Investment Rundown

The price chart for the last 12 months with ChargePoint Holdings, Inc. (NYSE:CHPT) has been anything but good. The company is down nearly 70% even whilst the hype for green energy and renewables persists. What I think has become extremely evident is that investors are no longer looking for the next Tesla (TSLA), they are looking for a profitable business able to maintain and expand margins. CHPT is not that right now and after my last article on the company it has lost another 40% in value. It’s a significant decline and I am cutting my ties with the stock right now and rating it a sell. If it bounces up in the near term so be it, but the company lacks the fundamentals I want and the risks it presents to a portfolio are too large to keep.

Company Segments

CHPT stands as a prominent figure in the EV charging arena, boasting a global presence with a strong foothold in the United States. The company’s core mission revolves around delivering a comprehensive ecosystem of solutions designed to meet the diverse requirements of various customer segments, encompassing commercial, fleet, and residential stakeholders actively engaged in the electric mobility landscape.

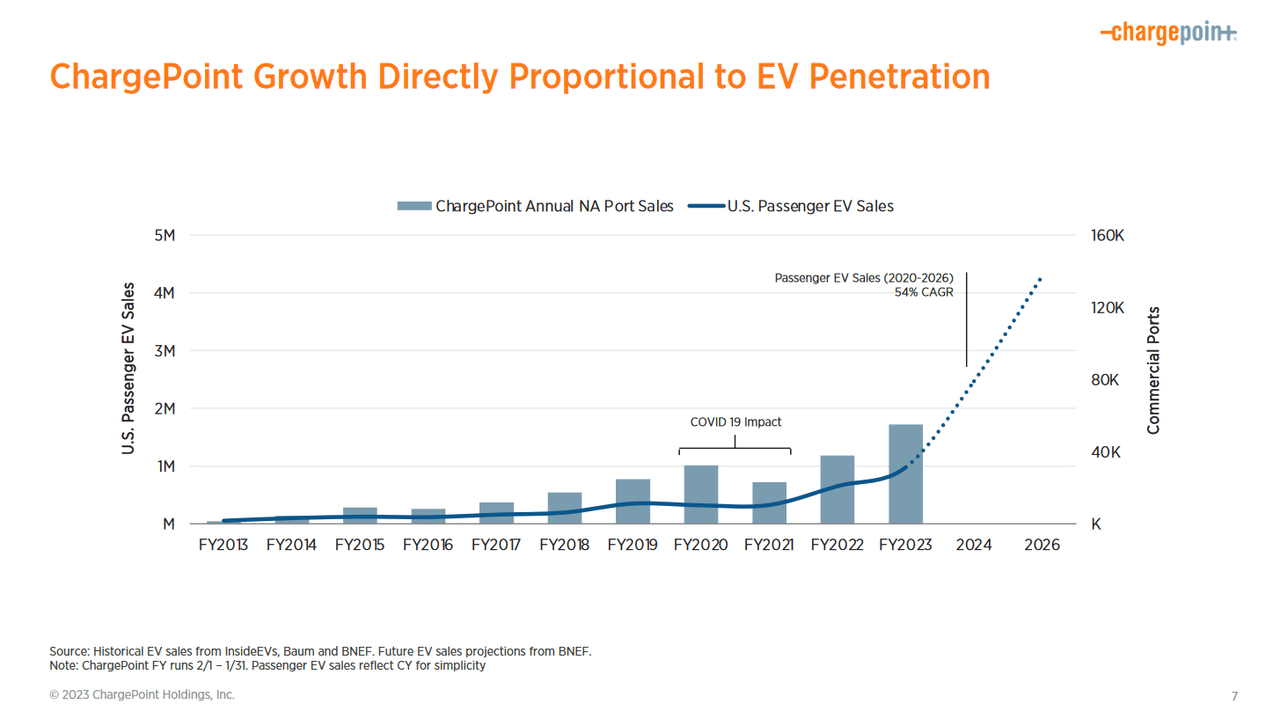

Investor Presentation

As the electric mobility revolution continues to gain momentum, CHPT’s commitment to providing innovative and scalable solutions places it at the forefront of this transformative industry. The company’s dedication to enhancing the accessibility and convenience of EV charging networks positions it as a key player in driving the global shift towards sustainable and eco-friendly transportation solutions.

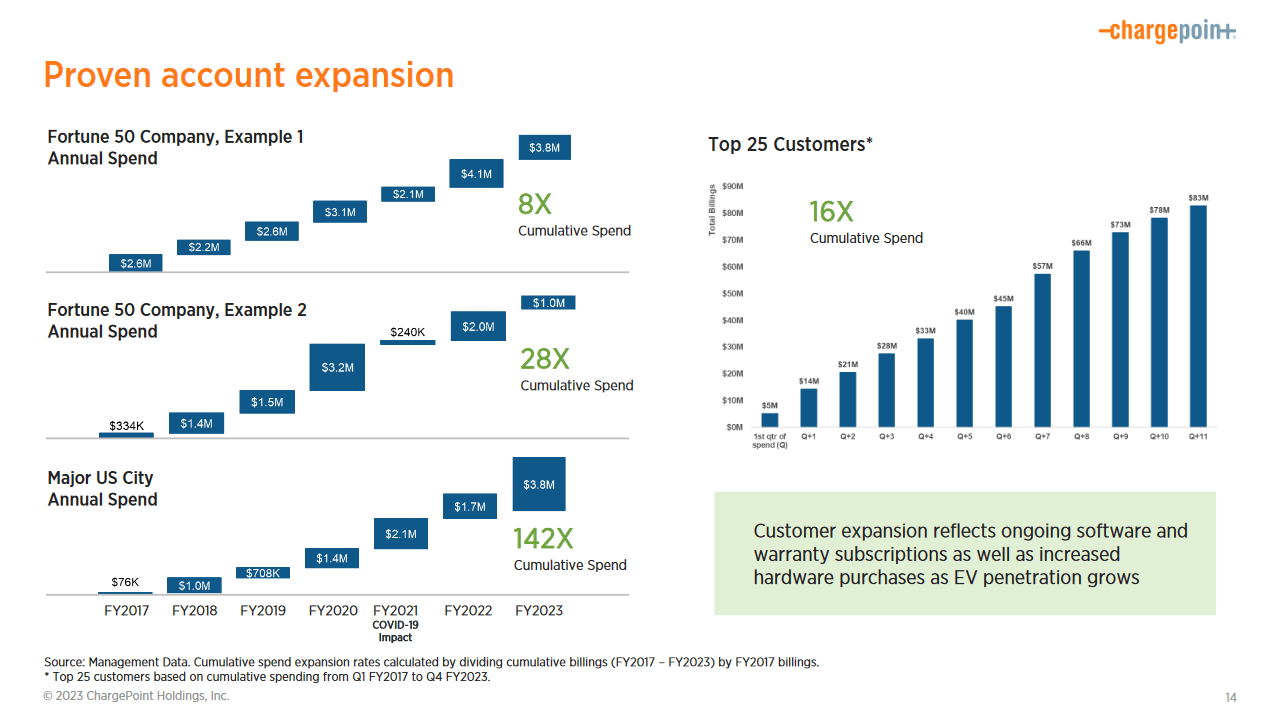

Investor Presentation

CHPT’s revenue streams have become increasingly diversified over the years, with a strategic focus on developing recurring revenue sources such as subscriptions. While this diversification is intended to enhance the company’s stability, it can also introduce potential volatility in earnings reports. The subscription model entails setting fixed prices while CHPT incurs the variable costs associated with electricity prices. Consequently, the company may experience higher earnings in quarters with lower electricity prices, as opposed to periods with higher costs, such as during colder months of the year.

Risks

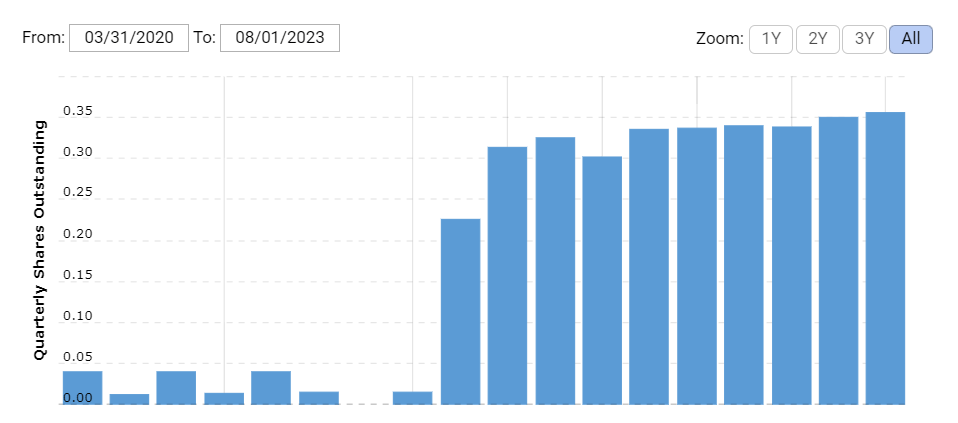

One noteworthy factor to consider is the elevated short interest in the market, which introduces the potential for a short squeeze should unforeseen positive developments arise. Engaging in a short position inherently carries risks, but implementing a well-thought-out stop-loss strategy can help mitigate some of these potential downsides. Besides a large amount of short interest in the company right now, there is also a significant amount of dilution occurring over the last several years that isn’t painting a very good picture here in my opinion. In 2021 the shares outstanding were 15 million, now they are over 347 million. With debt levels approaching $300 million I think we are going to see more dilution, as CHPT is unlikely to blow its entire cash position on paying down its debts, that would be a significant shift in the company’s financials and possibly something that would upset the markets instead.

Macrotrends

However, it’s equally important to take into account the prevailing market conditions, which may pose significant headwinds for CHPT in the foreseeable future. These challenges could include factors such as evolving competitive dynamics, shifts in government policies affecting the electric vehicle charging sector, or fluctuations in consumer adoption rates of electric vehicles. Evaluating and addressing these potential obstacles is essential for making informed investment decisions regarding CHPT. The rise in interest rates has been further weighing in on the business as the interest expense is $11.4 million, up from $1.5 million back in 2021. During this period the net income has been further growing and is at nearly $400 million. With such losses, CHPT could essentially have a greater negative net income than their entire market cap on an annual basis quite soon.

Financials

Earnings Report

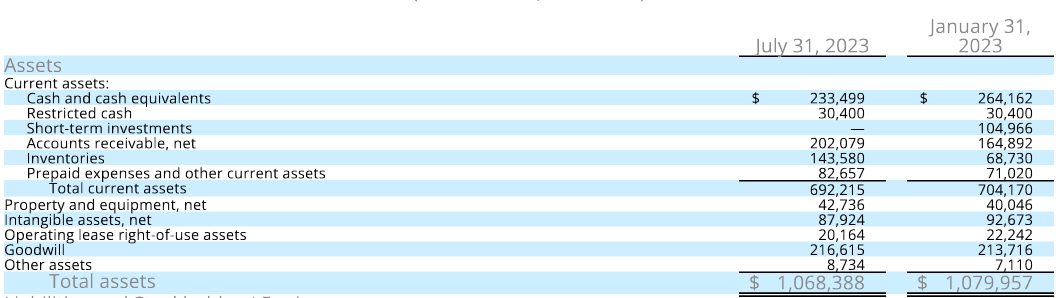

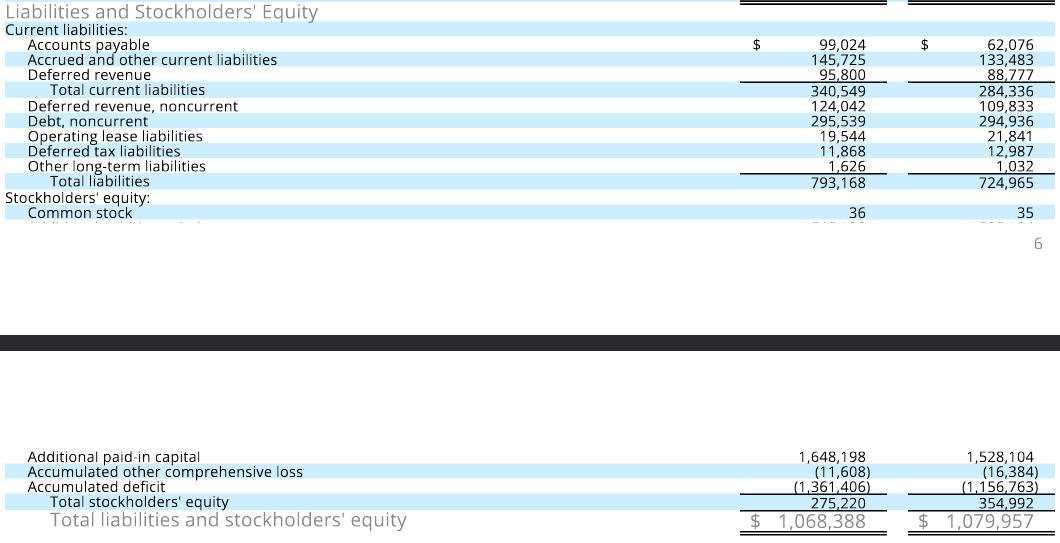

Looking at the assets of CHPT they have experienced a slight decline since December 31, 2022, mostly caused by a lower cash position, but also offset somewhat by higher accounts receivables. I don’t think this is a very significant deal to the company, it still is quite solid. The cash position can cover a significant amount of the debts for the company right now, which are at $295 million.

Earnings Report

With the debt sleeves rising somewhat though, over the last few quarters, I am worried that CHPT will see it fit to continue this practice even after not being able to generate a profit. As I have been talking quite a lot about the lack of earnings of CHPT, let’s take a look at the estimates for it going forward.

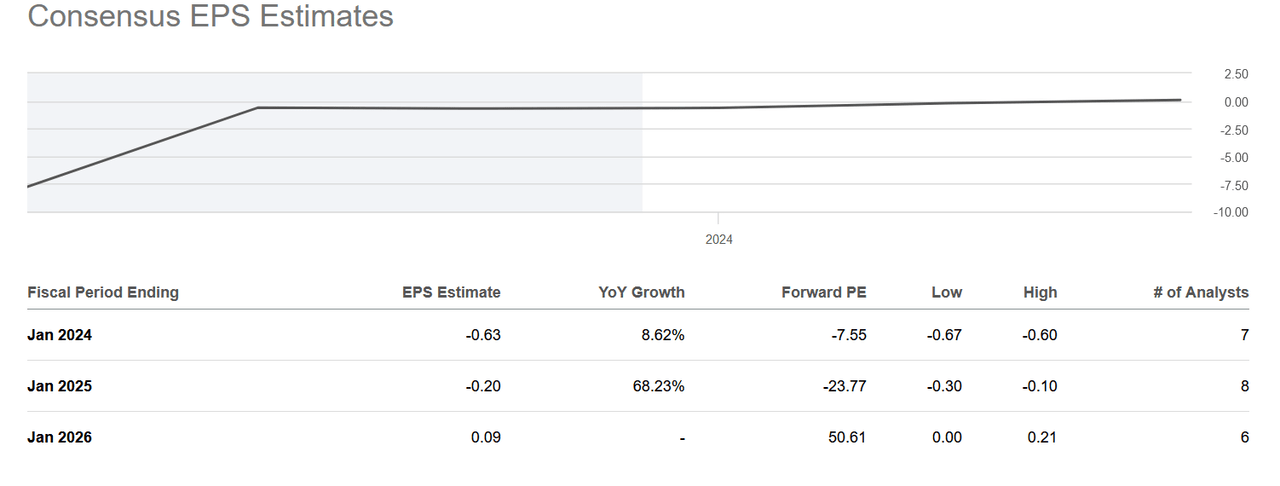

Seeking Alpha

In 2026 the company is estimated to post its first positive earnings. This would still give the company a high p/e of 50. Even if the company grows the EPS by solid double digits, I still think it’s too high to pay right now to be justified. It would have to have a stagnating share price for some time until the p/e can catch up to something more in line with the automobile industry, which is around 10 right now. That leaves a lot of capital tied up in an investment that possibly won’t be generating any immediate returns. For me, that is now a risk I don’t want to take and will be rating CHPT a sell as a result.

Final Words

I have before been quite positive about the prospects of CHPT about their capabilities to capitalize on the shift towards green energy and renewables. But with increased competition from companies with far larger spending budgets and a lack of net income, CHPT looks too risky to have in a portfolio right now. Since the last article, the share price has tanked by 40%, and I right now think the time is not to be invested in the business.

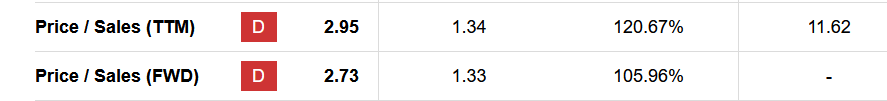

Seeking Alpha

Even after reaching a profitable level, CHPT is too expensive and will likely yield lackluster returns over the coming years. For this reason, I am now downgrading the company to a sell instead.

Read the full article here