W. P. Carey Inc. (NYSE:WPC) showcased a remarkable financial performance in the second quarter of 2023, with its revenues experiencing a significant surge. WPC’s growth is attributed to its Real Estate segment, net investment activities, contributions from the CPA:18 Merger, and rent escalations. This article presents WPC’s financial performance and technical analysis to identify potential investment opportunities. The stock price is approaching a robust support level, indicating a potential rebound, suggesting that investors might consider entering at this point in anticipation of a price increase.

A Dive into WPC’s Financial Highlights and Prospects

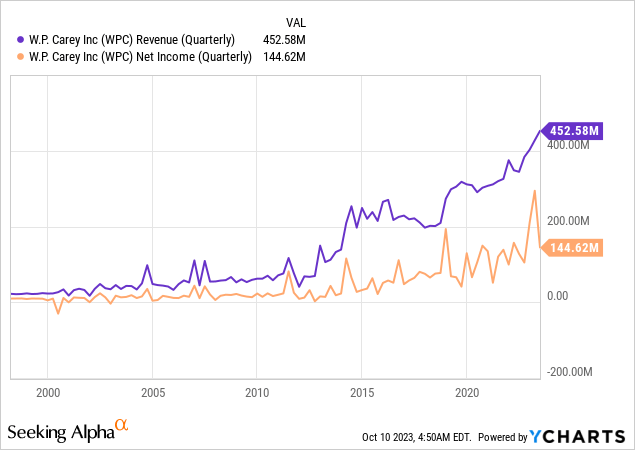

WPC exhibited impressive financial growth in the second quarter of 2023. The company’s total revenues, which include reimbursable costs, soared to $452.58 million, marking a 31.4% increase from Q2 2022. This surge was primarily fuelled by the Real Estate segment, which reported a 33.1% revenue increase at $452.2 million. The growth catalysts were primarily net investment activities, the CPA:18 Merger’s contributions, and subsequent rent escalations.

Of note, 12 hotel properties transitioned from net lease to operating in early 2023, and a notable lease revenue reclassification occurred due to dealings with U-Haul. Moreover, the net income for Q2 2023 reached $144.62 million, up 13.2% from Q2 2022’s $127.7 million. The increase was driven by net solid investment activities and the CPA:18 Merger, though offset partly by reduced profits from real estate sales and increased interest expenses. The chart below displays WPC’s quarterly revenue and net income, revealing a dip in Q2 2023 compared to the previous quarter; however, the overarching trend is upward, suggesting promising future profitability for WPC.

Moreover, the Adjusted Funds from Operations (AFFO) for WPC in the second quarter of 2023 touched $1.36 per diluted share, representing a 3.8% increase year-over-year. The Real Estate segment was instrumental in this rise, posting an AFFO of $1.36 per diluted share – a 7.1% hike from Q2 2022. This boost was attributed to net investment activities, the CPA:18 Merger’s impact, and rent escalations. Additionally, WPC declared an elevated quarterly cash dividend of $1.069 per share, translating to an annual rate of $4.28.

Throughout 2023, WPC finalized investments amounting to $938.5 million, with Q2 2023 alone accounting for $760.7 million. Furthermore, the company plans to undertake capital investments and commitments of approximately $96.4 million in the latter half of 2023.

Navigating the Nuances of Long-term Technical Support

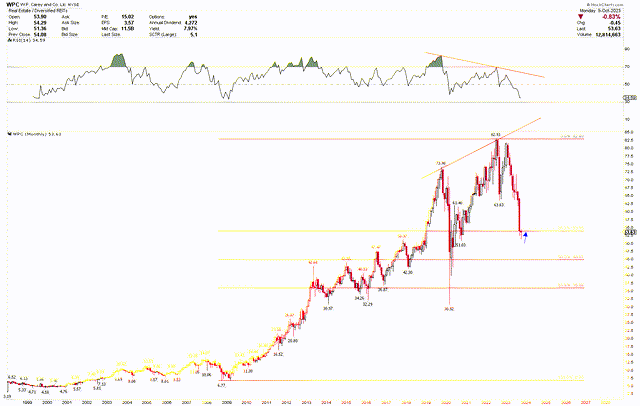

Despite impressive financial results, the stock price has retreated from its peak to a solid long-term support at $53.85, represented by the 38.2% Fibonacci retracement from the monumental rally that began in 2008. The overall trajectory for WPC remains optimistically bullish, rooted in the 2008 lows of $6.77. Following the 2008 financial crisis, WPC’s strategic diversification into varied high-quality commercial assets across numerous sectors and regions fortified it against isolated economic slumps. A key element of WPC’s approach was its focus on long-term, triple-net lease structures, ensuring a steady revenue stream even during volatile periods. The company also took advantage of acquisition opportunities, especially during unfavorable market conditions, enhancing its portfolio with valued assets. This strategy, combined with the general economic recovery and a revived real estate market, led to a significant appreciation of WPC’s stock price over the subsequent years.

WPC Monthly Chart (stockcharts.com)

This impressive surge, however, was countered by a bearish divergence, evident from the RSI on the chart. While the overall momentum remains bullish in the longer perspective, the stock price is now nearing long-term support, denoted by a blue arrow.

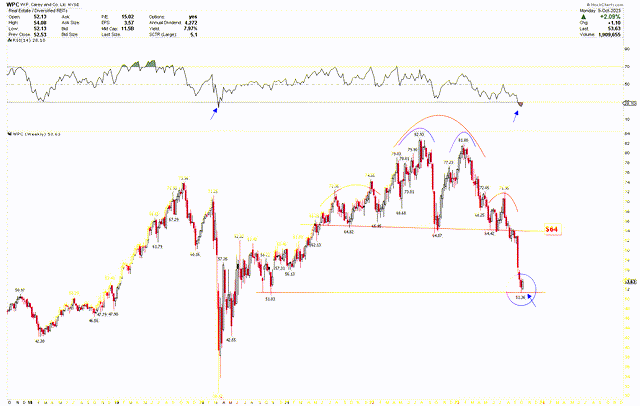

Diving deeper into WPC’s technical landscape, the accompanying weekly chart showcases a bearish head and shoulders pattern, with the head at $82.93 and shoulders at $74.55 and $71.95. Notably, the peak of this pattern was marked by a double top at $82.93 and $81.80. This bearish trend has pushed the stock to considerably lower values, but it has met its objective at $51, marked by a red support line. Furthermore, the stock is veering into oversold territory, suggesting a potential sharp recovery soon.

WPC Weekly Chart (stockcharts.com)

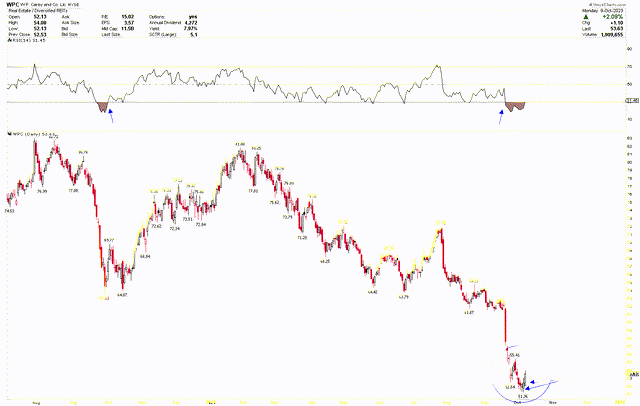

The short-term daily chart bolsters the theory of a formidable foundation for WPC. It reveals the stock’s promising position at oversold levels and its bounce back from recent lows. There’s a bullish hammer formation at the support level, and its subsequent candle suggests a positive outlook for the market.

WPC Daily chart (stockcharts.com)

Market Risk

WPC’s notable revenue growth is largely credited to its Real Estate segment, making it vulnerable to any downturns or disruptions within the real estate market. The recent financial enhancement also owes much to the CPA:18 Merger, implying that any unexpected challenges related to this merger might cast a shadow on WPC’s anticipated performance.

Meanwhile, the company’s dependency on net investment activities for growth can be a double-edged sword; a decline in investment avenues or misjudged investments could stifle progress. Coupled with a burgeoning net income, WPC disclosed elevated interest expenses; a surge in interest rates or borrowing might further amplify these costs, denting the net income. From a technical standpoint, the price has hit a significant support level; however, breaking this support suggests a continued downward trend.

Bottom Line

WPC’s second quarter of 2023 has been highlighted by significant achievements, particularly in its Real Estate segment. The company witnessed remarkable revenue growth, driven by net investment activities, the CPA:18 Merger, and subsequent rent escalations. This growth was further evidenced by the healthy increase in net income and Adjusted Funds from Operations (AFFO). While the dividend update and AFFO forecast showcase WPC’s strong financial position, their impressive real estate developments, prudent balance, and capital management further emphasize the company’s strategic prowess.

Despite the outstanding financial results, the technical analysis indicates a retreat in stock price, approaching significant long-term support. Although this suggests potential price fluctuations, the overall trajectory for WPC remains optimistically bullish, reflecting the company’s robust strategic diversifications and resilience to economic downturns. Investors can consider buying WPC at its present value, as the stock trades at a significant support level, with a rebound suggesting potential for upward movement.

Read the full article here