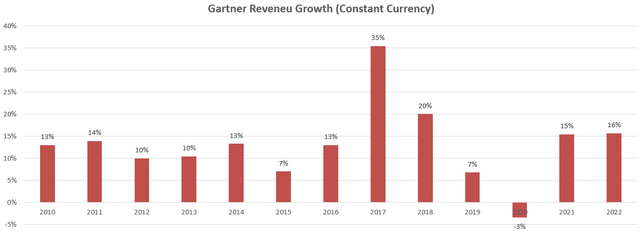

Gartner (NYSE:IT) offers industry insights and data-driven research to business leaders, including CFOs, CIOs, and supply chain managers. They have been growing their revenue at a double-digit rate over the past decade and are targeting double-digit revenue growth with margin expansion for the medium term. I appreciate their high recurring business model in their Research business line and their efficient direct sales force model. In my estimation, the stock price is undervalued, and I assign a ‘Strong Buy’ rating to Gartner.

Strong Recurring Growth in Research Business

Gartner’s Research business provides corporate executives with industry insights, data analysis, and guidance. This segment constitutes Gartner’s core, contributing more than 80% of its total revenue. In FY20, during the pandemic, Gartner’s Consulting business decreased by 4%, and Conferences experienced a significant 75% decline due to widespread event cancellations. However, the Research business showed resilience, with a 7% increase during that period.

Gartner 10Ks

I believe the resilience of their Research business can be attributed to several key factors. Firstly, over 90% of the Research business operates on a subscription basis, making it highly recurring. Enterprises are unlikely to cancel their research subscriptions during recessions since executives still require business insights for decision-making, regardless of the macroeconomic conditions. Secondly, Gartner possesses significant pricing power in their Research business. On Q2 FY23’s earnings call, they have indicated that their ability to increase prices can offset any wage inflation at a minimum. This pricing power allows Gartner to sustain revenue growth through pricing adjustments in any given year. Lastly, the Research market is substantial for Gartner, with an estimated total addressable market size of around $200 billion. Despite this vast potential, Gartner earned only $4.6 billion in revenue in FY22, indicating significant room for growth and a promising future in this market.

Efficient Direct Sales Force

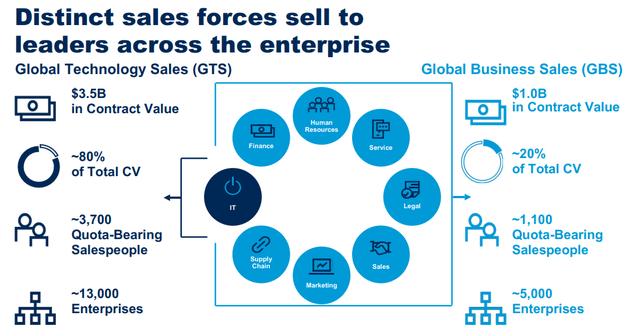

Gartner’s sales force caters to a diverse range of enterprise executives, including CFOs, CEOs, CIOs, and supply chain leaders. According to their disclosure, their Global Technology sales target IT departments, encompassing CEOs, Chief Marketing Officers, and senior product leaders. Meanwhile, their Global Business sales reach leaders and teams beyond the IT industry, spanning departments such as HR, supply chain, finance, marketing, sales, legal, and others. I believe Gartner effectively manages its sales force, covering a broad spectrum of target customers. Moreover, all these sales teams can leverage Gartner’s comprehensive research reports, insights, data, and tools to serve their clients effectively.

Gartner Investor Presentation

Gartner has emphasized their commitment to hiring top-quality talent and ensuring a robust sales productivity. It is evident to me that their effective management of the sales force is a key factor contributing significantly to their success.

One of the key leading indicators Gartner is using is the Contract Value (CV), which is calculated as the annualized value of all contracts in effect at a specific point in time, without regard to the duration of the contract, according to their FY22 annual report. Gartner’s sales managers are examining the CV growth rate, and then they would attempt to align the sales headcount growth with their booking growth. I believe that by using CV growth as the barometer, Gartner’s management could avoid hiring too many direct salespersons or having insufficient sales headcount to meet the demands.

On Q1 FY23’s earnings call, their management indicated that their sales team’s turnover was very low, and their retention rate was quite high compared to their peers. It normally takes 3 years for their sales team to achieve full productivity. I believe a stable and low-turnover sales force is quite important for Gartner.

Results and Outlook

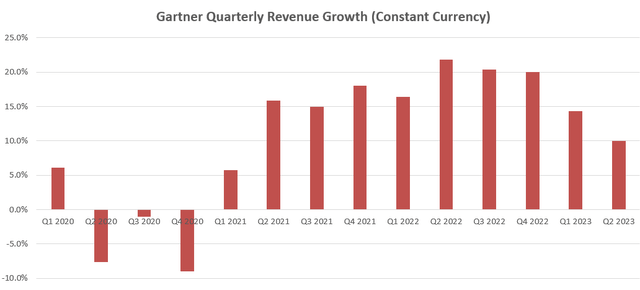

In Q2 FY23, Gartner achieved a 10% foreign exchange neutral revenue growth with a stable adjusted EPS year over year. Their Research business grew by 6.5% in constant currency, Conferences increased by 48.4%, and Consulting was up by 5.9% year over year.

By the end of the quarter, they had $1.2 billion in cash and $2.5 billion in debts, resulting in a gross debt leverage ratio under 2x. This low debt leverage appears healthy and secure, especially in a weak economic environment, in my opinion.

During the quarter, Gartner repurchased $132 million worth of stocks, leaving them with $830 million remaining for future buybacks. Their free cash flow increased by 4% in Q2 FY23, and their adjusted free cash flow conversion from GAAP net income was 119%, indicating a very strong conversion ratio, in my view.

Gartner Quarterly Results

In terms of their outlook, Gartner anticipates Research revenue to grow by 6% for FY23 on a constant currency basis. They project Conference revenue to be at least $490 million and Consulting revenue to be at least $505 million. Moreover, they have guided for full-year EBITDA of at least $1.36 billion, an increase of $30 million from their previous guidance. These results indicate a strong quarter with a positive outlook.

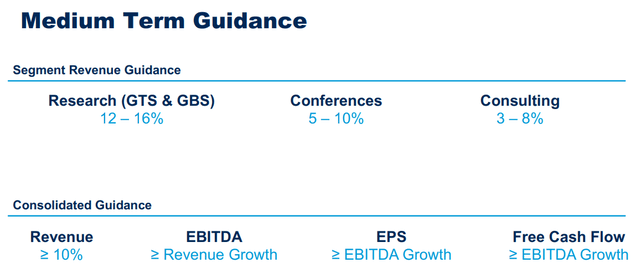

Looking ahead to the medium term, Gartner aims for double-digit revenue growth, with margin expansion driven by operating leverage. According to my calculations, if their Research business grows by 12%, Consulting by 5%, and Conferences by 5%, their overall top-line growth rate would be around 11%. With an 11% top-line growth and approximately 7-8% growth in operating expenses, they could achieve around 20-30 basis points of annual margin expansion. If this holds true, their EBITDA growth could outpace their revenue growth.

Over the past 5 years, Gartner has repurchased $3.3 billion of its own stocks out of the total $4.3 billion cash generated from operations. With the share repurchases, the EPS growth rate should be higher than their EBITDA growth. Taking everything into account, I believe their medium-term guidance is reasonable and achievable.

Gartner Investor Presentation

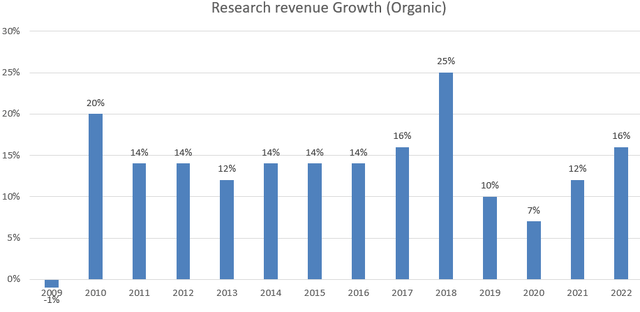

As discussed previously, Gartner’s growth is primarily driven by their Research business. The chart below examines the organic growth rate of their Research business from FY09 to FY22. It has been growing at double digits in most of their fiscal years, and I believe the Research growth creates a safety net for Gartner. Their 12-16% growth rate looks quite achievable considering their strong historical growth track record.

Gartner 10Ks

Key Risks

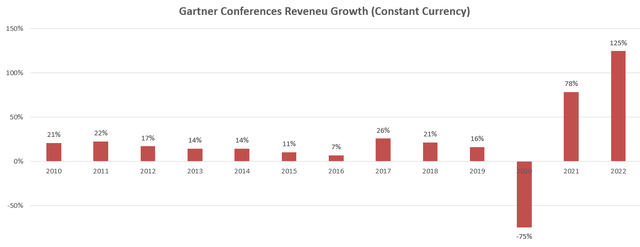

Volatility of Conference Business: I believe the most significant variable in Gartner’s growth lies within their Conference business, which accounted for 9% of total revenue in FY22. This segment organizes industry events, exhibitions, and conferences for enterprises. Consequently, the business’s growth is contingent upon the number of attendees, making it susceptible to volatility on a yearly basis. As depicted in the chart below, the growth rate exhibits considerable volatility; for instance, during the pandemic period, it plummeted by 75% due to widespread event cancellations.

Gartner 10Ks

I agree that the Conference business poses challenges for financial modeling and forecasting. Nevertheless, considering it constitutes only 9% of total revenue, its impact on overall growth is manageable for Gartner.

New Tech Startups: Historically, Gartner has been a leading authority in industry research for the technology sector. Their data and reports are widely utilized by numerous tech startups and venture capitalists for fundraising and roadshows. Gartner, however, does not disclose the percentage of their revenue that comes from these small tech companies. In the current macroeconomic environment, capital is tightening for these startups. The sluggish demand could potentially lead to weaker growth for Gartner’s Research business.

Valuation

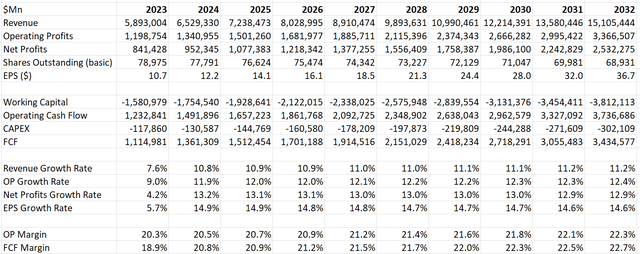

My normalized revenue assumption falls within the range of their medium-term guidance. I anticipate the Research business to grow by 12%, and Consulting and Conferences to grow by 5% annually. Although their target for Research growth in the medium term ranges from 12-16%, my assumption is at the lower end to maintain a conservative model.

When combined, the normalized revenue growth in my model totals approximately 11%, aligning with their double-digit growth expectations. The expansion of their operating margin primarily stems from operating leverage, with operating expenses forecasted to grow at a rate lower than their topline growth. According to my calculations, their annual margin expansion is around 20 basis points over the next decade. With these assumptions, I project their free cash flow conversion to reach 22.7% by FY32.

Gartner DCF – Author’s Calculation

The model utilizes a 10% discount rate, a 4% terminal growth rate, and a 22% tax rate. After discounting all the free cash flows from the firm, I have calculated the fair value of their stock price to be $407 per share, based on my estimate.

Conclusions

I am impressed by Gartner’s consistent double-digit revenue growth and solid margin profile. Despite the potential volatility in their Conferences business, I have confidence that Gartner can achieve its double-digit revenue growth target. In my assessment, the stock price is undervalued, leading me to assign a ‘Strong Buy’ rating to Gartner.

Read the full article here