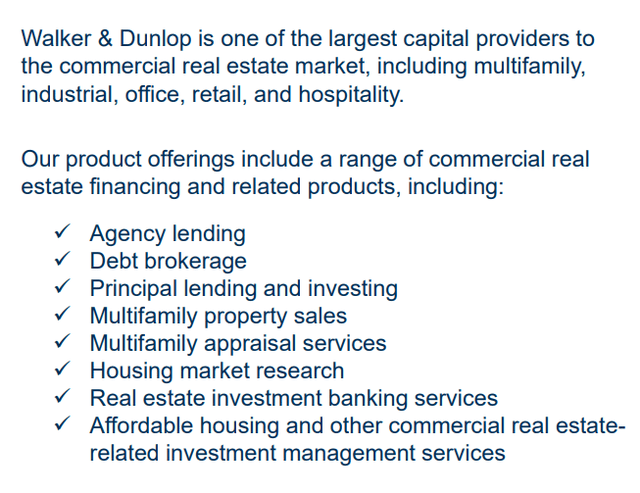

Walker & Dunlop (NYSE:WD) is a Bethesda, Maryland-based integrated commercial real estate finance and advisory services firm, with operations across CRE consultancy to CRE portfolio management, CRE loan servicing, and so on and so forth.

Investor Overview August 2023

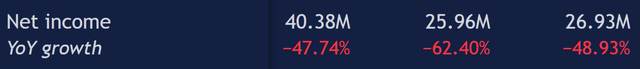

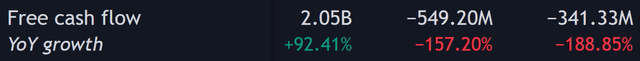

Through these activities, WD has achieved Q2’23 revenues amounting to $265.50mn- a 13.84% decline YoY- alongside a net income of $26.93mn- a 48.93% decline- and a free cash flow of -341.33mn- a 188.85% decline largely driven by declines in operating cash flow, itself a product of interest rates and other factors squeezing the CRE market.

TradingView TradingView TradingView

Introduction

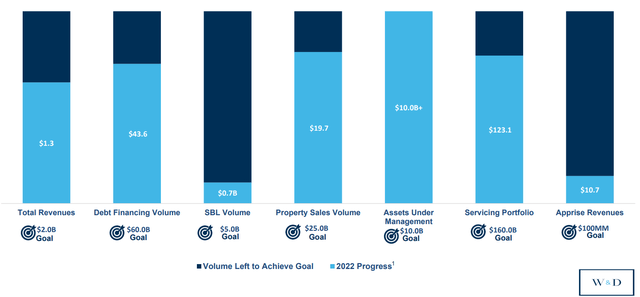

In spite of short to medium-term challenges related to vacant CRE and interest rates reducing the value of fixed-income real estate facilities, WD continues to pursue and fulfill its longer-term growth objectives. By 2025, the firm has committed to the expansion of debt financing volumes across origination, small balances, and loan servicing in addition to growing property sales to $25bn, growing investment banking and asset management AUM to $10bn, and ultimately achieving ESG inclusionary objectives in parallel.

August 2023 Investor Overview

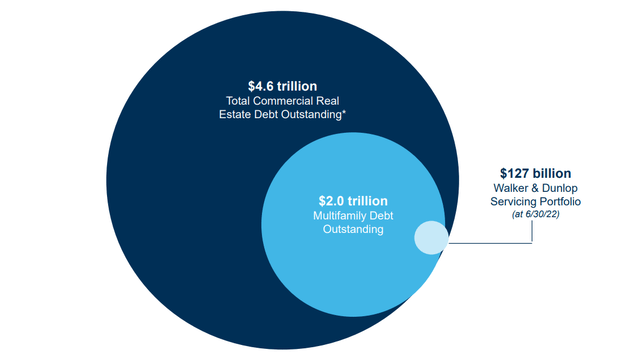

By doing so, WD aims to expand its footprint, particularly across the CRE and multifamily credit industries, which offer a multi-trillion TAM and are well-positioned, with many CRE firms and assets increasingly in distressed positions and thus selling at major discounts.

August 2023 Investor Overview

The confluence of WD’s general strategy alongside their general undervaluation would lead me to rate the company a ‘strong buy’, however, uncertainty regarding the length of macro turmoil and WD’s ability to remain deleveraged leads me to rate WD a ‘buy’.

Valuation & Financials

Trailing Year Price Action

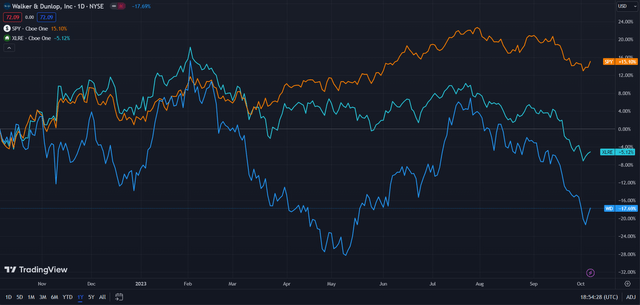

In the TTM period, WD’s stock- down 17.69%- has underperformed both the Real Estate Select Sector SPDR Fund (XLRE)- down 5.12%- and the broader market, as represented by the S&P 500 (SPY)- up 15.10% in the same period.

WD (Dark Blue) vs Industry and Market (TradingView)

While real estate as a whole has seen price decline attributed to rising interest rates, leading to compressed demand and reduced liquidity, WD has been hit particularly hard due to pressures on the wider CRE industry from work-from-home, interest rates, etc.

That said, I believe WD is underpriced due to an unfair affiliation with other CRE firms and subsequent index inclusion; the company, holding multifamily assets and focusing on credit facilities for CRE firms, thus operates with different dynamics and remains fundamentally undervalued.

Comparable Companies

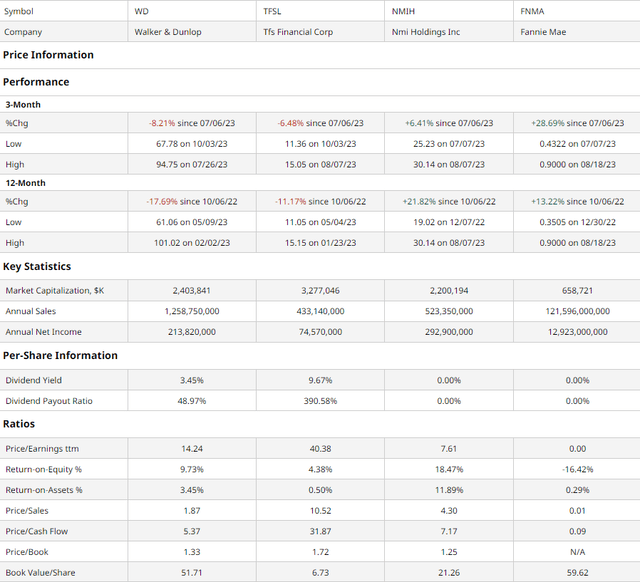

With WD occupying a more specialized niche in the CRE industry, the company is not directly comparable with many publicly listed firms, as many CRE companies are either REITs or larger private equity or asset management firms. As such, I sought to compare WD with similarly sized residential or commercial real estate credit companies. This group includes the Cleveland, Ohio-based TFS Financial Corporation (TFSL), Emeryville, California-based mortgage insurer, NMI Holdings (NMIH), and Washington, D.C.-based mortgage securitizer and government-sponsored enterprise, Fannie Mae (OTCQB:FNMA).

barchart.com

Both in the trailing twelve-month period and the trailing quarter, WD has experienced the poorest price action among peers, which can largely be attributed to the company’s exposure to CRE. Thus, I believe the company maintains an outsized capability for growth, unfairly undervalued as demonstrated by superior multiples-based value and growth/income capabilities.

For instance, WD maintains the second-best trailing P/E of the peer group, alongside the second-lowest P/S, P/CF, and P/B, demonstrating value across all financial statements. Moreover, the firm retains the second-highest book value/share of the group.

Additionally, when assessing capacity and outcomes of reinvestment into the company, WD demonstrates strength with the second-highest ROE and second-best ROA.

To top it all off, WD’s 3.45% dividend is the second-highest in the group with a much more reasonable payout ratio than TFS Financial, which has the highest dividend.

Valuation & Upside

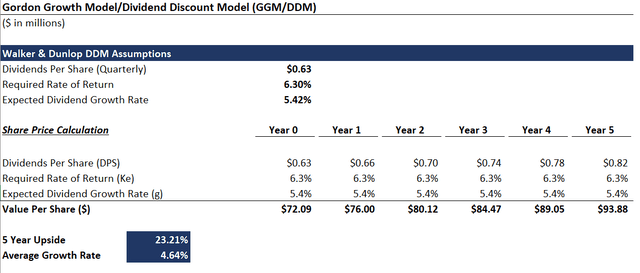

When assessing a financial company, a discounted cash flow valuation often fails to holistically encompass a firm’s value. Thus, I applied a dividend discount model in addition to my DCF to more accurately calculate the firm’s upside.

WD DDM, Created by Analyst on Excel

Walking through my model, I estimate a required rate of return of 6.30%, incorporating a 10Y US treasury yield and WD’s lower beta- at least when assessing net returns. Moreover, I projected WD’s forward dividend growth rate to be in line with the 5Y historic average.

Through the model, the WD seems to have a 1Y upside of 4.64%, with its accurate value being $76.00.

On the other hand, my discounted cash flow analysis, at its base case, projects the net present value of WD to be $78.20, meaning that at the current price of $72.30, the stock is undervalued by 8%.

My model, calculated over 5 years without built-in perpetual growth, assumes a discount rate of 10%, incorporating higher risk-free rates and the company’s debt-heavy cap structure. Additionally, I assumed a forward average revenue growth rate of 7%, much lower than the company’s trailing 5Y average growth rate of 11.72%, to incorporate slowed growth due to recessionary pressures.

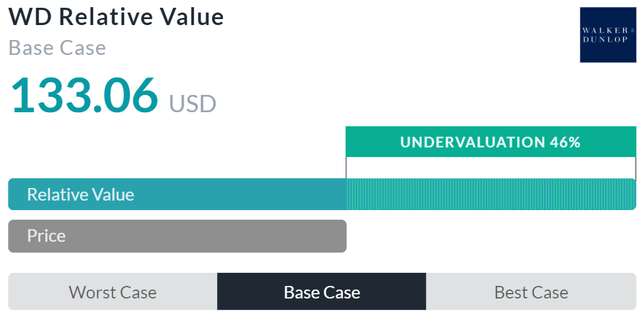

Alpha Spread

Alpha Spread’s multiples-based relative valuation tool more than validates my thesis on WD’s undervaluation, estimating a relative value of $133.06, a 46% undervaluation.

However, Alpha Spread seems to overvalue WD due to its inability to account for forward risk or eliminate outliers in its datasets.

Therefore, taking a weighted average of my DDM, DCF, and Alpha Spread’s relative valuation, with less weighting given to the relative valuation model, the fair value of WD is $81.47, with the stock undervalued by 11%.

Walker & Dunlop Maintains An Integrated Commercial Real Estate Presence

WD is well on track to achieve its 2025 targets, already accomplishing $10bn+ in AUM across its asset management and investment banking verticals, and well on its way to achieving the desired debt financing volume, property sales volume, and servicing portfolio size. By positioning itself across the CRE pipeline, involved in both the origination, investment, and servicing of CRE assets, WD can better fortify itself against downswings in the market- able to take advantage of refinancing in a recessionary cycle or expand portfolio sizes in inflationary cycles, for example- and ultimately ensure more stable cash flows going forward.

August 2023 Investor Overview

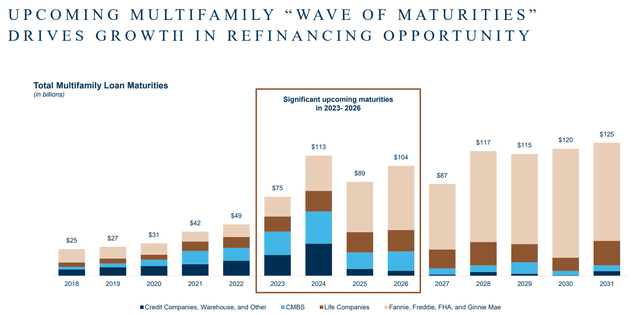

The graphic below epitomizes WD’s ability to discover opportunity in difficult macro environments, with a large number of maturities due over the next few years enabling substantial revenue expansion through refinancing and higher rates.

August 2023 Investor Overview

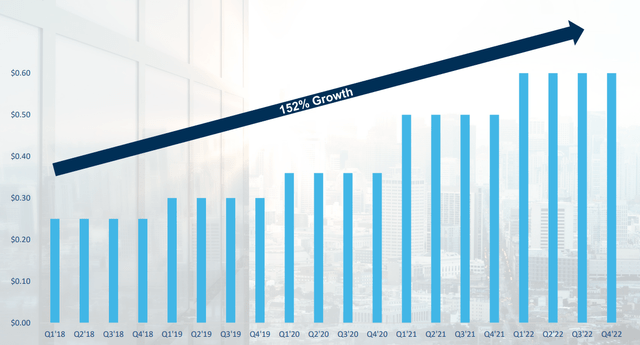

All this culminates in WD’s development of their already strong dividend, with investors in WD seeing their dividends triple over the past 5 years in spite of a slate of differing, equally challenging economic environments.

August 2023 Investor Overview

Wall Street Consensus

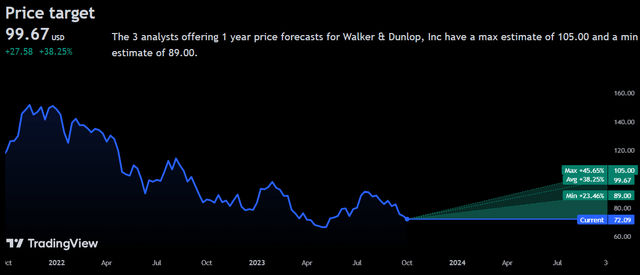

Analysts largely support my positive view of the company, estimating an average 1Y price target of $99.67, a 38.25% increase.

TradingView

Even at the minimum projected price target of $89.00, a 23.46% increase, analysts are much more optimistic about the stock and the market’s durability than me, with analyst minimum expectations ~$8 higher than my base case fair value.

Risks & Challenges

Sticky Interest Rates May Increase Expense Base & Compress Demand

The largest and most obvious risk to CRE and by extension WD right now is the rising costs, potential defaults, and overall depressed demand relating to stubbornly high interest rates. As rates rise, the risk-adjusted attractiveness of WD reduces, while increasing costs reduce free cash flows and the ability to reinvest or return capital, and there is reduced overall CRE activity.

Servicing Business May Face Risk From Third Parties

While WD may face direct default risk on its multifamily assets, as a loan servicer with direct intermediation between the lender and loan recipient, WD may face greater risk to its income if either party is unable to effectively operate. For instance, for loans sold under the Fannie Mae DUS program, WD must absorb the initial 5% loss on the asset; while more positively WD’s losses would be capped at 20% of the value of the unpaid balance, this also means WD is particularly sensitive to multiparty risk across the North American multifamily market.

Conclusion

Looking forward, WD maintains an excellent operational model with positioning across the CRE pipeline and remains undervalued by investors due to its attachment to CRE and subsequent risks.

Read the full article here