Following the devastating attacks in Israel, defense stocks surged, and Lockheed Martin (NYSE:LMT) was no exception. With event-driven surges like these, there are two ways things could be heading. The first path is that the surge fades and the second one is that the event sets in motion a rally. In this report, I will be re-evaluating the stock prior to its Q3 financial results presentation later this month.

Generally, I do expect the buy thesis laid out previously to remain intact for the simple reason that little has changed since, other than the stock losing value and Lockheed Martin increased its dividend which seemingly makes the investment case for the stock even more compelling.

The Need For Higher Defense Spending Is Clear

The tragic events in Israel do show one thing and that’s conflict in the world has not been isolated to just the challenges in Ukraine. There are various conflict areas – Ukraine, Israel, and the Middle East, and Taiwan. Each conflict zone is not in isolation and also drives higher defense spending in the region and among allies.

The evoX Defense Monitor shows that in 2024, global defense budgets are expected to increase to $2.6 trillion, a staggering amount driven by global conflict. The expanding defense budgets support spending in several areas, namely modernization, expansion of capacity, expansion of existing capability and new weapon system capabilities. Generally, conflict spurs the prospects for defense contractors, but it’s the defense solutions portfolio that determines which defense contractors will benefit more than others. I view Lockheed Martin as one of the companies that is positioned well in the defense landscape.

What To Expect From Lockheed Martin Q3 2023 Financial Results?

For the third quarter, analysts expect revenues between $16.08 billion and $16.97 billion with a consensus estimate of $16.69 billion indicating 0.62% growth and EPS of $6.64-$6.82 with a consensus estimate of $6.62 indicating a 3.7% drop. If you would solely look at the positive backdrop for defense companies, the projections are somewhat underwhelming. However, it should be noted that prior to the escalation in Ukraine, Lockheed Martin was seeing some pressure as certain programs would ramp down offsetting ramp-ups on other programs resulting in lower growth or even flattish sales in 2023 and 2024. These years have been marked as transition years and defense companies are as agile as an oil tanker, it is hard to turn it but once it is moving it is hard to stop it.

Despite escalating conflicts, those transition years are not magically going to turn into high growth as defense contracting and procurement are almost as agile. The defense industry is driven by the mid- to longer-term trends. So, 2023 and 2024 are not going to be huge is the expectation due to the ramp-up nature and the relatively long time for customer interest translating to backlog and subsequently to revenues. The war in Ukraine did accelerate translation to backlog somewhat, but ramping up programs is still another story. Furthermore, the F-35 program has been coping with some setbacks in terms of its ability to deliver the advanced jet as well as the production rate unlikely to be hitting the sustained higher production levels that were initially anticipated. The positive is that 2024 is now the point at which Lockheed Martin does expect a return to growth, so there is some positive compression in the timeline.

When Will Lockheed Martin Report Q3 2023 Financial Results?

Lockheed Martin will be reporting its Q3 2023 financial results and 2023 guidance on the 17th of October before the opening bell followed by an earnings call at 11 AM EST.

What Dividend Does Lockheed Martin Pay?

Lockheed Martin recently announced an increase of its quarterly dividend to $3.15 per share, providing a 5.1% increase with a 2.9% forward yield. It’s not a juicy yield, but the prospects of share price appreciation and dividend increases provide a nice yield overall.

I previously pointed out that the dividend increases were falling behind of the CAGR of 13% and that has been the case for several years now. The 5.1% increase results in annual dividend increasing 6.6% which is lower than the long-term CAGR as well as the CAGR measured from a certain year to 2023. So, the dividend hike is losing steam in some sense, but it should also be pointed out that maintaining a high CAGR is challenging.

Lockheed Martin Further Enhances Shareholder Value

The positive for shareholders is that the company authorized the purchase of up to an additional $6 billion, nearly doubling the total authorization of the current program to $13B for future purchases. While not everyone is a fan of share repurchases and prefers dividends, the share repurchases provide some additional yield when timed well and also play an important role in keeping a dividend growth record.

Is Lockheed Martin Stock A Buy?

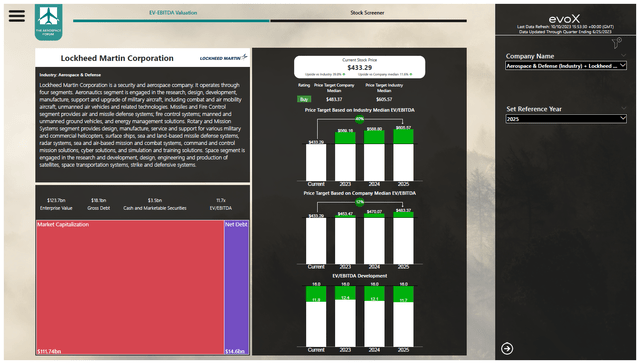

Lockheed Martin stock price target evaluation (The Aerospace Forum)

Previously I put a $553 stock price target based on valuing Lockheed Martin in line with the industry median. My near-term price target now is $483 per share up from $464 given that Lockheed Martin tends to trade forward at 2025 earnings. Based on the industry median the longer-term target for now is $569 per share. The changes in estimates are driven by better free cash flow performance, slightly better results, higher share repurchases this year and lower debt accumulation than initially anticipated. As a result, I continue to maintain my buy rating for the stock.

Conclusion: Lockheed Martin Remains A Buy Amidst Global Tension

Lockheed Martin is facing pressure on the long-term production rate of the F-35, but we also see that in the current geopolitical landscape, there is upward pressure on defense spending and the F-35 is gaining traction in Europe. We’re also seeing that Lockheed Martin seems to be returning to growth a year earlier than initially expected. So, while there’s some program ramp friction, we do see upside for the stock. Additional upside in the years after will be driven by an ability to convert backlog to sales. So, I do expect that while the market currently still cheers on high order intake, at some point the focus will shift toward the ability to actually convert the backlog at a fast but sustainable rate.

Read the full article here