The Invesco Food & Beverage ETF (NYSEARCA:PBJ) is actually quite risky because the big brands invite a certain degree of complacency. We often find that companies with brand equity receive an always unjustified ‘invincibility premium’, meanwhile there are major risks in evolving consumer behavior on a secular basis, including eschewing calories, as well as the immediate effects from inflation which leads to margin pressure. A good thing is that PBJ doesn’t include the Bud Light brand in its allocations, so none of that fallout is in sight. Overall, we are indefinitely underweight these brand equity heavyweights as secular factors evolve.

PBJ Breakdown

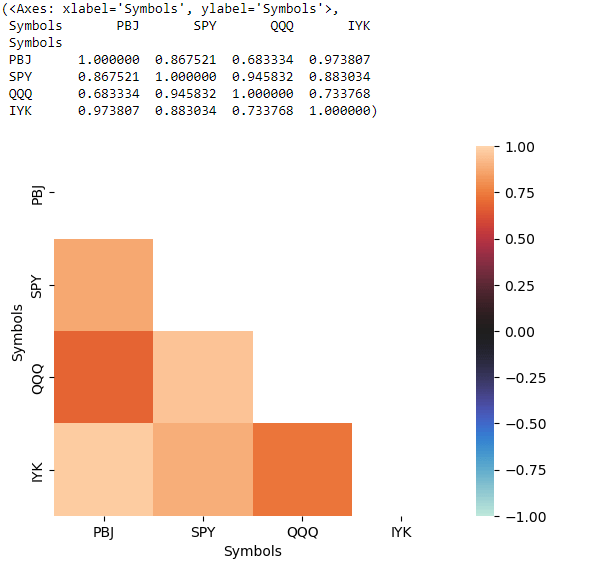

PBJ is not a value-weighted ETF, and it contains plenty of somewhat smaller companies. It is also a limited group of only 30 companies. This is not a good thing, because it means that the fund will put a premium on the expense ratio and management fee, which in total is at 0.57% which is higher than average for brand equity ETFs with plenty of large-cap allocations. There isn’t anything orthogonal about these allocations either and how they’ve evolved in performance over the last 3 years, with a very high correlation with the broadest of consumer staples ETFs. Paying extra for lacking value-add is not a particularly good start.

Correlations (VTS)

Here are some of the holdings, note the allocation sizes are somewhat uniform: Chipotle (CMG), PepsiCo (PEP), Coca-Cola (KO), Constellation Brands (STZ), General Mills (GIS), Mondelez (MDLZ), Monster (MNST), Adecoagro (AGRO), Dole (DOLE) and Bunge (BG). The average allocation is around 3% per stock, again related to the uniformity in allocations, and this is a somewhat representative group to be able to make comments on the direction of the ETF. This group is comprised of commodity food producers, food inputs, consumer staple companies, and beverage companies.

There are some real problems with 3/4 of these categories:

- Consumer staples are under pressure in a couple of ways. Weight loss drugs are now a problem for major calorie-rich brands, hitting PEP and KO shares badly recently. This is an immediate effect related to prospective blockbuster weight-loss meds that could influence the prevalent population of overweight and obese people in America and literally reduce the appetite for calorie-rich targets. Novo Nordisk’s (NVO) win is Coca-Cola’s loss. This also reflects a point we’ve made for years, and it is the reason why we would never own Coca-Cola, which is its massive multiple compared to tobacco despite comparable damage to public health. There is a mounting realization of this that could work against these supposedly invincible brands with a complacent shareholder base that could cause major capital impairment when that shoe drops and regulators in major markets introduce sugar taxes, even though it could take a long time and this is not the consensus view at all for now. But this concern is bad for the majority of consumer staples and the weight loss drug successes of Wegovy and others could breathe life into that discussion by equity researchers with clients.

- It gets worse with inflation, which is at least not as much of a secular problem (to the extent you ignore the inflationary effects from cascading deglobalization). Inflation means downtrading to less profitable supermarket brands, removing volume and margin. Even within the portfolio, there is a shift from out-of-home products to at-home products, also associated with negative mix effects that hit margins.

- For farmers and food producers, the risks are fertilizer availability and prices. While exposures like Adecoagro are advantaged, due to the characteristics of their primary crops and helpful protectionism by India for rice, a severe issue around fertilizer supply, a major strategic resource that is seeing protectionist hoarding in China and where Russia is a major producer, could impact the crops and turn down yields and income meaningfully.

- Food inputs, including Bunge with fertilizer, look good and are supported by strategic and geopolitical factors on top of resilient end markets.

Bottom Line

We don’t like the guaranteed losses in expense ratios, to begin with when the PBJ is correlated with the cheaper iShares US Consumer Staples ETF (IYK) with a 0.4% expense ratio. We also are underweight consumer staples as there are emerging and current risks that threaten immediate earnings direction in the face of generally higher interest expenses across corporate America, a problem even for the broader index’s forecast direction in our opinion. The main benefit of the PBJ is that it is not value-weighted compared to IYK, which means that you at least get away from the large-cap stocks with more brand equity and in our opinion more distance to fall. Indeed, the PE for PBJ is around 16x compared to the IYK 20x. But performance between the ETFs is still quite comparable, -5.5% to -9% for IYK, and the 16x PE is still pretty high implying an earnings yield lower than risk-free benchmarks despite several mounting avenues of potential earnings pressure – not a compelling combination. We just don’t want anything to do with this when the markets are complex right now and there are all sorts of interesting propositions that start at low multiples.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Read the full article here