Introduction

Enel (OTCPK:ENLAY) is among the top-ten largest electric utilities based on market value. In Europe, it is in the top three and with its €60 billion in market cap is the largest stock traded on in the Italian Stock Exchange.

I have been watching Enel closely because I admit I have been at odds with its balance sheet all throughout 2022. Yet, recent changes make me think the company might be on the right path towards healthier financials.

Turnaround in action

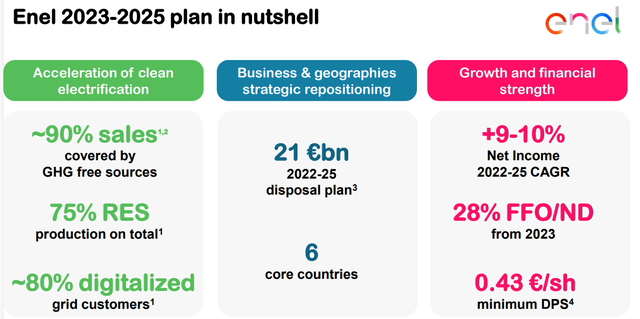

I see a few things improving with the company, as outlined by the new 2023-2025 strategic plan.

Enel Investor Presentation

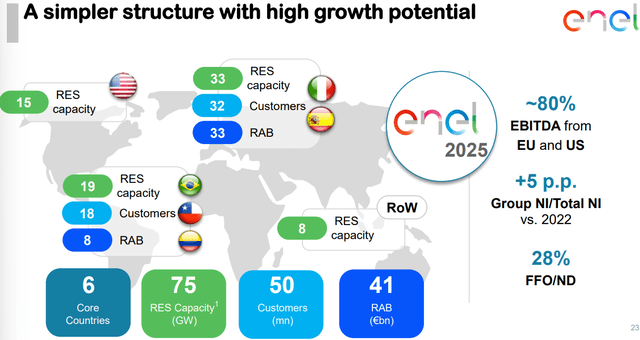

In fact, in the last Investor Presentation, Enel confirmed it wants to reposition its business and geographies by focusing only on 6 core countries, where the transition to green electricity is accelerating: Italy, Spain, Chile, Brazil, Colombia, and the U.S.

Enel Investor Presentation

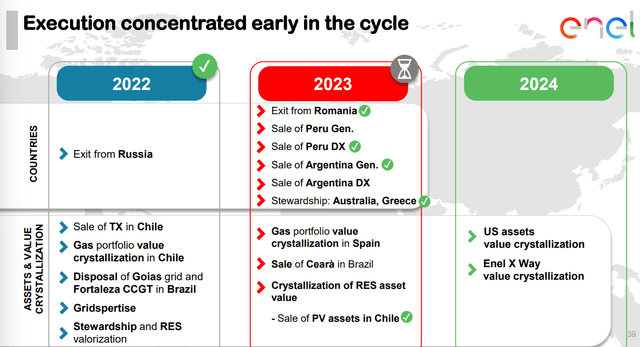

This is why it is selling its non-core assets, such as the Greek power utility PPC, to cash in and delever its balance sheet. I like the execution concentrated at the beginning of the 2023-2025 cycle, with sales of assets in Peru, Romania, Argentina.

Enel Investor Presentation

Enel needs to spend billions as many countries around the world are switching from fossil fuel energy to clean electricity, needing, as a consequence, new services and infrastructures.

In its core countries, Enel is set to spend €17 billion from 2023 to 2025 to reach a 19 GW renewable development.

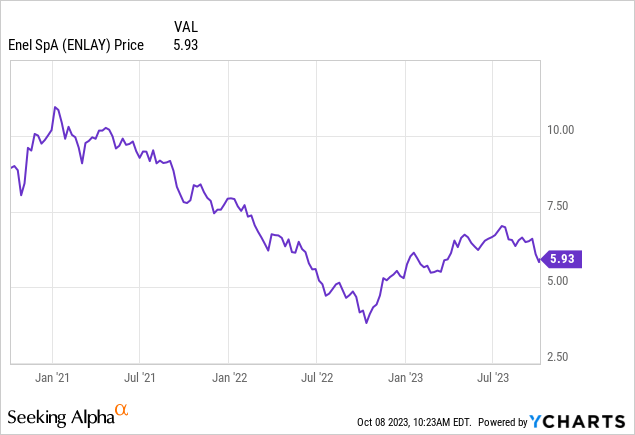

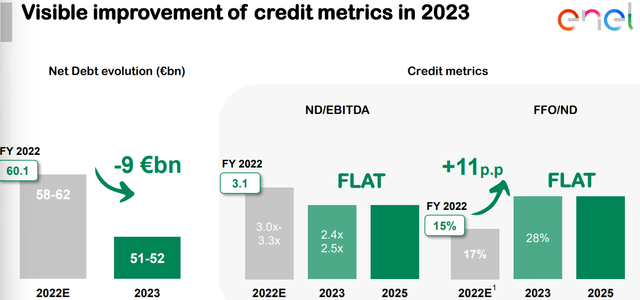

Enel was severely punished during 2022 due to interest rates rising. Since its net debt was €60.1 billion and its ND/EBITDA was 3.1, investors sold heavily out of the company, chopping its market cap in half before the stock started rebounding, making it an outperformer in 2023.

Regarding the issue Enel was punished for, this year Enel is working hard to reduce its net debt, with a net debt evolution that is targeting a reduction of €9 billion (-14% in one year). This should lower the ND/EBITDA ratio to 2.4, and improve the FFO/ND ratio by 11 percentage points.

Enel Investor Presentation

In any case, the cost of debt for Enel is stable and it currently stands at 3.5%, where it should remain for the next few years since the average debt life is almost 7 years.

Enel is starting to achieve a financial de-risking. While between 2020 and 2022 the average yearly LT refinancing was €13.1 billion, from 2023 to 2025 it should only be € 4.5 billion.

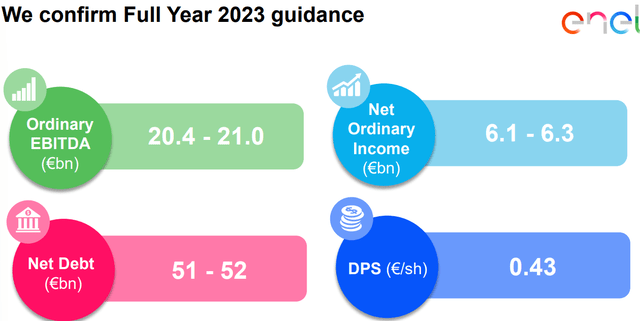

Growth targets

Enel closed FY 2022 with €19.7 billion in EBITDA and €5.4 billion in net income. From 2023 to 2025, Enel aims at a 4-5% EBITDA CAGR and a 9-10% net income CAGR. Since Enel is a stock beloved my income seeking investors, these targets should protect the new dividend of €0.43 per share (paid semi-annually). In fact, Enel declared it will pay a minimum DPS of €0.43 for each one of the next three years.

1H 2023 Results

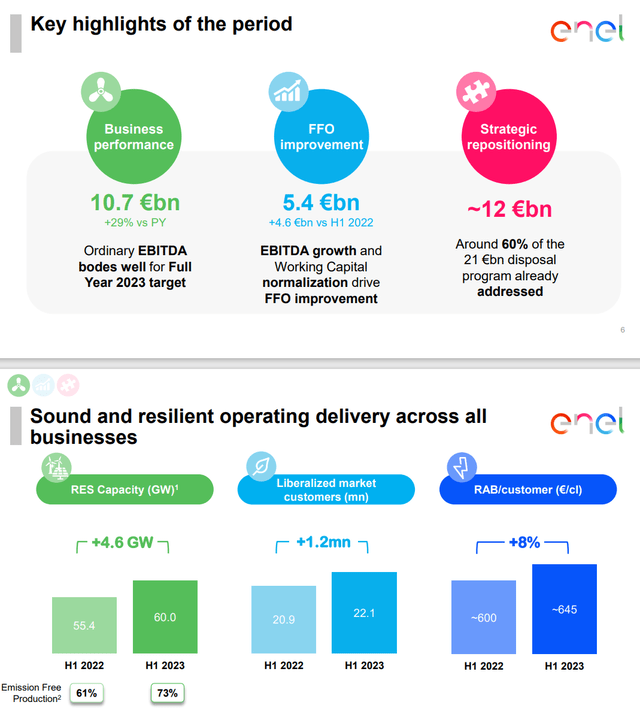

So far, Enel seems to be moving at the right pace to achieve its goals. When it released its 1H results we saw revenues down -28% as a result of decline in commodity sale prices on end-user markets. Yet, ordinary EBITDA came in at € 10.7 billion, up 29.4% YoY.

Enel 1H 2023 Results Presentation

In addition, as we can see, all businesses delivered improving results, showing how Enel’s execution is performing well.

Now, utilities are usually levered. But, as far as this is accepted by many investors, I am not willing to invest in one if it doesn’t have a ND/EBITDA ratio below 3.

As we can see from the infographic below, Enel felt confident enough to confirm its FY 2023 guidance, which also promises a juicy dividend hike of 7.5%.

Enel 1H 2023 Results Presentation

In addition, Enel said it has already completed 60% of its disposal plan, meaning by the end of the year €12.2 billion of the €21 Enel should raise will already be in the company’s pockets.

Valuation

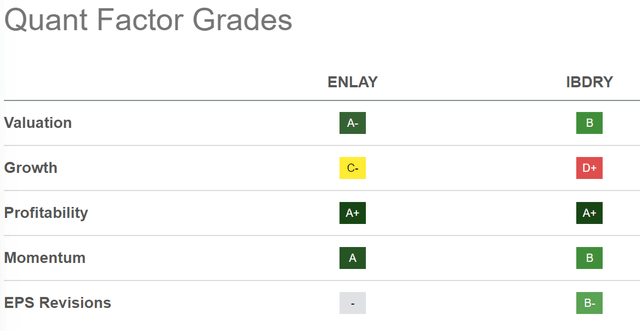

Enel currently trades at a valuation grade of A-, according to the Seeking Alpha’s Quant Rating.

In fact, its PE is 14 vs. the sector median of 17; its EV/EBITDA is currently a 6.7 vs. the sector median at 10.6.

Of course, being a utility, its growth grade is lower: a C-, which is decent for a company in this industry.

In terms of profitability, though its margins are graded with a D, Enel receives an A+ by the system, likely because of its strong cash from operations generation, coupled with a return on common equity at 12.15% vs. the sector median of 8.55%.

Compared to its major European peer, the Spanish Iberdrola (OTCPK:IBDRY), Enel seems like a better deal, aka it is trading at a discount.

Seeking Alpha

Yet, I think Enel’s undervaluation is still linked to a higher risk perceived by investors, given that the turnaround seems only to have recently started. True, Enel’s stock is up big over the last 365 days (+47.51% vs. 15.12% of its Spanish peer). Yet, if we look at the return YTD, Enel is up only 6.5% (while Iberdrola is down 7.2%), meaning most of the price surge happened between October and December of last year.

In other words, Mr. Market seems to have appreciated the first signs of a turnaround, but now it seems to be waiting for some of the announced targets to be actually completed by the end of the fiscal year. Therefore, investors are before a choice: if Enel’s new management can deliver, it seems like the stock can already be buy; if Enel’s new management still needs to be tested, the stock becomes a hold until its FY 2023 results in my view.

I am part of the second group, because I don’t want to invest in a company where I still want a better understanding of how the new management team is able to execute. Nonetheless, Enel is now in my watchlist and I will keep a close eye on it.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here