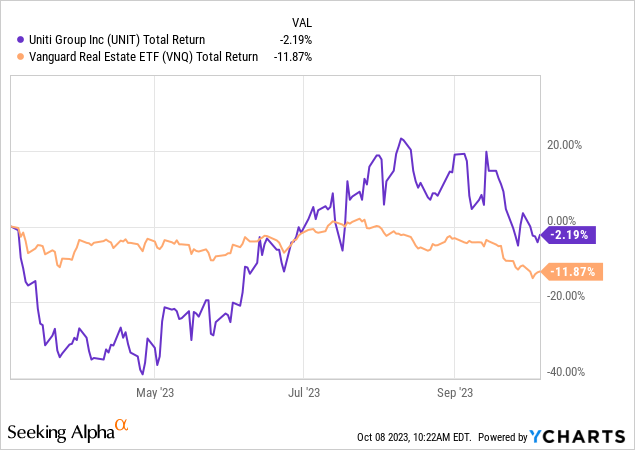

In our last coverage of Uniti Group Inc. (NASDAQ:UNIT) we decided to stay out as the risk-reward was about as unfavorable as it got. The stock has not done too badly, especially considering how REITs in general have fared. The small negative total return must be a welcome relief to anyone dabbling in the Real Estate space.

We look at the last released results and tell you what you should consider before diving into this play.

Q2-2023

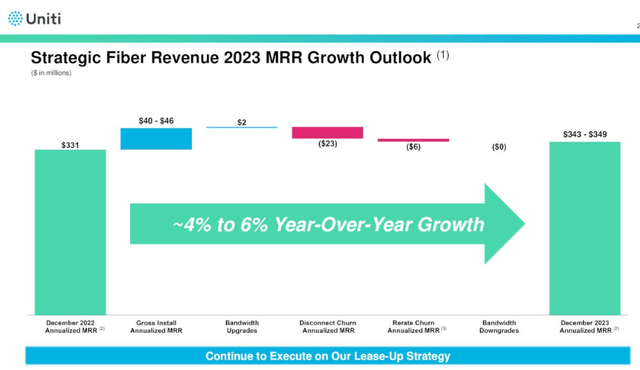

Our last article was in March, and UNIT has two quarters out since then. The focus as always was on the growth in reoccurring revenues. Who is not going to love a slide showing 4%-6% growth when you are already getting a hefty double-digit dividend yield to begin with?

UNITI Q2-2023 Presentation

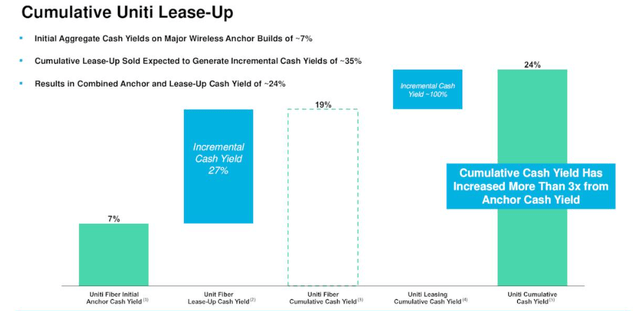

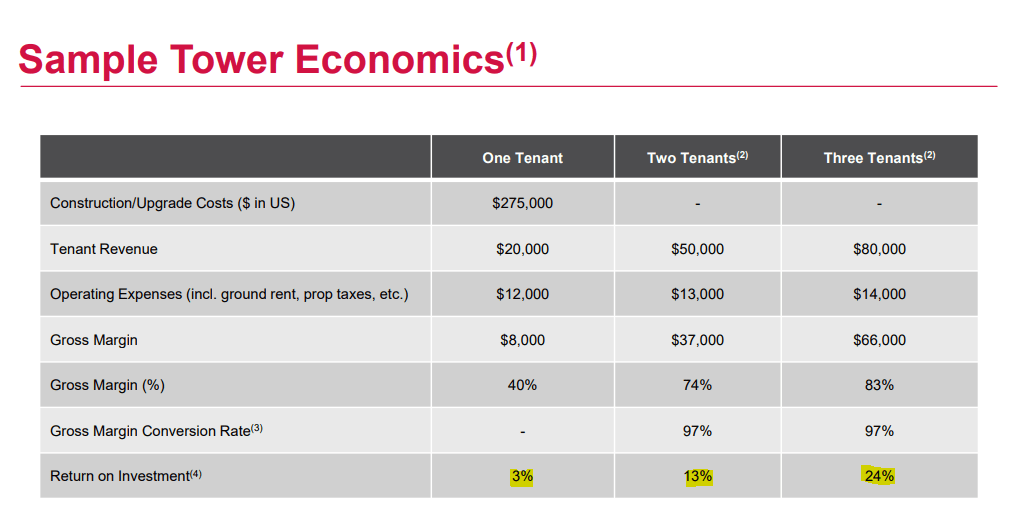

UNIT’s talking points also include playing up how the second and third tenants really create a strong yield over the anchor tenant.

UNITI Q2-2023 Presentation

If that kind of numbers seem familiar to you, you might be getting a Déjà vu from American Tower (AMT) slides.

AMT Presentation

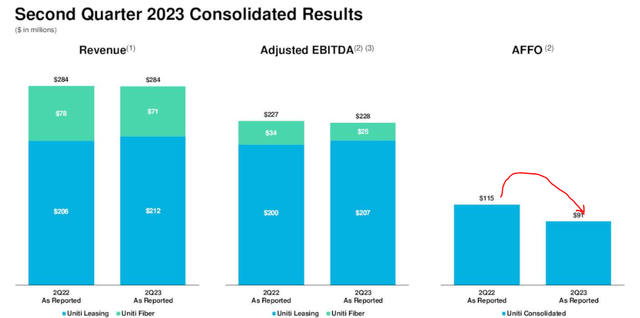

Of course, the core theme that we do need to focus on is what you, the shareholder, actually end up keeping. On that front, we saw a flattish revenue (where did that 4%-6% growth go?), flattish adjusted EBITDA and a collapsing adjusted funds from operations (AFFO). So, an awesome appetizer with a poor main course.

UNITI Q2-2023 Presentation

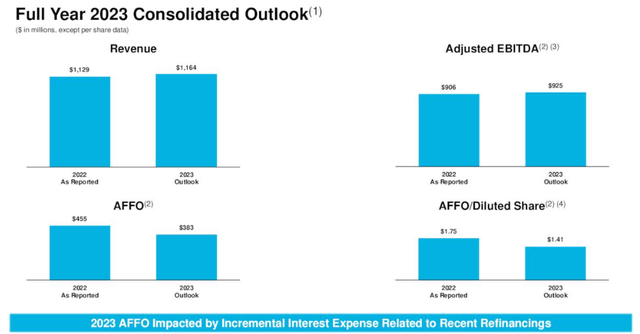

Maybe “collapsing” is a bit of a strong word for the 20% drop in AFFO, but it is definitely worrisome. Full year results will follow a similar trend based on the last outlook.

UNITI Q2-2023 Presentation

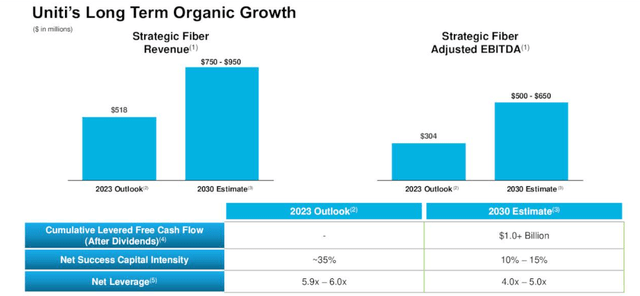

UNIT concluded its presentation with a long term outlook that aims for Fiber EBITDA to perhaps double by 2030 and reduce leverage down to 4.5X (midpoint).

UNITI Q2-2023 Presentation

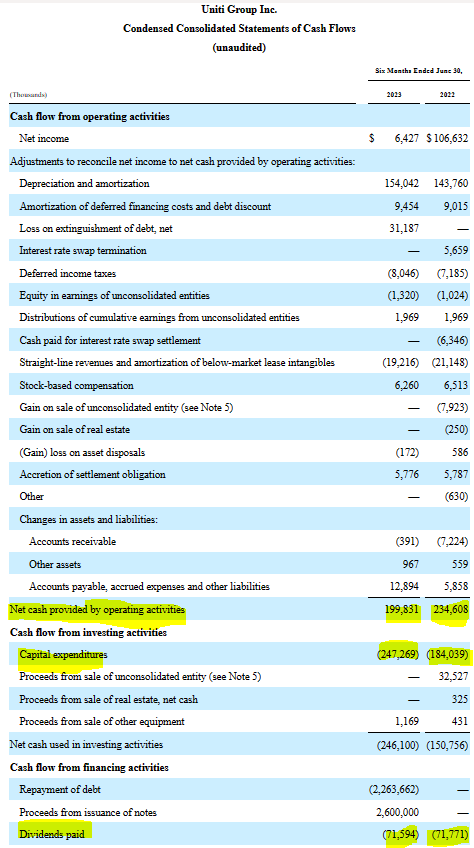

All peaches and roses despite the 20% drop in AFFO this year. But let’s look at the real state of affairs. For the eighth year running, UNIT continued to have capex running at an unbelievably high rate. For the first six months of the year, it exceeded operating cash flow by almost $48 million.

UNITI Q2-2023 10-Q

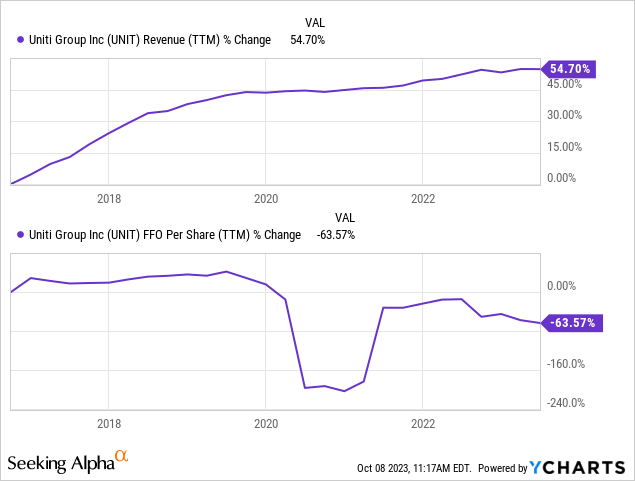

If you add up capex and dividends paid, you exceed operating cash flow once again. This is the state of affairs here and the company continues to run a cash flow deficit. There is of course the promise of the growth that comes with this capex spending. If you look at the revenue base, yeah you see it. Revenues are up 54.7% since the first year of existence. But the chart is a bit misleading as the bulk of that was during year 1 and year 2. Even moving past that, we can see that the key metric of FFO, is now down 63.57%.

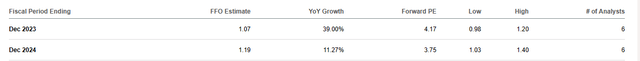

2023 and 2024 FFO is set up to grow, but even the latter numbers won’t be in the ballpark of where we were in 2018.

Seeking Alpha

Outlook

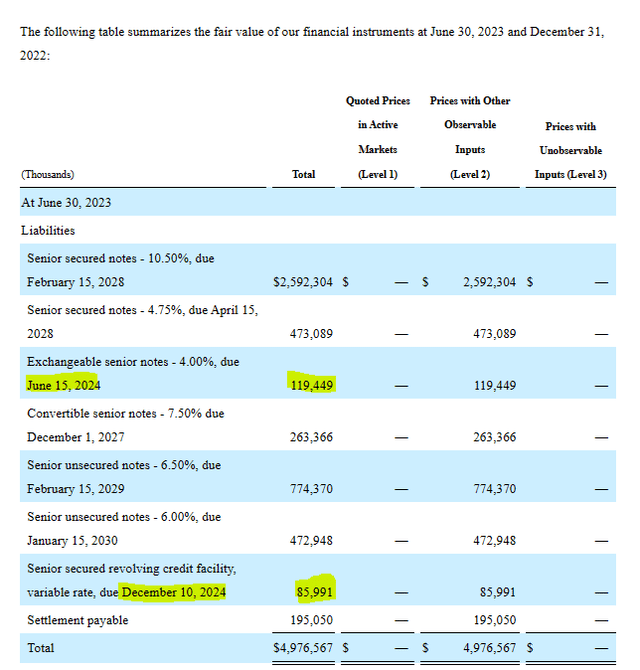

For firms with credit ratings in this category (B/B+), liquidity is of paramount concern. UNIT has no immediate issues here. Cash on hand and the revolver facility of $300 million give an adequate buffer. There are also no big debt repayments due.

UNITI Q2-2023 10-Q

So there is no immediate payback for bears pushing for end of the world scenarios. The bull case on the other hand rests on the company finally getting free cash flow positive as GCI payments to Windstream finally drop off in mid-2025.

Elana, this is Paul. I can take the first question and maybe, Kenny can take the second question on DISH. But yes, the quick answer to your question is, yes, 2025, we still see that as an inflection point for free cash flow. And part of that is just continuing to execute on our growth plan, mid-single-digit growth. As Kenny talked about in his comments, that’s very predictable, given — and our visibility to that is very good given our funnel and our sales force and the demand for our products and services and the breadth of use cases for our products and services, as Kenny said. But the bigger part of that journey to free cash flow positive here over the next year to 2 years into 2025 is, just the mechanics of our commitments to Windstream with regard to the settlement expenses that fall off in the middle of that year, in 2025 and GCI commitments start to ratchet down in terms of the total annual capital commitment over time. And the revenue from those GCI investments steps up over time, so that is positive for our cash flow and helps us to get to that inflection point. So that’s still our plan.

Source: Q2-2023 Conference Call Transcript

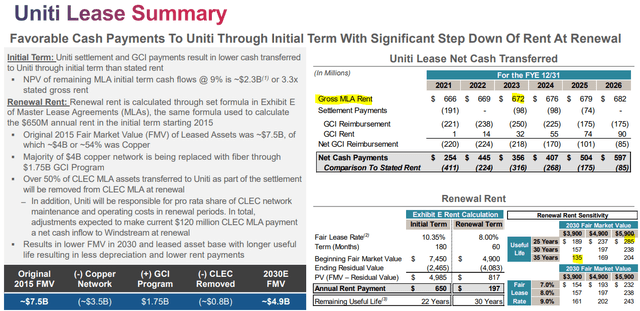

So if all of this follows the path that UNIT has outlined, there can be some upside here. The capital structure currently is almost entirely debt ($5.0 billion) with the common shares representing a lottery ticket ($1.0 billion). So if you get even one multiple higher on EV to EBITDA, you basically will double your common share price. Of course, before all of you take the hint that this is a great setup, keep in mind that we are here precisely because the firm has not delivered on any of its promises. EBITDA growth has been extremely poor, and the firm did compromise on rent commitments to Windstream after repeatedly saying it would not. Even that long-drawn-out negotiation was clearly lacking clarity. Windstream is still insisting that post 2030, the lease payments to UNIT will drop substantially.

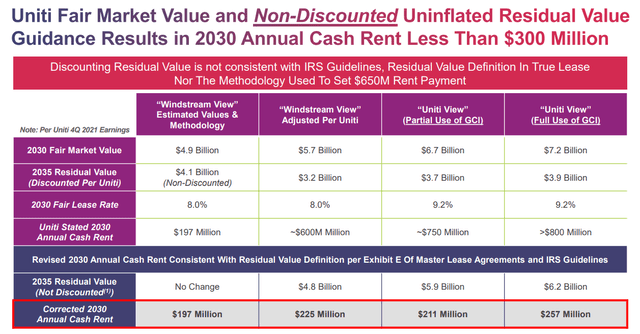

Windstream Q2-2023 Presentation

This drop, if it did occur, would likely push UNIT straight into another chapter, if readers get our drift.

Windstream Q2-2023 Presentation

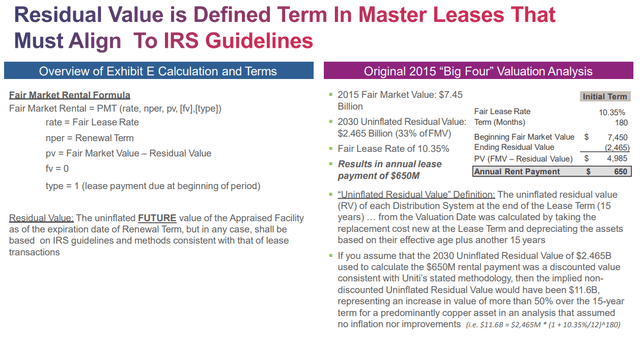

Windstream’s argument is based on the definitions of “residual value” that they explain in the slide below.

Windstream Q2-2023 Presentation

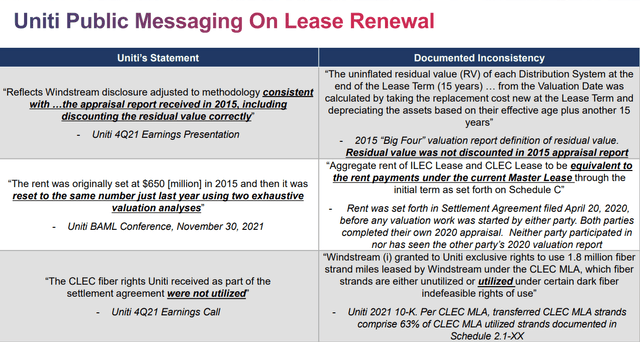

They also actually point out what they see as inconsistent messaging from UNIT.

Windstream Q2-2023 Presentation

Our stand here is that we really don’t know which side is in the right here. But the fact that we don’t have this clearly spelled out after months of negotiating and a massive lawyer bill the first time around, is appalling. The event is also very far off, so one could argue that it is not that relevant. But we do think it keeps buyers away from UNIT and likely raises the cost of equity in the process.

Verdict

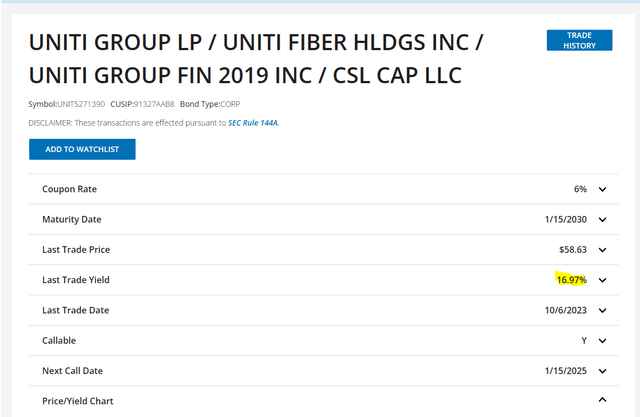

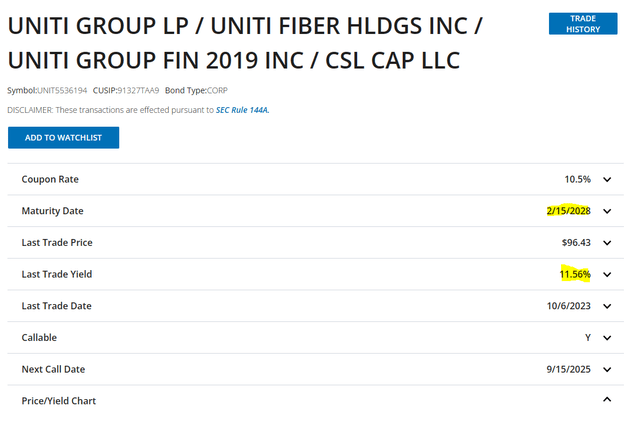

If UNIT gets to a free cash flow positive state and gets this Windstream issue put to bed, the stock could easily double. So from a risk-reward perspective, it is better balanced. We say that because there is almost no scenario where this could fold over the next 2-3 years, so including the dividends, you cannot lose 100% from here. Windstream is the real wild card here, and we don’t have perfect visibility into its financial flow and what it might do next. It still accounts for 66% of UNIT revenues. All those who argued that UNIT would not be forced to negotiate on the rent were proven wrong in the past. These things hold us back. For the optimist out there who believes that UNIT has real assets that hold value through thick and thin, the unsecured bonds offer an interesting yield to maturity.

FINRA

These are rated “C” and below the actual credit rating of the company. The reason is that there is a lot of secured debt that comes due ahead of this. That secured debt actually yields a lot less, thanks to the far higher recovery in a default.

FINRA

While both of these bonds do state SEC 144A rules, they were tradable on Interactive Brokers. So investors have a few choices to play this. For our part, we have not dabbled in any of these yet, but we are watching to see if we get a better setup.

Read the full article here