Investment Thesis

MercadoLibre (NASDAQ:MELI) is experiencing robust growth and maintaining profitability, offering an attractive investment opportunity. However, there’s a noticeable concern that has kept some investors at bay, primarily the deceleration in its fintech business, which remains evident.

That being said, I’d like to make the case that this stock is currently valued at just 25 times forward income from operations, a valuation that, as you’ll soon see, is remarkably enticing.

Quick Recap,

In my previous bullish analysis, I said,

Investors had latched on to one story, that of MercadoLibre as a rapidly growing Fintech business. But in the past few quarters, the Fintech business hasn’t lived up to investor expectations.

However, I make the case that its story isn’t over. And that, with a few more quarters of consistent around 30% revenue growth rates, investors should be more than willing to jump back into the name, as they’ll believe that it’s now “compelling once again.”

After all, the stock needs a transitional phase where investors realign their expectations to view MercadoLibre as a 30% CAGR business rather than the previously expected +50% CAGR.

Let’s take a closer look at the ongoing concern related to the slowing fintech business.

MELI Q2 2023

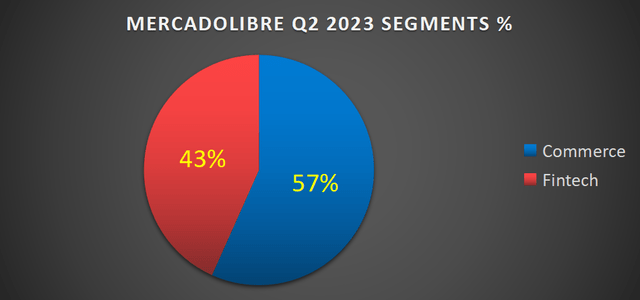

As of now, nearly half of MercadoLibre’s revenue comes from its Commerce business, while the other half is contributed by its Fintech business.

MercadoLibre’s fintech business is a dynamic segment within the company, with a strong presence across various Latin American markets. Notably, its operations in Mexico present an enticing opportunity, capitalizing on the country’s sizable population and its relatively lower adoption of financial services compared to other Latin American markets.

Mercado Pago, the fintech arm, caters to both payers and merchants, leveraging the user base within the company’s ecosystem. Users can easily open digital accounts, and their funds can earn interest through partners, while various financial services, including money transfers and online payments, are provided to meet the remittances demand in the market. The business also extends its offerings to include credit and insurance products, contributing to a comprehensive fintech ecosystem tailored to the core financial needs of consumers in the region.

Now, let’s examine the recent developments within the fintech business.

MELI Q2 2023

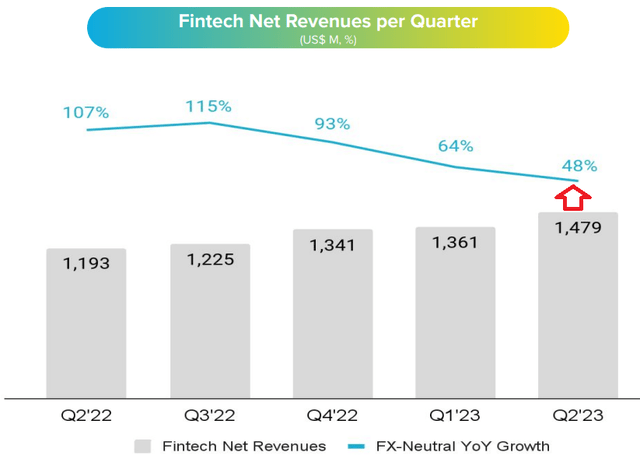

A closer look at the data reveals a notable deceleration in MercadoLibre’s fintech business with each passing quarter. Investors are understandably concerned about the rate at which the fintech business will stabilize.

Moreover, there’s an additional challenge for the fintech business – the customer adoption curve.

MELI Q2 2023

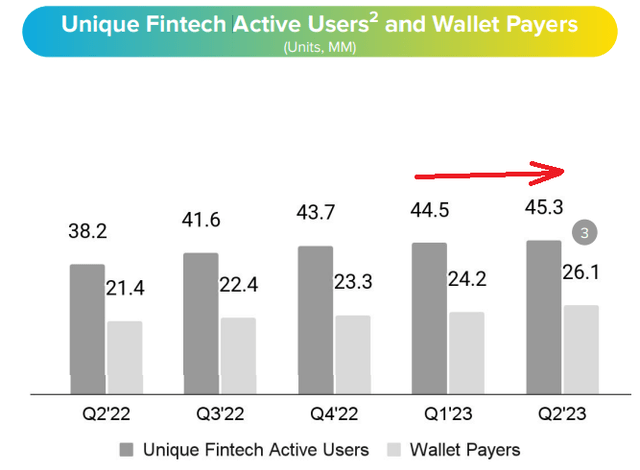

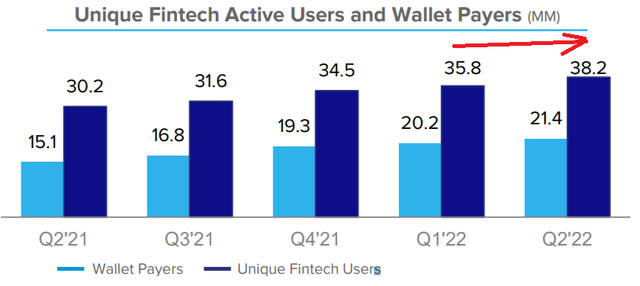

I’ve often emphasized the significance of the customer adoption curve as a key indicator of business health. Is the business thriving or stagnating? The answer is often found in the customer adoption curve.

MELI Q2 2022

For context, let’s go back to the same period a year ago, Q2 2022. During that time, the sequential growth in active fintech users, moving from Q1 2022 to Q2 2022, was 6.7%. In contrast, in the most recent quarter, Q2 2023, the sequential growth was only 1.8%.

Although these differences might not seem significant at first glance, it’s essential to remember that we are comparing a 90-day period from one year to the next. In valuing a growth stock, anything less than impressive growth can potentially weigh on the stock, especially in uncertain market conditions.

Now, let’s discuss why I maintain a bullish stance on MercadoLibre.

Revenue Growth Rates Will Stabilize

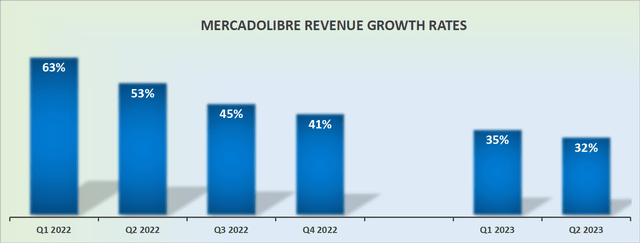

MELI revenue growth rates

Looking ahead, MercadoLibre’s comparables for Q3 and Q4 will become significantly more favorable. Moreover, as we project into 2024, the company will be competing against 35% year-over-year growth rates instead of the previous +50% CAGR.

With a lower growth threshold in the future, investors have every reason to stay committed to this stock. However, there must be a temporary period where investors adapt to MercadoLibre as a mid-30% CAGR business with a corresponding valuation.

Now, let’s shift our focus to the core bullish case for MercadoLibre.

Impressive Profitability

What I’ve consistently found appealing about MercadoLibre is its dedication to profitability. It’s crucial to note that a focus on profitability doesn’t mean a business was initially profitable. Instead, it means that MercadoLibre has prioritized being self-sustainable and delivering profitable growth, rather than pursuing growth solely for the sake of expansion.

MELI Q2 2023

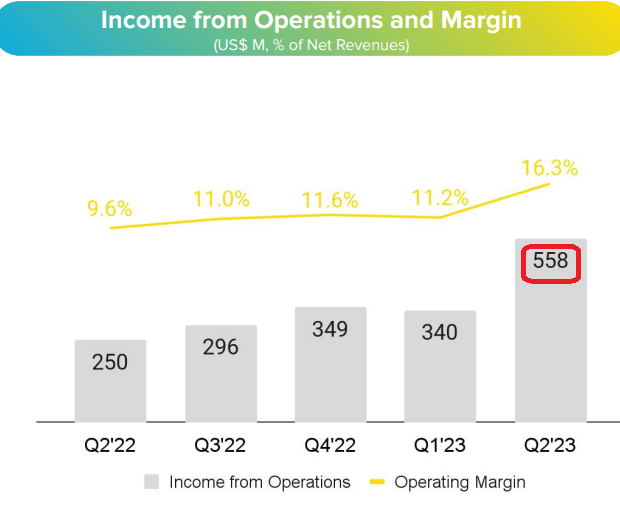

This dedication has translated into MercadoLibre’s income from operations growing at an impressive 123% year-over-year, significantly outpacing its revenue growth rates.

At this pace, it’s highly likely that MercadoLibre could report $2.5 billion of income from operations over the next twelve months, a figure that is certainly within reach. Currently, the stock is valued at just 25 times forward income from operations, a very reasonable valuation for a company that is clearly growing at a rate of 30% or more.

The Bottom Line

I believe that MercadoLibre presents an exciting investment opportunity. While concerns about the deceleration in its fintech business have persisted, the stock’s valuation, at just 25 times forward income from operations, is undeniably attractive.

The company’s dedication to profitability, with income from operations growing at a remarkable 123% year-over-year, sets the stage for future success.

Despite the recent slowdown in the fintech sector, there is potential for a return to compelling growth, provided the next few quarters maintain around 30% revenue growth rates.

As the market aligns its expectations with MercadoLibre as a mid-30% CAGR business, the stock holds promise, especially with more favorable comparables ahead.

The company’s presence in the Latin American fintech market, notably in Mexico, is a significant strength, offering a comprehensive fintech ecosystem that caters to the financial needs of consumers in the region. While challenges persist, including the customer adoption curve, the long-term outlook remains promising.

Read the full article here