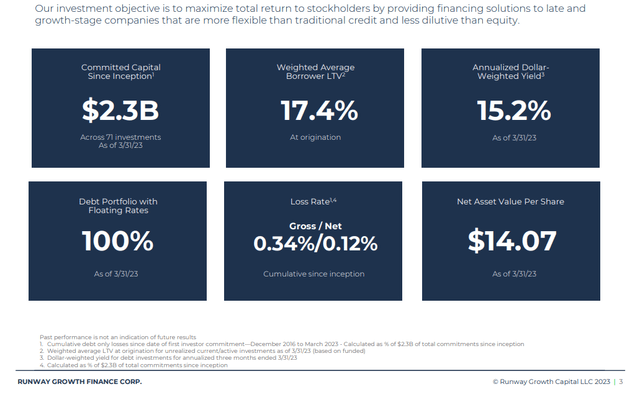

I’d call this a solid and steady quarter for RWAY in what is a challenging environment, within an ever tougher macro backdrop. Despite some small losses and higher expenses, earnings remained flat which is testament to the earnings power they have built since they started the business. Lower than target leverage and significantly lower than peer group leverage helps reduce the risk somewhat versus other investments in this space, as does the fact that 95% of the book is in steady senior secured and first lien debt where the loan to value (LTV) of the underlying companies is a meagre 17.4%

Summary (Company Presentation)

During the conference call the point was made that the current supplemental dividend of 5c per quarter is likely to be maintained subject to any significant adverse occurrence and that once leverage reaches 1.1x its likely to stay around that area which implies the business will in all likelihood run at below peer group averages for the foreseeable future at least, perhaps even permanently.

For a more in-depth overview of the risks associated with RWAY please see my prior article here.

Other than those mentioned there I’d add that the equity investment in underlying companies clearly does show that veering away from the core top of stack debt strategy does carry some additional risk, the true merits of which will only be truly presented in an environment where interest rates are lower and the business environment is stronger, I’m sure that this part of the cycle is coming at some point but it’s worth noting the impact this can have on NAV for one thing and the opportunity cost of not having those assets sit in more immediately return generating assets for another.

I consider the reiteration of the supplemental dividend as management saying they are comfortable with how the business is performing in the current environment and as a result am happy to keep nibbling as the share price swings provide opportunity.

I’ll say again though that these investments are higher risk and that liquidity in this name is also quite small due to the large key shareholders here. So keep that in mind when deciding on your position size should you choose to invest here.

At current prices we have a dividend yield of 16% and a discount to NAV of over 20%. If you purchase or add to your position before the close of business on the 11th of May, you’re still in line to collect 45c in income which boosts the yield considerably from a year-on-year perspective to $2.25 for a yield on cost of 20% assuming all remains the same.

Read the full article here