- Note: For your convenience and our collective sanity, I will use calendar year quarters. The staggered fiscal year reporting formats serve to create confusion, especially for those not spending their waking moments studying these businesses. So we will use calendar year and the corresponding quarters for all discussion herein.

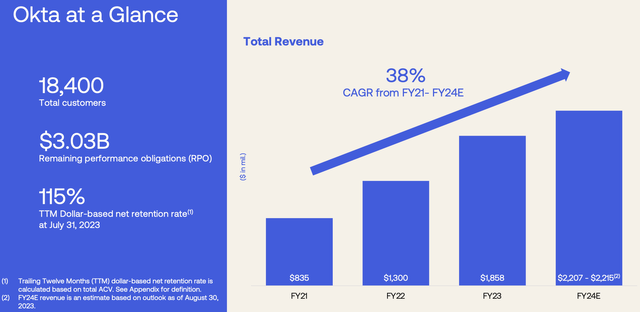

Okta’s Rapid Growth As The Leading Cloud-Native Identity Security Platform Globally

Okta Q2 2023 Earnings Presentation

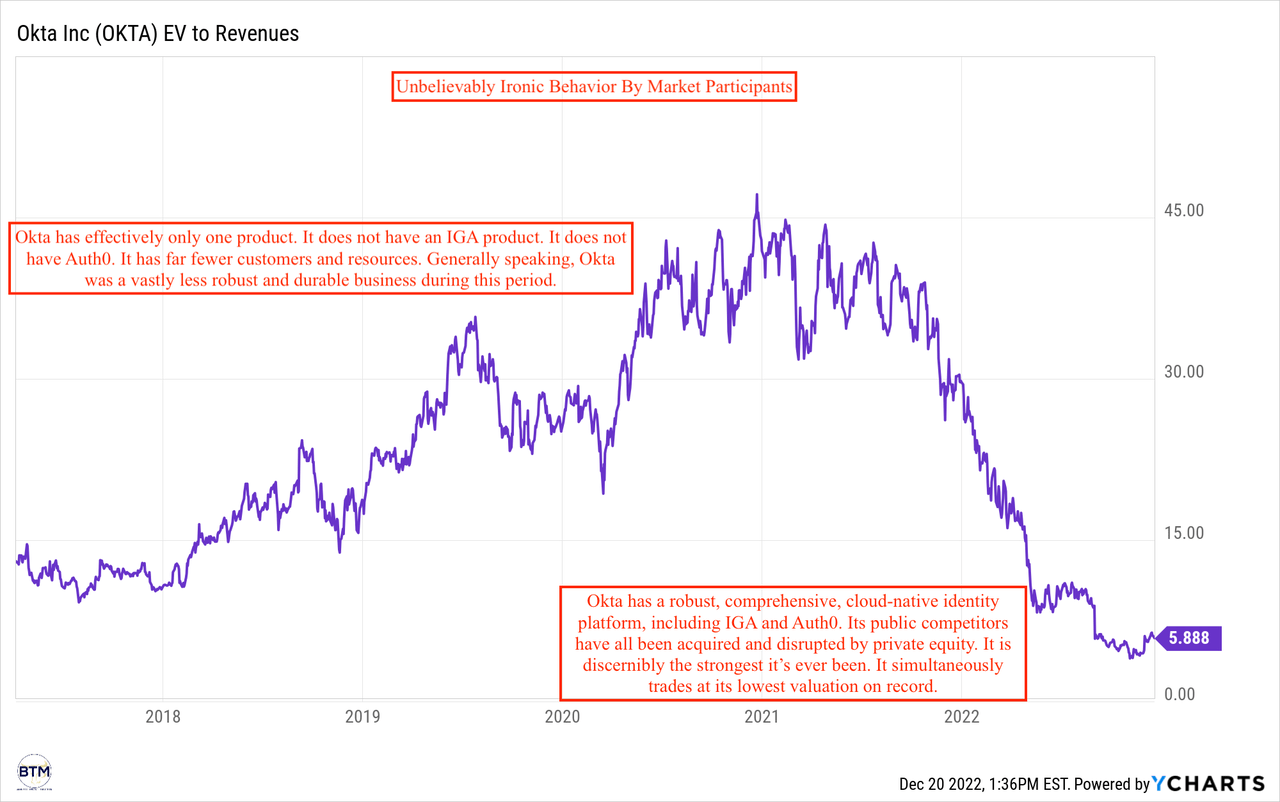

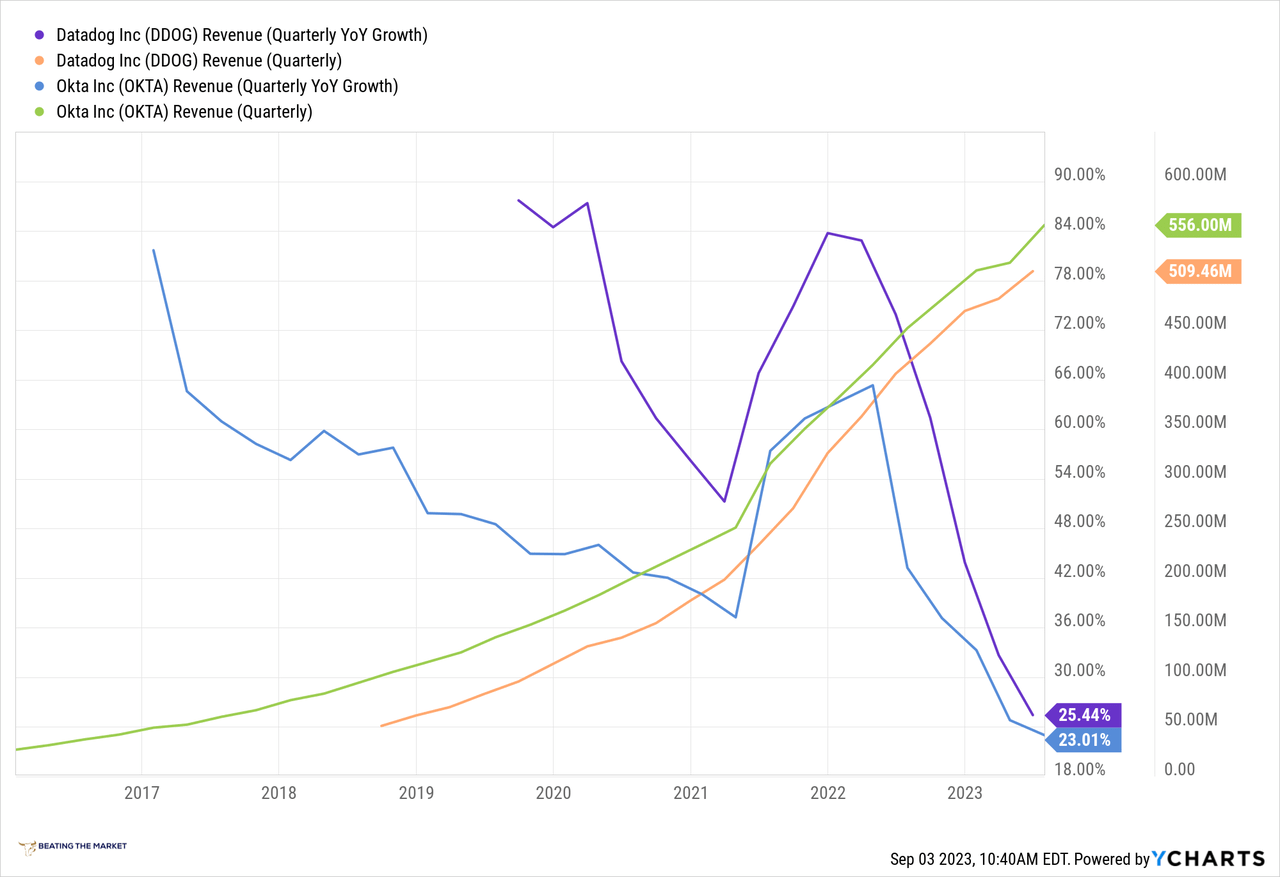

The Market’s Shifting Perception Of Objectively The Same Business

YCharts

- Note: I understand that we have experienced the fastest interest rate hiking cycle in American history. I understand there’s an affordability crisis in the U.S. economy presently, creating a drag on growth and creating rapidly rising credit delinquencies. I understand Okta’s (NASDAQ:OKTA) growth has slowed as a result of these factors. Were the market truly efficient, as The Efficient Market Hypothesis suggests, then it would have baked all of this into Okta’s valuation in 2019-2020, instead of pricing it at 15x+ EV/sales, which kept me away from the company at the time. Today, it would be baking in the good times that will inevitably come in the years and decades ahead, but, alas, it is not, and the market is not efficient.

I would ask that you excuse my erroneous description of Okta in the title of the chart of Okta’s valuation just above.

The title should instead read, “The Market’s Shifting Perception of Objectively The Same Business, Which Has Strengthened To A Noteworthy Degree In The Last 24 Months.” The evidence of which can be seen in Okta’s most recent quarterly revenue figure illustrated below:

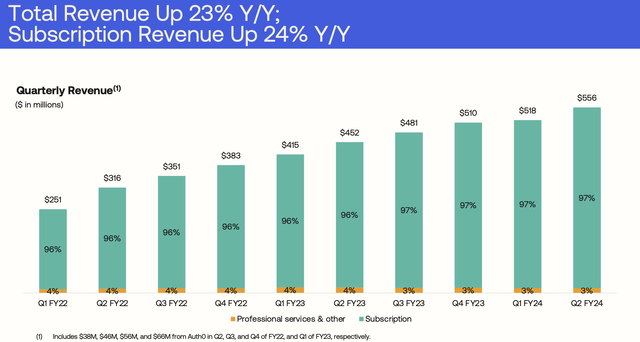

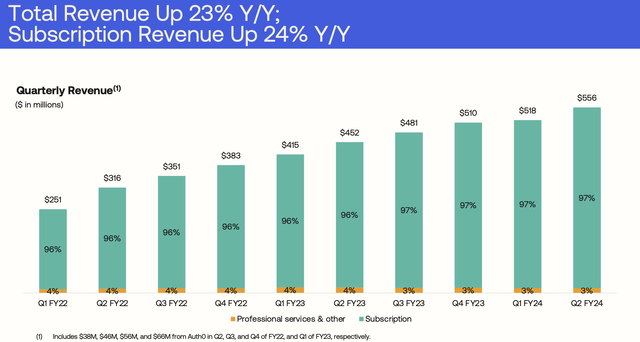

Okta’s Healthy Sales Growth Which Accelerated Sequentially In Q2 2023

Okta Q2 2023 Earnings Presentation

Indeed, Okta Has Strengthened, But There Have Been Some Speed Bumps

I would be remiss to not mention that Okta has had some issues with its execution over the last 24 months.

Specifically, following its acquisition of Auth0, which is a phenomenal Customer Identity platform selected by leading companies like OpenAI (creator of ChatGPT), Okta made poor strategic decisions in structuring its Go To Market motion/strategy.

So OpenAI is super interesting. OpenAI is a customer identity cloud customer, which, when you log in to ChatGPT, you log in through Okta. And it’s interesting because a developer inside of OpenAI three years ago picked our customer identity cloud, because it had a great developer experience, from the website and started using it. At the time, it was the log-in for their APIs and then ChatGPT took off. And now, as you mentioned, we’ve had really pretty sizable transactions with them over the last couple of quarters. And so it’s a great testament to our strategy on customer identity, having something that appeals to developers.

Todd McKinnon, CEO, Q2 2023 Okta Earnings Call

Following the Auth0 acquisition, Okta configured its Go To Market strategy such that sales representatives (reps for short) would sell both Workforce and Customer Identity clouds [WIAM & CIAM respectively], and this proved to be too challenging for Okta’s reps, as the platforms and their end users differ to the extent that it’s not optimal for the same rep to sell both platforms, i.e., to sell both clouds simultaneously (WIAM & CIAM).

CEO Todd McKinnon conveyed these nuances in stating,

The fact that it’s traditionally been the way you do Identity is, you have a big on-premise installation and you control it yourself, and it’s in your data center. It’s legacy software. It’s really tightly coupled with the stack, whether it’s Oracle or IBM, and that’s on the Workforce side.

And then on the Customer Identity side, it’s really build it yourself. Maybe it’s open source. Maybe it’s just build your own password checking and registration form and roll your own.

Todd McKinnon, CEO, Q2 2023 Okta Earnings Call

In tandem with the poorly configured Go To Market strategy, sales rep flight occurred, and sales rep productivity declined.

Additionally, a wave of prominent sales/Go To Market execs departed:

Among those who left Okta are Chief Financial Officer Bill Losch; Hector Aguilar, president of technology; Ryan Carlson, who preceded Collins as CMO and was an executive vice president; Levent Besik, senior vice president of product management; Charles Race, president of worldwide field operations; Patrick McCue, senior vice president of worldwide partners; Lennard Fisher, senior vice president of demand generation; and vice president of corporate marketing Alyssa Smrekar, according to their respective LinkedIn profiles.

Bloomberg (Shared Via Yahoo But Written By Bloomberg Writer)

And so it has been throughout 2022 and early 2023: the prevailing narrative has been related to Okta’s struggling Go To Market motion. Okta’s narrative shifted rapidly from being “The Identity Cloud” on par with Workday (WDAY) and CrowdStrike (CRWD) to a company struggling to properly configure its Go To Market motion following a blockbuster acquisition (Auth0) and amidst executive flight.

And, naturally, as is so often the case when share price declines occur, and thereby start driving narrative for the business, the Microsoft (MSFT) bear thesis once again became prominent (Microsoft has offered an Identity product since 2014 and competes against virtually every software business on earth; not just Okta).

As of today, based on commentary from management and based on the Go To Market data I will share with you in a moment, it certainly appears Okta has resolved the bulk of the issues with which the company has been beset over the last 24 months or so.

I’m assuming on the first question, what inning we’re in for execution, I’m assuming you meant kind of like Customer Identity Cloud integration, rep attrition, some of the stuff we talked about in the previous quarters.

[Here, Mr. McKinnon addresses the issues I mentioned above: improperly configuring Auth0’s Go To Market motion following acquisition and sales rep and Go To Market executive attrition.]I think that is behind us.

I think when we look at the clarity of the message of our two clouds, the participation rate of reps in the Customer Identity Cloud deals, I feel comfortable with those things. The overhang or the question there is, what is the macro impact and how long will it last?

Because we think our go-to-market and our sales team can be more productive. We think, first of all, you can always get better. There is always things we’re doing to increase productivity and get better and striving to be better tomorrow than we are today.

But I think the macro is a question mark there. We have our thoughts and our assumptions in the forecasts and in the models, but I think that the degree to which our productivity is trading off between macro and what the potential is, I think we’ll have to see how that unfolds. And I think, frankly, we’re taking a pretty conservative approach there assuming that the macro is going to be kind of is what it is for a while. We don’t think it’s going to get any worse, but we don’t think it’s going to get better tomorrow either. So, we’re being pretty conservative on that.

Todd McKinnon, CEO, Q2 2023 Okta Earnings Call

Of course, this is just commentary from management, but, as I will quantitatively demonstrate for you in the next section, Okta has demonstrably improved its Go To Market motion such that it set deal size records in Q2 2023.

Addressing Weak Customer Growth: Has GTM Actually Been Fixed?

We also experienced further improvement in metrics related to our go-to-market team, including average tenure, ramp in the number of sales reps closing Workforce Identity and Customer Identity deals. While these are all encouraging data points, we believe it’s prudent to maintain a cautious near-term outlook.

Brett Tighe, CFO, Q2 2023 Okta Earnings Call

When Okta reported earnings, I saw the revenue beat and the sequential addition of revenue (Q2 to Q3), and I was quite impressed.

In this respect, it was a truly legendary quarter for the company.

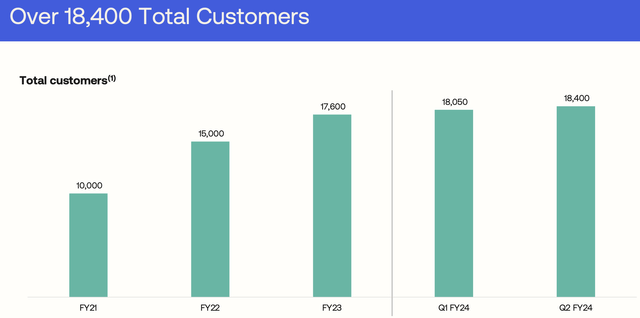

However, I then continued assessing the quarter, and I found that the company grew customers at its slowest rate ever in the company’s history.

Okta Q2 2023 Earnings Presentation

In all, we added 350 new customers in the quarter, bringing our total customer base to over 18,400, representing growth of 12%. New customer growth is an area that we believe has been impacted by the macro environment, which results in a sales environment that is more conducive to expanding existing customer relationships. The net customer adds also reflects increasing strength with larger organizations and public sector agencies. We continue to see strong growth with large customers for both Workforce and Customer Identity, and we are proud to work with some of the most important organizations in the world, such as ADT, Mars, and General Services Administration.

Todd McKinnon, CEO, Q2 2023 Okta Earnings Call

As we read, Okta added only 350 customers in the quarter, which I initially believed was indicative of a Go To Market motion that was still broken to some degree.

This concern was largely ameliorated when I tuned into the call and learned more about the sales performance in the quarter quantitatively.

In Q2, we added 125 customers with $100,000-plus annual contract value or ACV. Our total base of $100,000-plus ACV customers now stands at over 4,200 and grew 19%. Similar to last quarter, our fastest growing cohort was customers with $1 million-plus ACV.

In fact, we had a record number of $5 million-plus total contract value deals. And when you look at the total contract value of the top 25 deals in the quarter, the aggregate value was over $100 million.

Todd McKinnon, CEO, Q2 2023 Okta Earnings Call

Interestingly, for a moment, I’d forgotten the macroeconomic environment in which we find ourselves. As I shared in S1’s (S) recent SOOS installment,

- Interest rates on credit cards are the highest they’ve been in over 30 years.

- We just experienced the fastest interest rate hiking cycle in American history after 1.4x’ing the money supply.

- The combination of giant inflation and wickedly tight credit has created a genuine affordability crisis for the lower and middle class in America and likely in many countries around the world.

- Unemployment recently began to rise, and job openings are collapsing 08-09 style.

- Inflation is still persisting!

These economic realities will likely keep the valuations of many of our companies depressed, suggesting that we can continue to accumulate them at discounts to fair value.

SentinelOne: Operating From Strength With $1.1B In Liquidity And No Debt (NYSE:S)

In short, the macroeconomic environment is brutal for the average person currently, and this ripples through the sectors like digital ads and software, where growth rates have collapsed. Slowing growth and difficulty with Go To Market motions has in no sense been idiosyncratic to Okta.

Comparison Of Datadog and Okta Growth Rates & Scale

YCharts

I’ve actually been very pleasantly surprised by Okta’s growth rate resilience. I believe it has been a testament to the company’s multi-product platform, akin to Axon (AXON), monday.com (MNDY), Affirm (AFRM), Tesla (TSLA), and virtually all of my companies. I will discuss this in greater detail in a moment.

But, while the macroeconomic environment is not great currently, it will improve, and Okta’s Go To Market success/improvements will be more clearly seen in the years following the current “fastest ever” interest rate hiking cycle and the associated economic fallout.

We’re really happy with the results in the quarter, particularly a couple of the things you mentioned, the large customer momentum.

We had — the top 25 deals were over $100 million of TCV in the quarter, which is super, super strong.

We also — you mentioned the customer counts and it’s definitely an area that we think is related to macro. Our customer adds are really influenced by the small business part of our business.

And we looked into that of course, and we manage that closely, and we look at the logo churn in that number, it’s very consistent with the last several quarters.

And I think what’s happening is that smaller businesses aren’t making new purchases, and I think as the economy picks up from here, we think eventually it will pick up, we’re not sure when, but as it picks up, we believe that that part of the logo count will increase.

On the high-end customers, the $1 million-plus ACV cohort was — it’s one of our strongest quarter ever for that cohort, including some big new wins.

We had one of the leading global companies in customer experience and support signed a completely new customer to Okta over $1 million ACV deal and it was all around OIG.

So, we’re seeing a lot of new business momentum in the largest companies in the world, which is pretty satisfying. So, yes, lot of good stuff to point to in the quarter, but I think the macro environment is still, while stabilizing, it’s still not as healthy as it could be for us and our business is reflecting that to some degree, especially the forward outlook.

Todd McKinnon, CEO, Q2 2023 Okta Earnings Call

We can see that:

- The macro is negatively impacting Okta.

- But Okta’s execution of its business, i.e., new, compelling product creation, which I’ve been highlighting for the last year or so, is actually overcoming these macro challenges! Which is precisely what we’ve expected would be the case and which is precisely what we’ve seen from companies like monday.com (MNDY) or S1 (S) or Affirm (AFRM) within my coverage universe.

Yes. I would just add to that, Rob. We talked about the big deals. We actually had one of the biggest — one of the strongest big deal quarters ever in the Company’s history. So, we talked about some stats, but it’s just in general, it was a very strong big deal quarter. But not just — that wasn’t the only highlight, there’s a bunch of highlights. I mean, Todd talked about it about Customer Identity participation. That’s up into the right. So, a lot of good things we’re seeing in the business. Lot of great execution by the go-to-market team that we’re really proud of, in spite of this macro headwind.

Brett Tighe, CFO, Q2 2023 Okta Earnings Call

Okta is setting these records because it’s no longer just selling SSO and MFA to its customer base and prospects. It is now selling OIG, PAM, Auth0 (CIAM), SSO, MFA, and device management individually and as a comprehensive platform.

It’s really quite incredible to witness this evolution and the fruits thereof via this record setting quarter. Just imagine what Okta will achieve once we emerge from the current macroeconomic environment!

Okta’s Healthy Sales Growth Which Accelerated Sequentially In Q2 2023 Due To New Products And Better Go To Market Motion

Okta Q2 2023 Earnings Presentation

Peter Weed: I’d love to go back to kind of — you started the conversation, emphasizing the strength with some of your largest customers, obviously frustrating that maybe the SMB side hasn’t been as strong and that sits some of the logo and hopefully, that comes back. But I’d love to dig in on those larger customers a little bit more and understand where the growth is coming from. Are we hearing about set reacceleration there? Or is this mostly about the kind of excitement of the Broader Okta platform and selling through more functionality. And we may even get a bigger boost from seat re-expansion in the future?

And then kind of like when you look out at the pipeline, obviously, the sales team is kind of stacking up stuff coming into the future like how unusual is this quarter? Is this — was this like a big bubble in the pipeline? Are you seeing similar type of setup in the next couple of quarters where we could see really good expansion on kind of similar types of execution?

Todd McKinnon: On the seat expansion question, I think seat expansion definitely is muted with the macro. So I think the success in large enterprise is more products. And I mentioned the OIG new business land at the global customer experience company. We have another example I can think of it was a big transaction in a well-known online real estate company, that was an addition of customer identity cloud. So selling the customer identity cloud to what was already a workforce customer.

[I mean… it’s a clear example of what I’ve been saying: The market loved Okta when it was just SSO and MFA.Now it is CIAM (Auth0) and a very comprehensive WIAM, i.e., PAM, OIG, SSO, MFA, and device access management, with future products still to come.

Each of Okta’s customers are now materially more valuable to the business, and we’re seeing this already despite a terrible macro environment.]

And then there’s examples in the customers and large customers of selling expansions of products, whether it’s upsells to advance multifactor authentication on the workforce side. So I would say it’s more use case expansion versus seat expansion.

The pipeline is interesting. The pipeline for the current quarter we’re in, in the fourth quarter is very strong. And I think the thing we have to really think about is in this macro environment, how that’s going to translate? We’ve seen in the past few quarters that the typical conversion rates and the close rates, not the competitive rates but the close rates of how much the pipeline goes into actual closed deals has changed since the economic times of a few years ago. So that’s the part we have to be prudent about. There’s stabilization in the macro. We’ve talked about the numbers. But I think we’re taking a little bit of a wait-and-see approach before we assume that those pipeline numbers are going to fall down into the closed business category at the rates that were — maybe you saw a year or so ago?

Q2 2023 Okta Earnings Call

So we’re getting this incredible growth resilience without seat expansion!

Virtually all growth is due to “Going Multi-Product,” and the benefits thereof, which I’ve been discussing ad nauseam lately with you.

Imagine where Okta will be when seat expansion begins again in earnest following our current macroeconomic environment’s malaise.

Speaking of going multi-product, let’s now examine Okta’s evolution into a multi-product platform.

Going Multi-Product

Over the last year or so, I’ve discussed what I believe to be arguably the most important quantitatively-based characteristic of the companies we own.

This is my “Third Foundational Investment Framework,” which I detailed for you recently here:

- Affirm Stock: A Genuine Innovation In Finance

- I included a multitude of examples outside of Affirm, though Affirm is a fantastic example of a company that fits within this framework.

Evolving into a multi-product business has a host of benefits, including:

- Expanded Go To Market avenues. Formerly, Okta only went to market with its core SSO product, which created very healthy growth. However, now it goes to market via multiple avenues: Auth0 (CIAM), PAM, OIG, Device Access Management, and SSO/MFA. This creates more entry points for Okta to wedge into prospective customers’ wallets. Once Okta has wedged itself into these prospects’ wallets, it can then “land and expand.” I discussed this process in our recent consideration of Axon (AXON), which is a fantastic example of this multi-product Go To Market motion.

- A multi-product platform enhances a business’ “embedding or switching costs moat.” When a customer only uses Okta SSO, the decision to switch to another software vendor may not be that difficult, but, if that same customer uses OIG, PAM, Auth0, MFA, and more, it becomes much harder to “rip and replace” Okta, which is the essence of an “embedding moat.”

- More durable business. We’re seeing this play out for Okta presently: Having multiple products being sold into the market simultaneously has made its growth rate vastly more resilient than the market anticipated. The stock should be $100/share today based on its recent revenue outperformance buttressed by this incredible multi-product business execution, but the market continues to incorporate the deteriorating macro-environment in Okta’s pricing, as well as the pricing of many of our businesses.

On the subject of Okta going multi-product, I found the following discussion insightful as it highlights this multi-product, comprehensive platform that’s been in development but is now rolling out, and we can see this, to some degree, in Okta’s recent revenue performance.

Adam Tindle: Todd, thanks for confirming the Privileged Access product for GA in Q4. I’m wondering kind of a two-part question, one, if you could give us maybe any feedback that you’ve gotten in that Early Access. And if you could compare it to the OIG product just to put it in context for us, that would be helpful.

And then secondly, if we kind of zoom out to a bigger picture, you’ve often talked about a unified platform of Identity and if I fast forward, you’re going to have Workforce, Customer, OIG, and the PAM products, sort of a holistic platform, wondering what that enables. If you’ve considered new go-to-markets like bundling and any update on the head of go-to-market alongside that would be helpful.

Todd McKinnon:

Your question about the broad platform: you talked about Workforce and we actually are pleased as we put Governance and Privileged under Workforce, it’s under the same umbrella. And then, Customer Identity of course is our second major cloud. You talked about what does it mean for go-to-market. I think our go-to-market structure is set up to take advantage of it. So, we have one sales team that’s — the tenure of our sales reps and their participation in deals in terms of both clouds is — are at levels that we’re happy with and comfortable with, which is a great sign. The tenure, the ramp, and experience and the ability to do broad deals across the suite is healthy.

And which means that, as the economy starts to improve and our message starts to resonate more, that’s going to be really help us in the future get back to really high levels of scale and growth that we think are possible in this big market.

Q2 2023 Okta Earnings Call

It only makes sense from a purely data-based reality perspective!

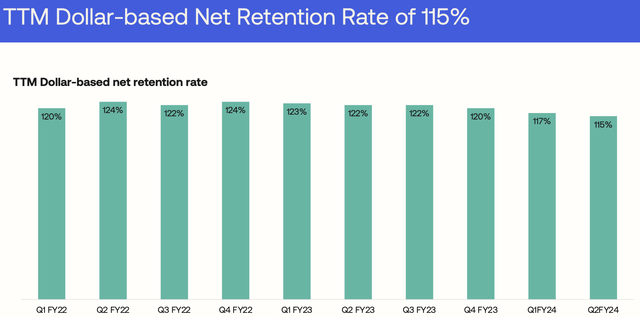

To close out this section, let’s briefly examine Okta’s NRR, which should benefit significantly from this expanded suite of products and lines of business in the years ahead.

Okta Q2 2023 Earnings Presentation

Consistent with prior quarters, gross retention rates remained strong in the mid-90% range. Our dollar-based net retention rate for the trailing 12-month period remains strong at 115%, and was driven by both upsell and cross-sell activity. Similar to last quarter, the sequential downtick in the net retention rate was a result of the macro environment, where customers are not expanding seats at the rate they have in recent years. We believe this trend will persist in this environment.

Brett Tighe, CFO, Q2 2023 Okta Earnings Call

I believe NRR will once against accelerate to 120% once we emerge from the current macro-environment.

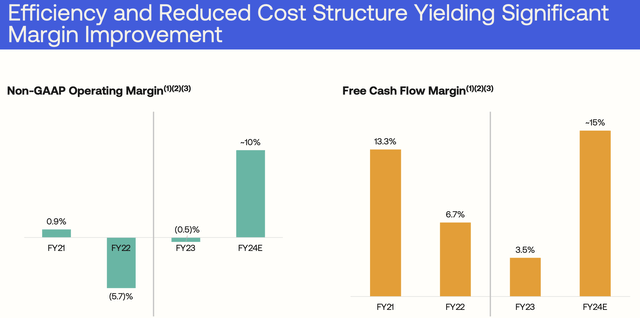

Next, below, we can see that Okta now produces very healthy free cash flow margins.

Okta Q2 2023 Earnings Presentation

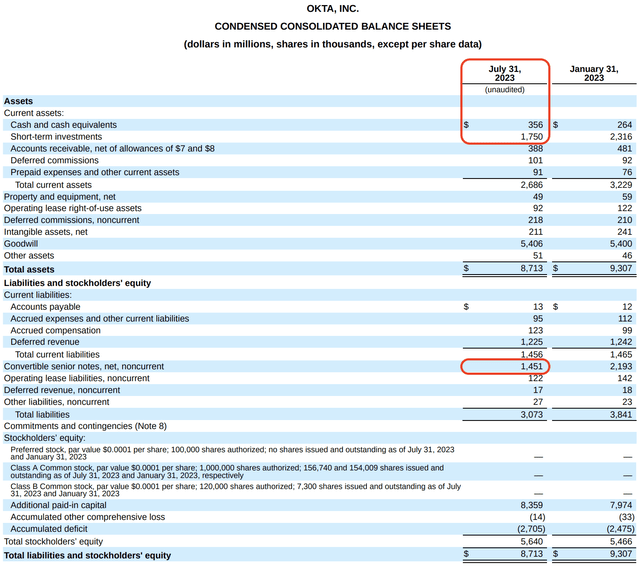

This has resulted in the balance sheet health depicted below:

Balance Sheet Health

Okta 10-Q

As we can see, Okta’s net cash position has grown substantially in just the last couple quarters. This is very heartening.

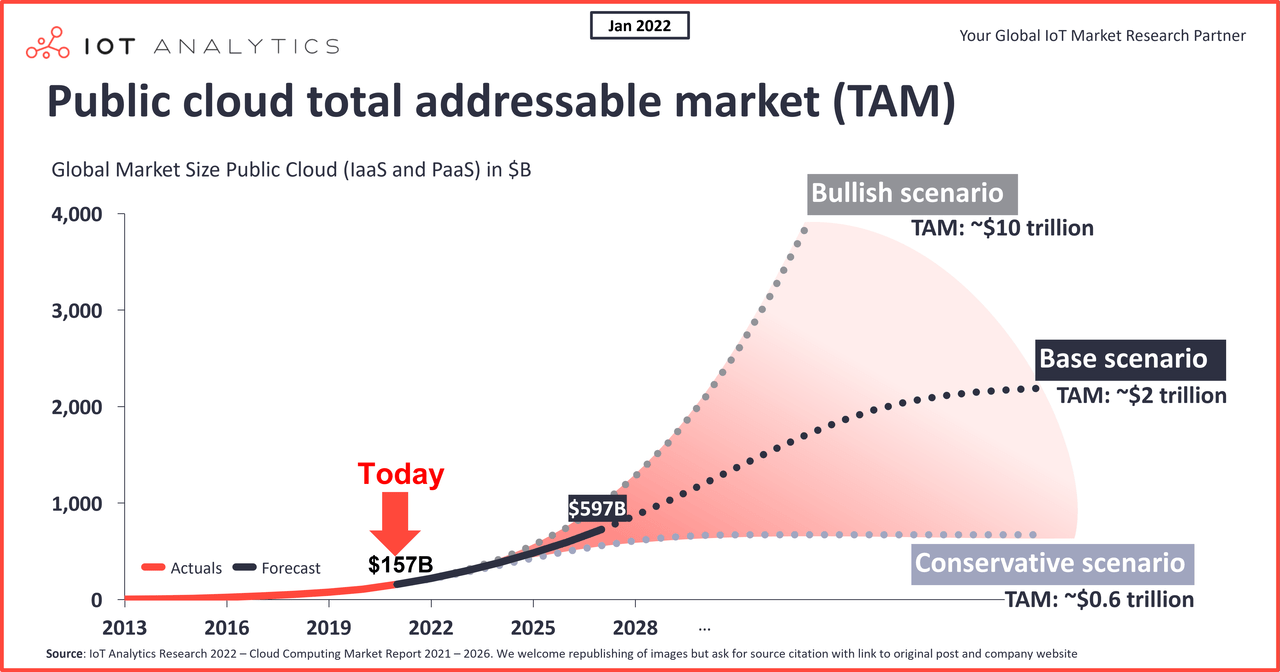

Concluding Thoughts: Remember That Cloud Computing Is Still Just Getting Started

We’ve spent a fair bit of time analyzing what we’re seeing, and I’ve spent a good chunk of time myself looking as well, and we like the fundamentals of what we’re seeing in AWS. The new customer pipeline looks strong. The set of ongoing migrations of workloads to AWS is strong. The product innovation and delivery is rapid and compelling. And people sometimes forget that 90-plus percent of global IT spend is still on-premises. If you believe that equation is going to flip, which we do, it’s going to move to the cloud. And having the cloud infrastructure offering with the broadest functionality by a fair bit, the best securing operational performance and the largest partner ecosystem bodes well for us moving forward.

Andy Jassy, CEO, Amazon Q1 2023 Earnings Call

IOT Analytics

I think it’s a really insightful question. I think if you look at the growth drivers and the potential, the market potential and the TAM being realized for Okta, it’s a really big factor. The fact that it’s traditionally been the way you do Identity is, you have a big on-premise installation and you control it yourself and you — it’s in your data center, it’s legacy software, it’s really tightly coupled with the stack, whether it’s Oracle or IBM, and that’s on the Workforce side.

And then on the Customer Identity side, it’s really build it yourself, maybe it’s open source, maybe it’s just build your own password checking and registration form and roll your own. And so, those two together are really as we think about catalysts in the business and long-term drivers, those are really important. When we talk about secular trends, cloud, and digital transformation, we’re really talking about these kind of things like the people have a bunch of on-premise technology and they want to use on-premise technology to manage it and the more they move to the cloud, the more likely they are to choose a cloud modern next-generation solution like Okta.

Todd McKinnon, CEO, Q2 2023 Okta Earnings Call

And this is as true in the public sector as it is in the government sector, where Okta will likely grow for decades to come.

The federal vertical is really a key important part of our strategy. It’s not just a big IT spend, but also, they have very direct mandates to use multi-factor and to invest in modern Identity Solutions. I spent about a week in Washington during last quarter, and one of the really interesting things I noticed is… they have the most formal programs around Identity. All the big agencies have a formal office or department around Identity. So, I think they are just mature in how they think about it, and they’re modernizing like everyone else. So, it’s a really big opportunity for us.

You mentioned the certifications, we did — last quarter, actually two quarters ago, we received our FedRAMP High authorization, which is really exciting. And we have a bunch of marquee customers that sponsored us that for that authorization and we’re excited to move forward, that we also have the ability to — on the military side, we have the ability to service IL5 workloads, which opens up more of the Department of Defense and some of the more sensitive military sides and we have great customers there, so it’s a really important part of our strategy, and it’s a big part of our focus.

The other part of the business that’s important is the state and local governments, so between federal, state, and local government, they need identity and we’re doing very well in those verticals and it’s a big area for our focus.

Todd McKinnon, CEO, Q2 2023 Okta Earnings Call

In short:

- The macroeconomic environment continues to mask the expanding product set that Okta possesses, via which it’s currently growing.

- This expanding product set serves to bolster growth by expanding Go To Market avenues and Okta’s ability to wedge itself into customers’ wallets; whereupon, it executes a land and expand strategy.

- This creates robust embedding and switching cost moats.

- The business is the strongest it’s ever been, and a long runway for growth still lies ahead of it.

I think we will be reward substantially in the decades ahead from those levels, even after the ~100% rebound from recent lows.

Thank you for reading, and have a great day.

Read the full article here