Investment thesis

Engie S.A. (OTCPK:ENGIY) is the largest private power generator in Brazil, with an installed capacity of about 12 GW. In its recent 2Q23 release, it celebrated becoming the country’s largest 100% renewable energy company. This strong position in the Brazilian market gives the company a significant competitive advantage in the energy sector.

In my opinion, this is a plausible reason for those who already own it to hold onto their shares. However, investors considering buying more stocks should wait for a more favorable entry point, as there might be greater unseen risks that the market is already pricing in the share value, possibly political and regulatory ones.

On the one hand, Engie has shown a solid history of financial performance, with consistent revenues, healthy profits, and dividend payments. Furthermore, the company is well-positioned in the energy and infrastructure sector, which tends to be resilient to economic crises. However, there are challenges and risks to be considered. The transition to cleaner and renewable energy sources might impact the company’s long-term financial results, requiring significant investments in infrastructure. Moreover, government policies and regulations can unpredictably influence the energy sector.

Brief introduction about Engie

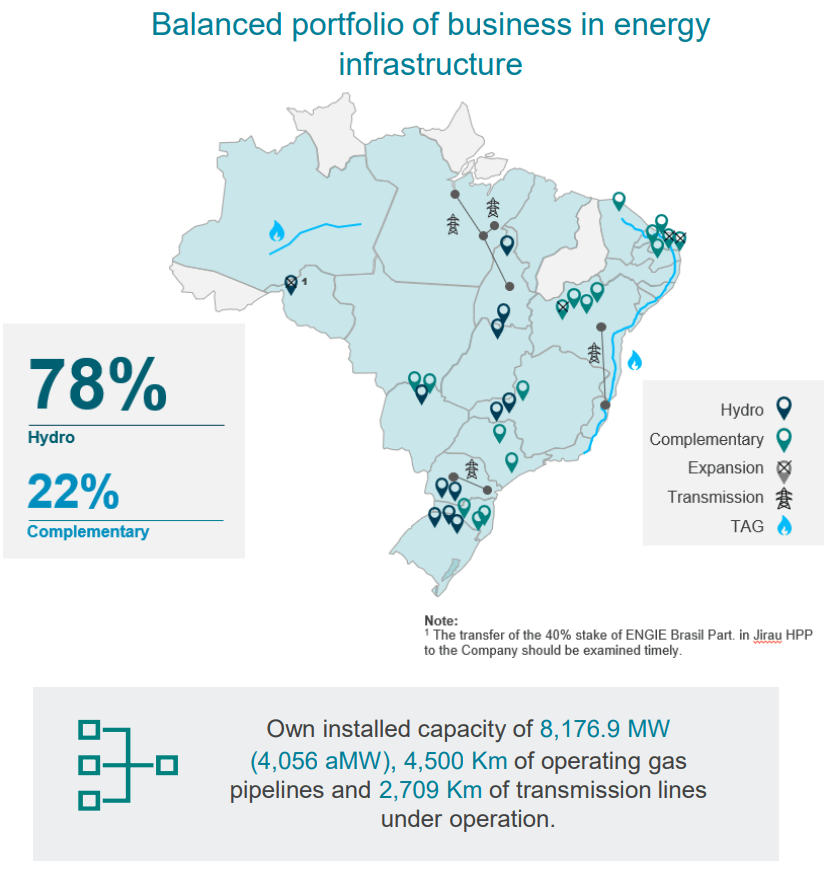

ENGIE Brasil Energia S.A., or simply Engie, is an energy infrastructure investment platform, operating in generation, commercialization, trading, and transmission, as well as natural gas transportation through the Transportadora Associada de Gás S.A. – TAG, in partnership with other stakeholders. As one of the country’s largest private energy producers, it implements and operates projects from renewable sources such as hydroelectric, wind farms, photovoltaic, biomass, and small hydroelectric plants.

The company operates with transparency, financial discipline, environmental respect, community support, and a focus on operational efficiency as enablers of long-term growth. ENGIE Brasil Energia is controlled by the Franco-Belgian group ENGIE, a global leader in independent energy production, with activities in over 70 countries and a strong presence in electricity, natural gas, and energy services.

By the end of Q2 2023, its own installed capacity amounted to 8,176.9 MW, operating a generator park of 9,897.6 MW, composed of 76 plants, of which 11 are hydroelectric and 65 complementary – three biomass, 51 wind, two Small Hydroelectric Plants (PCHs), and nine solar – 72 of which are wholly owned by Engie, and four are operated in partnerships with other companies.

Company’s latest developments

“Engie is investing BRL 10 billion in three renewable energy projects in Brazil, two wind and one solar, according to the company’s president in Brazil, Mauricio Bähr.” Among these projects is the Santo Agostinho, in the northern region of the country, set to be completed by the end of the year. This highlights how the country has immense potential for renewable energy generation, especially wind and solar. These resources are abundantly available (especially in the regions targeted by Engie’s projects) and are non-polluting, making them a sustainable alternative for the significant electric sector in the present and indispensable in the future.

Valor Investe

“Adding up the other projects, the wind farm in the Serra do Assuruá, in Bahia, and the Assu Sol, also in Rio Grande do Norte, we will have 2,000 MW of new installed capacity in Brazil,” said the executive during Engie Day. As with other investments, Engie demonstrates resilience, always discussing the totality of future returns, justifying its significant movements in several projects simultaneously.

Such projects, in addition to contributing to the diversification of the country’s energy matrix and reducing the dependence on fossil fuels, will generate jobs and income for the Brazilian population. This could spark political interest and positively influence future regulatory decisions.

“Engie has a global goal of reaching 50 GW of renewable capacity by 2025 and 80 GW by 2030. In Brazil, beyond these three projects, the company is still looking into which other renewable energy projects will be added to its portfolio. “Brazil is the Disneyland of renewable energies,” says Bähr.”

Valor Investe

“According to the company, the model of the equipment that suffered damage in the Potiguar wind farm is the same as the one at the center of a broad review of Siemens Gamesa’s wind turbine business, announced in June, which punished Siemens Energy’s stock.

Engie also said that, as a precaution, it is conducting a detailed evaluation of 13 turbines in operation and another five being commissioned – a total number of wind generators that have the same blade supplier as the damaged one.”

This is a point I paid a lot of attention to. It is important that the investment, installation, and maintenance of equipment be done responsibly and that there be regular inspections in order to prevent malfunctions and accidents that could have negative impacts on both the company’s finances and its employees, as well as the environment. For example, it is essential that wind and solar plants are installed in places that do not affect biodiversity.

In any case, such events, if not handled with proper care, can directly affect the company’s popularity in the future and consequently its price, increasing insecurity among its investors and potentially leading to sanctions in more severe contexts.

A brief snapshot of the latest financials

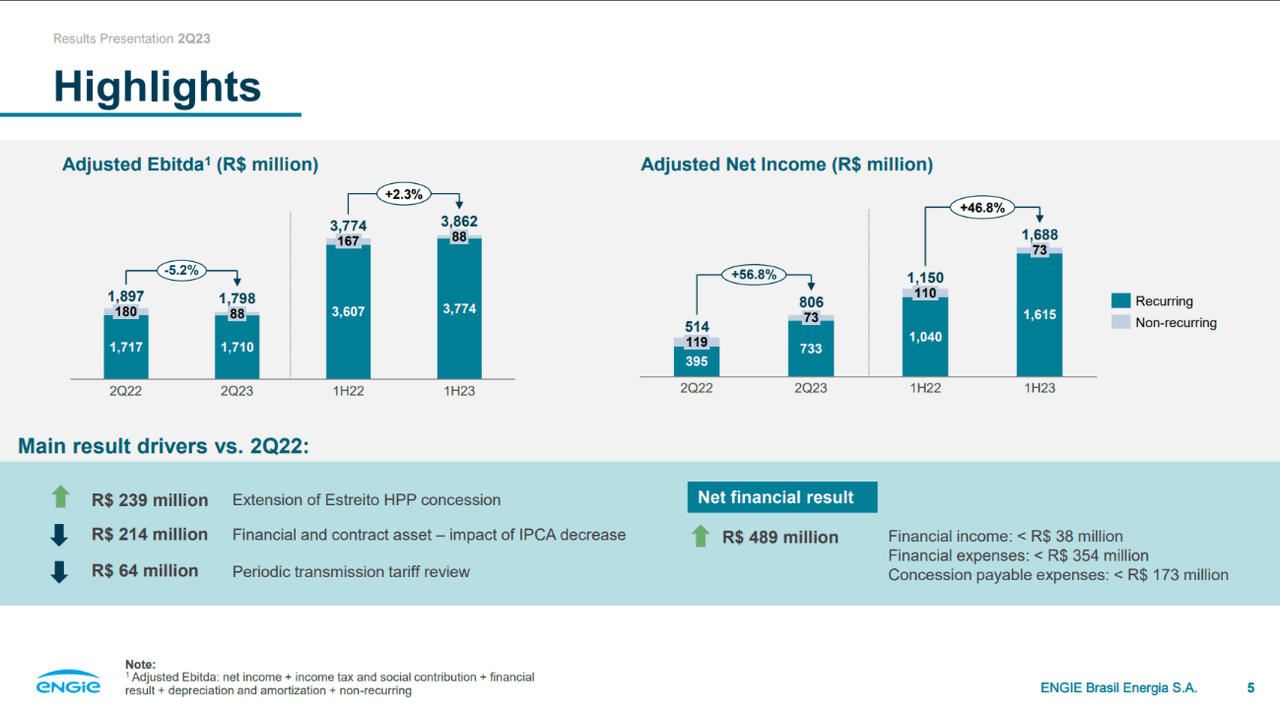

The adjusted EBITDA showed a decrease of 5.2% compared to the previous period, reaching R$ 1.798 billion in 2Q23. The adjusted EBITDA margin was 68.9%, an increase of 5.6 percentage points compared to 2Q22. In my view, this is a negative result, but due to the increased margin, it demonstrates greater flexibility and efficiency in its operational costs.

I see that this EBITDA drop is also due to external factors such as a 12.9% decrease in net revenue for the period, caused by a reduction in energy sales prices, resulting from the reduced hydroelectric generation during the period, which was caused by droughts. With the company’s focus on renewable energies, this impact on results is expected to be increasingly reduced in the coming years.

The adjusted EBITDA for transmission effects increased by 10.9% compared to the previous period of 2Q22, from R$ 1.7 billion to R$ 1.9 billion. This was previously affected by a reduction in sales volumes, by lower revenue from financial assets and contract remuneration by R$ 214 million, and the effects of the periodic tariff review of transmission assets by R$ 64 million. These factors were mitigated by the acknowledgment of amounts related to the concession extension of the UHE Estreito (a hydroelectric plant located in Maranhão, a state in Northeast Brazil), with compensation of R$ 239 million.

A 56.8% increase was recorded in the Adjusted Net Profit when compared to the same quarter in 2022, reaching R$ 806 million. This was due, in addition to the effects I mentioned earlier, to the reduction in net expenses, reduction in energy purchases, and increase in the net energy sales price. The increase in Engie’s adjusted net profit directly contributed to the rise in the EBITDA margin and is a very positive result, indicating that the company is recovering from recent economic crises in the sector and is well positioned.

Investor Relations

Valuation

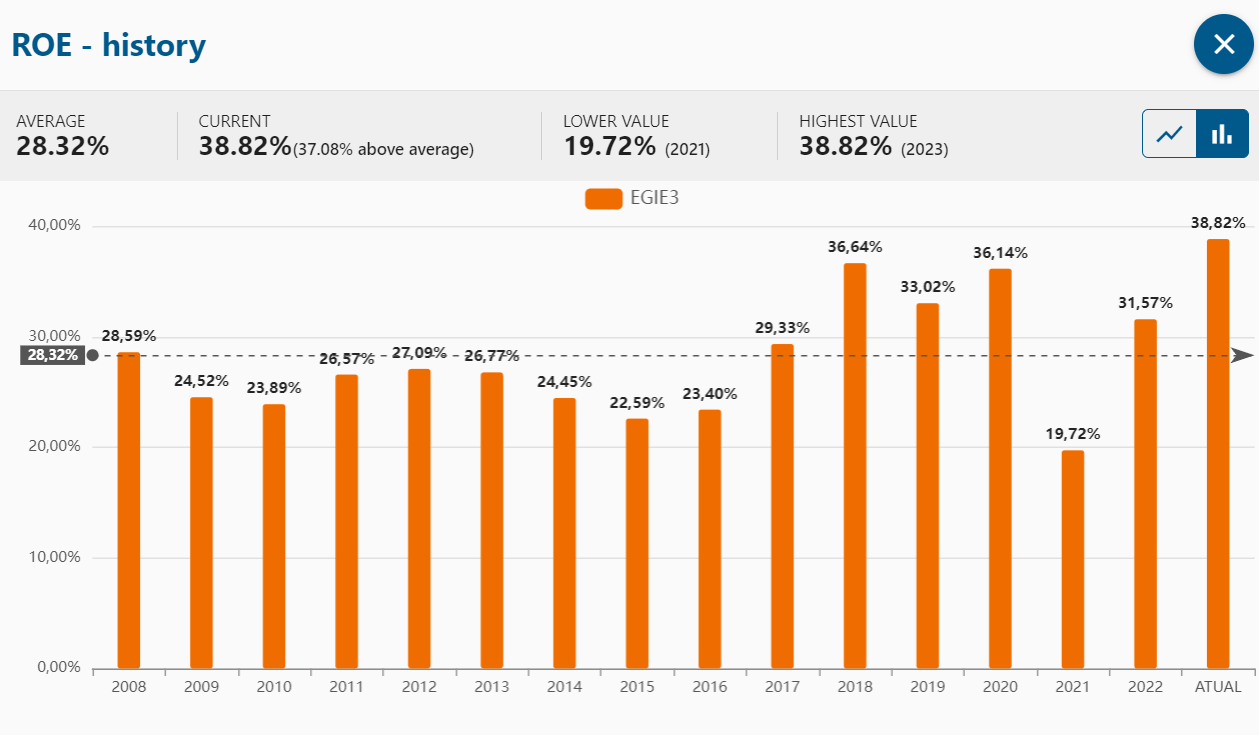

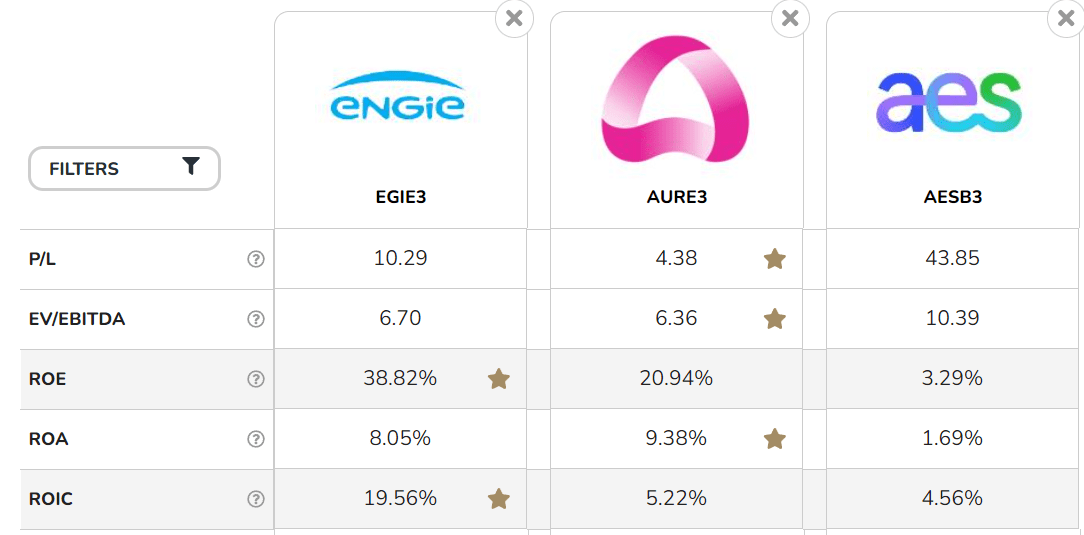

After a challenging year due to the pandemic and the water crisis of 2021, and a good rebound in 2022, Engie in 2023 achieved the milestone of breaking its ROE’s previous historical high of 36.64% in 2018 and reached a peak of 38.82%, the highest one in over 15 years, as we can see in the graph below.

StatusInvest

Even with this significant return, especially when compared to other private energy sector competitors such as Auren Energia and AES Brasil, adding an ROA of 8.05% compared to Auren’s 9.38% and a ROIC of 19.56%, I find it odd that Engie has such a low P/E of 10.29 with such a high ROE and an EV/EBITDA of 6.70 with an also high ROIC. In my observation, looking at the stable historical ROIC and ROE of the company over the years, this P/E might be justified by external factors, since Engie has proven to be the most efficient and well-managed energy company in the private sector, reinforcing the thesis to keep it in the portfolio.

Valuation indicators between peers in the sector. Here, P/L translates into P/E (StatusInvest)

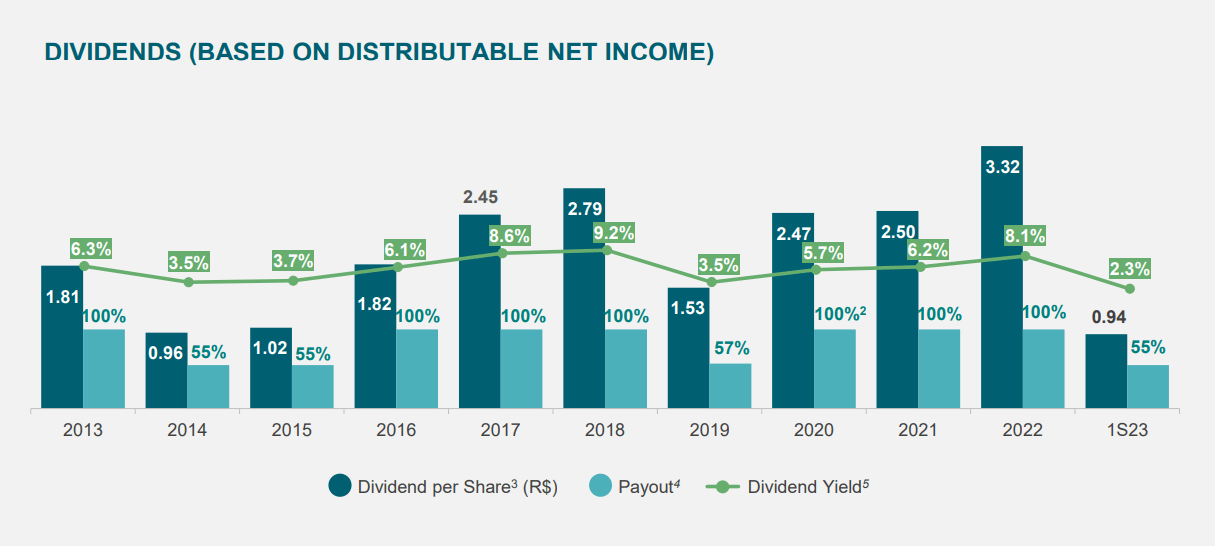

So, in my view, this could suggest that Engie’s returns might be likely mispriced, or I believe investors still have concerns about the company’s future results regarding its recent expansions, debts, portfolio diversifications, involved risks, and expectations about its competitors. It’s worth noting the recent decision to decrease the Dividend Yield from an average of 8.1% to 2.3%, roughly by more than 70%, and the payout ratio from 100% to 55% after a 3-year consistency period, highlighting the heavy allocations of resources in long-term investments.

Investor Relations

Potential risks

Despite having a broad and diversified range of renewable energy alternatives today, Brazil is still highly dependent on energy from hydroelectric plants. Thus, sudden drought periods, such as the worst water crisis in 91 years that took place in Brazil in 2021, can significantly impact Engie’s results, since this energy source still makes up more than 78% of its portfolio.

Investor Relations

Another risk for those willing to invest in the sector, and those who wish to maintain their positions, is the regulatory environment. The government regulates the energy sector in the country, and the current administration, along with some politicians, often do not support certain proposals for reform in the energy industry. Instead, they accept measures that support tariff increases and other types of taxes for both consumers and companies.

However, I believe in an optimistic scenario where regulatory risks are not so impactful, and the reinvestment of resources continues to yield consistent returns. As of now, for example, to the surprise of many in 2023, reservoir levels are above 70%, prices are low, and there’s abundant supply, which poses a great environment for Engie’s appreciation.

That is, experiencing exponential growth in the coming years, offering more confidence to investors and consequently increasing its price. It’s becoming increasingly uncertain about the best time to invest in the company, seeing that it has a growing vision for the future of renewable energy sources both in Brazil and globally.

Bloomberg

Conclusion

I believe that Engie is a promising company with good potential for growth in the future. The company is well-positioned for the transition to cleaner and renewable energy sources, which is a global trend.

Although Engie shows a solid track record of financial performance with consistent profits, dividend payments, and an impressive return on equity (ROE), some aspects of its valuation seem contradictory. With a high ROE, a low P/E ratio, and a reduced EV/EBITDA, Engie appears undervalued compared to its peers in the sector.

I believe the company should reduce its dependence on hydroelectric power to mitigate the risk of droughts and other adverse weather conditions. The company should also monitor government regulations to identify growth opportunities and avoid unexpected costs. If it manages to mitigate these risks, I believe the stock has the potential for significant appreciation in the long term, making it an excellent decision to keep it in the portfolio.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here