Annaly Capital Management (NYSE:NLY) is one of the leading mREITs in my coverage, with a market cap of $8.8B. That makes Annaly a leader in the mREIT universe and a force to be reckoned with. Despite that, NLY has underperformed the S&P 500 (SPX) (SPY) over the past ten years, notching a 10Y total return CAGR of 2.4%.

I urged investors to be wary about adding NLY in late November 2022 as it surged from its October lows, up nearly 44% back then. As such, I suggested waiting for a steep pullback first. That caution has worked out, as NLY has significantly underperformed the SPY since then, delivering a total return of -3%, notwithstanding NLY’s highly attractive forward dividend yield of 14.7%.

However, I also highlighted that NLY “has likely bottomed.” In other words, I didn’t expect NLY to crash below its October 2022 lows. NLY’s performance over the past year has validated that bottoming thesis. Why?

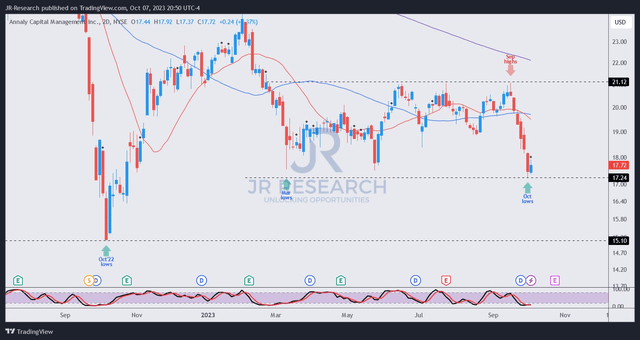

Despite its recent hammering, NLY has remained well above its October bottom of $15 while forming a potent bear trap (false downside breakdown) on its short-term chart. As such, I have conviction in that support zone, which should see robust buying support from dip buyers attracted by NLY’s attractive dividend yields. Makes sense? Let’s go through NLY’s buying thesis at the current levels.

1. 10Y Treasury Yield Has Surged Above October 2022 Highs

The 10Y Treasury yield (US10Y) has surged well above its October 2022 highs, reaching 4.89% this week. Accordingly, the powerful yield rally over the past four weeks saw it take out its previous highs in mid-September 2023, spooking bond buyers into a rapid retreat as they took on further losses.

Investors should recall that Annaly telegraphed in its July 2023 earnings call that management anticipated lower interest rate volatility as the Fed closed in on its peak rate hikes. However, the significant volatility over the past four weeks likely took bond operators by surprise as they repositioned for a potentially much higher-for-longer Fed.

NLY has also reacted negatively to the interest rate volatility, suggesting market operators have attempted to price in the headwinds. As such, NLY has collapsed by nearly 20% in price-performance terms over the past two months toward its October 2023 lows of $17.3. However, buyers have not allowed a further selloff toward its October 2022 lows of $15, suggesting investors are still anticipating a peak Fed.

2. Annaly’s Worst Hammering Is Likely Over

Analysts’ estimates remain favorable over the worst hammering of Annaly’s operating performance in recent times. As such, we should anticipate Annaly posting a lower YoY impact on distributable earnings over the next year after this year’s significant decline.

Accordingly, Annaly is projected to deliver a forward distributable EPS of $2.84 in FY24, down 3.1% from this year’s $2.93 estimate. However, the YoY impact is expected to be much better than the nearly 31% decline for this year’s consensus estimates. As such, I believe investors are likely looking forward, positioning themselves for an improved performance moving ahead.

Furthermore, NLY’s book value per share is still expected to bottom out this year, recovering to $22.5 by Q2 next year. Accordingly, Annaly posted a book value per share of $20.7 in the recently reported Q2 in July. As such, it provides another significant tailwind for NLY to attract dip buyers to return.

3. Powerful Bear Trap Price Action

NLY price chart (2-Day, short-term) (TradingView)

As seen in NLY’s short-term chart above, NLY took out a pivotal support zone that held NLY’s consolidation phase since its March lows. However, a bear trap (false downside breakdown) has formed at the $17.2 level, well above its October 2022 lows of $15.1.

As such, I’m confident that dip-buyers have not been spooked into falling back toward last year’s lows. Moreover, the steep collapse from its September highs at the $21.1 level is reminiscent of a capitulation move that preceded the bear trap, which is constructive.

Notwithstanding my optimism, NLY doesn’t have a validated bear trap structure on its medium- and long-term price action, which would have strengthened my bullish thesis at the current levels.

Takeaway

Annaly is scheduled to report its third-quarter earnings release on October 25. All eyes will be on management’s commentary about the recent interest rate volatility and how management expects it to affect the company’s performance over the next year.

However, these challenges have not gone unnoticed, as the market had already attempted to price them in, with NLY capitulating below its March 2023 lows recently.

Therefore, with NLY’s forward dividend yield not expected to be slashed, I believe the move corroborates my conviction that last year’s lows should be defended robustly, setting up NLY well for an ongoing recovery in 2024.

Rating: Upgraded to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here