After a steep decline in August, the latest Korean export data indicates that things are headed in the right direction. Crucially for Korea’s tech-heavy equity market, semiconductor exports have been a key source of strength, supporting the case for a tech-led recovery sooner rather than later. For the domestic economy, on the other hand, the outlook isn’t as great, as the impact of a highly restrictive monetary policy stance and China’s slowdown start to bite.

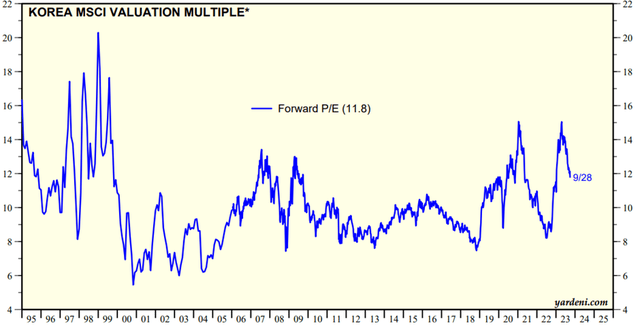

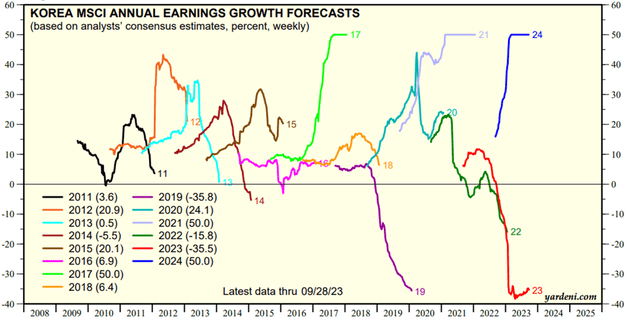

But bad news can be good news, particularly with core CPI nearing target levels; a further growth slowdown could, thus, pave the way for a policy pivot. Having suffered a torrid last few months, Korean large-caps aren’t pricing in much optimism either – against consensus earnings estimates for +50% earnings growth in 2024 (albeit off a -36% decline in earnings this year), the benchmark MSCI Korea index is priced at a very reasonable ~12x fwd P/E.

Yardeni

Expect a potentially catalyst-rich next few months for Korea, with a monetary policy response from the Bank of Korea and clarity about the midterm policy path at the top of the list. On the fiscal side, Korea’s conservative president Yoon is poised for a major cabinet reshuffle ahead of next year’s legislative election; expect increasingly populist policy measures to be implemented in response to his low popularity numbers, in turn, easing domestic consumption pressures in the near-term. Lastly, a pending (albeit delayed) inclusion into the FTSE World Government Bond Index (WGBI) presents an additional technical catalyst for Korea’s benchmark risk-free rate.

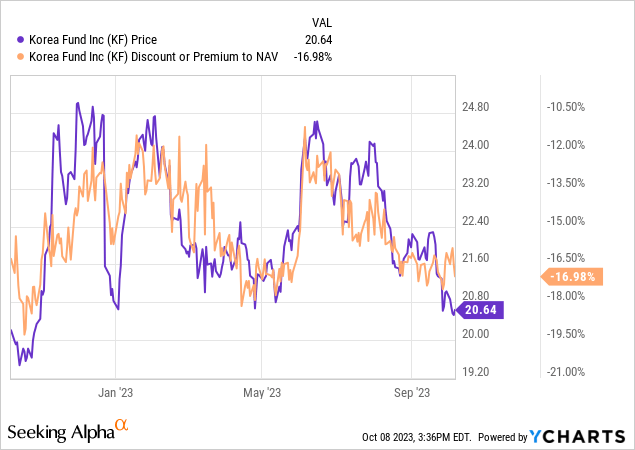

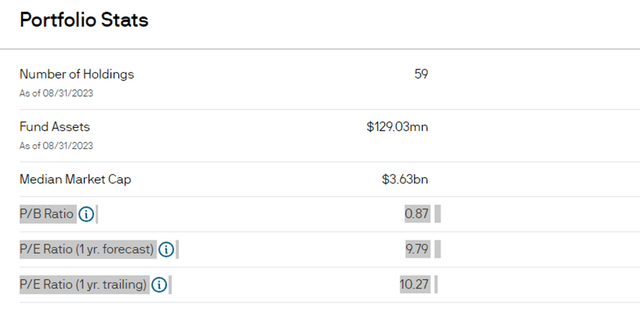

More cost-sensitive investors will probably prefer passively managed ETF options like the Franklin FTSE South Korea ETF (FLKR) or the iShares MSCI South Korea ETF (EWY). But the JPMorgan-managed Korea Fund (NYSE:KF), after suffering a bout of underperformance, has been punished quite harshly and offers interesting value. Not only is the fund portfolio now priced at a ~10% discount to book (below EWY), but it also trades at a wider ~17% NAV discount. While the higher expense ratio isn’t great, the steep NAV discount and buyback support mean patient, long-term-oriented investors could still come out ahead with KF.

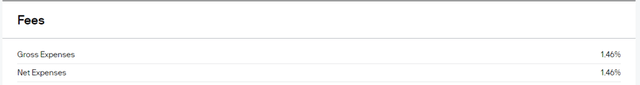

Fund Overview – Some Portfolio Changes; Pricier Expense Ratio Stands Out

The Korea Fund, actively managed by JPMorgan’s Korea country specialist John Cho (two years’ experience managing the fund, sixteen years with JPM), targets long-term capital appreciation relative to its benchmark MSCI Korea 25/50 Index. Like most other bottom-up active funds, KF builds its portfolio around high-conviction value names. The fund has, unsurprisingly, seen its net asset base decline to $121m following a turbulent Q3. But the pace at which the expense ratio has risen, now at ~1.5% (up from ~1.1% previously), is concerning – by comparison, passive alternatives like EWY (~0.6%) and FLKR (~0.1%) have kept their competitive fee structures intact.

JPMorgan

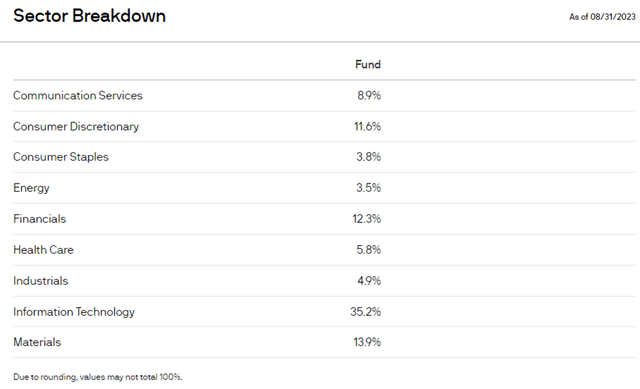

The 59-stock KF portfolio remains, much like its benchmark index, fairly concentrated around Information Technology (allocation increased to 35.2%). Materials have declined slightly to 13.9%, while the Financial sector (12.3%) has replaced Consumer Discretionary (11.6%) as the third-largest sector exposure. Other meaningful portfolio contributions include Communication Services (8.9%) and Health Care (5.8%). In total, the cumulative top-five sector contribution has risen to ~82% of the overall fund.

JPMorgan

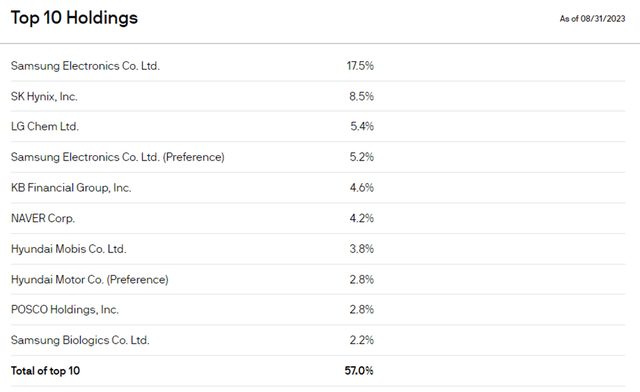

The most notable change to KF’s single-stock allocation is the restructured exposure to semiconductor/mobile giant Samsung Electronics (OTCPK:SSNLF) common stock at 17.5% (down from ~23% previously). Instead, KF now splits its exposure via Samsung preferred stock as well (5.2%). Korea’s other major semiconductor company, SK Hynix (OTC:HXSCF), has also gained share at 8.5%, followed by LG Chemical (OTCPK:LGCLF), despite its recent stock price decline. Korean internet company NAVER Corp (OTCPK:NHNCF) rounds out the tech exposure at 4.2%. The fund’s financial allocation, while meaningful in aggregate, is spread across several names, led by KB Financial Group (KB) at 4.6%.

The portfolio has also shrunk (59 holdings vs. 98 before), but KF isn’t as heavily concentrated around its top ten holdings either (~57% of the overall portfolio). All in all, the portfolio composition has deviated a fair bit from its benchmark MSCI Korea 25/50 Index over the last few months.

JPMorgan

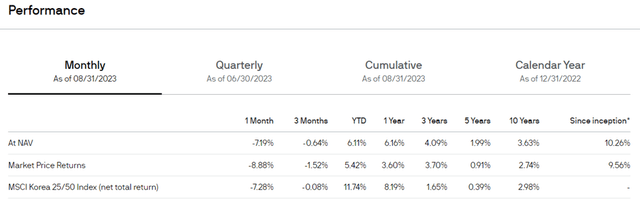

Fund Performance – Recent Turbulence Widens Performance Gap; NAV Discount Widens

A market-wide drawdown for Korean stocks over the last few months, along with underperformance for some of the fund’s key overweights in materials (LG Chemical and SK Group chemicals affiliate SKC), has further weighed on the fund’s YTD performance (+5.4% in market price terms). This also means that over the last three and five years, KF’s relative outperformance vs its benchmark index and passive ETF counterparts has narrowed. Still, the fund has annualized at a solid +10.3% since inception in 1984; even in market price terms, after accounting for the NAV discount, the fund has delivered good investor returns (+9.6% annualized).

JPMorgan

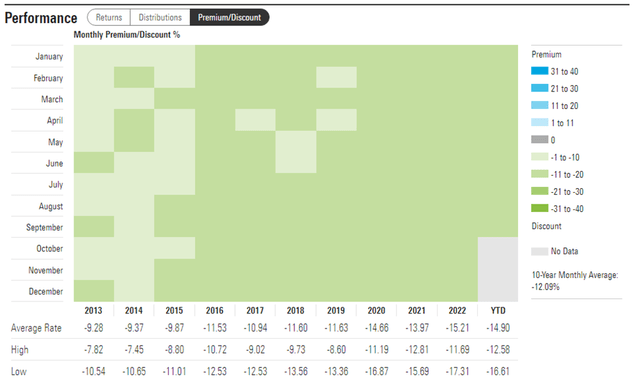

The fund’s NAV discount has widened again over the last month, now at ~17% (vs. low to mid-teens average in 2021/2022). Likely culprits include deteriorating investor sentiment on the fund’s prospects following a poor YTD performance, as well as the increased expense ratio. Outside of the year-end distribution, there isn’t a clear catalyst for the NAV discount to narrow anytime soon. The fund’s relative underperformance through current fund manager John Cho’s tenure also isn’t ideal, nor are the higher fees. That said, the performance-linked buyback (up to 25% of outstanding shares), which per the fund’s annual report hasn’t yet kicked in, continues to offer some downside protection.

Morningstar

Don’t Write Off the Korea Fund Just Yet

Korea’s export-dependent economy has been hit hard by the China slowdown, but green shoots of a recovery are emerging. September’s data showed the export contraction narrowed to 4.4% YoY (vs -8.3% YoY in August), which bodes well for a more resilient Q4 GDP outcome. Similarly, Korean semiconductors, a key component of its large-cap indices, are gearing up for a cyclical turnaround.

On the other hand, the domestic economy looks poised to slow further amid one of the steepest rate hike cycles in the country’s history (note the vast majority of Korean mortgages are floating). The silver lining is that core CPI is also trending closer toward target, potentially triggering a reversal of the BoK’s monetary policy stance in the coming months. Given where valuations are (~12x fwd P/E for +50% fwd earnings growth), stocks aren’t priced for too many positives and could re-rate significantly as Korea pivots toward monetary easing.

Yardeni

Investors have two major passive options to play Korea (FLKR and EWY), though those willing to bet on a discounted active fund will also find value in KF. The NAV discount has blown out in recent months, likely in reaction to the poor performance over the last year, which is hardly justification for the increased fees. Over the last decade, though, the manager has outpaced the benchmark MSCI Korea 25/50 Index and runs a slightly less top-heavy portfolio than EWY, so there’s a good chance the discount narrows, in my view. Plus, the KF book is a few turns below passive alternatives at <0.9x P/B (even cheaper if you account for the NAV discount).

JPMorgan

Key events to monitor in the coming months include a potential cabinet reshuffle ahead of next year’s legislative election, as well as fiscal policy measures to support weakening domestic consumption. Despite another delay, the pending inclusion of Korean sovereign debt into the FTSE World Government Bond Index (WGBI) also presents a potential catalyst.

Read the full article here