Get ready for charts, images, and tables because they are better than words. Your continued feedback is greatly appreciated, so please leave a comment with suggestions.

This one is going to be short and sweet.

In the prior article, I told readers they could vote for a mortgage REIT to have our projections shared.

Two of the candidates that were at the top of the list were AGNC Investment (AGNC) and Chimera Investment (CIM).

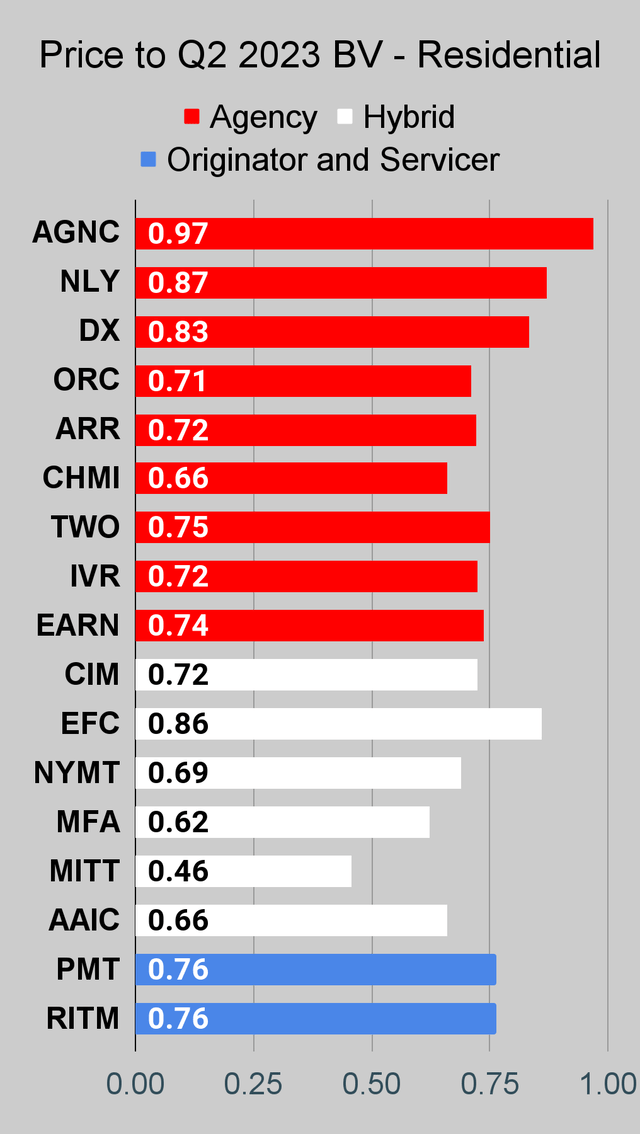

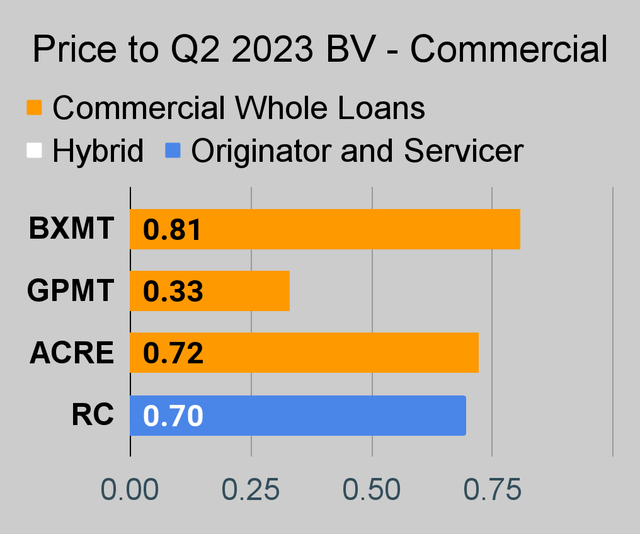

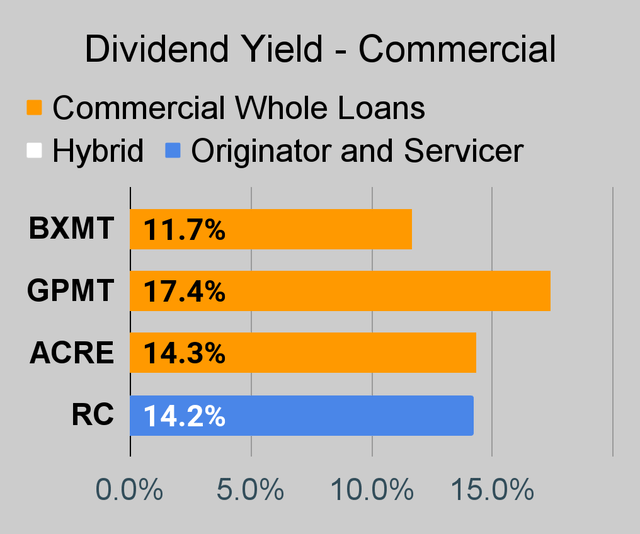

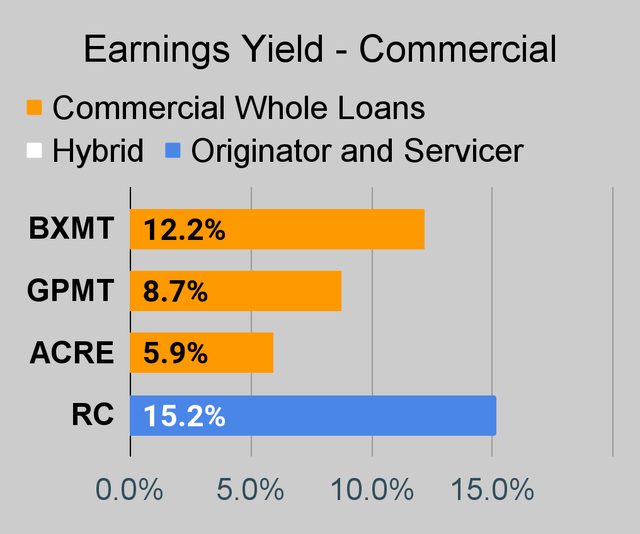

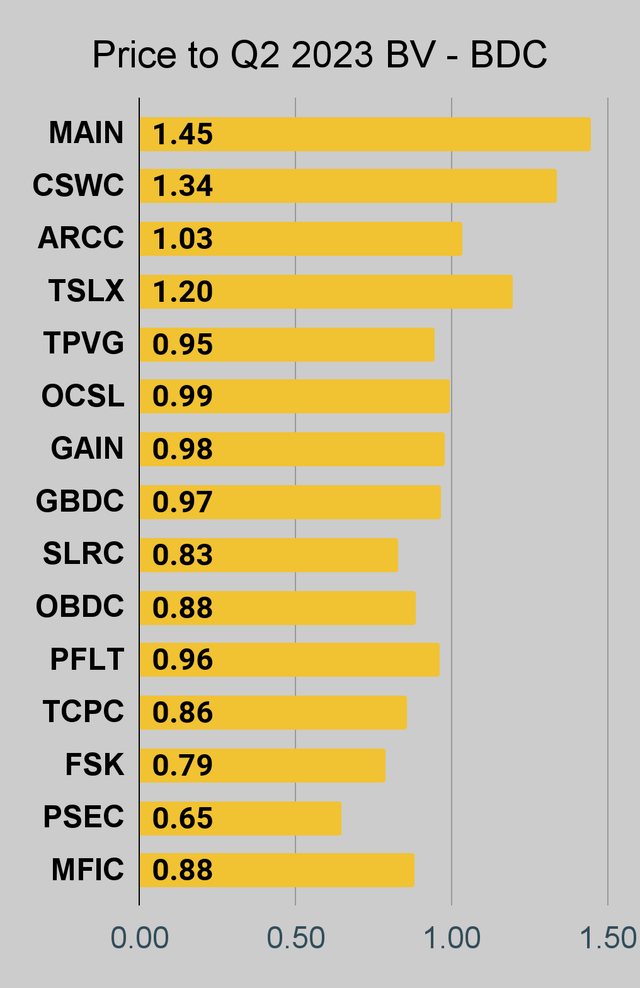

I’ll go over projections for both. As a reminder, the charts later in this article utilize the price-to-book for the prior quarter (Q2 2023 results). Book values changed materially. Do not put too much emphasis on it for mortgage REITs. On the other hand, book values for BDCs were pretty flat. You could use that chart and it shouldn’t be off by much.

AGNC Stock

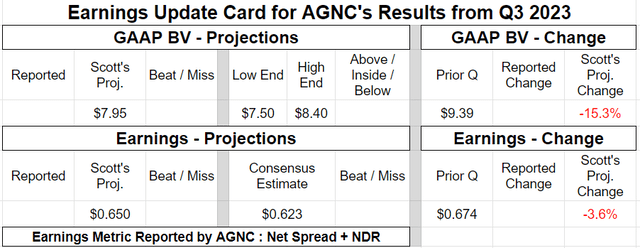

I could draw this out needlessly with words, but those articles are awful. Here’s the table:

The REIT Forum

We don’t have reported values yet, so it a bunch of the calculations are empty. However, you can see our projections on the left, the prior quarter on the right, and the quarter-over-quarter change.

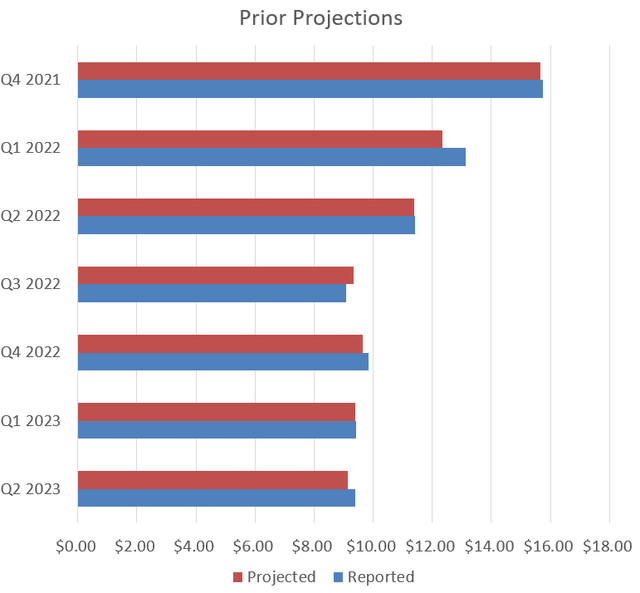

That’s a substantial drop in projected tangible BV. I want to emphasize that when interest rate volatility is this high, accuracy becomes more difficult. Estimates within The REIT Forum are usually pretty accurate. However, they won’t be perfect. To give you a feel for historical accuracy, we’re comparing estimates and results for prior quarters:

The REIT Forum

That’s a pretty good record. Further, it’s interesting to see how much book value declined over that period. Feels like it was just going up in flames sometimes.

Property of The REIT Forum

So when I’m posting about how AGNC doesn’t really have this significant discount to book value other investors are relying on, I’m working with much more recent data. Retail investors will often need to rely on price-to-trailing-book values, but it’s sad when analysts expect to get paid for using June 30, 2023, values.

I’m bearish on AGNC. $9.09 is too high. There are other choices available that are much better.

In general, the agency mortgage REITs should be reporting most of the biggest losses for the sector. The biggest swing came from rates running significantly higher. They hedge for smaller movements in rates, but Q3 2023 was another nasty one.

The agency mortgage REITs include AGNC, NLY, DX, TWO, ORC, ARR, CHMI, and IVR.

CIM Stock

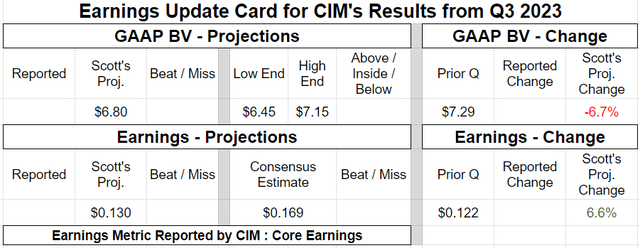

Same thing for CIM. We’ve got a card to share the values:

The REIT Forum

Projections are calling for book value per share to fall by about 6.7%. Of course, we don’t expect to be perfectly accurate. We don’t need to. As long as the estimate is in the right ballpark, we’re miles ahead of the people who are using outdated information. Historically, we’ve usually been much better than just the right ballpark.

We already have these estimates for Q3 2023 for every mortgage REIT and BDC we cover.

Why Does Book Value Keep Falling?

You know how mortgage rates kept going up? OK, there you go. Mortgage rates went up and mortgage prices went down. Mortgage REITs own mortgages and they use leverage, so that increase was bad.

Does that mean mortgage REITs are doomed? Absolutely not. They can actually produce a pretty significant amount of income in the current environment (much more than a few years ago when many investors adored the sector). Despite the inversion of the yield curve, the mortgage REITs can still hedge rates with swaps. It’s not a perfect hedge though and it can underperform when rates move significantly in either direction.

Unfortunately, because of how mortgage REIT accounting uses amortized costs, most people don’t have a clue how the interest income and expenses are actually. Quite a few analysts also struggle with REIT accounting. Now, I’d rather not be relying on someone who has blinders on. If they are trying to sprint through the work, that would be even worse. But to honor their bravery (with someone else’s money), I prepared this statute:

Property of The REIT Forum

Well, this image of a statute. That’s good enough, right?

For common shares, the BDCs really outperformed on book value. We’re projecting gains in book value for a few. That includes MAIN, CSWC, and TSLX, along with a few others.

Coming Up

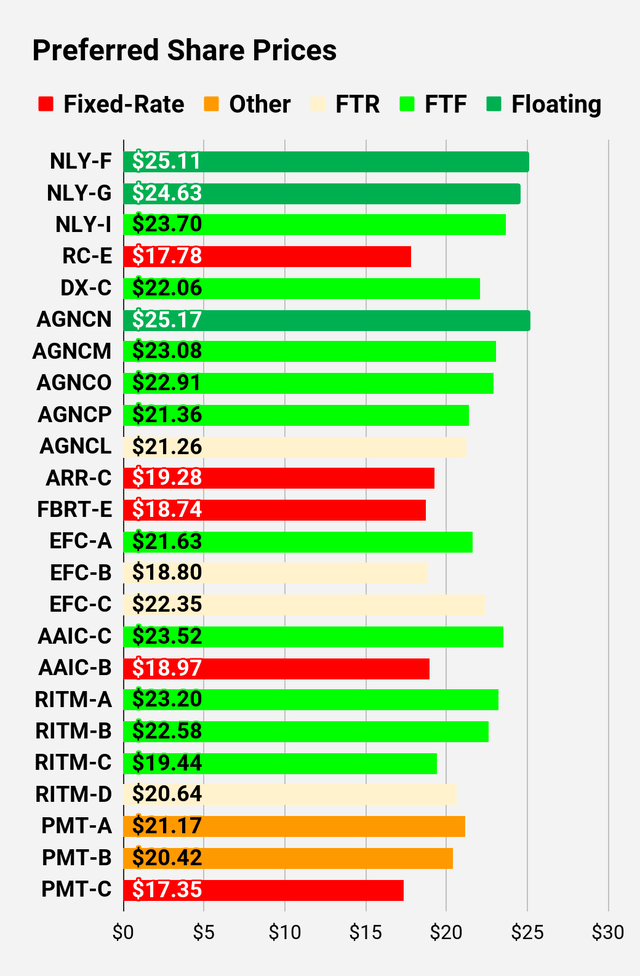

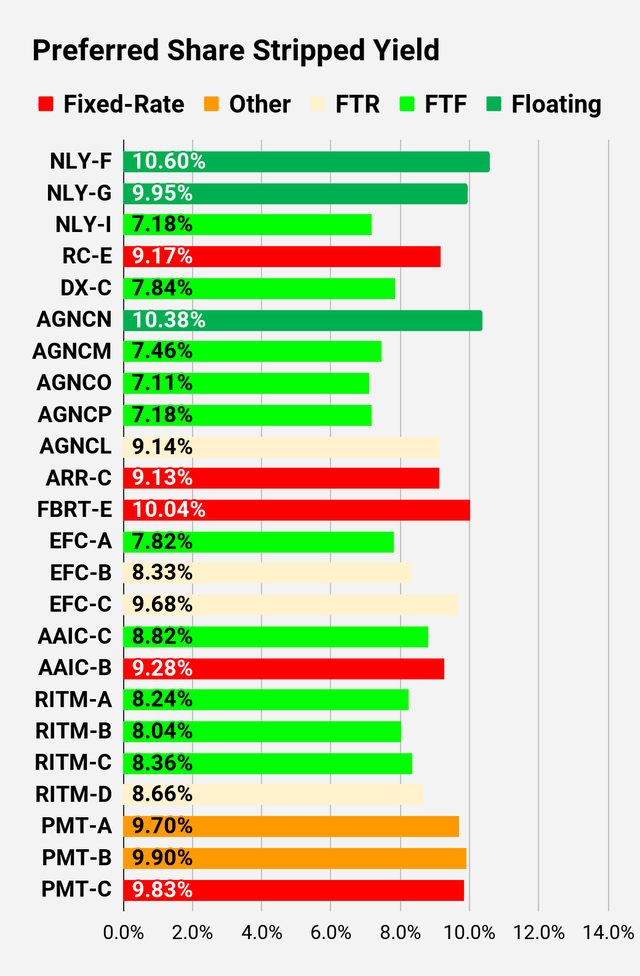

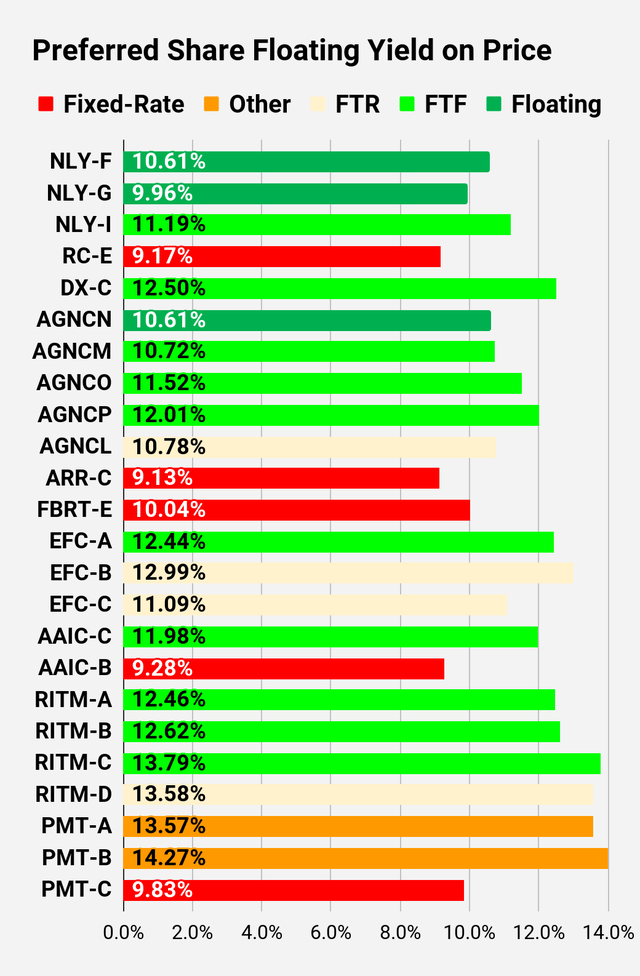

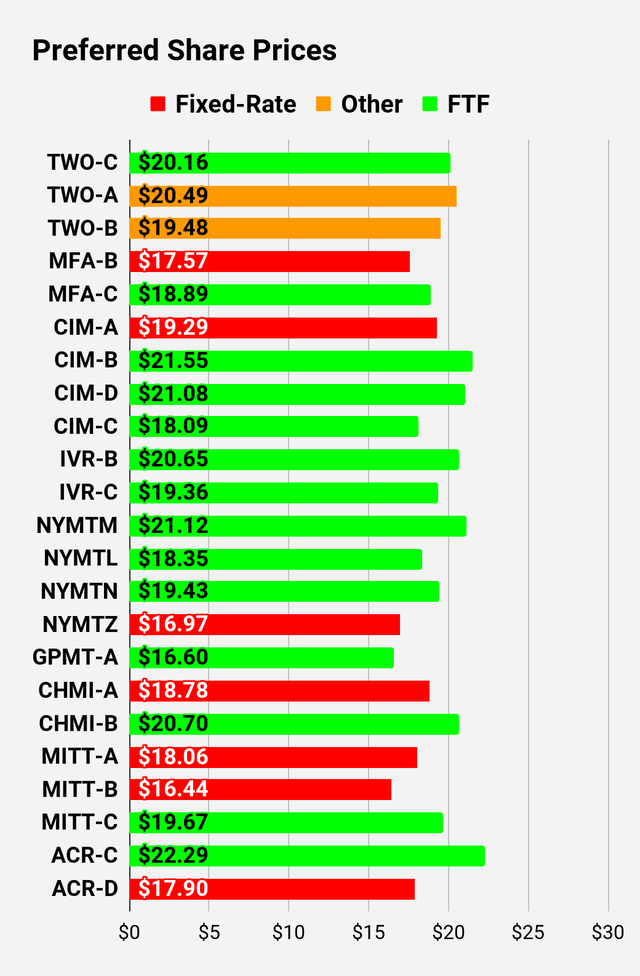

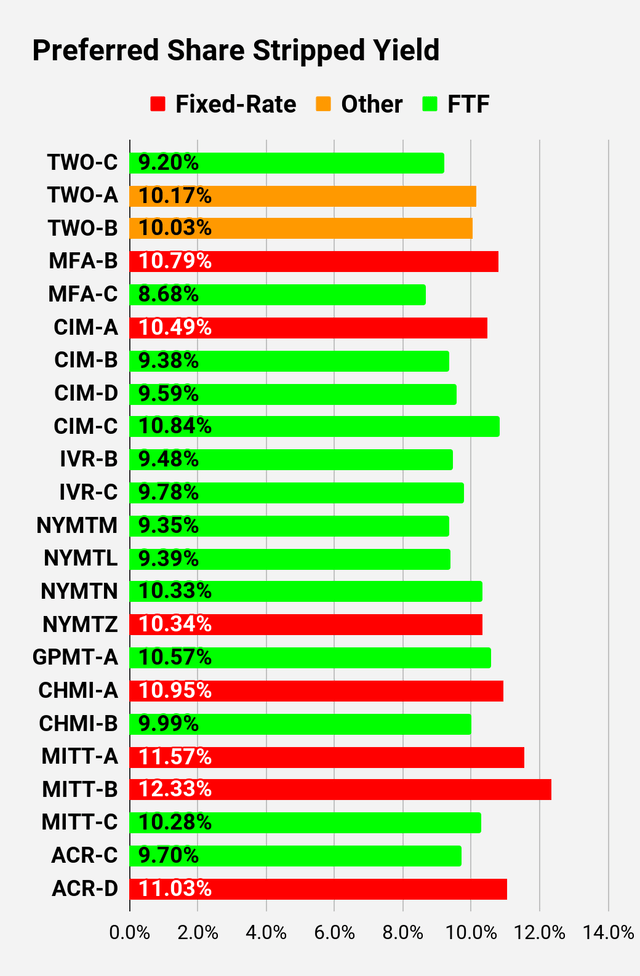

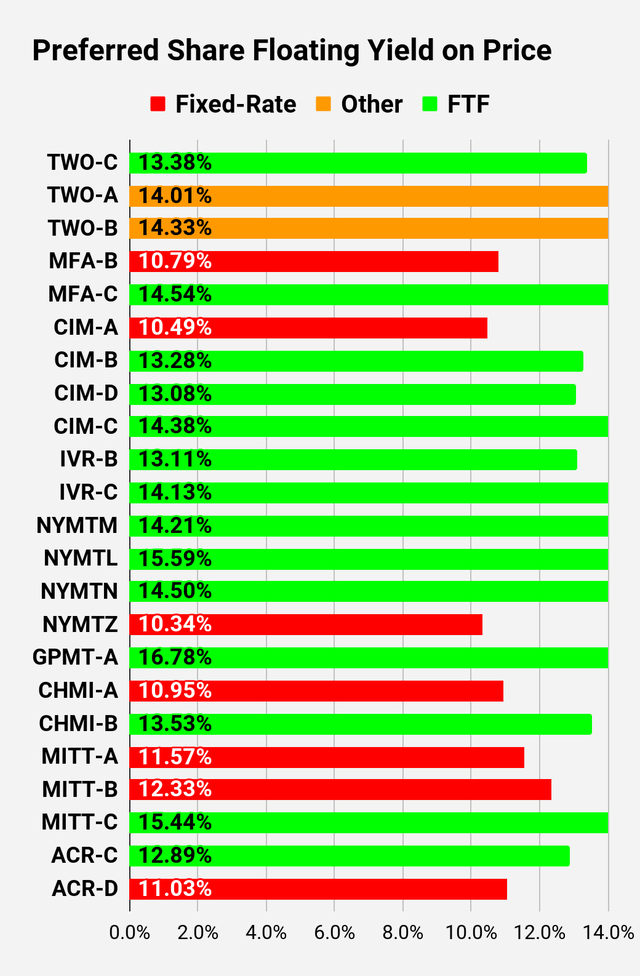

I just finished our Portfolio Update today and I’m feeling particularly excited about preferred shares. There are several great opportunities from preferred shares. If interest rates remain elevated, many of these shares can see big dividend increases due to their “fixed-to-floating” status.

The preferred shares sit above the common shares. Their call value does not change. Their dividend rate does not change, unless they are switching to a floating rate in accordance with the prospectus. Due to the rise in interest rates, any share that starts floating (within the group we cover) would see a significant dividend increase. Dividend increases are particularly uncommon for mortgage REITs, so it’s a great feature to get from a preferred share.

Stock Table

We will close out the rest of the article with the tables and charts we provide for readers to help them track the sector for both common shares and preferred shares.

We’re including a quick table for the common shares that will be shown in our tables:

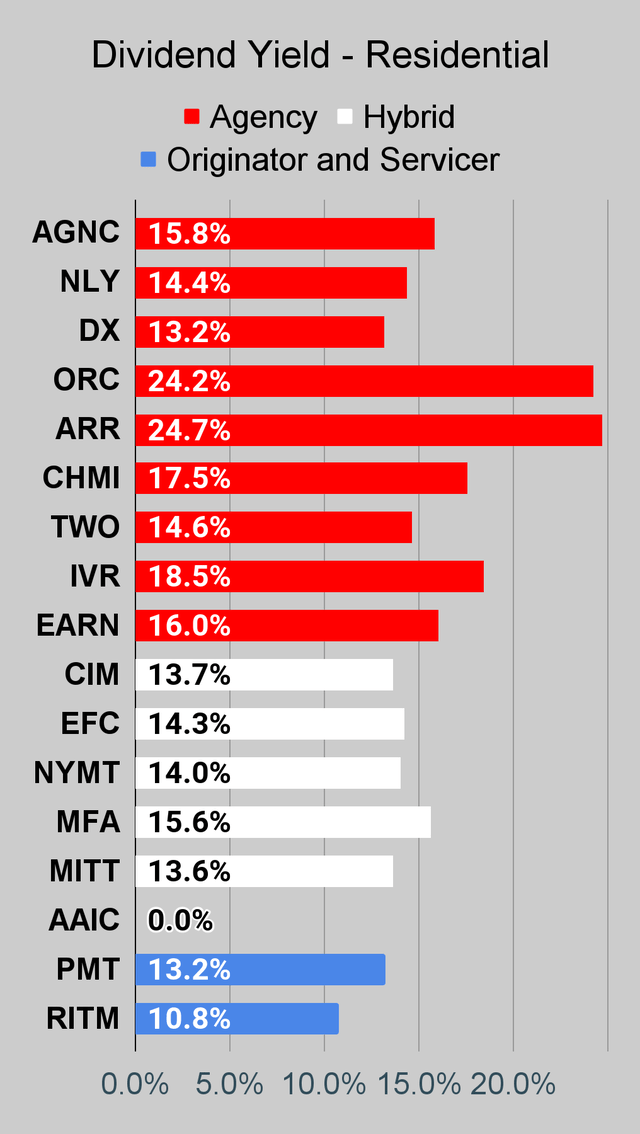

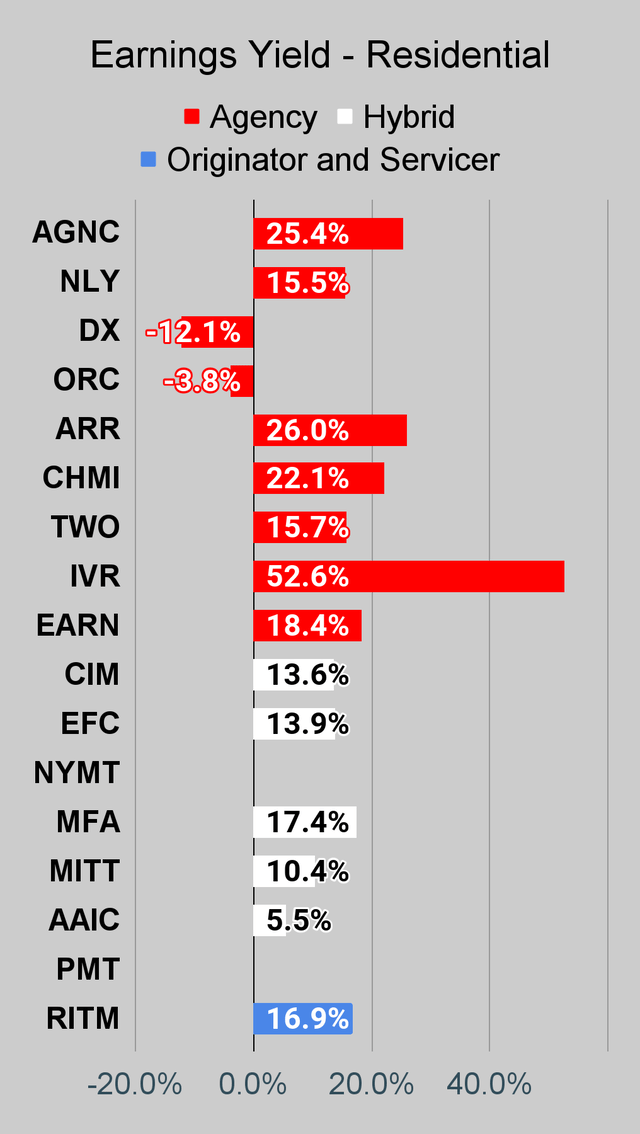

If you’re looking for a stock and I haven’t mentioned it yet, you’ll still find it in the charts below. The charts contain comparisons based on price-to-book value, dividend yields, and earnings yield. You won’t find these tables anywhere else.

For mortgage REITs, please look at the charts for AGNC, NLY, DX, ORC, ARR, CHMI, TWO, IVR, EARN, CIM, EFC, NYMT, MFA, MITT, AAIC, PMT, RITM, BXMT, GPMT, WMC, and RC.

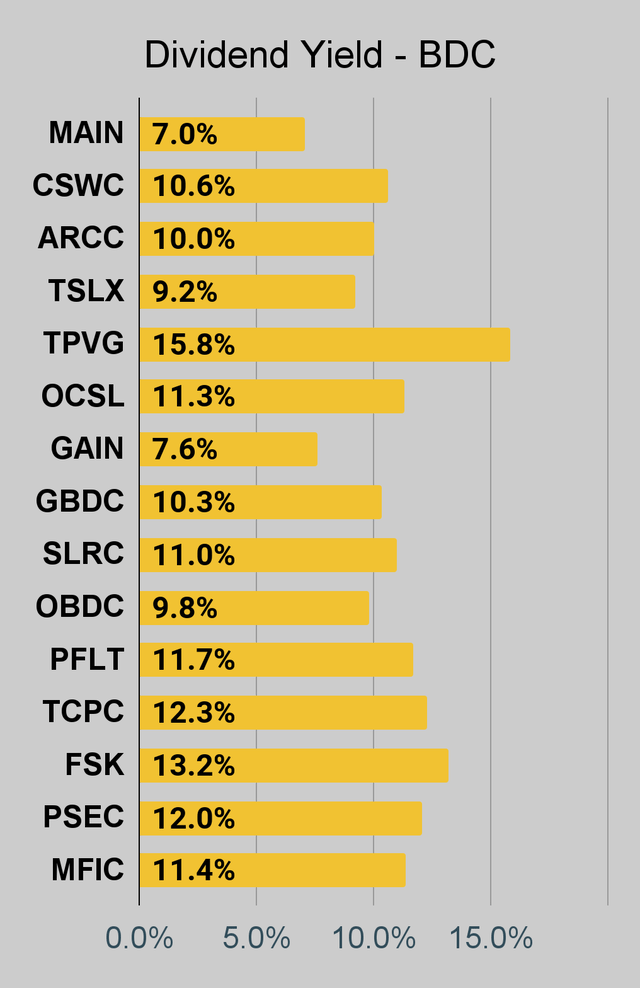

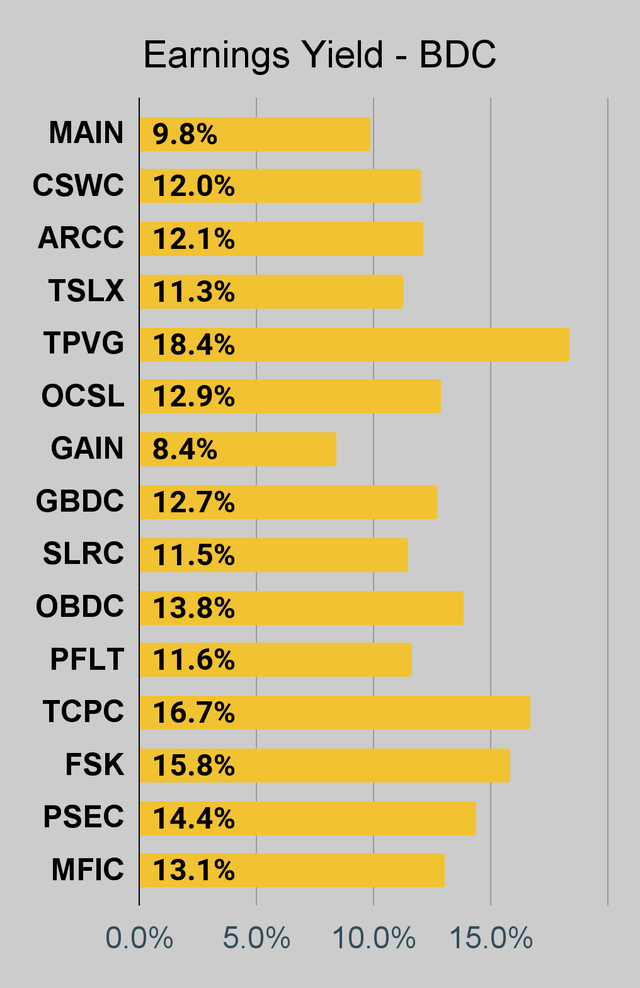

For BDCs, please look at the charts for MAIN, CSWC, ARCC, TSLX, TPVG, OCSL, GAIN, GBDC, SLRC, OBDC, PFLT, TCPC, FSK, PSEC, and MFIC.

This series is the easiest place to find charts providing up-to-date comparisons across the sector.

Warning

Book values changed dramatically during Q3 2023. Relying on mortgage REIT trailing book value would be very unwise. Especially for agency mortgage REITs. The values for BDCs didn’t change much.

Residential Mortgage REIT Charts

Note: The chart for our public articles uses the book value per share from the latest earnings release. Current estimated book value per share is used in reaching our targets and trading decisions. It’s available in our service, but those estimates are not included in the charts below. PMT and NYMT are not showing an earnings yield metric as neither REIT provides a quarterly “Core EPS” metric. Presently, a few other REITs also have no consensus estimate.

Second Note: Due to the way historical amortized cost and hedging is factored into the earnings metrics, it’s possible for two mortgage REITs with similar portfolios to post materially different metrics for “earnings.” I would be very cautious about putting much emphasis on the consensus analyst estimate (which is used to determine the earnings yield). In particular, throughout late 2022 the earnings metric became less comparable for many REITs.

The REIT Forum |

The REIT Forum |

The REIT Forum |

Commercial Mortgage REIT Charts

The REIT Forum |

The REIT Forum |

The REIT Forum |

BDC Charts

The REIT Forum |

The REIT Forum |

The REIT Forum |

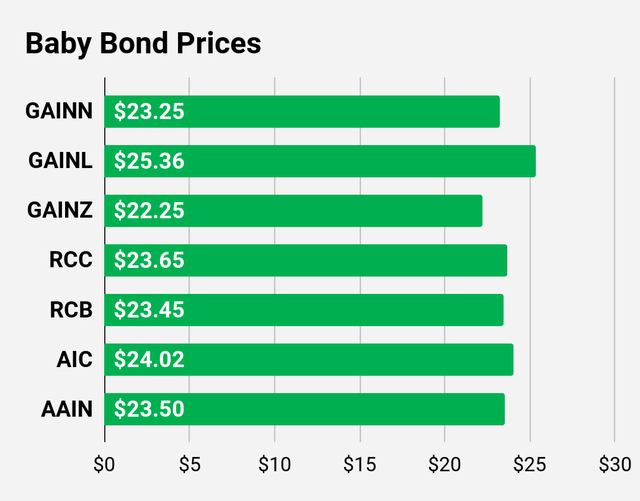

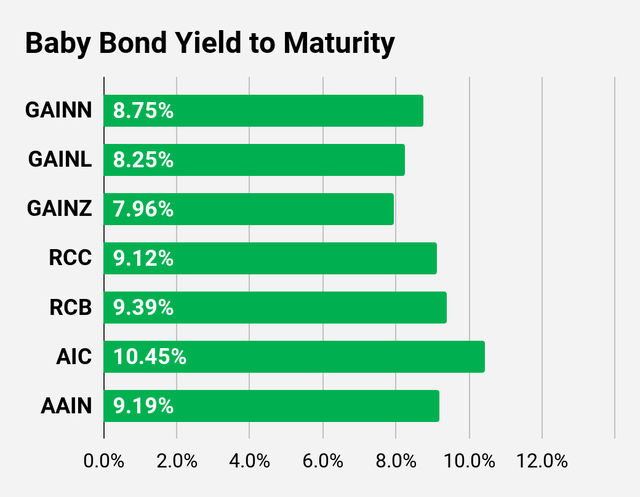

Preferred Share and Baby Bond Charts

I changed the coloring a bit. We needed to adjust to include that the first fixed-to-floating shares have transitioned over to floating rates. When a share is already floating, the stripped yield may be different from the “Floating Yield on Price” due to changes in interest rates. For instance, NLY-F already has a floating rate. However, the rate is only reset once per three months. The stripped yield is calculated using the upcoming projected dividend payment and the “Floating Yield on Price” is based on where the dividend would be if the rate reset today. In my opinion, for these shares the “Floating Yield on Price” is clearly the more important metric.

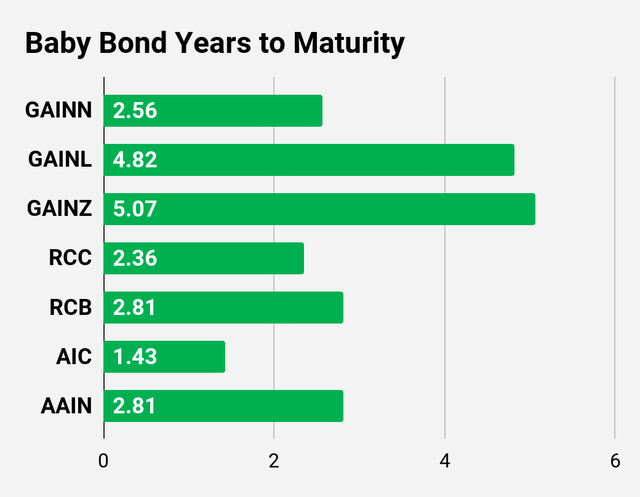

Baby Bonds:

The REIT Forum |

The REIT Forum |

The REIT Forum |

Preferred Shares:

The REIT Forum |

The REIT Forum |

The REIT Forum |

The REIT Forum |

The REIT Forum |

The REIT Forum |

Note: Shares that are classified as “Other” are not necessarily the same. Within The REIT Forum, we provide further distinction. For the purpose of these charts, I lumped all of them together as “Other.”

- Rating: Bearish on AGNC common shares. I expect the preferred shares to significantly outperform the common over the next 12 months.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here