Jacobs Solutions Inc. (NYSE:J) provides consulting services among other offerings to governmental and private sector customers. The company has an interesting spin-off happening in the coming fiscal year, possibly creating shareholder value through a more refined offering. Although the spin-off is a promising prospect, I believe the stock is priced quite high – I see a hold rating as constituted.

The Company & Stock

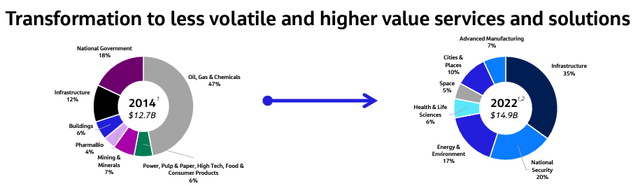

Jacobs provides consulting, technical, and project delivery services in the United States, Europe, Canada, Asia, and Australia among other geographical areas – the company is well diversified in terms of geographic markets. The company also operates in multiple sectors, as the largest ‘infrastructure’ sector only represents around a third of Jacobs. The currently serviced sectors are a result of a long-term strategy of transforming into higher-value industries and offerings:

Sector Transformation (Jacobs Solutions September 2023 Investor Presentation)

Many of Jacobs’ offerings service the public sector – I believe that this is a valuable prospect, as public spending often stays more stable than the private sector’s in economic turmoil in Keynesian economics’ manner. As many companies have recently had struggles in keeping up a good earnings level, Jacobs has kept a good revenue trajectory in recent quarters, as will be further explained in the financials segment.

Jacobs’ stock has performed reasonably well on the stock market – the stock has had a CAGR of 9.1% in the past ten years on top of a very nominal dividend yield that currently stands at 0.74%.

Ten-Year Stock Chart (Seeking Alpha)

Potential Spin-Off or Sale

Jacobs operates through four segments – People & Places Solutions, PA Consulting, Divergent Solutions, and Critical Missions Solutions. The company is planning to spin off its Critical Mission Solutions segment in fiscal year 2024 which represents around 35% of the entire company’s revenues. The segment provides cyber, data analytics, systems, and software application integration services along with other similar services to mostly U.S.-based government agencies.

The planned spin-off could create shareholder value. The transaction should create space for the separate organizations to pursue unique strategies for the separate industries and market dynamics that the current segments operate in, setting the separate companies up for better growth. Instead of a becoming separately listed company through a spin-off, the segment could also be bought off – as written on Seeking Alpha, there are rumors that Veritas and Platinum Equity could bid for the segment at a valuation of around $4 billion. The valuation seems quite good for Jacobs in my opinion, as the segment had around $4.4 billion in revenues with an 8% operating margin in FY2022 – the valuation would represent an EV/EBIT of around 11.4, getting rid of a segment that isn’t quite in line with the rest of the company’s strategy. The CMS segment also had the worst performance in Q3/FY2023 in terms of operating profit growth.

Financials

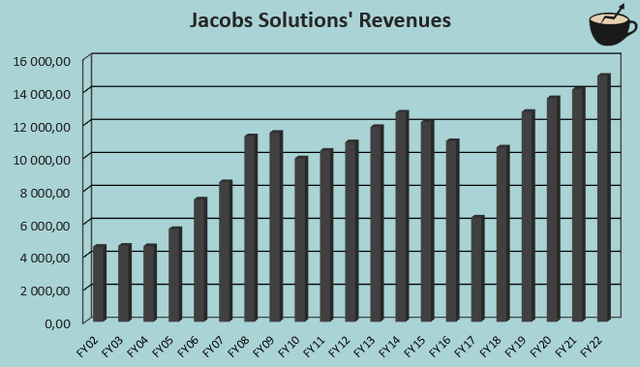

Jacobs’ long-term revenue growth is quite good. The company has had a compounded annual growth rate of 6.1% from FY2002 to FY2022:

Author’s Calculation Using TIKR Data

The growth is partly caused by constant acquisitions – from FY2013 to FY2022, the company’s cash acquisition came up to more than $6 billion. The company’s organic growth performance could be improved in the future as a result of the spin-off of CMS, though, as the company communicates in its September 2023 investor presentation.

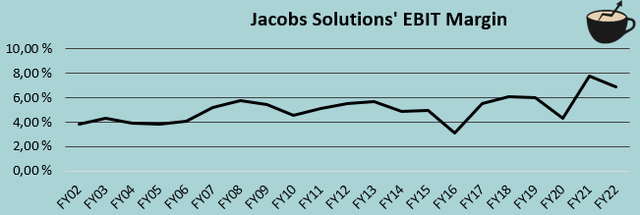

Jacobs has had an average EBIT margin of 5.1% from FY2002 to FY2022, with a good history of slight margin expansion – the margin has grown from 3.8% in FY2002 into a current trailing level of 6.6%. The margin has been mostly quite stable:

Author’s Calculation Using TIKR Data

The company leverages debt to its advantage – currently, Jacobs has long-term debt amounting to $3.2 billion, of which a small portion of around $55 million is in the current portion and the rest in the long-term portion. Compared to the company’s market capitalization of $17.6 billion, the amount still seems quite moderate. With the potential sale of the CMS segment, Jacobs’ balance sheet could be further strengthened into a net cash position.

Valuation

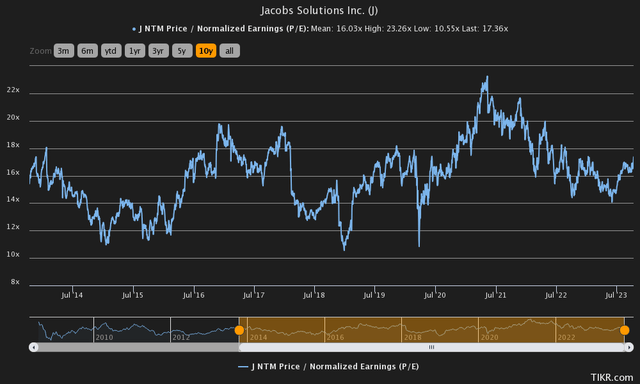

The spin-off prospect doesn’t come without a price tag, though – currently, Jacobs is priced at a forward P/E ratio of 17.4, slightly above the ten-year average of 16.0:

Historical Forward P/E (TIKR)

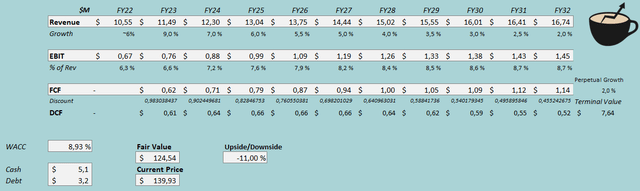

To further analyze the valuation and to get a grasp of an estimated fair value for the stock, I constructed a discounted cash flow model that takes the potential sale of CMS into account. In the model, I estimate the company’s financials excluding the CMS segment and add $4 billion in cash into the company’s balance sheet, in line with reported rumors of the potential valuation at sale.

For the company’s revenues (excluding CMS), I estimate a growth of 9% in FY2023 in line with the first three quarters of the fiscal year. After the year, I estimate a growth of 7%, slightly above Jacobs’ historical growth rate – the company should grow faster without the CMS segment as the remaining segments have shown a better growth performance. The growth could be even further improved through a more refined strategy. Beyond FY2024, I estimate Jacobs’ growth to slow down in steps throughout the years into a perpetual growth rate of 2%. The growth estimates represent a CAGR of 4.7% from FY2022 to FY2023.

In line with Jacobs’ history, I estimate the company to continue growing its EBIT margin in the long term. As the CMS segment isn’t included within the company, Jacobs could improve the margin by cutting costs and streamlining the organization for the refined offering – I believe that the margin expansion of 2.4 percentage points from FY2022 to FY2032 is doable. The company has a good cash flow conversion as the EBIT includes a good amount of amortization due to historical acquisitions.

The mentioned estimates along with a cost of capital of 8.93% craft the following DCF model with a fair value estimate of $124.54, around 11% below the current price:

DCF Model (Author’s Calculation)

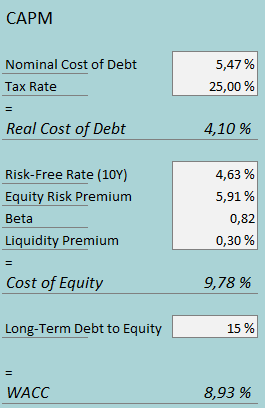

The used weighed average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q3/FY2023, Jacobs had around $44 million in interest expenses – with the company’s current interest-bearing debt balance, the company’s annualized interest rate comes up to 5.47%. Jacobs leverages debt quite modestly – I estimate a long-term debt-to-equity ratio of 15%, near the current figure.

On the cost of equity side, I use the United States’ 10-year bond yield of 4.63% as the risk-free rate. The equity risk premium of 5.91% is Professor Aswath Damodaran’s latest estimate made in July. The beta estimate of 0.82 is taken from Yahoo Finance’s estimates. Finally, I add a small liquidity premium of 0.3%, crafting a cost of equity of 9.78% and a WACC of 8.93%.

Takeaway

At the current price, Jacobs doesn’t seem like too good of an opportunity despite the promising prospects of the spin-off – although I modeled a good amount of financials improvements as a result of the sale of the CMS, the DCF model points towards a very slightly overvalued stock. As it stands, I have a hold rating for the stock at the current point.

Read the full article here