ASML Holding N.V. (NASDAQ:ASML) is a Dutch multinational company that specializes in advanced photolithography equipment used in semiconductor manufacturing. ASML is a key player in the global semiconductor industry, providing cutting-edge lithography machines that enable the production of smaller and more powerful semiconductor chips. These chips are crucial components in various electronic devices, including smartphones, computers, and automotive systems. Over the years ASML has positioned itself to be almost the only supplier of this cutting edge technology that has revolutionized the mass scale production of chips.

To understand ASML and its competitive advantages, it is of utmost importance to know how the chip market works. Four sectors can be identified: key technology suppliers, foundries, designers and consumers.

Technology suppliers are companies focused on developing all the machinery needed to ensure that mass production of chips is achieved. In other words, suppliers are the first elements in the value chain and are essential to ensure cost efficient machines for foundries. ASML falls within this category thanks to its EUV and DUV machines, which use UV light to print circuits at characteristic lengths in the order of nanometers.

Foundries are the factories of integrated circuits in the world. The sector is highly oligopolistic and the three main players are Samsung, TSMC (TSM) and Intel (INTC), which is also present not only in assembly but also in design. This sector is more cyclical since shipments are demand dependent and their revenue is not as recurring as other parts of the value chain.

Designers are in charge of shipping to customers customized integrated circuits with specific functionalities that can serve for image processing, data management, data storage or simply mere computing power. The current AI cycle in which we are living demands more data storage capacity, as well as computing power and more image and video processing capacity. Companies such as NVIDIA (NVDA) are profiting from this and, indirectly, others such as ASML will also find benefits from this new digitalization wave that we are immersed in.

Customers include companies which need electronic chips to manufacture their products. Some of these companies include Tesla (TSLA) and Apple (AAPL), among others.

As mentioned previously, ASML falls within the category of technology suppliers, which produce a range of new techniques and machines that use and apply Physics in order to improve the large scale manufacturing process of semiconductors. Optical lithography is the most commonly used technique in order to impress circuits in wafers. The normal preparation of a wafer consists of two layers: substrate and oxide. The substrate consists of a semiconductor material (normally referred to as p, less populated with electrons) and an oxide. After this, a layer of photoresist is applied, a material which is degraded by light after exposure. Exposure to UV light via masks allows technicians to carve shapes in the photoresist and later a chemical agent removes the parts of oxide that are not protected by the photoresist anymore. Finally, the remaining layers of photoresist are eliminated and the semiconductor has been designed according to the client’s needs. The company has developed machines that help automatize this technique using DUV and EUV technologies, which stand for deep ultra violet and extreme ultraviolet photolithography, respectively.

The most updated technology of ASML has achieved to produce nm wavelengths that can carve the wafers at these characteristic distances. Constant improvements in carving, as well as UV laser technology have helped the company achieve a degree of technological maturity that no other company has yet developed.

During years ASML has been one of the few companies that has developed photolithographic technology and has taken it to another level. The company started producing basic lithographic systems in the 80s, as a joint venture of Philips and Advanced Semiconductors Materials, but their growth was slow and their expansion capacity limited. In the 90s the company went public and began to trade in the Amsterdam Stock Exchange. This allowed the corporation to capture capital in order to fuel growth and investments in research and development. The 2000s were a golden age for ASML since they developed their TWINSCAN machines, which allowed exposure of one wafer and measurement and alignment of the next. This was a landmark in ASML’s technological maturity because it provided a boost in productivity that was not possible before the development of the TWINSCAN machines. At the end of the 2000s more advanced technological improvements were made thanks to a more accurate and precise drawing laser. The culmen of ASML was without doubt acquired in the decade of the 2010s. In 2010, the company shipped the first EUV system (NXE:3100) which used shorter wavelength for drawing and designing. This meant another boost in productivity because smaller and more efficient chips could be manufactured. But how do these machines really work?

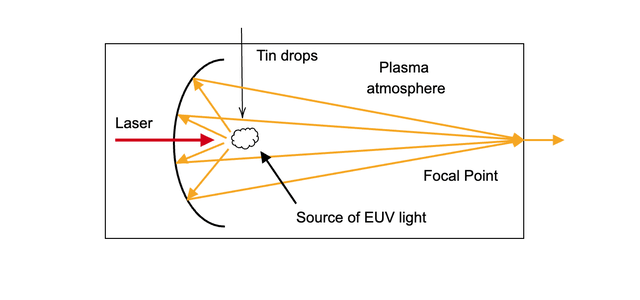

Briefly speaking, the machine is like an ultra-precise robot which draws paintings at a nanometric scale. Don’t get me wrong, it is not that ASML has decided to shift to artistic endeavors. The paintings are the designs of the microchips that the foundries such as TSMC produce for their clients. Via their software, the engineers at TSMC indicate the machine which type of customized circuits they want in order to satisfy the demands of two big consumers of these products: Apple and Tesla. When the engineer gives the order, more than a million of lines of code process the commands and translate them into electric signals, which trigger the production of UV light within the system. UV light is a part of the electromagnetic spectrum which occurs naturally, but used in a confined space makes lithography possible. The EUV light is produced with a plasma (an aggregation state of matter which consists of a mixture of gas particles combined with ionized elements) via releasing tin drops to the ionized gas. A more powerful laser then hits the modified tin, which releases EUV light which will be conducted via a sequence of mirrors until it draws in the wafer the desired shape.

How EUV light is generated (Own models)

The EUV light is then sent to the scanner for alignment to project over the wafer and print the desired circuit. At this moment ASML is the only company in the world that is able to produce EUV powered lithography systems. This current irreproducibility of its technology, combined with the company’s presence in a market with decades of growth, reduce the probabilities of technological disruption and guarantees the existence of a durable moat, which is a synonym of relatively low terminal value risk.

The natural question that arises now is: how does all of this technology translate into economic value and profit generation? The world’s digitalization, accelerated by a larger consumption in electronics has boosted the demand for chips and factories have been working hard to keep up to the increasing demand. This tailwind has benefited ASML, which has consolidated its position as market leader and broadened its installed based for its main customers. Sales from EUV and DUV machines are the main sources of income for the Dutch corporation. In addition, an older installed base constantly requires supervision and maintenance of key components that only ASML can provide. Over the last years, the company has continuously increased its sales from maintenance of installed based, which amounted to more than €5 billion in 2022.

Sales per se are not the only important thing for ASML, but also control of their supply chain. The company has key technology providers that they have been acquiring in order to improve vertical integration and reduce dependency from companies that could stop selling essential components for the fabrication of their technology. Full ownership also allows ASML to determine how providers are to produce (mirrors for the machines for instance) in accordance to the company’s needs. The gross margins reflect this policy and have doubled over the last decade. Despite the fact that the company has grown significantly over the last years, the percentage of the cost of sales has decreased in relative terms compared to the sales. This indicates that a strategy of intense growth combined with disciplined cost structure has turned successful and positive for the company. In addition to this, the company has a net cash position that exemplifies how good the business has been running without the need of recurring to debt to boost growth.

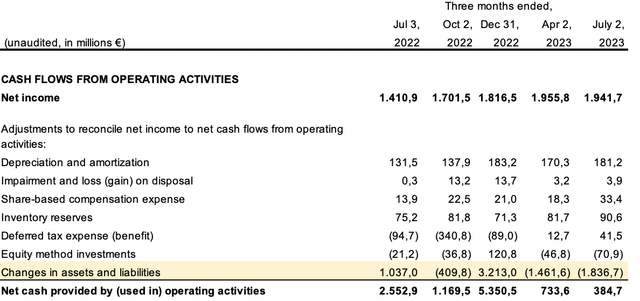

The free cash flow profile of the company is a bit erratic since it is subject to the natural cycles that occur in the semiconductor market. This market is characterized by periods of tight supply caused by strengthening demand and/or insufficient manufacturing capacity, followed by periods of surplus inventory caused by weakening demand and/or excess manufacturing capacity. Since the company is totally immersed in this market, it is subject to this fluctuations and hence to a higher volatility that the average public company. At this point of the article the reader may ask: is it possible for ASML to sustain their cash flow generation in the future? I believe the answer is yes. And this is due to the increasing widening moat that EUV technology and capex investments provide to the company. In 2012, the company produced €1.9 FCF/share while in 2022 this amounted to €18, multiplying by 9 times in 10 years, which is equivalent to an annual growth rate of 24% in the same period. However, due to the accumulation and depletion cycles inherent to semiconductor companies, they have had some difficulties in terms of cash flows. In the last quarter, net income has increased due to higher shipments of lithographic equipments, which increased to the amount of €5.6 billion. Installed base management resulted in revenue of €1.6 billion in Q2 2023. In contrast to this, net bookings decreased more than 50% with respect to the same period in the previous year. This drop has produced negative changes in assets and liabilities, which has led to a temporary decline on the cash flow generation of the company. This was due to an increase in inventory as a provision for a higher demand than realized.

Cash Flow Statement (Investor Relations)

The highlighted line shows how this cash outflow impacted negatively on operating cash flow, which is down 84% with respect to last year. Despite the abrupt drop, it is important to stress that once demand is normalized again according to the semiconductor cycle, cash flow generation should go back again to healthy levels.

A brief point that is interesting to make is related to the capital allocation policy in terms of remuneration to shareholders. The company has systematically maintained a growing dividend that can be modulated depending on the moment of the semiconductor cycle. As far as share buybacks go, I personally understand that they have not been opportunistic enough to maximize value generation for their shareholder base. It is questionable, to say the least, that the company bought back €8 billion in shares when they were trading at the highest valuations of the last decade. Although many management decisions have gone in the right direction, this move is one of the negative points to highlight in capital management.

Regarding valuation, a reasonable estimate for ASML is to compound in FCF at annual rates of 12% (expected growth based on ROIC and reinvestment rate) in the next five years if demand for new EUV and DUV machines alongside repair needs continue to thrive. The terminal value can be computed via the following expression:

Terminal Value = Cash Flow in Year 5 / (Discount Rate – Terminal Growth Rate)

In this case:

- Cash Flow in Year 5 (‘CF5’) = €12 billion.

- Discount Rate (‘R’) = 10% (reasonable internal rate of return for ASML in the long term).

- Terminal Growth Rate (‘G’) = 3.5% (logical estimated growth for ASML for year 5 onwards).

Plug these values into the formula:

Terminal Value = €12 billion / (0.10 – 0.035), Terminal Value = €154 billion.

Adding all the value of present cash flows the equity value is around €209 billion, around €528 in a per share basis. This number should not be considered as a fixed value, but more as a reference point around which value can oscillate around to a certain degree. The direct implications of this aforementioned oscillation have to do with which discount rate and terminal growth rate the investor decides to use.

In short, ASML is a company that has competitive advantages in the form of high capital requirements and a monopolistic producer of the most efficient technology for printing circuits on wafers. The constant culture of innovation, as well as its ability to remain at the technological forefront, are other non-obvious competitive advantages that can help widen the defensive moat in the long term. Until now, the company has made correct decisions in terms of capital allocation, especially in relation to expansion capex and not so much in relation to shareholder remuneration, which has been un-opportunistic when the valuation was excessively demanding. Some risks on the horizon may come from the development of new technologies that displace ASML as a key material producer for the semiconductor industry. However, this scenario is unlikely because the installed base continues to increase and the company works intensively to improve useful life with new technologies and complementary services.

Read the full article here