Blessed is he who expects nothing, for he shall never be disappointed.” – Alexander Pope

It has been just over 13 months since we took a look at Altimmune (NASDAQ:ALT). We concluded that article by noting that the stock was speculative, and the company was likely to have to do another capital raise in the near future and at best, the stock merited only a small ‘watch item‘ holding.

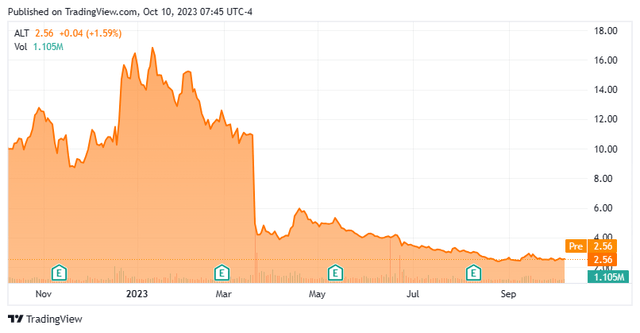

Seeking Alpha

The stock has spent the last disappointing its shareholders as can be seen in the chart above. Is there any hope left from this once-promising biotech stock? An analysis follows below.

Company Overview:

Altimmune, Inc. is based just outside of Washington, D.C. in Gaithersburg, MD. This clinical-stage biotech concern is focused on developing treatments for obesity and liver diseases. The stock currently trades around $2.50 a share and sports an approximate market capitalization of $135 million.

November Company Presentation

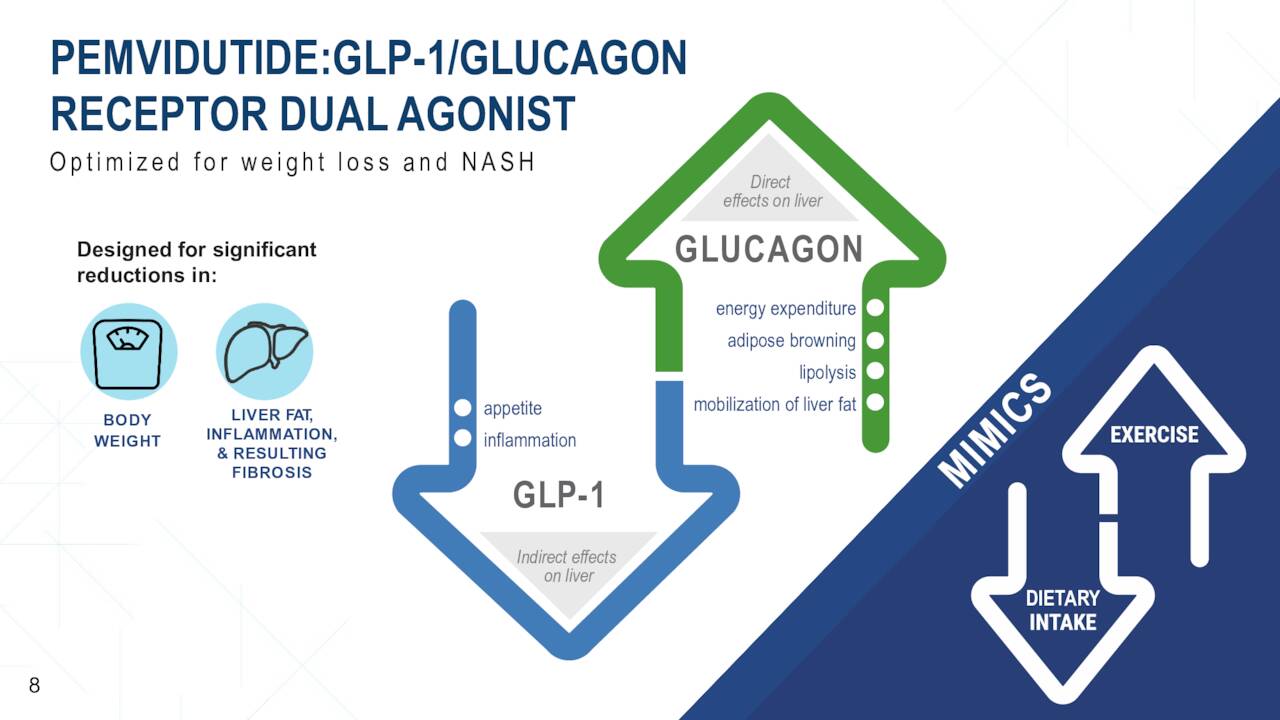

The company’s lead asset is a GLP-1/glucagon dual receptor agonist called pemvidutide. In January 2022, the FDA approved the company’s Investigational New Drug or IND application on this candidate so it could be evaluated in a Phase 2 clinical trial in treating obesity.

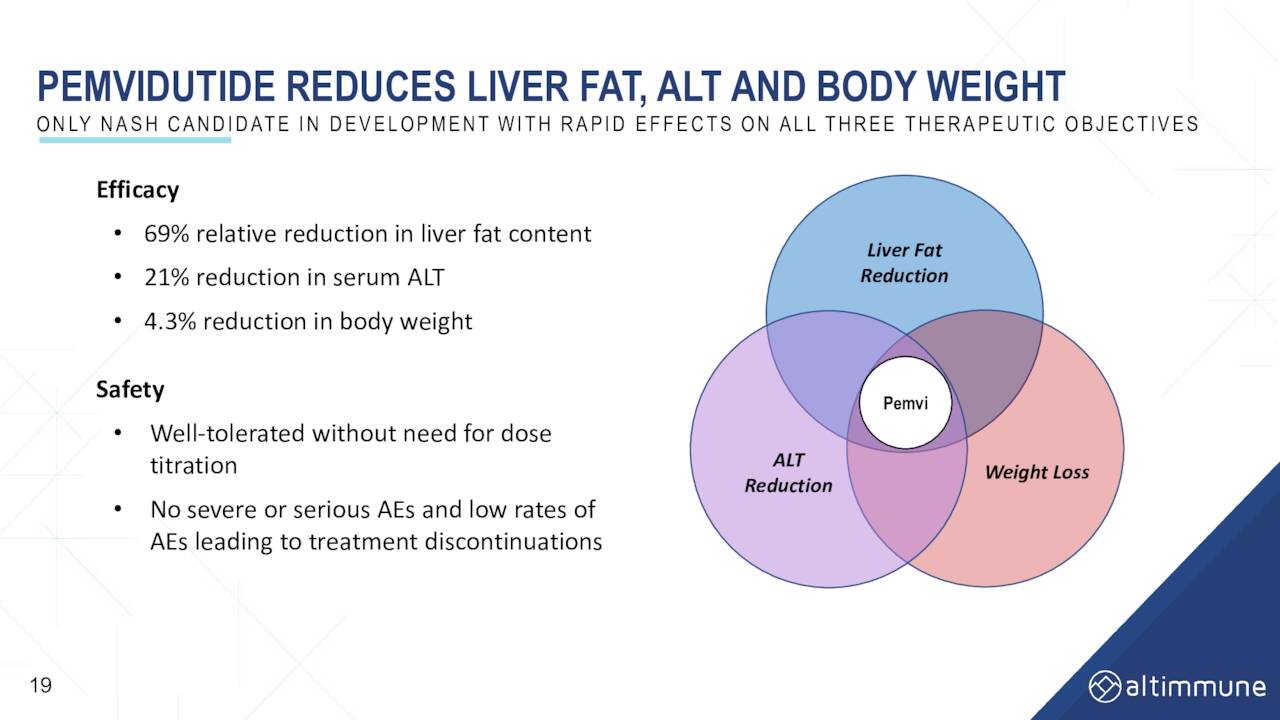

What crushed the stock in mid-March of this year was that Altimmune reported data from this just over 300-person study called MOMENTUM on March 21st. Some weight loss was achieved and there were no severe adverse effects or SAE from the 160-person cohort that posted an interim analysis after 24 weeks using various doses (1.2 mg, 1.8 mg, and 2.4 mg of pemvidutide). However, the results were judged underwhelming by investors which sent the stock down some 55% immediately after the data dump. Goldman Sachs downgraded the stock the day after this trial disclosure noting the trial’s high discontinuation rates as but one reason for concern. The analyst at Goldman further stated that:

While we continue to see a path forward for pemvidutide, development of the agent is complicated by the potential need for additional dose modification/exploration studies, and the commercial opportunity may be limited to a more niche subset of patients“.

MOMENTUM is a 48-week trial so full top-line data from this study should be out before the end of the year. Hopefully, results show more encouraging data points when they come out for shareholders.

November Company Presentation

Pemvidutide is also being evaluated as a potential treatment for NASH, a huge and growing market. A 190-person Phase 2b biopsy-driven is currently underway. The main endpoints for the trial are NASH resolution and fibrosis improvement after 24 weeks of treatment. The test subjects will also be followed for an additional 24 weeks for assessment of safety and additional biomarker responses. Top-line results after 24 weeks of treatment are currently scheduled for some time in the first quarter of 2025. The compound did show some encouraging early-stage results for this indication.

November Company Presentation

Finally, Altimmune is also developing HepTcell targeting patients chronically infected with the hepatitis B virus or HBV. HepTcell is an immunotherapeutic product candidate. Top-line results from a Phase 2 study after 24 weeks of treatment are due out in the first quarter of next year.

Analyst Commentary & Balance Sheet:

The analyst community seems to have kept its faith in the company’s prospects despite the stock’s horrid performance. Over the past two months, JMP Securities, B Riley Financial and H.C. Wainwright have all reissued Buy ratings on the stock with identical $15 price targets. Piper Sandler also reiterated their Buy rating with an even more optimistic $25 price target.

Just over 13% of the stock’s overall float is currently held short. The company’s CFO sold $43,000 worth of stock this March. A few other insiders have bought just over $120,000 worth of shares so far in 2023, collectively. Altimmune ended the second quarter of this year with approximately $160 million worth of cash and marketable securities on its balance sheet after posting a net loss of $16.1 million for the quarter. The company carries no long-term debt.

Verdict:

The good news is Altimmune is trading for slightly under the net cash on its balance sheet and still has a few ‘shots on goal‘. The company also continues to enjoy strong analyst firm support. However, its most advanced program seems at best to be a niche product in the GLP-1 weight loss space. A market that is being dominated by Wegovy and Ozempic by Novo Nordisk (NVO) and Mounjaro by Eli Lilly (LLY). Altimmune does have a couple of earlier-stage products in its pipeline that are many, many years from any potential commercialization.

Hopefully, top line data from MOMENTUM later this year will improve the narrative around Altimmune. Outside of that, the stock at best merits a very small position for aggressive investors within a well-diversified biotech portfolio.

It is easier to forgive an enemy than to forgive a friend.” – William Blake

Read the full article here